Asia Pacific Industrial Emission Control Systems Market Research Report – Segmented By System (Electrostatic precipitators, Catalytic systems, Absorbers, Scrubbers, Others), Industry, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific Industrial Emission Control Systems Market Size

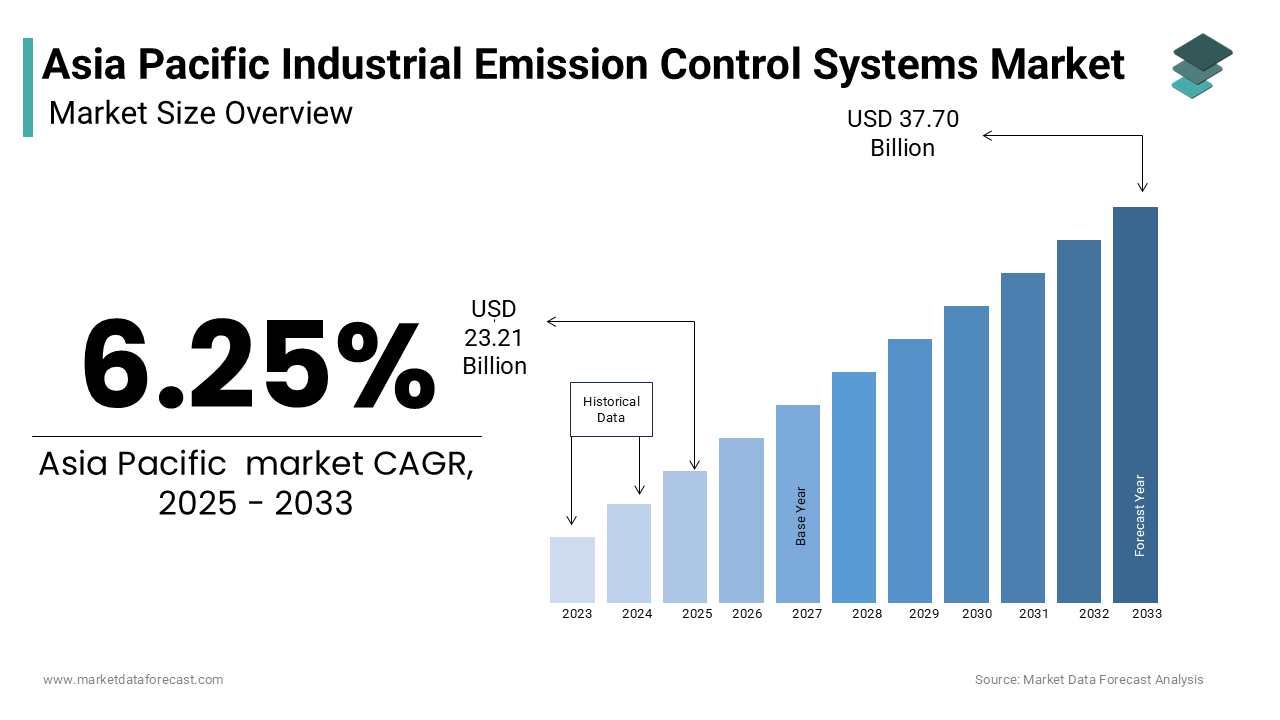

The Asia Pacific Industrial Emission Control Systems Market was worth USD 21.84 billion in 2024. The Asia Pacific market is expected to reach USD 37.70 billion by 2033 from USD 23.21 billion in 2025, rising at a CAGR of 6.25% from 2025 to 2033.

The Asia Pacific industrial emission control systems market represents a critical segment within the broader environmental technology industry, addressing the growing need to mitigate air pollution and comply with stringent environmental regulations. These systems encompass technologies such as electrostatic precipitators (ESPs), scrubbers, fabric filters, and catalytic converters, which are deployed across industries like power generation, cement manufacturing, steel production, and petrochemicals to reduce harmful emissions.

MARKET DRIVERS

Stringent Environmental Regulations

Stringent environmental regulations imposed by governments across the Asia Pacific region serve as a significant driver for the industrial emission control systems market. Regulatory frameworks, such as China’s Blue Sky Protection Campaign and Japan’s Act on Promotion of Global Warming Countermeasures, mandate industries to adopt advanced emission control technologies. According to the United Nations Environment Programme (UNEP), approximately 70% of countries in the region have implemented national air quality standards, compelling industries to invest in systems like scrubbers and fabric filters. Such mandates create a predictable demand for emission control systems, ensuring sustained market growth. In addition, international agreements like the Paris Climate Accord further reinforce regional commitments. Industries failing to comply face penalties, operational restrictions, or reputational damage, incentivizing proactive adoption of these systems.

