Asia-Pacific Electric Vehicle Market Size, Share, Trends & Growth Forecast Report, Segmented By Vehicle, Propulsion, Drive, Range, Component Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore & Rest of APAC), Industry Analysis Forecast (2025 to 2033)

Asia-Pacific Electric Vehicle Market Size

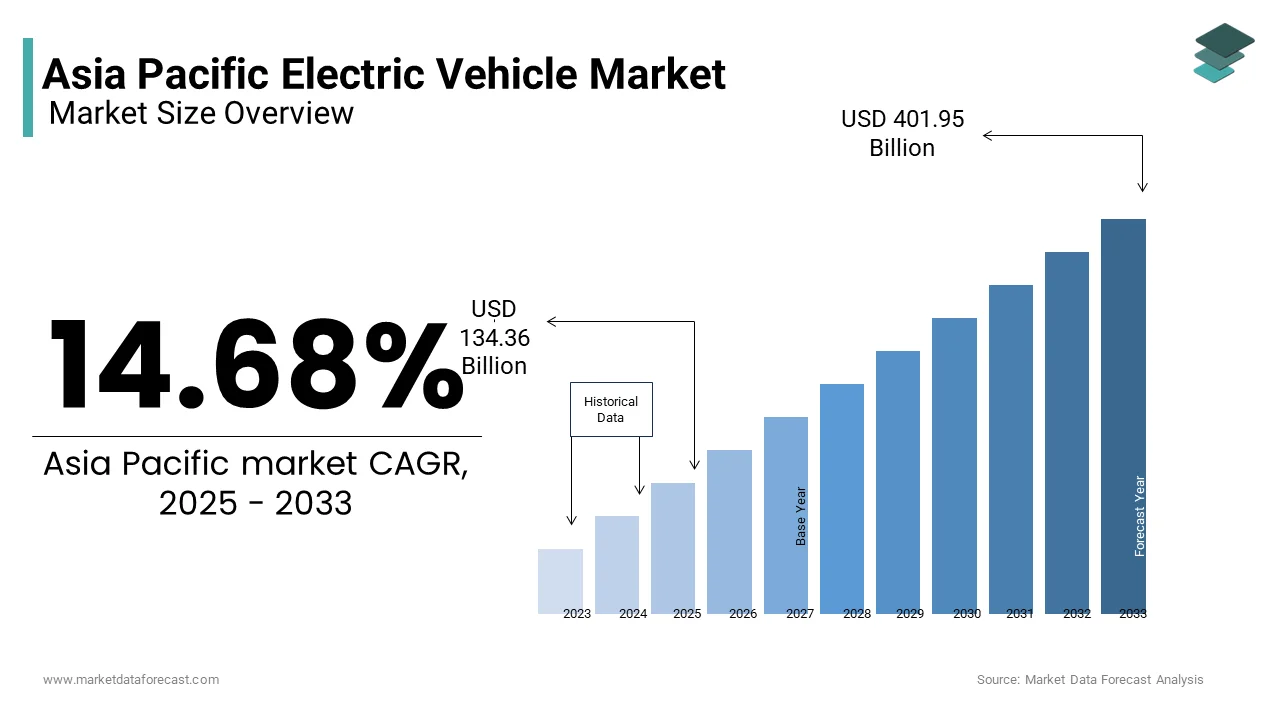

The Asia-Pacific electric vehicle (EV) market was valued at USD 117.14 billion in 2024 and is anticipated to reach USD 134.36 billion in 2025, from USD 401.95 billion by 2033, growing at a compound annual growth rate CAGR of 14.68 % during the forecast period from 2025 to 2033.

MARKET DRIVERS

Government Policies and Incentives

Government initiatives play a pivotal role in propelling the Asia Pacific EV market forward. For example, China’s New Energy Vehicle (NEV) mandate requires automakers to produce a minimum percentage of EVs annually, owing to driving manufacturers to prioritize electrification. Similarly, India’s Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME II) scheme offers financial incentives worth $1.4 billion to boost EV production and infrastructure development. These policies not only reduce upfront costs for consumers but also stimulate investments in R&D and manufacturing capabilities. Furthermore, regulatory frameworks mandating zero-emission zones in urban areas, as seen in Japan and South Korea, create additional demand for EVs.

