Asia Pacific Flat Glass Market Research Report – Segmentation By Product (Insulated glass, Tempered glass, Laminated glass), End-user, and Region (India, China, Japan, South Korea, Australia & New Zealand, Thailand) - Industry Analysis, Size, Share, Growth, Trends, And Forecasts 2025 to 2033

Asia Pacific Flat Glass Market Size

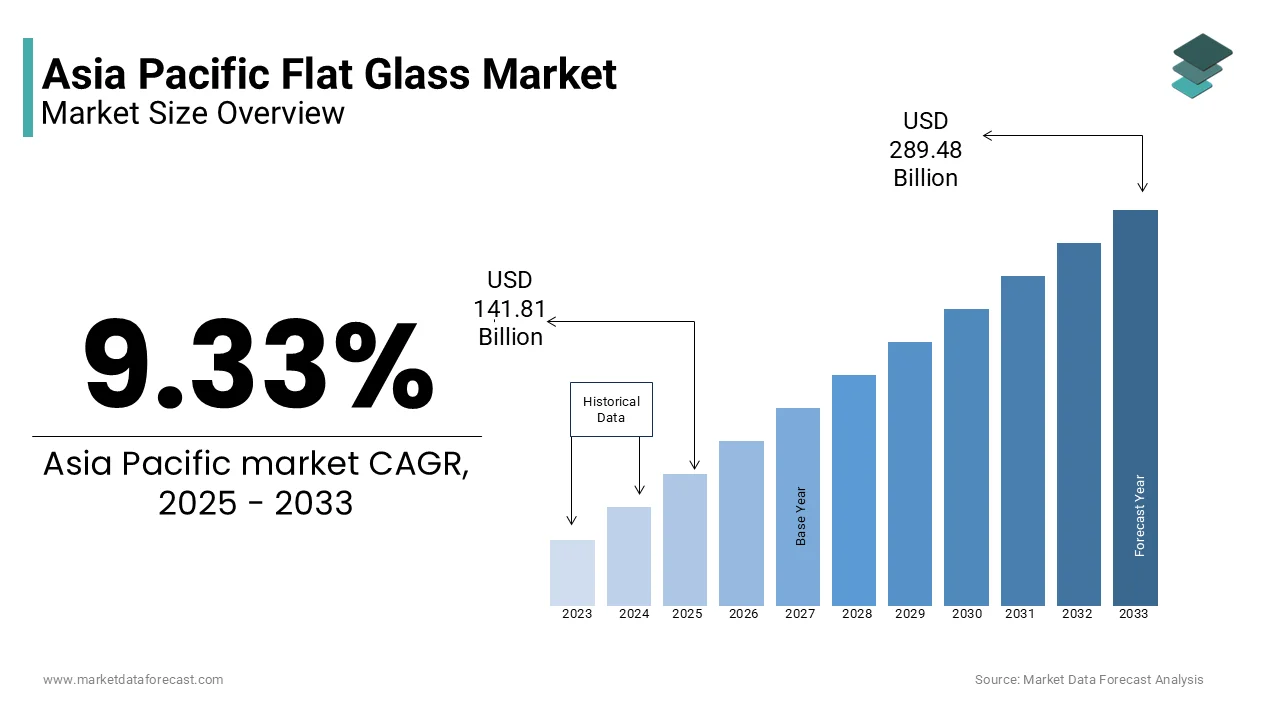

The Asia Pacific Flat Glass Market was worth USD 129.71 billion in 2024 and the market size is expected to reach USD 289.48 billion by 2033 from USD 141.81 billion in 2025. The market is growing at a CAGR of 9.33%.

MARKET DRIVERS

Urbanization and Infrastructure Development

One of the primary drivers of the Asia Pacific flat glass market is the unprecedented rate of urbanization, which fuels demand in the construction sector. According to the United Nations, the urban population in Asia is projected to grow by 35% by 2050, creating an urgent need for residential and commercial spaces. This demographic shift translates into heightened consumption of flat glass for skyscrapers, shopping malls, and housing complexes. For instance, China’s Belt and Road Initiative has catalyzed infrastructure projects across Asia, with investments exceeding $1 trillion. These projects necessitate vast quantities of flat glass, particularly for facades and interior applications. Furthermore, advancements in architectural designs, such as the use of glass curtain walls, have amplified demand.

