Europe Dental Equipment Market Size, Share, Trends & Growth Forecast Report By Product Type, End User and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Dental Equipment Market Size

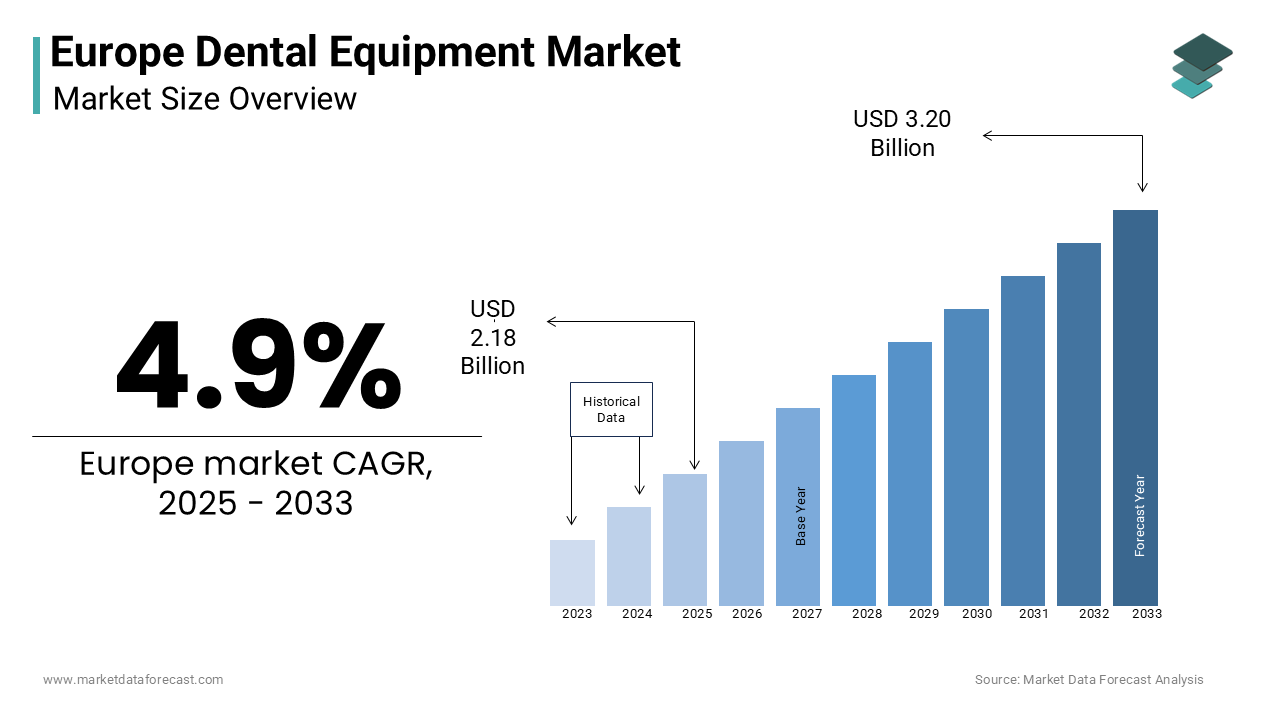

The size of the European dental equipment market was valued at USD 2.08 billion in 2024. The European market size is further predicted to be worth USD 3.20 billion by 2033 from USD 2.18 billion in 2025, with a growing potential of 4.9% during the forecast period.

The Europe smart meters market has established a robust presence and is driven by regulatory mandates, technological advancements, and the growing emphasis on energy efficiency. According to the European Commission, over 70% of EU households are expected to be equipped with smart meters by 2025, reflecting the region's commitment to modernizing its energy infrastructure. Also, the market is further bolstered by initiatives like the European Green Deal, which aims to achieve carbon neutrality by 2050. Germany, France, and the UK collectively account for nearly 60% of the total market revenue, supported by their well-developed smart grid ecosystems and high adoption rates of advanced metering technologies. Additionally, rising consumer awareness about energy conservation and real-time monitoring has created a favorable environment for sustained growth in the smart meters market.