Technological Advancements in Battery Efficiency

Breakthroughs in battery technology are another major driver of the Asia Pacific EV market. According to Panasonic Corporation, advancements in lithium-ion batteries have increased energy density by 30% over the past five years by extending vehicle ranges to over 500 kilometers on a single charge. Additionally, the development of solid-state batteries, projected to achieve commercial viability by 2025 as per Toyota Corporation, promises even greater efficiency and safety. Samsung SDI reports that these innovations could reduce charging times to under 10 minutes by enhancing user convenience.

MARKET RESTRAINTS

High Initial Costs and Affordability Concerns

Despite the long-term cost benefits of EVs, their high initial prices remain a significant barrier for many consumers in the Asia Pacific region. Entry-level EV models typically cost 30-50% more than their gasoline counterparts by making them inaccessible to price-sensitive demographics in emerging economies like Indonesia and Vietnam. While financing options and installment plans are being introduced, they remain limited in scope and accessibility. Additionally, the lack of widespread awareness about total cost of ownership further exacerbates affordability concerns

Inadequate Charging Infrastructure

Another critical restraint is the insufficient development of EV charging infrastructure. For example, in Thailand, where EV adoption is growing rapidly, the ratio of charging points to vehicles is just 1:20, significantly lower than the recommended 1:5 ratio. This scarcity forces drivers to rely on home charging, which is impractical for those living in densely populated urban areas or without dedicated parking spaces. Furthermore, interoperability issues between different charging networks, as per the World Economic Forum, complicate user experiences. Governments and private players must collaborate to expand and standardize charging infrastructure, which is ensuring seamless connectivity and fostering consumer confidence in EV technology.

MARKET OPPORTUNITIES

Expansion into Rural and Semi-Urban Areas

The untapped potential of rural and semi-urban markets presents a transformative opportunity for the Asia Pacific EV market. As per the Food and Agriculture Organization, over 45% of the region’s population resides in rural areas, where access to affordable and sustainable transportation remains limited. EVs, particularly two-wheelers and small utility vehicles, can address this gap by offering cost-effective mobility solutions. For instance, in rural India, Tata Motors has partnered with microfinance institutions to provide affordable EV financing options for farmers and small business owners. Similarly, in Indonesia, government-backed solar-powered charging stations are being piloted to enhance accessibility in remote regions.

Integration of Smart Mobility Solutions

The integration of smart mobility technologies represents another promising avenue for market expansion. In the Asia Pacific region, innovations such as AI-powered navigation systems, vehicle-to-grid (V2G) technology, and IoT-enabled diagnostics are gaining traction among tech-savvy consumers. For example, Hyundai’s SmartSense suite, launched in South Korea, uses real-time data to optimize energy consumption and improve driving efficiency. Additionally, partnerships with tech giants like Alibaba and Tencent are enabling seamless connectivity between EVs and smart city ecosystems. According to Frost & Sullivan, these advancements could reduce energy wastage by up to 20%, enhancing overall sustainability. The manufacturers can differentiate their offerings and elevate the appeal of EVs in the competitive Asia Pacific market by leveraging cutting-edge technologies.

MARKET CHALLENGES

Supply Chain Vulnerabilities and Material Shortages

One of the most pressing challenges facing the Asia Pacific EV market is the vulnerability of supply chains to disruptions. According to the International Chamber of Commerce, the global semiconductor shortage caused a 20% decline in EV production in 2021, which is impacting regional manufacturers significantly. Geopolitical tensions, particularly between China and the United States, have further exacerbated shortages of critical components like lithium-ion batteries and electronic control units. Additionally, the rising cost of raw materials, such as cobalt and nickel, has increased production expenses. The London Metal Exchange reports that cobalt prices surged by 40% in 2022, straining profit margins. These supply chain bottlenecks not only delay production timelines but also inflate retail prices, which is making it difficult for manufacturers to meet growing consumer demand. Addressing these vulnerabilities requires diversification of sourcing strategies and investment in localized production capabilities.