Automotive Industry Expansion

The burgeoning automotive sector in the Asia Pacific region serves as another critical driver for flat glass demand. With over 40 million vehicles produced annually in the region, as per OICA (International Organization of Motor Vehicle Manufacturers), the need for automotive glass has skyrocketed. Countries like Thailand and Indonesia are establishing themselves as global automotive hubs, further boosting demand. Additionally, the rise of electric vehicles (EVs) is reshaping the market. EVs often feature larger glass surfaces for enhanced visibility and aesthetics, increasing per-unit glass consumption. Moreover, safety regulations mandating laminated and tempered glass in vehicles have intensified usage. In South Korea, Hyundai and Kia’s focus on exporting high-end vehicles has led to a year-on-year increase in automotive glass demand.

MARKET RESTRAINTS

Volatility in Raw Material Prices

A significant restraint impacting the Asia Pacific flat glass market is the volatility in raw material prices, particularly silica sand and soda ash, which are essential for glass production. This surge directly affects production costs, squeezing profit margins for manufacturers. For instance, in India, where the flat glass industry relies heavily on imported soda ash, producers faced a 15% rise in operational costs, as per the All India Glass Manufacturers' Federation. Such fluctuations create uncertainty, discouraging long-term investments in capacity expansion. Also, the reliance on fossil fuels for energy-intensive glass manufacturing exacerbates cost pressures, given the rising global energy prices.

Stringent Environmental Regulations

Another critical restraint is the implementation of stringent environmental regulations aimed at reducing carbon emissions and promoting sustainability. The flat glass manufacturing process is energy-intensive, accounting for approximately 3% of global industrial emissions, according to the International Energy Agency. Governments in the region are enforcing stricter emission norms, compelling manufacturers to adopt cleaner technologies. For example, China’s National Development and Reform Commission mandates that glass manufacturers reduce energy consumption by 15% by 2025. While necessary, these measures impose additional compliance costs. Smaller players, unable to afford such upgrades, face the risk of closure or consolidation. Furthermore, bans on single-use glass products in countries like Australia and New Zealand limit market diversification.

MARKET OPPORTUNITIES

Rising Adoption of Solar Energy Solutions

The growing emphasis on renewable energy presents a lucrative opportunity for the Asia Pacific flat glass market, particularly in the solar energy sector. Photovoltaic (PV) modules require high-quality flat glass for optimal performance, and the region is witnessing a surge in solar installations. According to the International Renewable Energy Agency, solar capacity in Asia is expected to grow significantly over the next five years, with China leading the charge by installing over 50 GW annually. This expansion translates into increased demand for specialized solar glass. Additionally, government incentives, such as subsidies and tax breaks, are encouraging investments in solar projects. In India, the Jawaharlal Nehru National Solar Mission aims to achieve 280 GW of solar capacity by 2030, driving demand for flat glass by an estimated 12% annually, according to the Ministry of New and Renewable Energy.

Technological Advancements in Smart Glass

Another promising opportunity lies in the development and adoption of smart glass technologies, which offer energy efficiency and enhanced functionality. Smart glass, capable of regulating light and heat transmission, is gaining traction in commercial buildings and luxury residences. Japan, for instance, is pioneering the use of electrochromic glass in skyscrapers, reducing cooling costs. Similarly, South Korea’s LG Electronics has launched innovative smart glass solutions for automotive and architectural applications, capturing a significant market share. The integration of Internet of Things (IoT) capabilities in smart glass further amplifies its appeal, creating new revenue streams for manufacturers.

MARKET CHALLENGES

Intense Market Competition and Price Wars

The Asia Pacific flat glass market is highly fragmented, with numerous local and international players vying for market share. This intense competition often leads to price wars, eroding profitability for manufacturers. For instance, in China, where the market is saturated with small-scale manufacturers, average selling prices dropped by 8% in 2022, as per the China National Flat Glass Industry Association. This trend is exacerbated by the influx of low-cost imports from neighboring countries like Vietnam and Malaysia, further pressuring domestic players. Apart from these, the lack of product differentiation compels companies to compete solely on price, stifling innovation and investment in advanced technologies.

