Asia Pacific EV Battery Reuse Market Research Report – Segmented By Application (Energy Storage EV Charging Base Stations Low Speed Vehicles), Source, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific EV Battery Reuse Market Size

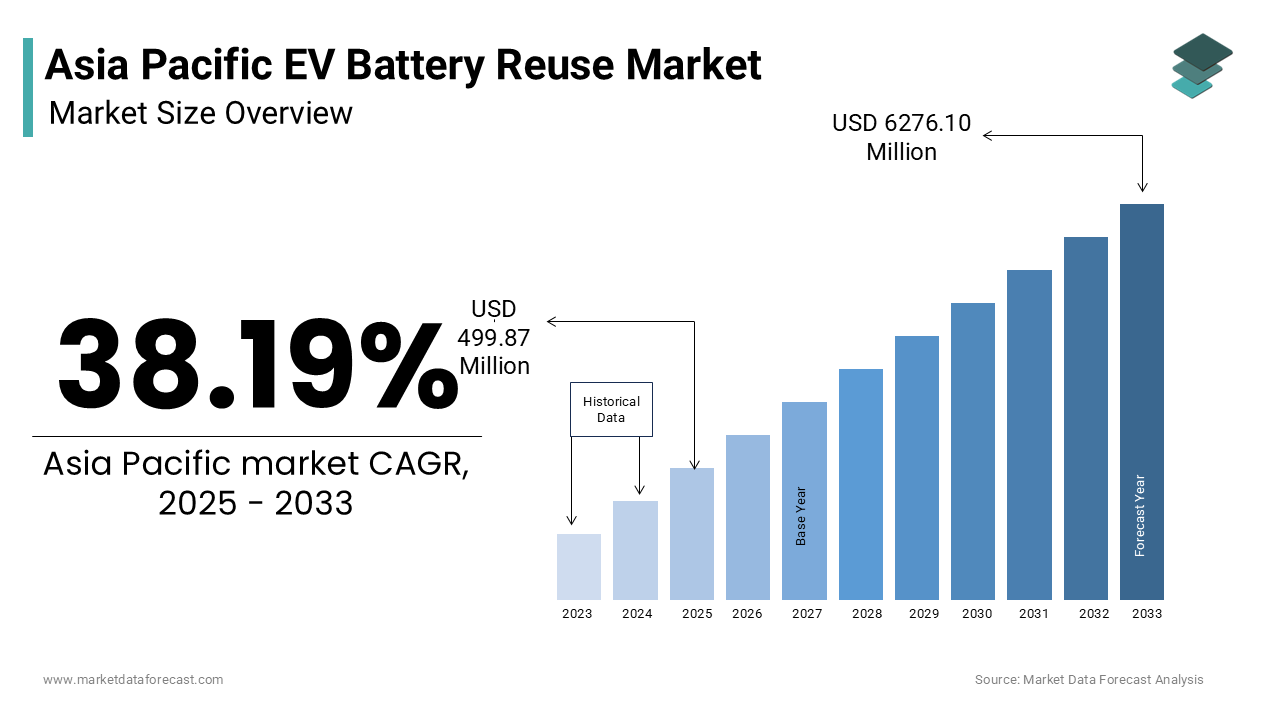

The Asia Pacific EV Battery Reuse Market was worth USD 364.34 million in 2024. The Asia Pacific market is expected to reach USD 6276.10 million by 2033 from USD 499.87 million in 2025, rising at a CAGR of 38.19% from 2025 to 2033.

The Asia Pacific EV battery reuse market refers to the ecosystem that facilitates the repurposing and second-life utilization of lithium-ion batteries from electric vehicles once they reach the end of their automotive lifecycle. These batteries, though no longer suitable for vehicle propulsion, often retain up to 70–80% of their original capacity, making them viable for alternative applications such as energy storage systems, grid balancing, renewable energy integration, and industrial backup power solutions. As the adoption of electric vehicles accelerates across the region, so does the volume of retired EV batteries, creating a growing need for sustainable and economically viable reuse strategies.

