Global Oral Biologics Market Size, Share, Trends & Growth Forecast Report By Drug Class, Disease Indication, Distribution Channel, and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Oral Biologics Market Size

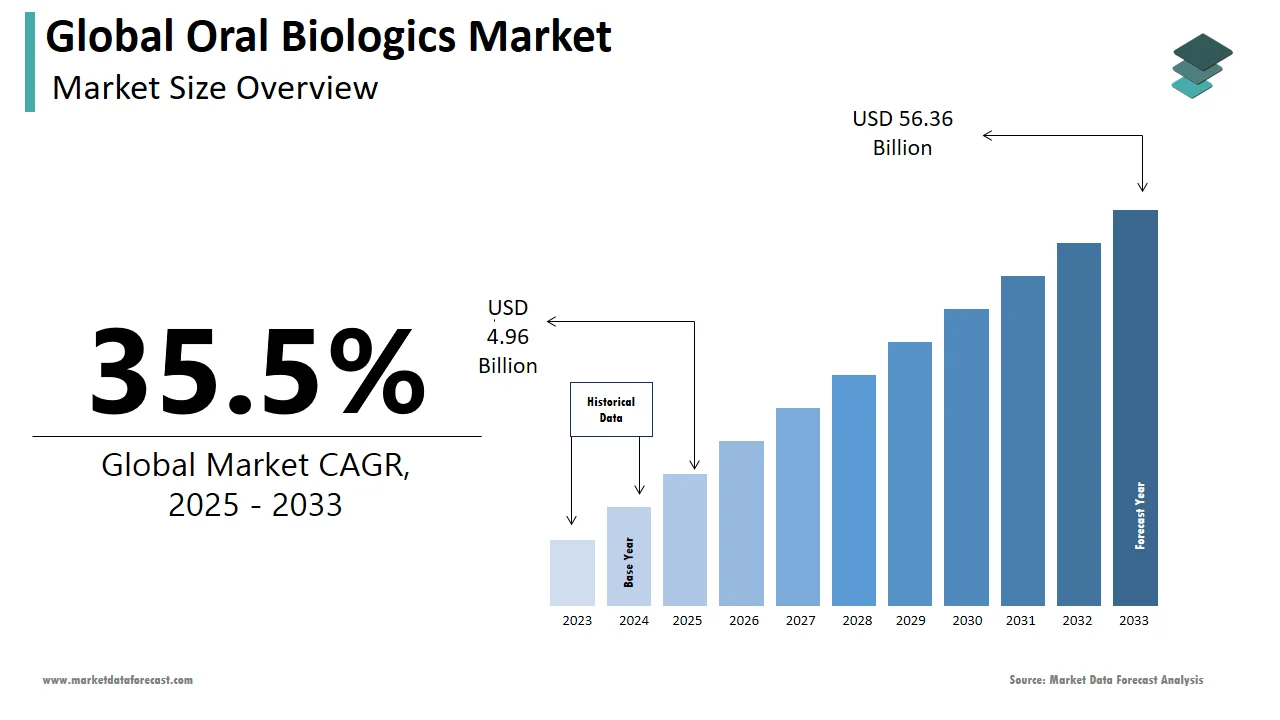

The size of the global oral biologics market was worth USD 3.66 billion in 2024. The global market is anticipated to grow at a CAGR of 35.5% from 2025 to 2033 and be worth USD 56.36 billion by 2033 from USD 4.96 billion in 2025.

The biologics market is the market of drugs that are made from the complex molecules extracted from the cells of living organisms like animals, plants, and microorganisms. The molecules extracted from living organisms can be used to study and make drugs for various chronic diseases like diabetes, psoriasis, arthritis, plaque, ulcerative colitis, Crohn's disease, inflammatory bowel diseases, etc. These medicines also stabilize cell membranes and improve immune functions in the body. These biological drugs can be ingested in 3 ways: subcutaneously, intravenously, or orally. Due to the ease and demand for the oral ingestion of the drugs, there is a high demand for oral biologics. In addition, Biologics medicines are the best cure for cardiometabolic diseases like rheumatoid arthritis.

MARKET DRIVERS

The growing prevalence of diabetes and arthritis is majorly propelling the growth of the global oral biologics market.

The total population suffering from diabetes will reach 642 million by 2040. According to a 2020 report from the arthritis foundation, 1 in 3 individuals 18-64 has arthritis in the U.S. An increased spread of the disease leads to more demand for oral biologics, thus fuelling the market growth. In addition, the rise in cardiovascular diseases has resulted in increased demand for the oral biologics market.

The efficiency and ease of administration of oral biologics allow it to have high demand. Strategic collaborations and research in the study of oral biologics are also helping in the market's growth. One such collaboration was in 2023, when Amgen Inc., a biopharmaceutical company, entered collaborative research with Bio-Ltd to develop orally administered formulations of biological drugs. Development activities and increasing research with government support are other major market drivers. For example, the U.S. Food Drug Administration revived the application of entering a bio-Ltd for a New Drug (IND) named EB613, orally delivered human parathyroid hormone (1-3) or PTH, which treats osteoporosis patients.