Supply Chain Disruptions and Logistics Issues

Another pressing challenge is the vulnerability of supply chains to disruptions, which hampers the availability of raw materials and finished products. The COVID-19 pandemic exposed critical weaknesses, with logistics bottlenecks causing delays and increased transportation costs. According to DHL’s Global Trade Barometer, shipping costs in the Asia Pacific region surged by 40% in 2021, impacting flat glass manufacturers reliant on just-in-time delivery systems. Natural disasters, such as typhoons and earthquakes, further compound these issues, disrupting production schedules. In addition, geopolitical tensions, such as trade restrictions between China and Australia, have strained cross-border supply chains.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.33% |

|

Segments Covered |

By Product Type, End-User, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of Asia-Pacific |

|

Market Leaders Profiled |

AGC Inc. (Asahi Glass Co., Ltd.), NSG Group (Nippon Sheet Glass Co., Ltd.), Saint-Gobain S.A., Guardian Glass, Central Glass Co., Ltd., China Glass Holdings Limited, Fuyao Glass Industry Group Co., Ltd., Xinyi Glass Holdings Limited, Taiwan Glass Industry Corporation, Sisecam Group, Schott AG, and others |

SEGMENTAL ANALYSIS

By Product Type Insights

The tempered glass segment commanded the Asia Pacific flat glass market with a commanding market share of a 40.3% in 2024. This control is mainly propelled by its widespread application in construction and automotive sectors, where safety and durability are paramount. Tempered glass is stronger than standard annealed glass, making it ideal for use in skyscrapers, facades, and vehicle windshields. For instance, China’s rapid urbanization has led to a surge in high-rise buildings, with tempered glass accounting for a major share of all facade materials used in commercial projects. Besides, stringent safety regulations mandating the use of tempered glass in public infrastructure have further bolstered its adoption. In India, the Ministry of Road Transport and Highways mandates tempered glass for all new vehicles, driving demand by an estimated 12% annually. Furthermore, technological advancements enabling cost-effective production have made tempered glass more accessible, fueling its growth across diverse applications.

The insulated glass segment is seeing the highest growth rate, projected to expand at a CAGR of 8.5%. This rise is caused by increasing demand for energy-efficient buildings, particularly in urban areas. Insulated glass units (IGUs) reduce heat transfer, improving thermal insulation and lowering energy consumption. For example, Japan’s government has implemented policies promoting zero-energy buildings, with IGUs being a key component, as per the Japan Green Building Council. The adoption of IGUs in residential buildings has risen over the past three years. Similarly, South Korea’s focus on sustainable architecture has led to an increase in IGU installations. Also, rising awareness about climate change and carbon footprint reduction has incentivized builders to adopt insulated glass, particularly in commercial spaces.

By End-User Insights

By End-User Insights

The construction sector represented the largest end-user of flat glass in the Asia Pacific region by commanding a market share of a 60% in 2024. This dominance is driven by unprecedented urbanization and infrastructure development across the region. For instance, China’s Belt and Road Initiative has catalyzed large-scale construction projects, with flat glass being a critical material for skyscrapers, airports, and bridges. Furthermore, the trend toward eco-friendly buildings has increased the use of coated and insulated flat glass, which enhances energy efficiency. In Australia, green building certifications mandate the use of sustainable materials, including flat glass, boosting demand year-on-year, according to the Green Building Council of Australia.

The electrical and electronics sector is the fastest-growing end-user segment in the Asia Pacific flat glass market, with a projected CAGR of 10.2% through 2033. This rapid expansion is fueled by the proliferation of solar energy solutions and advanced display technologies. Solar photovoltaic (PV) modules, which require specialized flat glass, are witnessing exponential adoption due to government incentives and declining installation costs. For example, China installed over 50 GW of solar capacity in 2022, driving demand for solar glass. Also, the rise of consumer electronics, such as smartphones and televisions, has increased the need for high-quality flat glass in display screens. South Korea’s Samsung and LG dominate this space, sourcing premium flat glass for OLED displays, contributing to a notable growth in demand. Moreover, innovations in smart glass technology for electronic devices are creating new opportunities.