MARKET DRIVERS

Expansion of Renewable Energy Infrastructure

One of the primary drivers of the Asia Pacific EV battery reuse market is the rapid expansion of renewable energy infrastructure across the region. Governments in countries like China, India, Japan, and Australia are aggressively investing in solar and wind power generation to meet climate commitments and reduce reliance on fossil fuels. According to the International Renewable Energy Agency, the Asia Pacific accounted for over 60% of global renewable energy installations in 2023, with solar PV alone contributing more than half of the new additions. However, the intermittent nature of renewable sources necessitates robust energy storage solutions to ensure grid stability and efficient load management. Second-life EV batteries offer a cost-effective and environmentally sustainable option for large-scale energy storage systems. In Japan, utilities such as TEPCO and Kyocera have deployed repurposed Nissan Leaf batteries in microgrid projects to balance fluctuating solar output. Similarly, in India’s rural regions, state-run agencies are experimenting with decommissioned EV battery packs to support off-grid solar installations, addressing both energy access and sustainability goals. Australia’s Clean Energy Council has also endorsed the use of second-life EV batteries in distributed energy networks, citing their ability to enhance system efficiency without adding to raw material demand.

Government Policies and Environmental Regulations Promoting the Circular Economy

Government policies and regulatory initiatives aimed at promoting a circular economy are playing a pivotal role in driving the EV battery reuse market in the Asia Pacific. Several regional governments have introduced mandatory recycling and reuse mandates to curb electronic waste and encourage sustainable resource management. In addition, in 2023, the Indonesian government announced a draft regulation mandating battery manufacturers to assume responsibility for post-consumer battery recovery—a move expected to stimulate local reuse initiatives.

MARKET RESTRAINTS

Lack of Standardization and Testing Protocols

A major restraint impeding the growth of the Asia Pacific EV battery reuse market is the absence of standardized testing protocols and certification mechanisms for second-life batteries. Unlike newly manufactured energy storage units, used EV batteries vary widely in terms of chemistry, performance degradation, and remaining life expectancy, making it difficult to assess their suitability for reuse applications. Without universally accepted evaluation criteria, stakeholders—ranging from battery recyclers to energy storage system integrators—face considerable uncertainty regarding product quality and reliability.

According to the United Nations Environment Programme, less than 30% of Asian countries have established comprehensive technical standards for assessing the health and safety of repurposed EV batteries. In India, despite government-backed pilot programs, inconsistencies in battery diagnostics continue to hinder commercial scalability. Similarly, in Indonesia and the Philippines, where EV adoption is still in its early stages, there is a lack of institutional frameworks to guide battery classification and grading procedures.

The absence of uniform protocols leads to fragmented market development and discourages investment from larger technology firms seeking predictable asset performance metrics.

High Initial Investment and Uncertain Economic Viability

Despite the environmental benefits associated with EV battery reuse, high initial capital requirements and uncertain economic returns remain significant barriers to widespread market adoption in the Asia Pacific. Repurposing EV batteries involves extensive sorting, disassembly, reconditioning, and integration into new energy systems—processes that demand specialized facilities, skilled labor, and advanced diagnostic equipment.

Moreover, profitability is heavily dependent on factors such as residual battery value, operational longevity, and market demand for secondary storage applications. While some pilot projects in South Korea and Australia have demonstrated positive return-on-investment scenarios, many small-to-mid-sized enterprises struggle to secure financing due to unpredictable revenue models and fluctuating battery supply volumes.

In China, despite aggressive government backing, several battery reuse startups have faced financial difficulties due to inconsistent feedstock availability and the falling cost of new lithium-ion cells. The declining price of fresh energy storage solutions has eroded the competitive advantage of second-life alternatives, making it harder for reuse initiatives to gain traction.

MARKET OPPORTUNITIES

Integration with Off-Grid and Rural Electrification Programs

A promising opportunity for the Asia Pacific EV battery reuse market lies in its potential integration with off-grid and rural electrification initiatives. Many countries in the region still face substantial energy access gaps, particularly in remote and island communities where extending centralized grid infrastructure is economically or logistically unfeasible. According to the International Energy Agency, a significant number of people in Southeast Asia lacked access to electricity, particularly in parts of Indonesia, the Philippines, and Papua New Guinea. Second-life EV batteries offer a viable solution by providing affordable, modular energy storage units that can be paired with decentralized renewable energy systems. These initiatives help address both energy poverty and sustainability goals by leveraging existing battery assets rather than sourcing new ones. Similarly, in Malaysia, the Sarawak Corridor of Renewable Energy (SCORE) program has explored the use of retired EV batteries to store excess hydroelectric power for nighttime usage in isolated settlements. The Philippines Department of Energy has also expressed interest in deploying second-life battery systems in island provinces where diesel generators remain the primary source of electricity.