MARKET DRIVERS

Rising Prevalence of Dental Disorders

The growing prevalence of dental disorders, such as caries, periodontitis, and malocclusion, is a key driver of the Europe dental equipment market. According to the World Health Organization, untreated dental caries affect approximately 35% of adults in Europe with the frequent dental interventions. This has led to increased demand for diagnostic and therapeutic equipment, such as intraoral scanners and dental lasers. According to the European Association of Dental Public Health, over 1.2 million dental implants are placed annually in Europe, with advanced equipment playing a pivotal role in these procedures. Furthermore, public awareness campaigns promoting oral hygiene and regular dental check-ups have amplified demand for preventive care solutions to ensure steady growth of the market.

Technological Advancements in Dental Equipment

Technological innovations in digital dentistry are another major driver of the Europe dental equipment market. According to the European Dental Association, the adoption of CAD/CAM systems has grown by over 25% annually in the past five years. These systems enable precise fabrication of dental prosthetics, reducing procedure times and improving patient outcomes. For example, Sirona Dental Systems’ CEREC technology has revolutionized chairside restorations, allowing dentists to design and fabricate crowns in a single visit. Additionally, advancements in dental imaging, such as cone-beam computed tomography (CBCT) that have enhanced diagnostic accuracy by making them indispensable in modern dental practices.

MARKET RESTRAINTS

High Costs of Advanced Equipment

One of the primary restraints in the Europe dental equipment market is the high cost associated with advanced technologies, which limits accessibility for smaller clinics and practitioners. According to the European Dental Practice Management Association, premium equipment like CBCT scanners and CAD/CAM systems can cost up to €100,000 is making them unaffordable for many dental practices outside major urban centers. This financial barrier is compounded by stringent reimbursement policies in countries like Italy and Spain, where insurance coverage for advanced dental procedures is often limited. While larger hospitals and clinics can absorb these costs, smaller practices struggle to justify the investment is creating disparities in access to cutting-edge dental technologies.

Stringent Regulatory Standards

The European Union’s Medical Device Regulation (MDR) implemented in 2021, has introduced stricter compliance requirements for dental equipment is posing challenges for manufacturers and practitioners alike. According to the European Federation of Pharmaceutical Industries and Associations, over 30% of small and medium-sized enterprises in the dental equipment sector have struggled to meet these new standards. The rigorous testing and certification processes increase time-to-market and operational costs for manufacturers, thereby slowing innovation. Moreover, the complexity of ensuring compliance across multiple EU member states creates additional barriers. This regulatory bottleneck not only impacts product availability but also stifles the entry of novel dental technologies is potentially hampering market growth in the long term.

MARKET OPPORTUNITIES

Growing Adoption of Digital Dentistry

The shift toward digital dentistry presents significant opportunities for the Europe dental equipment market. According to the European Digital Dentistry Society, over 70% of dental practices in Western Europe have adopted at least one form of digital technology, such as intraoral scanners or 3D printers. These tools streamline workflows, reduce human error, and enhance patient outcomes. For instance, Align Technology’s iTero scanner has gained widespread adoption for orthodontic applications by enabling precise treatment planning. Additionally, government incentives promoting digital health solutions have accelerated adoption, particularly in rural areas where access to specialized dental care is limited.

Expansion of Ambulatory Surgical Centers (ASCs)

The proliferation of ambulatory surgical centers (ASCs) across Europe is creating new avenues for dental equipment adoption. ASCs are rapidly becoming the preferred choice for outpatient dental surgeries due to their cost-effectiveness and patient-centric approach. As per the European Society of Ambulatory Surgery, the number of ASCs performing dental procedures has increased by 20% over the past decade. These centers rely heavily on advanced equipment, such as dental lasers and CBCT scanners, for procedures like implant placements and root canal treatments. Moreover, the shift toward outpatient care models, supported by favorable government policies, is expected to drive demand further. For instance, Germany’s recent healthcare reforms have incentivized ASC operations is leading to a surge in dental equipment usage in outpatient settings.