REGIONAL ANALYSIS

China remains the undisputed leader in the Asia Pacific flat glass market by accounting for 55.5% of the total regional share in 2024. This dominance is due to its robust manufacturing capabilities and extensive infrastructure projects. With over 300 flat glass production facilities, China produces approximately 800 million square meters annually, catering to both domestic and international markets. Urbanization remains a key driver, with cities like Shanghai and Beijing leading the charge in adopting advanced architectural designs, such as glass curtain walls. Furthermore, the Belt and Road Initiative has spurred demand for flat glass in overseas infrastructure projects, boosting exports.

India is a significant and rapidly growing player in the Asia Pacific flat glass market. The nation’s growth is propelled by rapid urbanization and government-led initiatives like the Smart Cities Mission and Pradhan Mantri Awas Yojana (PMAY). These programs aim to construct affordable housing and modern infrastructure, driving flat glass demand. According to the Confederation of Indian Industry, the construction sector alone accounts for notable share of India’s flat glass consumption. Additionally, the automotive industry, supported by favorable government policies, contributes significantly to demand. India produced over 4 million vehicles in 2022, requiring tempered and laminated glass for windshields and windows, as per the Society of Indian Automobile Manufacturers.

Japan is major contributor to the Asia Pacific flat glass market. It is propelled by its focus on energy-efficient and sustainable building practices. The country’s stringent building codes mandate the use of advanced flat glass, such as low-emissivity (low-E) and insulated glass, to enhance energy efficiency. According to the Ministry of Land, Infrastructure, Transport, and Tourism, over 60% of new buildings in Japan incorporate these technologies. In addition, Japan’s aging population has increased demand for healthcare facilities, which rely heavily on flat glass for natural lighting and aesthetics. The automotive sector also plays a pivotal role, with companies like Toyota and Honda sourcing high-quality flat glass for vehicle production, driving demand.

South Korea holds a significant position in the Asia Pacific flat glass market which is driven by its technological advancements and strong presence in the electronics sector. The nation is a global leader in display technologies, with companies like Samsung and LG sourcing premium flat glass for OLED and LCD screens. Besides, the government’s push for renewable energy has increased demand for solar glass, with installations growing. South Korea’s focus on smart cities and green buildings has further amplified demand for insulated and coated flat glass, contributing to a notable growth in the construction sector.

Australia holds a smaller share in the Asia Pacific flat glass market by characterized by its emphasis on sustainability and premium architectural designs. The country’s strict environmental regulations promote the use of energy-efficient flat glass in residential and commercial buildings. According to the Green Building Council of Australia, a large share of new constructions incorporate insulated or low-E glass to achieve sustainability certifications. Additionally, Australia’s booming real estate market, particularly in cities like Sydney and Melbourne, drives demand for high-quality flat glass in luxury apartments and office spaces. The automotive sector also contributes, with electric vehicle adoption increasing.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

AGC Inc. (Asahi Glass Co., Ltd.), NSG Group (Nippon Sheet Glass Co., Ltd.), Saint-Gobain S.A., Guardian Glass, Central Glass Co., Ltd., China Glass Holdings Limited, Fuyao Glass Industry Group Co., Ltd., Xinyi Glass Holdings Limited, Taiwan Glass Industry Corporation, Sisecam Group, Schott AG are the key players in the Asia Pacific flat glass market.

The Asia Pacific flat glass market is characterized by intense competition, driven by the presence of both global giants and regional players. Established companies like Asahi Glass Co., Nippon Sheet Glass, and Saint-Gobain Sekurit dominate the market through their extensive product portfolios, technological expertise, and strong distribution networks. These leaders focus on innovation, sustainability, and strategic collaborations to maintain their competitive edge. Meanwhile, smaller regional players often adopt cost-effective strategies to capture niche markets, particularly in emerging economies like India and Vietnam. This dynamic environment fosters healthy competition, encouraging continuous improvement and adaptation to changing market demands. Additionally, the rise of smart glass and solar glass technologies has created new avenues for differentiation, prompting companies to invest in research and development.