Consumer Awareness and Perception Gaps

Another significant hurdle is the lack of consumer awareness and misconceptions regarding EVs. According to Nielsen, only 35% of respondents in Southeast Asia are familiar with the operational advantages of EVs compared to traditional vehicles. Misconceptions about battery longevity, charging infrastructure, and overall durability persist by deterring potential buyers. For instance, in Malaysia, many consumers believe that EV batteries require frequent replacements, despite evidence suggesting modern models last up to eight years with proper care. Furthermore, inadequate after-sales services and repair facilities in smaller towns amplify skepticism. According to a study by Frost & Sullivan, improving consumer education through targeted marketing campaigns and hands-on workshops could boost adoption rates by 30%.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.68% |

|

Segments Covered |

By Vehicle, Propulsion, Drive, Range, Component, and Country |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country's Covered |

The United States, Canada, and the Rest of North America |

|

Market Leaders Profiled |

BYD Company Motors, BMW Group, Tesla, Nissan Motor Corporation, Volkswagen AG, Toyota Motor Corporation, General Motors, Energica Motor Company S.P.A., Daimler AG, and Ford Motor Company |

SEGMENTAL ANALYSIS

By Vehicle Type Insights

The passenger cars segment dominated the Asia Pacific electric vehicle (EV) market with a dominant share in 2024 owing to the region's growing urbanization and rising disposable incomes, which fuel demand for personal mobility solutions. For instance, in China, over 80% of EV buyers are urban professionals seeking affordable, eco-friendly alternatives to traditional vehicles. Government incentives further amplify this trend; as per the Ministry of Industry and Information Technology, subsidies for passenger EVs have led to a 150% increase in sales since 2020. Additionally, advancements in battery technology have extended driving ranges to over 500 kilo meters, addressing range anxiety concerns. According to Panasonic Corporation, these innovations have reduced charging times by 40% thereby enhancing user convenience. Another factor is the proliferation of shared mobility platforms like Didi Chuxing, which integrate passenger EVs into their fleets, which is normalizing their adoption.

The commercial EVs segment is likely to register a CAGR of 32.5% throughout the forecast period. The growth of the segment is fueled by the burgeoning e-commerce sector, which relies heavily on efficient last-mile delivery solutions. Companies like JD.com and Amazon are transitioning their fleets to electric vans and trucks, with Alibaba committing to electrify 50% of its delivery fleet by 2030. Another contributing factor is technological innovation. Bosch’s introduction of dual-motor systems has enhanced the performance of commercial EVs by enabling them to handle heavy payloads and steep inclines.

By Propulsion Type Insights

The Battery Electric Vehicles (BEVs) segment was accounted in holding 62.1% of the Asia Pacific EV market share in 2024 due to its alignment with consumer preferences for fully electric, zero-emission vehicles. A key driver is the declining cost of lithium-ion batteries, which dropped below $150 per kWh in 2022, according to BloombergNEF by making BEVs more affordable. Additionally, BEVs offer superior environmental benefits; Toyota Corporation states that replacing internal combustion engines with BEVs could reduce CO2 emissions by up to 50 million tons annually in the region. Governments also favor BEVs through policies like China’s New Energy Vehicle mandate, which prioritizes BEV production. Another factor is the proliferation of public charging infrastructure. South Korea plans to expand its network to 15,000 stations by 2025 by ensuring seamless connectivity for BEV users.

