Global Dental Equipment Market Size, Share, Trends & Growth Analysis Report – Segmented By Product Type (Dental Radiology Equipment, Systems and Parts, Dental Lasers, Laboratory Machines, Hygiene Maintenance and Others), End-User (Hospitals and Clinics, Dental Laboratories and Others) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2025 to 2033)

Global Dental Equipment Market Size

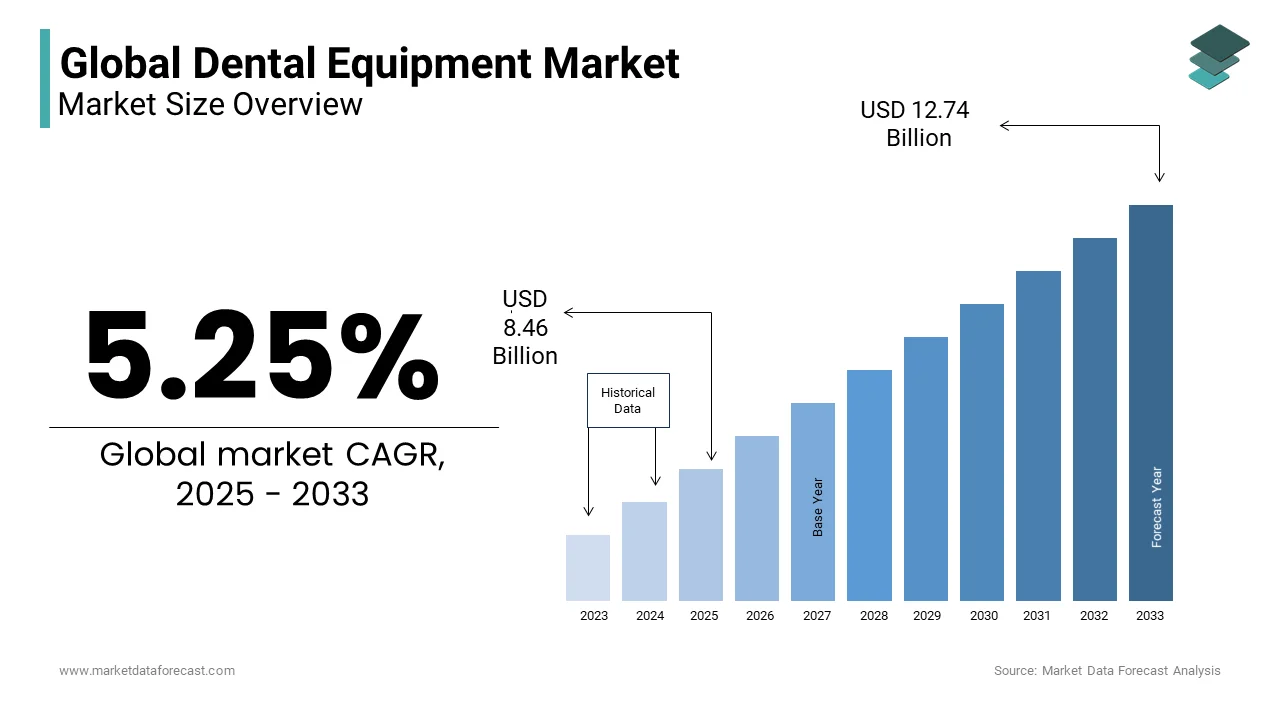

The global dental equipment market size was valued at USD 8.04 billion in 2024. The dental equipment market size is expected to have 5.25 % CAGR from 2025 to 2033 and be worth USD 12.74 billion by 2033 from USD 8.46 billion in 2025.