MARKET CHALLENGES

Limited Awareness Among Practitioners

The limited awareness among practitioners about its benefits remains a significant challenge. Many dentists in Europe still prefer traditional tools due to familiarity and perceived reliability, as per a survey conducted by the European Dental Association. This reluctance to adopt newer technologies hampers market growth in less urbanized regions where training programs are scarce. Additionally, the lack of standardized guidelines for equipment selection complicates decision-making for clinicians. The full potential of innovative dental technologies cannot be realized is posing a barrier to widespread adoption.

Supply Chain Disruptions

The Europe dental equipment market is also vulnerable to supply chain disruptions, exacerbated by geopolitical tensions and economic uncertainties. For instance, the ongoing semiconductor shortage has impacted the production of advanced imaging systems that complement dental equipment, according to a report by the European Semiconductor Industry Association. Furthermore, fluctuations in raw material prices, particularly for metals like titanium and stainless steel, have increased manufacturing costs. These challenges are compounded by logistical bottlenecks, which delay product deliveries and disrupt inventory management.

SEGMENTAL ANALYSIS

By Product Insights

The therapeutic equipment dominated the Europe dental equipment market with a share of 40.9% in 2024. Dental chairs and units are indispensable in every dental practice by providing the foundation for various procedures. Their widespread adoption is driven by their versatility and ergonomic design, which enhance patient comfort and practitioner efficiency. According to the European Dental Practice Management Association, over 90% of dental clinics are equipped with advanced dental chairs featuring integrated diagnostic tools and adjustable settings. Additionally, technological advancements, such as smart chairs with IoT connectivity, have further amplified demand.

The CAD/CAM systems segment is likely to register a CAGR of 11.5% during the forecast period. The segment growth is fueled by their ability to streamline workflows and improve precision in restorative dentistry. For instance, CAD/CAM systems enable same-day crown fabrication thereby reducing patient visits and enhancing convenience. According to a study by the European Association of Dental Public Health, over 60% of dental labs in Europe utilize CAD/CAM technology for designing prosthetics. Additionally, government incentives promoting digital health solutions have accelerated adoption in rural areas where access to specialized dental care is limited.

By Diagnostic Equipment Insights

The dental imaging segment was the largest and held 50.4% of the Europe dental equipment market share in 2024. For instance, intraoral X-rays and panoramic imaging systems are widely used for detecting cavities, fractures, and periodontal diseases. According to the European Dental Association, over 80% of dental practices in Europe are equipped with digital radiography systems, which offer higher resolution and lower radiation exposure compared to traditional methods. Additionally, advancements in imaging software have enhanced diagnostic accuracy will amplify the growth of the market.

The Cone-beam computed tomography (CBCT) scanners segment is projected to grow with a CAGR of 12.8% during the forecast period. Their growth is fueled by their ability to provide three-dimensional images of dental structures by enabling precise diagnosis and treatment planning. For example, CBCT scanners are increasingly being adopted in implantology and orthodontics, where they enhance procedural accuracy. According to a study by the European Association of Dental Public Health, over 40% of dental clinics in urban areas utilize CBCT technology.

By End User Insights

The hospitals and clinics segment was accounted in holding the dominant share of the Europe dental equipment market in 2024. Their extensive infrastructure and multidisciplinary teams make them the primary users of advanced dental equipment. Procedures like dental implants, orthodontics, and maxillofacial surgeries are predominantly performed in hospital settings. Additionally, government investments in healthcare infrastructure have ensured widespread availability of cutting-edge dental technologies is enhancing the growth of the market.

The ambulatory surgical centers (ASCs) segment is solely to grow with an estimated CAGR of 10.5% during the forecast period. The shift toward outpatient care models, supported by favorable government policies, is accelerating ASC adoption. These centers rely heavily on advanced equipment, such as dental lasers and CBCT scanners, for procedures like implant placements and root canal treatments. For instance, Germany’s recent healthcare reforms have incentivized ASC operations is leading to a surge in dental equipment usage in outpatient settings.