TOP PLAYERS IN THE MARKET

Asahi Glass Co., Ltd. (AGC)

Asahi Glass Co., Ltd., a global leader in flat glass manufacturing, has a significant presence in the Asia Pacific market. The company is renowned for its innovative product portfolio, including energy-efficient and solar glass solutions. AGC’s commitment to sustainability is evident in its development of eco-friendly technologies, such as low-emissivity coatings and insulated glass units. By collaborating with architects and construction firms, AGC has positioned itself as a preferred supplier for green building projects.

Nippon Sheet Glass Co., Ltd. (NSG)

Nippon Sheet Glass Co., Ltd. is another key player, known for its premium-quality flat glass products. NSG leverages its expertise in automotive and architectural glass to cater to diverse end-user segments. The company emphasizes customization, offering tailored solutions for high-rise buildings and luxury vehicles. Its strategic partnerships with global automakers and real estate developers have strengthened its market position. NSG’s dedication to innovation and customer-centric approaches enables it to meet evolving market demands while maintaining a competitive edge.

Saint-Gobain Sekurit

Saint-Gobain Sekurit specializes in advanced flat glass solutions for the automotive and construction sectors. The company’s emphasis on safety and durability has made it a trusted name in laminated and tempered glass. By integrating smart technologies into its products, such as electrochromic glass, Saint-Gobain Sekurit addresses the growing demand for energy-efficient solutions. This positions Saint-Gobain Sekurit as a pivotal contributor to the global flat glass market.

TOP STRATEGIES USED BY KEY PLAYERS

Product Innovation and Diversification

Key players in the Asia Pacific flat glass market prioritize product innovation to stay ahead of competitors. Companies like Asahi Glass Co. and Nippon Sheet Glass invest heavily in developing advanced glass technologies, such as smart glass and solar glass, to cater to emerging trends in sustainability and energy efficiency.

Strategic Collaborations and Partnerships

Collaborations with architects, builders, and automakers are a cornerstone of success for leading players. For instance, Saint-Gobain Sekurit partners with automotive manufacturers to supply customized glass solutions for electric vehicles. Similarly, Asahi Glass Co. collaborates with government bodies to promote green building practices. These alliances enable companies to tap into new markets, leverage shared expertise, and enhance their service offerings, thereby strengthening their foothold in the competitive landscape.

Focus on Sustainability and Green Initiatives

Sustainability is a key driver of growth in the flat glass market, with companies adopting eco-friendly practices to align with global environmental goals. Nippon Sheet Glass and Saint-Gobain Sekurit have implemented initiatives to reduce carbon emissions and energy consumption during production.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Asahi Glass Co. launched a new line of electrochromic smart glass designed for energy-efficient buildings. This move aimed to capitalize on the growing demand for sustainable architectural solutions in urban areas.

- In March 2024, Nippon Sheet Glass partnered with a leading automotive manufacturer in South Korea to supply laminated glass for electric vehicles. This collaboration strengthened its foothold in the rapidly expanding EV market.

- In May 2024, Saint-Gobain Sekurit acquired a regional flat glass distributor in Southeast Asia to expand its distribution network. This acquisition enhanced its ability to serve customers in emerging markets like Thailand and Indonesia.

- In July 2024, Asahi Glass Co. established a joint venture with a Chinese construction firm to develop insulated glass units for high-rise buildings. This initiative aligned with China’s push for energy-efficient infrastructure.

- In September 2024, Nippon Sheet Glass introduced a recyclable glass product line targeting environmentally conscious consumers in Australia and New Zealand. This action reinforced its commitment to sustainability and regulatory compliance.

MARKET SEGMENTATION

This research report on the Asia Pacific flat glass market has been segmented and sub-segmented based on the following categories.

By Product Type

- Insulated glass

- Tempered glass

- Laminated glass

- Others

By End-User

- Construction

- Automotive

- Electrical & electronics

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What is the Asia Pacific Flat Glass Market growth rate during the projection period?

The Asia Pacific Flat Glass Market is expected to grow with a CAGR of 9.33% between 2025 to 2033.

2. What can be the total Asia Pacific Flat Glass Market value?

The Asia Pacific Flat Glass Market size is expected to reach a revised size of USD 289.48 billion by 2033.

3. Name any three Asia Pacific Flat Glass Market key players?

Guardian Glass, Central Glass Co., Ltd., and China Glass Holdings Limited are the three Asia Pacific Flat Glass Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com