The growing population suffering dental disorders, rising awareness about oral hygiene, and technological advancements in dental procedures have significantly contributed to the demand for dental equipment in recent years. During the forecast period as well, the global dental equipment market is predicted to achieve considerable growth. The United States, Germany, Japan, China, India, and Brazil are the largest consumers of dental equipment as these countries have the highest number of dental clinics, hospitals, and specialized dental care centers. The adoption of advanced dental technologies and treatments is happening swiftly in developed and developing countries and contributing to the increasing demand for dental equipment. To address the growing demand and gain a competitive edge in the global market, dental equipment companies have been implementing strategies such as increasing investments in R&D to innovate products, expanding their distribution networks and establishing partnerships with dental clinics and hospitals and exploring strategic mergers and acquisitions. Likewise, trends such as the increasing population suffering dental diseases, technological advancements, rising demand for dental services and increasing efforts from the market participants are estimated to continue and accelerate during the forecast timeline and result in the global dental equipment market growth.

MARKET DRIVERS

The growing aging population is one of the factors propelling the global dental equipment market growth.

The aging population is growing at a significant rate worldwide. The increasing geriatric population demands preventive, restorative, and surgical dental care services. In addition, personalized care for elderly adults, provided through specially crafted dental tools and equipment, is produced to boost their comfort. Dental health issues such as tooth decay, gum disease and tooth loss are associated with growing age. People who are old frequently require more extensive dental treatments and procedures to maintain oral health and treat age-related dental conditions. As per the World Health Organization (WHO), around 22% of the global population is anticipated to be aged 60 years and more and the same kind of growth is predicted to be seen in the population suffering from dental diseases and likely to result in the global market growth.

Y-O-Y growth in the number of dental procedures to address the growing burden of dental diseases is contributing to the growth of the dental equipment market growth.

The growing awareness of advancements in dental technologies among dental professionals has resulted in an increasing number of dental procedures worldwide. People in several countries have realized the importance of oral care and visiting dental clinics and dental hospitals for a variety of dental services that range from routine cleanings and fillings to more complex procedures like root canals, dental implants and orthodontic treatments. For instance, as per the estimations of the American Dental Association (ADA), around 195 million dental visits were recorded in the United States in 2019. On the other hand, the burden of dental diseases is also growing and contributing to the increasing demand for dental treatments and procedures and propelling the dental equipment market. For instance, the 2019 Global Burden of Disease (GBD) says an estimated 50% of the global population suffering dental diseases.

Various government initiatives to promote dental hygiene awareness are expected to contribute to market growth.

Governments in many countries have recently introduced initiatives to improve dental health. Additionally, growing dental tourism activities to create awareness about the current availability of dental procedures and investments by government and private healthcare infrastructure organizations are propelling market growth in the coming years. The growing focus from the market participants to develop modern R&D facilities and new product launches to meet the demands of the dental equipment market.

MARKET RESTRAINTS

High costs associated with dental equipment are majorly hampering the global market growth.

Due to these high costs, this equipment is unaffordable to small dental clinics and practices, and likewise, the overall growth of the dental equipment market is hindered. In addition, the lack of proper reimbursement policies in some countries negatively affects the dental equipment market growth. In addition, limited access to dental care in many countries worldwide, strict regulatory requirements, poor awareness among healthcare providers regarding the availability of advanced dental equipment options in some countries, and competition from alternative treatments further inhibit the growth rate of the dental equipment market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Market Leaders Profiled |

Danaher Corporation, Planmeca OY, A-dec Inc, Carestream Health, Inc, Dentsply Sirona, AMD LASERS, Biolase, Inc., Ivoclar Vivadent AG, Midmark Corporation and 3M. |

SEGMENTAL ANALYSIS

By Product Type Insights

The systems and parts segment accounted for the largest share of the global market in 2024 and is expected to grow at the fastest CAGR among all segments worldwide during the forecast period. The segment's growth is majorly driven by the growing emphasis by the market participants on developing new and advanced dental equipment and the increasing adoption of technological developments in the manufacturing of dental equipment. Under the sub-segments, the CAD/CAM segment held the major share of the market in 2024 and is likely to showcase a promising CAGR during the forecast period due to the growing number of technological advancements. In addition, CAD/CAM techniques are increasingly replacing die-casting techniques, further contributing to the segment's growth. Furthermore, the cone beam CT systems segment is expected to witness a notable CAGR during the forecast period.On the other hand, digital radiology equipment is expected to hold a considerable share of the global market during the forecast period, owing to the increasing patient population suffering from dental problems worldwide.