The research and development of new drugs that help treat chronic diseases are expected to drive the oral biologics market. An example would be the development of the SOMA capsule by the Massachusetts Institute of Technology. SOMA is an oral capsule for insulin patients, which helps eliminate the need for intravenous injections of insulin. Thus, the market growth drivers are the demand, need, and effectiveness of oral biologics.

MARKET RESTRAINTS

The R&D involved with oral biologics is often challenging and requires a high budget. In addition, the low availability of molecule drugs such as proteins and peptides (Approximately 0-2%) when administered orally makes it challenging to produce the drugs. These technical difficulties restrain the growth of the oral biologics market. Aside from this, the lack of proper commercialization of the oral delivery of biologics is also a major restrain.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

35.5% |

|

Segments Covered |

By Drug Class, Disease Indication, Distribution Channel, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Novo Nordisk A/S, Biocon Limited, Oramed Pharmaceuticals Inc., Rani Therapeutics, Entera Bio Ltd., AbbVie Inc., Enteris BioPharma Inc., Chiasma Inc., Allena Pharmaceuticals Inc., Lilly, Lumen Bioscience Inc., Pfizer Inc., and BeiGene, and Others. |

SEGMENTAL ANALYSIS

By Drug Class Insights

There are different classes of drugs under the oral biologics; the Glucagon-like peptide 1 (GLP-1) Receptor Agonist is the biggest driver of the oral biologics market among all the drug classes.

By Disease Indication Insights

These are the various disease indications of oral biologics. Diabetes is the most prominent indicator, with numerous cases. Thus, diabetes is the most prevalent disease in the market.

By Distribution Channel Insights

The distribution channels of oral biologics sell the drugs to consumers. The largest distributor of drugs and the most significant contributor to the oral biologics market are retail pharmacies.