Growing Demand for Stationary Energy Storage Solutions

Another significant opportunity for the Asia Pacific EV battery reuse market is the rising demand for stationary energy storage solutions driven by the expansion of smart grids, peak load management, and behind-the-meter applications. Utilities and industrial operators are increasingly adopting energy storage systems to stabilize power flow, manage intermittency from renewable sources, and reduce dependency on fossil-fuel-based peaking plants. According to BloombergNEF, global stationary storage deployments are projected to exceed 411 GW by 2030. In Japan, companies like SoftBank and Tokyo Electric Power Company (TEPCO) have been actively deploying second-life EV batteries in grid-scale storage projects to support frequency regulation and voltage stabilization. South Korea is also advancing similar initiatives under its "Energy Storage System (ESS) Roadmap," which encourages utilities to incorporate repurposed EV batteries into virtual power plant networks. In Australia, A Better Routeplanner, a battery analytics firm, has partnered with energy providers to deploy EV battery-based storage units for commercial customers aiming to lower demand charges.

MARKET CHALLENGES

Logistical Complexity in Battery Collection and Sorting

One of the most pressing challenges facing the Asia Pacific EV battery reuse market is the logistical complexity involved in collecting, transporting, and sorting used batteries. Unlike traditional scrap metals or consumer electronics, EV batteries are bulky, heavy, and pose safety risks if mishandled. Establishing an efficient reverse logistics chain—from EV dismantlers to certified testing centers—is a formidable task, especially in sprawling and diverse geographies.

In countries like India and Indonesia, where vehicle scrappage processes are largely informal, recovering intact battery packs in usable conditions remains a challenge. According to the World Bank, only a small percentage of end-of-life EVs in the region undergo formal dismantling procedures, resulting in lost opportunities for battery recovery. Even when batteries are retrieved, discrepancies in chemistries, pack designs, and state-of-health assessments complicate the sorting process.

However, the lack of integrated digital tracking systems hinders real-time monitoring of battery flows. In Japan, despite high EV penetration, the absence of dedicated transportation protocols for used batteries increases handling costs and delays processing timelines.

Technological Limitations in Battery Health Assessment and Reintegration

A critical technological challenge hindering the expansion of the Asia Pacific EV battery reuse market is the difficulty in accurately assessing the health and remaining useful life of used battery packs. Unlike new energy storage systems, which come with guaranteed performance warranties, second-life EV batteries exhibit variable degradation patterns depending on prior usage, charging habits, and thermal exposure. Without precise diagnostics, determining whether a battery is suitable for reuse and at what capacity remains highly uncertain.

Advanced testing platforms such as electrochemical impedance spectroscopy and AI-driven predictive modeling exist but are not widely deployed across the region due to high implementation costs. According to McKinsey & Company, only a handful of battery refurbishment centers in Asia Pacific employ sophisticated diagnostic tools capable of providing granular insights into cell-level degradation and failure risks.

This limitation affects not only resale value but also integration feasibility in grid-connected applications. In Australia and South Korea, where utility-scale reuse trials have been conducted, inconsistent battery performance has led to suboptimal system efficiencies and increased maintenance burdens. In India, where startups attempt to retrofit used EV modules for home storage, compatibility issues between different battery chemistries often lead to premature failures.

SEGMENTAL ANALYSIS

By Application Insights

The energy storage segment held the largest share of the Asia Pacific EV battery reuse market at 47.6% in 2024 which is driven primarily by the increasing need for grid stability and renewable energy integration. With governments across the region pushing for higher penetration of solar and wind power, the demand for cost-effective stationary energy storage solutions has surged.

State Grid Corporation has already initiated pilot projects integrating used EV modules for frequency regulation and peak shaving. Similarly, Japan’s Ministry of Economy, Trade and Industry (METI) supports initiatives like the Yokohama Smart City Project, where former Nissan Leaf batteries are repurposed for residential and commercial energy storage.

Australia's Clean Energy Council reported that a major share of new large-scale solar farms now include some form of battery storage, with reused EV units providing a lower-cost alternative to fresh lithium-ion cells.