The Hybrid Electric Vehicles (HEVs) segment is likely to grow with a CAGR of 28.3% during the forecast period. This surge is driven by their versatility and appeal to consumers transitioning from traditional vehicles. HEVs combine internal combustion engines with electric motors by offering extended ranges and reducing range anxiety concerns. As per Honda Corporation, HEVs are particularly popular in emerging markets like India and Indonesia, where charging infrastructure remains underdeveloped. Additionally, government incentives, such as Japan’s Green Growth Strategy, encourage HEV adoption as an interim solution toward full electrification. Another contributing factor is affordability; Samsung SDI reports that HEVs are 20-30% cheaper than BEVs by making them accessible to price-sensitive demographics.

By Drive Type Insights

The Front Wheel Drive (FWD) segment was the largest by capturing a significant share of the Asia Pacific electric vehicle market in 2024 with its cost-effectiveness and efficiency for urban commuting. According to Nissan Corporation, FWD systems are lighter and simpler to manufacture by reducing production costs by up to 15%. Additionally, FWD EVs excel in city environments, where compact designs and maneuverability are prioritized. Another factor is energy efficiency. Bosch reports that FWD systems consume 10% less energy than all-wheel drive counterparts that is extending driving ranges. These advantages ensure that FWD remains the preferred choice for manufacturers and consumers alike.

The All Wheel Drive (AWD) segment is projected to grow at a CAGR of 35.2% throughout the forecast period. The growth of the segment is driven by increasing demand for high-performance vehicles in premium segments. As per Tesla Corporation, AWD systems enhance traction and stability by making them ideal for regions with diverse terrains, such as mountainous areas in China and rural parts of Australia. Additionally, luxury automakers like BMW and Mercedes-Benz are integrating AWD technology into their flagship models by appealing to affluent consumers. Government initiatives, such as South Korea’s subsidy programs for high-end EVs that further stimulate adoption. Another contributing factor is technological innovation; LG Chem’s development of modular battery systems has improved the efficiency of AWD EVs by boosting their appeal.

By Range Insights

The 151-300 miles range segment was accounted in holding 55.4% of the Asia Pacific EV market share in 2024 due to its balance of affordability and practicality by catering to both urban and suburban commuters. According to Panasonic Corporation, advancements in lithium-ion batteries have made this range achievable without significantly increasing costs, appealing to price-conscious buyers. Additionally, government policies favor mid-range EVs; India’s FAME II scheme provides higher subsidies for vehicles within this category, boosting sales.

The EVs with ranges exceeding 300 miles segment is attributed to witness a fastest CAGR of 40.5% in the next coming years. This exponential growth is fueled by advancements in battery technology and increasing demand for long-distance travel solutions. As per Tesla Corporation, innovations in solid-state batteries could extend ranges to over 500 miles while reducing charging times to under 10 minutes. Additionally, premium automakers like Porsche and Audi are targeting affluent consumers who prioritize performance and luxury. Government incentives, such as Australia’s tax rebates for high-end EVs, further accelerate adoption. Another contributing factor is urban planning; Japan’s expansion of expressway charging stations ensures seamless connectivity for long-range EVs. These dynamics position the above 300 miles category as the fastest-growing segment in the Asia Pacific EV market.

By Component Insights

The battery packs and high-voltage segment was the largest by occupying 45.6% of the Asia Pacific EV market share in 2024 with its role in determining vehicle performance and range. According to Samsung SDI, advancements in lithium-ion technology have increased energy density by 30%, enhancing battery efficiency. Additionally, economies of scale have reduced production costs by making these components more accessible. Another factor is regulatory support. South Korea mandates the use of advanced battery systems to meet stringent emission standards.

The motors segment is projected to grow at a CAGR of 38.7% throughout the forecast period owing to the advancements in motor technology and increasing demand for high-performance EVs. As per Bosch, the development of permanent magnet synchronous motors has improved efficiency by 20% by appealing to manufacturers and consumers alike. Additionally, government incentives, such as Japan’s subsidies for innovative EV components, stimulate adoption.