REGIONAL ANALYSIS

Germany was the top performer in the Europe dental equipment market with 25.9% of share in 2024. The country’s growth is attributed to the robust healthcare infrastructure and high adoption rates of advanced technologies. According to the German Dental Association, over 70% of dental practices in the country are equipped with digital imaging systems, such as CBCT scanners. Germany’s aging population is projected to reach 21 million individuals aged 65+ by 2030 that further amplifies demand for restorative and therapeutic dental procedures.

France is expected to hit a dominant CAGR of 12.3% in the next coming years. The country’s growth is due to the strong emphasis on preventive dental care and technological innovation. As per the French National Health Authority, over 60% of adults undergo annual dental check-ups, driving demand for diagnostic equipment like intraoral scanners. Additionally, government initiatives promoting digital health solutions have accelerated adoption in rural areas where access to specialized care is limited.

The UK is likely to have prominent growth opportunities in the fortune years. This growth is due to high prevalence of dental disorders and a strong regulatory framework supporting medical device innovation. According to the British Dental Association, over 50% of adults in the UK suffer from moderate to severe periodontal diseases. The NHS’s focus on preventive care has further amplified demand for advanced diagnostic and therapeutic equipment.

Italy dental equipment market growth is driven by its extensive network of private clinics and specialized dental centers. According to the Italian Dental Association, over 40% of dental practices are equipped with CAD/CAM systems for restorative procedures. Italy’s aging demographic, where 23% of the population is over 65 that drives demand for restorative and implantology equipment by ensuring sustained growth.

Spain dental equipment market is ascribed to have significant opportunities in the next coming years. As per the Spanish Dental Federation, untreated caries affect nearly 30% of adults, necessitating frequent interventions. Spain’s emphasis on cost-effective healthcare solutions has led to the widespread adoption of ASCs, where advanced dental equipment is indispensable is propelling market expansion.

KEY MARKET PLAYERS AND COMPETETIVE LANDSCAPE

A few promising companies in the Europe Dental Equipment Market profiled in this report are Danaher Corporation, Planmeca OY, A-dec Inc., Carestream Health, Inc., Dentsply Sirona, AMD LASERS, Biolase, Inc., Ivoclar Vivadent AG, Midmark Corporation, and 3M.

The Europe dental equipment market is highly competitive, driven by increasing demand for advanced dental care, growing awareness about oral hygiene, and rising investments in dental clinics. Key players include global manufacturers like Dentsply Sirona, Planmeca, and 3M, alongside regional firms specializing in niche products. The market benefits from technological advancements such as CAD/CAM systems, intraoral scanners, and laser dentistry by enabling more precise and efficient treatments. Government initiatives promoting preventive dental care and the expansion of dental tourism further fuel growth. Companies are focusing on product innovation to cater to diverse needs, including portable and cost-effective solutions for rural areas. Strategic collaborations with dental associations and educational institutions are common to enhance training and adoption of new technologies. Additionally, SMEs are entering the market with affordable and innovative equipment, intensifying competition. The competitive landscape is shaped by innovation, regulatory compliance, and efforts to address affordability concerns. Overall, the market emphasizes improving patient outcomes by enhancing clinical efficiency, and integrating digital solutions into dental practices.

Top Players in the Europe Dental Equipment Market

Dentsply Sirona

Dentsply Sirona is a global leader in the dental equipment market, renowned for its innovative solutions tailored to diverse applications. The company’s CEREC CAD/CAM system has revolutionized chairside restorations, enabling precise fabrication of dental prosthetics. Dentsply Sirona’s commitment to improving patient outcomes is evident in its collaborations with European dental associations to develop next-generation technologies. Its presence in Europe is strengthened by a robust distribution network and partnerships with local healthcare providers.

Planmeca Oy

Planmeca is a key player in the Europe dental equipment market, offering a diverse portfolio of products designed for diagnostic and therapeutic applications. The company’s expertise lies in developing advanced imaging systems, such as CBCT scanners, which enhance diagnostic accuracy. Planmeca’s acquisition of smaller firms specializing in digital dentistry has enhanced its product offerings, particularly in intraoral scanners.