The EV charging segment is projected to grow at the fastest rate in the Asia Pacific EV battery reuse market, with a CAGR of 13.6% between 2025 and 2033. This rapid expansion is fueled by the increasing deployment of decentralized and mobile EV charging infrastructure that leverages repurposed battery packs to store and supply electricity on demand. China leads this trend, having installed over 7.6 million public and private EV charging points by 2023, according to the China Electricity Council. Many of these stations incorporate second-life EV batteries as buffer storage units to manage load fluctuations and reduce peak grid dependency. For instance, BYD and CATL have partnered to develop modular battery-based charging kiosks that support fast-charging without direct grid draw.

In South Korea, companies like SK On and LG Energy Solution are exploring battery reuse in ultra-fast charging hubs planned under the country’s Electric Mobility Roadmap 2030, which aims to deploy 500,000 EV chargers nationwide by 2030. Meanwhile, Indian startups such as Log9 Materials are piloting off-grid EV charging stations powered by repurposed lithium-ion batteries, particularly in remote areas with weak grid connectivity.

By Source Insights

The Battery Electric Vehicles (BEVs) segment represented the largest source in the Asia Pacific EV battery reuse market by accounting for 59.1% of total volume in 2024. This influence is due to the rapid mass adoption of fully electric passenger vehicles, particularly in countries like China, South Korea, and Japan, where government incentives and emissions regulations are accelerating the transition away from internal combustion engines.

According to the International Energy Agency, BEV sales accounted for over 80% of total electric vehicle registrations in the Asia Pacific in 2023, outpacing both Hybrid Electric Vehicles (HEVs) and Plug-in Hybrid Electric Vehicles (PHEVs). China alone contributed more than 9 million BEV sales in 2023, as reported by the China Association of Automobile Manufacturers (CAAM), generating a significant inflow of end-of-life battery packs available for reuse.

Japan’s Ministry of Land, Infrastructure, Transport and Tourism noted that BEV registrations had surpassed 400,000 units by the end of 2023, a fourfold increase compared to 2020 levels. This exponential growth translates into a growing stock of high-capacity lithium-ion batteries entering the secondary market within the next five to seven years.

South Korea is also experiencing a surge in BEV adoption, with major automakers like Hyundai and Kia aggressively expanding their all-electric lineups.

The Plug-in Hybrid Electric Vehicles (PHEVs) segment is emerging as the fastest-growing source in the Asia Pacific EV battery reuse market, anticipated to expand at a CAGR of 11.2%. Unlike conventional hybrids, PHEVs feature larger battery capacities that allow for limited all-electric driving before switching to gasoline propulsion—making them increasingly attractive in markets where full electrification is still evolving. This segment is gaining traction due to shifting consumer preferences and regulatory support in key economies. In China, the Ministry of Industry and Information Technology revised its subsidy framework in 2023 to reintroduce partial incentives for PHEVs, prompting automakers like BYD and Geely to ramp up production. As a result, PHEV sales crossed 2.5 million units in 2023, a 75% year-on-year increase, according to the China Passenger Car Association. Toyota, one of the world’s largest hybrid vehicle manufacturers, reported a 30% rise in PHEV exports from Japan in 2023, targeting markets with less developed charging infrastructure. Also, Southeast Asian countries like Thailand and Malaysia are promoting PHEVs through tax exemptions and import duty reductions.

REGIONAL ANALYSIS

China stood at the forefront of the Asia Pacific EV battery reuse market by commanding a 38.6% of the regional share in 2024. As the world’s largest EV market, China generates vast volumes of decommissioned lithium-ion batteries annually, creating a robust foundation for second-life applications. According to the China Automotive Technology and Research Center (CATARC), over 9 million EVs were sold in China in 2023, many of which will reach the end of their first lifecycle within the next decade. Recognizing this impending influx, the Chinese government introduced stringent guidelines mandating automakers to establish battery collection and recycling systems, with a strong emphasis on reuse before final disposal. State-backed initiatives further bolster market development. The Ministry of Industry and Information Technology launched a battery traceability platform in 2022, enabling stakeholders to monitor and assess the health of retired battery packs. In addition, collaborations between major players like CATL, BYD, and Sinopec have led to the establishment of dedicated battery refurbishment centers focused on integrating second-life units into grid-scale energy storage installations.