COUNTRY LEVEL ANALYSIS

China was the largest contributor in the Asia Pacific EV market with a 60.3% of share in 2024 due to its massive population and extensive urbanization efforts. According to the National Bureau of Statistics, China’s urban population exceeds 900 million by creating a fertile ground for EV adoption. Government policies play a pivotal role, while the Ministry of Industry and Information Technology offers subsidies for manufacturers producing energy-efficient EVs, which is boosting production volumes.

India is positioned second by holding 15.4% of the Asia Pacific EV market share in 2024. The country’s rapid economic growth and increasing environmental awareness are key drivers of this position. The Ministry of Heavy Industries states that EV sales surged by 45% in 2022 with the FAME II scheme, which provides financial incentives for buyers. Additionally, India’s young demographic, with over 65% of the population under 35, fosters a tech-savvy consumer base eager to adopt innovative mobility solutions. As per Deloitte Insights, urban millennials prioritize sustainability, with 70% willing to pay a premium for eco-friendly products.

Japan's electric vehicle market growth is driven by its advanced technological ecosystem and commitment to sustainability. Panasonic Corporation reports that Japan accounts for 40% of global investments in EV R& Ds in smart features like GPS integration and IoT connectivity. Additionally, Japan’s aging population drives demand for EVs as a safe and convenient mode of transport. According to the Ministry of Health, Labour and Welfare, over 28% of Japanese citizens are aged 65 or above, creating a niche market for senior-friendly mobility solutions.

South Korea’s market growth is fueled by its emphasis on innovation and sustainability. Samsung SDI states that South Korea leads the world in developing next-generation battery technologies, such as solid-state systems, which enhance EV performance. Additionally, stringent emission regulations mandate the adoption of low-carbon transport modes, driving EV sales.

Australia and New Zealand are poised to have significant growth opportunities in the next coming years. This segment is characterized by a preference for premium, high-performance models. Additionally, the region’s focus on outdoor recreation fuels the popularity of off-road models. Tourism New Zealand reports that adventure tourism contributes $10 billion annually to the economy, with EVs playing a growing role in this sector. Government incentives, such as Australia’s Electric Vehicle Discount Scheme, further stimulate adoption by reducing upfront costs.

KEY MARKET PLAYERS

Companies that play a noteworthy role in the Asia-Pacific electric vehicle market include BYD Company Motors, BMW Group, Tesla, Nissan Motor Corporation, Volkswagen AG, Toyota Motor Corporation, General Motors, Energica Motor Company S.P.A., Daimler AG, and Ford Motor Company. are the market players that are dominating the Asia-Pacific electric vehicle market.

TOP PLAYERS IN THE MARKET

Tesla, Inc.

Tesla has a prominent position as a global leader in the Asia Pacific EV market through its cutting-edge technology and expansive charging infrastructure. The company’s Gigafactory in Shanghai plays a pivotal role in meeting regional demand by producing over 500,000 vehicles annually. In North America, Tesla’s Supercharger network and energy storage solutions have set benchmarks for efficiency. To strengthen its presence, Tesla launched the Model Y compact SUV in early 2023 by targeting urban consumers in densely populated cities like Seoul and Singapore. Additionally, the company partnered with local governments to install solar-powered charging stations across rural areas by addressing range anxiety concerns and promoting sustainability.

BYD Auto Co., Ltd.

BYD Auto is a dominant player in the Asia Pacific EV market by leveraging its expertise in battery manufacturing and vehicle production. The company’s Blade Battery technology has gained acclaim for its safety and longevity by appealing to both individual buyers and fleet operators. In North America, BYD focuses on commercial EVs, supplying electric buses to major cities like Los Angeles and Toronto. To bolster its regional standing, BYD introduced the Dolphin EV series in mid-2023, designed for affordability and urban commuting. Furthermore, the company collaborated with Japan’s Panasonic Corporation to enhance battery efficiency, ensuring longer ranges and faster charging times.

Nissan Motor Co., Ltd.