Rising Urbanization and Industrial Activity

The Asia Pacific region’s rapid urbanization and industrial expansion are key drivers propelling the demand for emission control systems. According to the United Nations Department of Economic and Social Affairs, urban populations in the region are expected to grow notably by 2035, intensifying energy consumption and industrial output. This growth is accompanied by increased emissions from sectors like construction, manufacturing, and transportation. For example, India’s cement production, which accounts for a significant portion of global output, generates significant particulate matter emissions, as noted by the Confederation of Indian Industry. Furthermore, the proliferation of special economic zones (SEZs) and industrial corridors amplifies demand. Projects like India’s Delhi-Mumbai Industrial Corridor and China’s Yangtze River Economic Belt prioritize sustainable development, requiring industries to integrate emission control systems into their operations.

MARKET RESTRAINTS

High Initial Investment Costs

One of the primary restraints in the adoption of industrial emission control systems is the high initial investment required for installation and integration. These systems often involve complex engineering designs, specialized materials, and advanced technologies, making them capital-intensive. According to the Asian Development Bank (ADB), small and medium enterprises (SMEs) in the region allocate less than 5% of their annual revenue to environmental compliance, limiting their ability to invest in costly emission control solutions. For instance, retrofitting an existing coal-fired power plant with flue gas desulfurization (FGD) systems can cost substantially, as noted by the Federation of Indian Chambers of Commerce & Industry (FICCI). Moreover, the financial burden extends beyond installation to include maintenance and operational costs. Regular servicing and replacement of components, such as catalysts in selective catalytic reduction (SCR) systems, add to the overall expenditure. This financial strain discourages widespread adoption, especially among smaller players, hindering market penetration.

Technological Limitations in Retrofitting

Another restraint stems from the technological limitations associated with retrofitting existing industrial facilities with emission control systems. Many older plants in the Asia Pacific region were not designed to accommodate modern emission control technologies, necessitating extensive modifications. According to the International Energy Agency (IEA), a significant portion of coal-fired power plants in Southeast Asia are more than 20 years old, complicating retrofitting efforts. For example, integrating fabric filters into legacy systems often requires structural changes, downtime, and additional energy consumption, as noted by the Institute of Energy Economics and Financial Analysis (IEEFA). Furthermore, retrofitting challenges are exacerbated by the lack of skilled personnel and technical expertise. A report by the World Resources Institute (WRI) highlights that only a small share of industrial facilities in the region have access to trained professionals capable of implementing advanced emission control solutions.

MARKET OPPORTUNITIES

Growing Adoption of Carbon Capture Technologies

The increasing adoption of carbon capture, utilization, and storage (CCUS) technologies presents a significant opportunity for the industrial emission control systems market. CCUS technologies complement traditional emission control systems by capturing carbon dioxide emissions directly from industrial sources. According to the Global CCS Institute, the number of CCUS projects in the Asia Pacific region grew by 30% between 2020 and 2022, with countries like Australia and China leading the way. For instance, China’s Sinopec launched its first large-scale CCUS project in Shandong Province, capable of capturing 1 million tons of CO2 annually, as reported by the Ministry of Ecology and Environment. Moreover, government incentives and private sector investments are accelerating CCUS adoption. For example, Japan’s Green Innovation Fund allocates $20 billion to support low-carbon technologies, including CCUS.

Expansion of Renewable Energy Infrastructure

The rapid expansion of renewable energy infrastructure in the Asia Pacific region offers another promising opportunity for the emission control systems market. While renewable energy inherently reduces emissions, auxiliary processes like biomass combustion and waste-to-energy conversion still require emission control technologies. For instance, Thailand’s waste-to-energy plants utilize fabric filters and ESPs to manage particulate emissions, as noted by the Thai Pollution Control Department. Also, the integration of renewable energy with industrial processes creates demand for advanced emission control systems. For example, hybrid solar-biomass plants require catalytic converters to minimize NOx emissions. The growing emphasis on sustainability and circular economy principles further amplifies opportunities for manufacturers to innovate and cater to this emerging segment.

MARKET CHALLENGES

Resistance from Small-Scale Industries

A significant challenge facing the industrial emission control systems market is resistance from small-scale industries, which form a substantial portion of the Asia Pacific’s industrial base. These industries often perceive emission control systems as unnecessary expenses that hinder profitability. According to the Asian Productivity Organization (APO), a large share of SMEs in the region operate with outdated equipment and lack awareness of modern emission control technologies. For instance, textile mills in Bangladesh, a major contributor to the country’s GDP, rely on antiquated machinery that emits high levels of particulate matter, as noted by the Bangladesh Textile Mills Association. Furthermore, fragmented regulatory frameworks exacerbate the issue. In many cases, local authorities cannot monitor and enforce compliance, allowing non-compliant industries to continue operations without penalty.