3Shape A/S

3Shape is a prominent name in the dental equipment market, known for its precision-engineered intraoral scanners and CAD/CAM software. The company’s TRIOS scanner is widely adopted for its ability to streamline workflows and improve treatment planning. 3Shape’s strategic investments in digital health technologies, such as integration with cloud-based platforms, have set it apart from competitors. Its strong brand reputation and focus on affordability ensure sustained demand for its products across Europe.

Top Strategies Used by Key Players in the Europe Dental Equipment Market

- Product Innovation and Technological Advancements

Companies are investing heavily in R&D to develop next-generation dental equipment with enhanced features, such as AI-driven diagnostics and IoT-enabled devices. These innovations cater to specific clinical needs, such as improving procedural accuracy and reducing treatment times. - Strategic Collaborations and Partnerships

Key players are forming alliances with dental associations, research institutions, and healthcare providers to co-develop advanced technologies. These collaborations enable companies to gain insights into real-world challenges and tailor their products accordingly. - Expansion into Emerging Markets

To strengthen their position, companies are expanding their presence in emerging European markets like Turkey and the Czech Republic. This strategy involves setting up localized manufacturing facilities and distribution networks to meet regional demands effectively.

RECENT MARKET DEVELOPMENTS

- In February 2023, Dentsply Sirona launched a new AI-powered intraoral scanner in Germany. This initiative aimed to improve diagnostic accuracy and streamline treatment planning.

- In April 2023, Planmeca acquired a Finnish startup specializing in 3D imaging software for dental applications. This acquisition was designed to strengthen its portfolio of digital dentistry solutions.

- In June 2023, 3M partnered with a UK-based dental chain to deploy its latest range of preventive care equipment. This collaboration sought to expand its market reach across Europe.

- In September 2023, Ivoclar Vivadent introduced a next-generation ceramic milling machine tailored for European labs. This launch aimed to enhance precision in restorative dentistry.

- In November 2023, KaVo Kerr expanded its manufacturing facility in Italy to meet rising demand for dental chairs and delivery units. This move aimed to consolidate its dominance in the European market.

MARKET SEGMENTATION

This research report on the European dental equipment market has been segmented and sub-segmented into the following categories.

By Product Type

- Dental Radiology Equipment

- Intraoral

- Digital sensors

- Digital X-Ray units

- Extraoral

- Analog

- Digital

- Intraoral

- Systems and Parts

- Cast Machine

- Instrument Delivery Systems

- Vacuums & Compressors

- Cone Beam CT Systems

- Furnace and Ovens

- CAD/CAM

- Electrosurgical Equipment

- Dental Lasers

- Diode Lasers

- Vertical Cavity Surface Emitting Lasers

- Quantum Well Lasers

- Vertical External Cavity Surface Emitting Lasers

- Heterostructure Lasers

- Distributed Feedback Lasers

- Quantum Cascade Lasers

- Separate Confinement Heterostructure Lasers

- Carbon dioxide Lasers

- Diode Lasers

- Laboratory Machines

- Micro Motor

- Ceramic Furnaces

- Electronic Waxer

- Hydraulic Press

- Suction Unit

- Hygiene Maintenance

- Air Purification & Filters

- Hypodermic Needle Incinerator

- Sterilizers

By End User

- Hospitals and Clinics

- Dental Laboratories

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

Which countries in Europe contribute the most to the dental equipment market?

Germany, France, and the United Kingdom are the leading contributors to the dental equipment market in Europe.

What are the key trends driving the growth of the dental equipment market in Europe?

The adoption of advanced technologies like digital dentistry, increasing demand for cosmetic dentistry, and a growing emphasis on preventive dental care are some of the major trends driving the growth of the European dental equipment market.

What factors are hindering the growth of the dental equipment market in Europe?

Regulatory challenges, high initial costs of advanced dental equipment, and limited reimbursement for dental procedures are some of the factors impeding market growth.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com