By End-User Insights

The hospitals and clinics segment held the major share of the global dental equipment market in 2024 and is predicted to keep the domination in the worldwide market during the forecast period. The lead of the hospitals and clinics segment is majorly attributed to the increasing adoption of digital dental equipment like CAD/CAM systems in hospitals worldwide, technological advancements and government-funded oral health programs in countries like Brazil.

The dental laboratories segment accounted for a substantial share of the worldwide market in 2024 and is predicted to witness a prominent CAGR during the forecast period. The rising demand for dental prosthetics, orthodontic appliances and other customized dental solutions and rapid adoption of digital workflows and 3D printing technologies to enhance productivity in dental laboratories are driving the growth of the dental laboratories segment in the global market. The demand for affordable dental solutions is growing exponentially in the in Asia-Pacific and due to this, APAC is turned as the most lucrative segment for dental equipment in the worldwide market.

REGIONAL ANALYSIS

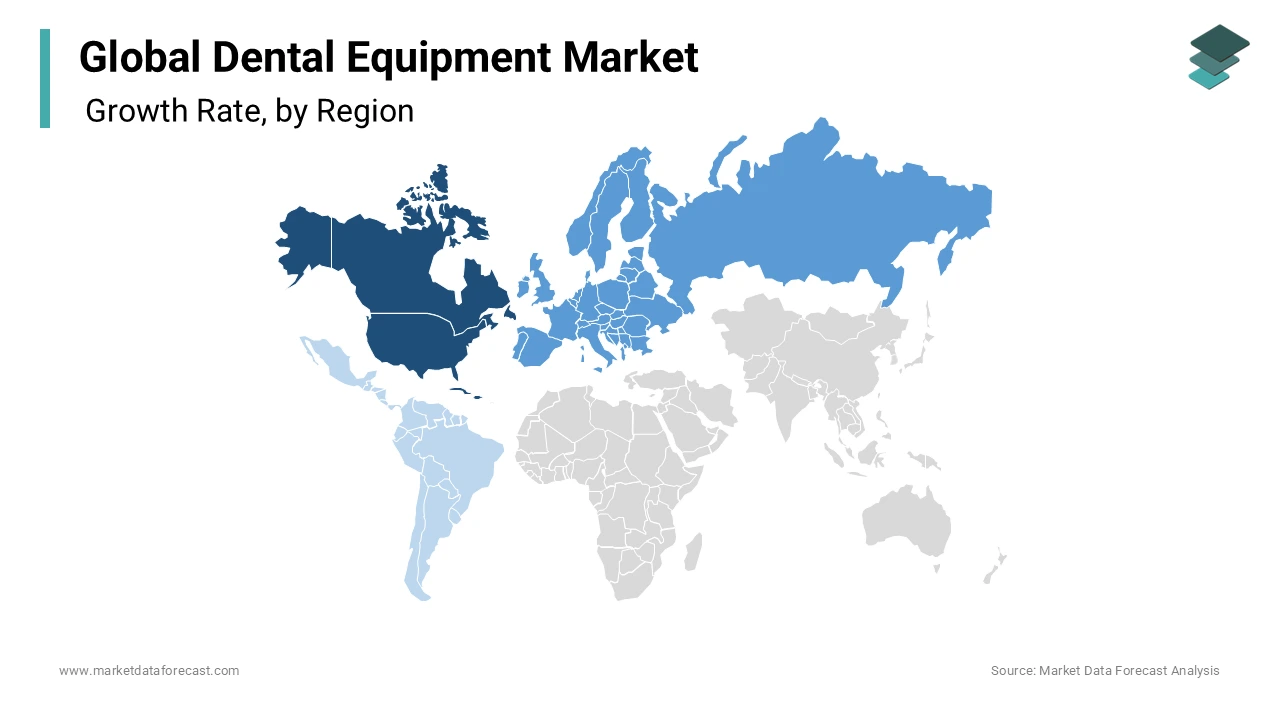

The North American region occupied the most significant share of the worldwide market in 2024 and the region's dominance in the worldwide market is expected to continue throughout the forecast period. The growth of the North American market is primarily driven by the increasing demand for cosmetic surgeries, the growing aging population, the presence of key market participants and the presence of sophisticated healthcare infrastructure. Moreover, collaborations between healthcare providers & research organizations and the availability of several dentists and dental clinics are propelling the market growth in this region. In addition, the growing awareness of dental care in the North American region contributes to regional market growth. As a result, the U.S. held the leading share of the North American market in 2024.