Lack of Standardization Across Regions

Another challenge is the lack of standardization in emission control requirements across the Asia Pacific region, complicating compliance for multinational corporations and regional players alike. According to the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP), emission standards vary significantly between countries, with some imposing strict limits while others maintain lenient policies. This inconsistency creates operational inefficiencies for companies operating across multiple jurisdictions, requiring them to adapt their systems to meet varying standards. Also, the absence of harmonized testing and certification protocols increases costs and delays implementation.

SEGMENTAL ANALYSIS

By System Insights

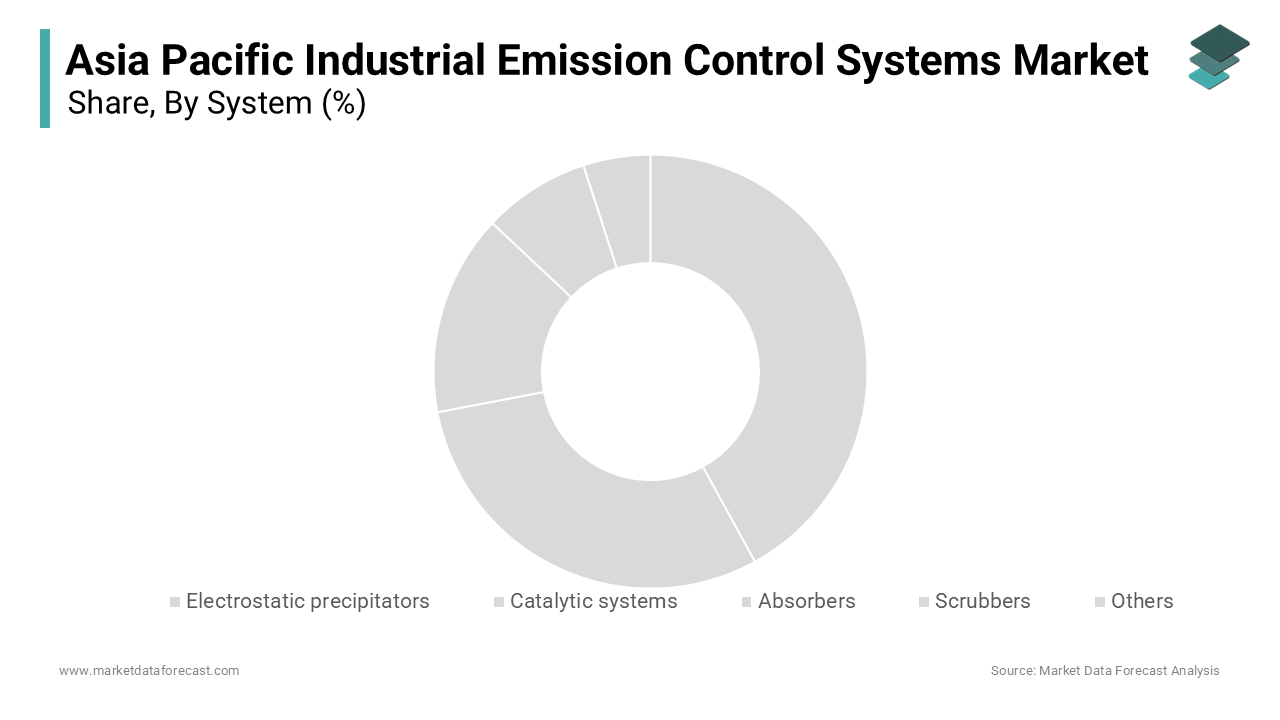

The electrostatic precipitators segment dominated the Asia Pacific industrial emission control systems market by holding a market share of 35% in 2024. This dominance is driven by their widespread application in power plants and heavy industries like cement and steel manufacturing. According to the International Energy Agency (IEA), coal-fired power plants account for a significant portion of electricity generation in the region, making ESPs indispensable for controlling particulate matter emissions. These systems are highly effective at capturing fine particles with high efficiency. Another key factor is the stringent regulatory environment targeting particulate matter emissions. For instance, China’s Ministry of Ecology and Environment mandates that coal-fired power plants reduce particulate emissions to below 10 mg/m³, necessitating advanced ESP installations. Also, the growing adoption of retrofitting projects further amplifies demand. A report by the Asian Development Bank (ADB) estimates that over 200 GW of coal-fired capacity in the region has been retrofitted with ESPs since 2018.