Nissan has been a pioneer in the Asia Pacific EV market with its flagship Leaf model, known for reliability and affordability. The company actively collaborates with governments to promote EV adoption in emerging economies like India and Indonesia. In North America, Nissan’s ProPILOT assist technology has gained traction for its advanced driver-assistance features. In March 2024, Nissan unveiled the Ariya EV, a premium crossover targeting tech-savvy millennials. Additionally, the company invested in expanding its production facilities in Thailand by aiming to meet growing regional demand while reducing costs.

Top Strategies Used By Key Market Participants

Key players in the Asia Pacific EV market employ strategies such as technological innovation, strategic partnerships, and localization to solidify their positions. Innovation remains central, with companies investing heavily in R&D to develop advanced battery technologies and smart features like AI-driven navigation systems. Strategic collaborations with regional manufacturers enable brands to tailor offerings to local preferences, enhancing accessibility and affordability. Localization strategies, including establishing production facilities within the region, reduce costs and improve supply chain efficiency. Marketing campaigns emphasizing sustainability resonate with environmentally conscious consumers. Collectively, these approaches foster growth, differentiation, and competitive advantage in the dynamic EV landscape.

COMPETITION OVERVIEW

The Asia Pacific EV market is characterized by intense competition, driven by global giants like Tesla and BYD alongside regional leaders such as Nissan and Tata Motors. Established brands compete fiercely on technological advancements by offering cutting-edge solutions like solid-state batteries and AI-integrated systems. Meanwhile, local manufacturers focus on affordability and customization to appeal to price-sensitive demographics. The market’s fragmented nature encourages innovation, with companies investing in R&D and forging strategic alliances to differentiate themselves. Government incentives further intensify rivalry, as firms vie to capitalize on subsidies and regulatory support. Additionally, the rise of shared mobility platforms has created new avenues for collaboration by enabling brands to expand their reach.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Tesla inaugurated a new Gigafactory in Thailand, aimed at boosting regional production capacity and reducing delivery times for Southeast Asian markets.

- In June 2023, BYD Auto launched the Dolphin EV series, targeting first-time buyers in urban areas across China and India with an affordable yet feature-rich model.

- In August 2023, Nissan partnered with Panasonic Corporation to co-develop next-generation lithium-ion batteries, enhancing energy density and charging efficiency.

- In February 2024, Tata Motors unveiled the Nexon EV Max in India, featuring extended range capabilities and a robust charging network to address consumer concerns.

- In October 2023, Hyundai Motor Group announced a $1 billion investment in Australia to establish a dedicated EV manufacturing hub, focusing on high-performance models for premium buyers.

MARKET SEGMENTATION

This research report on the Asia-Pacific electric vehicle market has been segmented and sub-segmented into the following categories.

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By Propulsion Type

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

By Drive Type

- All Wheel Drive

- Front Wheel Drive

- Rear Wheel Drive

By Range

- Up to 150 Miles

- 151-300 Miles

- Above 300 Miles

By Component

- Battery Pack & High Voltage Component

- Motor

- Brake, Wheel & Suspension

- Body & Chassis

- Low-Voltage Electric Component

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

What’s driving the rapid growth of the electric vehicle market in Asia-Pacific?

The surge is fueled by rising fuel costs, climate concerns, urban air pollution, and strong policy pushes from governments encouraging cleaner transportation solutions.

How is battery technology evolving in the Asia-Pacific EV market?

EV manufacturers are rapidly adopting lithium iron phosphate (LFP) and solid-state batteries for better safety, lower costs, and extended driving range, key to mass-market adoption.

What challenges does the EV market face in the Asia-Pacific region?

Major barriers include uneven charging infrastructure, high upfront costs, limited local battery production in some countries, and range anxiety in rural or developing areas.

How are governments supporting EV adoption across Asia-Pacific?

Countries like China, India, and South Korea offer incentives such as tax rebates, manufacturing subsidies, EV quotas, and policies mandating electric public transport fleets.

What does the future look like for electric vehicles in Asia-Pacific?

Expect rapid expansion driven by urban e-mobility solutions, smart city integration, localized battery manufacturing, and a strong shift toward electric two- and three-wheelers in developing economies.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com