The European market accounted for the second-largest share of the worldwide market in 2024 and is estimated to grow at a robust CAGR during the forecast period. Factors such as increasing healthcare expenditure, favorable reimbursement policies, the growing aging population suffering from dental issues and rising demand for quality treatment procedures promote the growth of the dental equipment market in Europe. Germany and the UK are predicted to hold a leading share of the European market during the forecast period.

Asia-Pacific is expected to account for the highest CAGR during the forecast period due to growing demand for dental procedures, less stringent regulations, and growing tourism. As a result, the Asia Pacific witnessed significant growth in the global dental equipment market during the forecast period. The growing geriatric population, increasing investment by government and private organizations to improve healthcare infrastructure facilities and awareness among the people about the current dental procedure are expected to drive the market growth. In addition, increasing disposable income, the growing number of dental procedures, increasing dental tourism, and rising awareness among people regarding oral health support the dental equipment market in APAC. As a result, India, China and Japan are major markets in the APAC region and are expected to hold a major share of the APAC regional market during the forecast period.

Latin America is anticipated to showcase a steady CAGR during the forecast period. The growth of the Latin American market is majorly driven by favorable reimbursement policies for dental procedures by the Latin American governments. Middle East and Africa is estimated to occupy a moderate share of the worldwide market in the coming years.

KEY MARKET PLAYERS

The list of key market participants leading the global dental equipment market profiled in the report is Danaher Corporation, Planmeca OY, A-dec Inc, Carestream Health, Inc, Dentsply Sirona, AMD LASERS, Biolase, Inc, Ivoclar Vivadent AG, Midmark Corporation, 3M.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, A-dec, one of the dental equipment manufacturers, announced their expansion plans with their launch of A-dec Certified Pre-Owned Equipment program.

- In June 2024, A-dec, announced their launch of A-dec 500 Pro and A-dec 300 Pro platforms. These products are digitally connected dental chairs with delivery systems.

MARKET SEGMENTATION

This research report on the global dental equipment market has been segmented and sub-segmented based on the product type, end-user, and region.

By Product Type

- Dental Radiology Equipment

- Intraoral

- Extra-oral

- Systems and parts

- Cast Machine

- Instrument Delivery Systems

- Vacuums & Compressors

- Cone Bean CT Systems

- Furnace and Ovens

- CAD/CAM

- Electrosurgical Equipment

- Dental lasers

- Diode Lasers

- Carbon dioxide lasers

- Laboratory Machines

- Micromotor

- Ceramic furnaces

- Electronic waxer

- Hydraulic press

- Suction unit

- Hygiene Maintenance

- Air purification and filters

- Hypodermic needle incinerator

- Sterilizers

- Others

By End User

- Hospitals and Clinics

- Dental Laboratories

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which region is growing the fastest in the global dental equipment market?

Geographically, North American dental equipment accounted for the largest share of the global market in 2024.

How much is the global dental equipment market going to be worth by 2033?

As per our research report, the global dental equipment market size is projected to be USD 12.74 Billion by 2033.

Which are the significant players operating in the dental equipment market?

Planmeca OY, A-dec Inc, Carestream Health, Inc, Dentsply Sirona, AMD LASERS, Biolase, Inc, and Ivoclar Vivadent AG are some of the significant players operating the dental equipment market.

At What CAGR, the global dental equipment market is expected to grow during the forecast period?

The global dental equipment market is estimated to grow at a CAGR of 5.25% during the forecast period.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com