Japan is rising in the Asia-Pacific EV battery reuse market. The country’s early adoption of electric mobility and well-established automotive manufacturing ecosystem positions it as a frontrunner in battery life extension strategies.

The Ministry of Economy, Trade and Industry (METI) has been instrumental in fostering reuse initiatives, launching pilot programs that explore the viability of integrating retired EV batteries into smart city grids and renewable energy storage hubs. One of the most notable examples is the Yokohama Smart City Project, where Nissan Leaf batteries are repurposed to stabilize local energy demand. In 2023, Nissan announced a partnership with Sumitomo Corporation to scale up its 4R Energy subsidiary, which specializes in reusing EV batteries for residential and commercial storage applications. Moreover, Japan’s commitment to achieving carbon neutrality by 2050 has prompted utilities like Tokyo Electric Power Company (TEPCO) to invest in second-life battery-based frequency regulation systems.

South Korea is expanding in the market and is positioning itself as a key player in the region’s circular battery economy. The nation’s strong presence in global battery manufacturing, combined with forward-thinking policy frameworks, has laid the groundwork for scaling up reuse operations.

The Korean Ministry of Trade, Industry & Energy rolled out the "Battery Reuse and Recycling Roadmap" in 2022, outlining standardized procedures for assessing battery health and defining quality benchmarks for secondary applications. This initiative has encouraged firms like LG Energy Solution, Samsung SDI, and SK On to actively participate in battery refurbishment ventures. One of the most prominent projects is the Korea Electric Power Corporation (KEPCO)-led energy storage system deployed using repurposed EV modules. KEPCO reported that several of its demonstration sites are already operational, utilizing second-life batteries to enhance grid stability and support renewable energy integration. Startups and research institutions are also playing a crucial role in advancing the reuse ecosystem.

India is emerging as a rapidly growing force in the sector. The country’s push for clean mobility, coupled with aggressive electrification targets, is fueling interest in sustainable battery management practices.

According to reports, India added over 1.2 million EVs to its roads in 2023, including two-wheelers, three-wheelers, and buses. As these vehicles age, the number of usable battery packs available for repurposing is expected to rise sharply. State-run organizations like the Solar Energy Corporation of India (SECI) are piloting projects that integrate retired e-bus batteries into rural solar mini-grids. These deployments help bridge the energy access gap while avoiding reliance on newly mined materials. Private sector engagement is also gaining momentum. Companies such as Exicom Telecommunications and Log9 Materials are developing modular second-life storage units tailored for industrial backup power and decentralized charging stations.

Australia accounts for a smaller portion of the Asia Pacific EV battery reuse market and is playing a vital but strategic role in the region’s evolving battery sustainability narrative. While EV adoption is still relatively modest compared to other major economies, the country’s strong focus on renewable energy and grid resilience is creating unique opportunities for second-life battery applications. One such initiative, conducted by A Better Routeplanner and Energy Estate, showcased how Tesla Model S battery modules could be integrated into commercial and industrial energy optimization setups. Second-life EV batteries present a cost-effective alternative to new lithium-ion units, particularly for behind-the-meter applications. Moreover, universities and research bodies such as the Commonwealth Scientific and Industrial Research Organisation (CSIRO) are actively engaged in developing diagnostic tools to evaluate battery health and performance longevity.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The competition in the Asia Pacific EV battery reuse market is intensifying as both traditional automotive and energy storage firms seek to capture a share of this emerging sector. Established battery manufacturers, automakers, and independent recycling companies are increasingly recognizing the economic and environmental potential of repurposing end-of-life EV batteries. While some players leverage their existing production capabilities and technical expertise to lead in reuse applications, others are forging new paths through innovative business models and cross-sector collaborations.

Market participants face challenges in differentiating themselves due to the relatively nascent stage of the industry and the lack of uniform standards for assessing and deploying second-life batteries. However, early movers are gaining an advantage by securing partnerships with automakers, developing proprietary diagnostic technologies, and aligning their offerings with national sustainability policies.

Top Players in the Asia Pacific EV Battery Reuse Market

CATL (Contemporary Amperex Technology Co. Limited)

CATL, headquartered in China, is a global leader in lithium-ion battery manufacturing and plays a dominant role in the Asia Pacific EV battery reuse market. The company has developed advanced battery lifecycle management systems that enable efficient sorting, testing, and repurposing of used EV batteries. CATL collaborates with automakers and energy companies to deploy second-life battery packs in grid-scale storage and renewable integration projects.