REGIONAL ANALYSIS

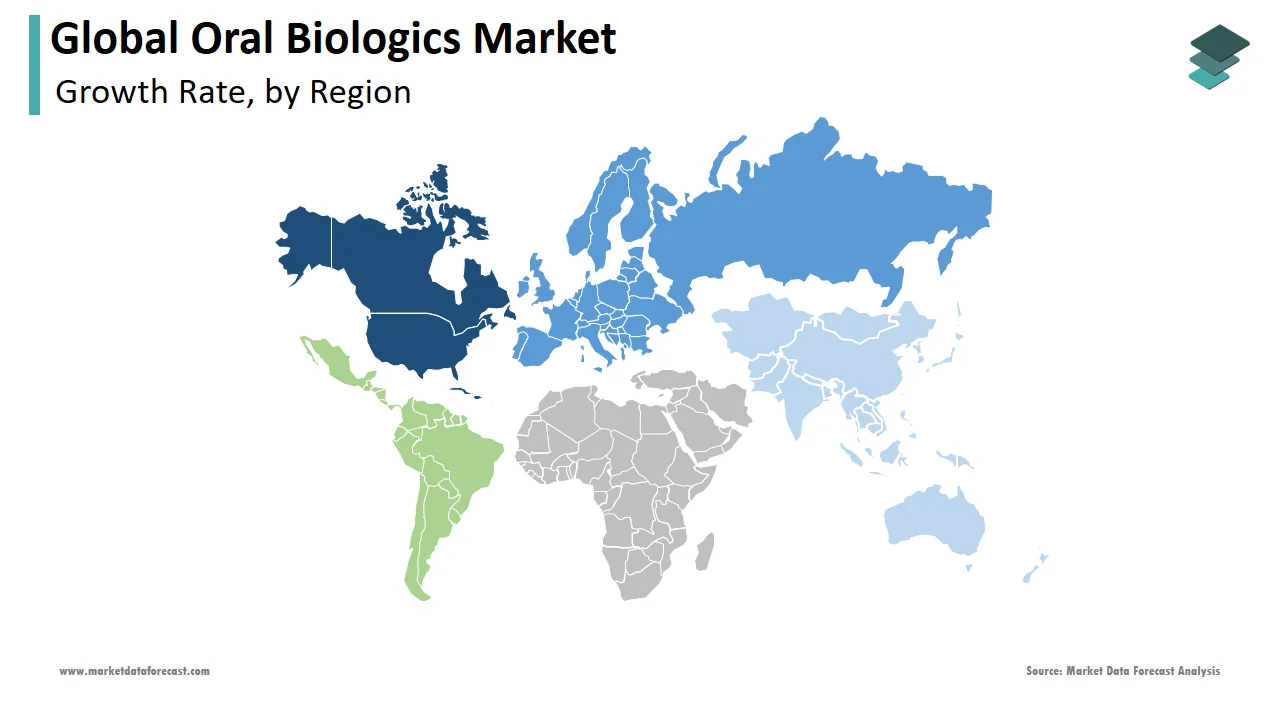

Geographically, North America dominated the oral biologics market in 2024. Countries such as the U.S. and Canada are currently contributing significantly to the oral biologics market in North America. The primary reasons are the acquisition and merger of companies and the FDA approvals for projects. For example, in 2019, AbbVie received FDA approval for Rinvoq, an oral biologic to treat rheumatoid arthritis. This government support and high research and development facilities drive the market growth for the region. In addition, the presence of key market players, advanced healthcare infrastructure, and favorable reimbursement policies are driving market growth. The U.S. accounts for the largest market share during the forecast period due to numerous biotechnology and pharmaceutical companies, high healthcare expansion, and advanced technology in healthcare.

Europe is another region that is expected to see a rise in the market for oral biologics in the forecast period. This growth is attributed to several manufacturing companies and players in the region and the development of new products. Countries like Germany, the U.K., Mexico, France, Italy, Spain, etc., are participating in the market's growth. The U.K. is likely to witness a significant share of the market during the forecast period. This is because of a supportive government, advancing healthcare sectors, and increasing research and development activities.

The Asia Pacific is projected to grow significantly during the forecast period due to improved healthcare sectors, a growing population, and supportive government policies. On the other hand, the Asia Pacific, with growing economies such as China, India, Japan, Australia, and South Korea, is also estimated to rise in the oral biologics market. With emerging importance and awareness about the efficiency of these drugs and to fight the increasing number of chronic diseases, this market is being developed. China is estimated to lead the APAC regional market growth in the coming period.

Latin America is expected to grow in the oral biologics market in the forecast period. Countries like Brazil, Mexico, and Argentina develop drugs in the oral biologics market.

The Middle East, with countries like GCC, Israel, and Africa, with countries like South Africa, Central Africa, and North Africa, are slowly showing progress in the market. However, they are currently predicted to be the regions with the slightest awareness and spread of the oral biologics market.

KEY MARKET PLAYERS

Novo Nordisk A/S, Biocon Limited, Oramed Pharmaceuticals Inc., Rani Therapeutics, Entera Bio Ltd., AbbVie Inc., Enteris BioPharma Inc., Chiasma Inc., Allena Pharmaceuticals Inc., Lilly, Lumen Bioscience Inc., Pfizer Inc., and BeiGene are a few of the prominent players in the global oral biologics market profiled in this report.

RECENT MARKET DEVELOPMENTS

- AbbVie was set to showcase the depth of its gastroenterology portfolio and pipeline at Digestive Disease Week. This proves that AbbVie's commitment to GI and IBD patients stands strong with their research in the field for 15 years. The paper was presented in May and showed several possibilities for the cure of various kinds of diseases.

- Lily's drug for diabetes, Mounjaro, wins FDA approval after much anticipation. It is a Type 2 diabetes and weight loss med that the FDA has approved. It also helps patients keep their blood sugar levels in check. This drug is believed to make significant changes in the medication for patients with diabetes.

- Eli Lilly, Sanofi, and Nord Nordisk have received a lawsuit from an Arkansan attorney general because of insulin prices. They are being sued for driving up the costs of the key medicines. In addition, the state is suing the companies and pharmacy benefit managers (PBMs) for the price hike of the important medicine.

MARKET SEGMENTATION

This global oral biologics market research report is segmented and sub-segmented into the following categories.

By Drug Class

- Glucagon-like peptide 1 (GLP-1) Receptor Agonist

- Recombinant Enzyme

- Somatostatin Analougue

- Guanylate Cyclase-C Agonist

- Hormone

- Others

By Disease Indication

- Irritable Bowel Syndrome (IBS)

- Chronic Idiopathic Constipation (CIC)

- Diabetes

- Hyperoxaluria

- Acromegaly

- Inflammatory Bowel Disease (IBD)

- Hypoparathyroidism

- Rheumatoid Arthritis

By Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the oral biologics market?

The global oral biologics market size is expected to be valued at USD 56.36 billion by 2033.

Which segment by drug class accounted for the major share in the oral biologics market in 2023?

Based on drug class, the Glucagon-like peptide 1 (GLP-1) Receptor Agonist segment is projected to lead the oral biologics market during the forecast period.

Which geographical region led the oral biologics market in 2024?

Geographically, the North American region accounted for the dominant share of the global oral biologics market in 2024.

Who are the key players in the global oral biologics market?

Companies playing a major role in the global oral biologics market are Novo Nordisk A/S, Biocon Limited, Oramed pharmaceuticals Inc., Rani Therapeutics, Entera Bio Ltd., AbbVie Inc., Enteris BioPharma Inc., Chiasma Inc., Allena Pharmaceuticals Inc., Lilly, Lumen Bioscience Inc., Pfizer Inc., and BeiGene.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com