Nissan Motor Co., Ltd.

Nissan has been at the forefront of EV battery reuse initiatives through its dedicated subsidiary 4R Energy, formed in collaboration with Sumitomo Corporation. The company pioneered early-stage reuse strategies by integrating retired Nissan Leaf batteries into residential and commercial energy storage solutions. Nissan’s focus on smart mobility ecosystems and partnerships with utilities has accelerated the adoption of second-life applications in Japan and beyond. Their standardized battery design approach simplifies inspection and reintegration processes, making them a trusted contributor to the growing EV battery reuse landscape in the Asia Pacific.

LG Energy Solution

LG Energy Solution is a major South Korean player shaping the Asia Pacific EV battery reuse market through strategic technology development and cross-industry collaborations. The company actively engages in repurposing end-of-life EV batteries for stationary storage and industrial energy optimization. LGES has established demonstration projects with utility providers to test the performance of second-life battery modules in real-world settings. With a strong presence in both the automotive and energy storage sectors, LG Energy Solution contributes significantly to advancing reuse standards and promoting sustainable battery value chains across the region.

Top Strategies Used by Key Market Participants

One of the primary strategies employed by key players in the Asia Pacific EV battery reuse market is technology innovation and diagnostics development. Companies are investing heavily in advanced assessment tools that accurately determine battery health and suitability for second-life use. These innovations enhance reliability and reduce uncertainty in reuse applications, encouraging broader adoption across industries.

Another critical approach is strategic partnerships with automakers, utilities, and research institutions. By forming alliances, companies can streamline battery collection, testing, and deployment into energy systems. These collaborations facilitate knowledge exchange, improve supply chain efficiency, and align reuse efforts with national sustainability goals.

Lastly, establishing dedicated reuse and remanufacturing facilities is becoming a cornerstone strategy. Major players are setting up specialized centers to process, repurpose, and integrate used EV batteries into new applications. These localized hubs support scalability and ensure compliance with environmental regulations while strengthening their regional foothold in the growing EV battery reuse ecosystem.

RECENT MARKET DEVELOPMENTS

- In January 2024, CATL announced a joint venture with a leading Chinese utility provider to develop large-scale energy storage systems using second-life EV batteries. This initiative aims to enhance the company's footprint in the stationary storage sector and promote sustainable power infrastructure.

- In June 2024, Nissan expanded its partnership with a Japanese energy firm to deploy repurposed Leaf batteries in rural microgrid projects. This move strengthens Nissan’s commitment to circular resource use and expands the practical applications of its legacy battery assets.

- In September 2024, LG Energy Solution launched a dedicated battery refurbishment center in South Korea focused exclusively on evaluating and repackaging used EV modules for industrial and commercial storage applications. This facility enhances the company’s ability to provide reliable second-life battery solutions.

- In November 2024, Toyota initiated a pilot program in Thailand to collect and assess PHEV battery packs for reuse in off-grid energy systems. This action reflects Toyota’s broader strategy to explore circular opportunities across its electrified vehicle portfolio.

- In February 2025, Sumitomo Corporation partnered with a Singapore-based clean tech startup to develop AI-driven diagnostics for assessing battery health before reuse. This collaboration supports more efficient decision-making and improves the economic viability of repurposed battery systems.

MARKET SEGMENTATION

This research report on the Asia Pacific EV battery reuse market is segmented and sub-segmented into the following categories.

By Application

- Energy Storage

- EV Charging

- Base Stations

- Low Speed Vehicles

By Source

- BEV

- HEV & PHEV

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

Why is the Asia Pacific region important for EV battery reuse?

Asia Pacific is a major hub for electric vehicle production and adoption, especially in countries like China, Japan, South Korea, and India, making it a key region for battery reuse and second-life energy solutions.

What is driving the growth of Asia Pacific EV Battery Reuse Market?

Growth is driven by rising EV adoption, increasing battery waste, supportive government policies, and a strong focus on sustainable and circular economy practices.

What is the future outlook of the EV battery reuse market in Asia Pacific?

The market is expected to grow steadily, supported by rising EV sales, advancements in battery diagnostics, and growing demand for affordable energy storage solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com