The catalytic systems segment is the fastest-growing segment in the Asia Pacific industrial emission control systems market, exhibiting a CAGR of 12.6%. This is fueled by the increasing focus on reducing nitrogen oxides (NOx) and volatile organic compounds (VOCs) from industrial emissions. Another driving factor is the rise of selective catalytic reduction (SCR) systems in the power and petrochemical sectors. Also, SCR installations in India’s thermal power plants increased notably between 2020 and 2022. Furthermore, government initiatives promoting cleaner air quality, such as Japan’s Act on Promotion of Global Warming Countermeasures, have accelerated the adoption of catalytic technologies. These systems are also gaining traction in emerging applications like waste-to-energy plants, where they help neutralize harmful emissions.

By Industry Insights

The power plants segment represented the largest end-use in the Asia Pacific industrial emission control systems market by commanding a 40.6% of the total share in 2024. This leading position is due to the region’s heavy reliance on coal-fired power generation, which contributes significantly to air pollution. According to the International Energy Agency (IEA), coal accounts for a considerable share of the region’s electricity production, creating immense demand for emission control technologies like scrubbers and electrostatic precipitators. Another driving factor is the implementation of stringent emission standards. Apart from these, the growing adoption of flue gas desulfurization (FGD) systems in countries like China and India amplifies demand. The Confederation of Indian Industry notes that a large majority of India’s coal-fired plants are equipped with FGD systems to comply with environmental norms.

The cement industry is quickly emerging in the Asia Pacific industrial emission control systems market, with a projected CAGR of 10%. This progress is propelled by the region’s booming construction sector, which drives cement production and, consequently, emissions. Another key factor is the push for sustainable practices. The Indian Bureau of Energy Efficiency reports that cement plants in India are required to adopt baghouse filters and electrostatic precipitators to meet particulate matter limits under the Perform, Achieve, and Trade (PAT) scheme. Similarly, China’s National Development and Reform Commission mandates that new cement plants install advanced emission control systems to achieve carbon neutrality by 2060.

REGIONAL ANALYSIS

China spearheaded the Asia Pacific industrial emission control systems market by accounting for a 45.5% of the regional share in 2024. This control is driven by the country’s status as the world’s largest emitter of greenhouse gases, primarily due to its reliance on coal-fired power plants. According to the Ministry of Ecology and Environment, China launched over 100 large-scale emission control projects in 2022 alone, focusing on industries like power generation and steel manufacturing. A further factor is the government’s aggressive push toward sustainability. Initiatives like the "Blue Sky Protection Campaign" mandate industries to adopt advanced technologies like scrubbers and catalytic converters. The Asian Development Bank notes that China invested $30 billion in emission control infrastructure in 2021, underscoring its commitment to reducing air pollution.

India is a lucrative market. The country’s rapid industrialization and urbanization have amplified air pollution levels, necessitating robust emission control measures. Another driving factor is the implementation of stringent regulations. The Ministry of Environment, Forest and Climate Change mandates industries to comply with emission norms under the National Clean Air Programme (NCAP). Besides, India’s growing emphasis on renewable energy integration, particularly in cement and power plants, creates opportunities for hybrid emission control solutions.

Japan possesses a significant position. The country’s advanced manufacturing base and stringent environmental policies drive demand for emission control systems. A different aspect is the focus on innovation. Japan’s place in catalytic systems, particularly selective catalytic reduction (SCR) technologies, positions it as a key player in the market. Like, a significant portion of Japan’s industrial facilities are equipped with state-of-the-art emission control systems, ensuring compliance with global standards.

South Korea contributes a key portion to the regional market share, driven by its focus on improving air quality in metropolitan areas. The additional crucial aspect is the adoption of advanced technologies like scrubbers and catalytic converters. South Korea’s Green New Deal allocates a substantial amount to promote sustainable industrial practices, creating demand for emission control systems.

Australia and New Zealand together mark a key player in the market and are driven by their focus on renewable energy and mining operations. Another factor is the emphasis on sustainability. New Zealand’s Zero Carbon Act mandates industries to adopt cleaner technologies, fostering demand for systems like absorbers and scrubbers.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Mitsubishi Heavy Industries, Ltd., Thermax Ltd., GE Vernova, Babcock & Wilcox Enterprises, Inc., DuPont Clean Technologies, Siemens AG, FLSmidth & Co. A/S, Alstom, Hamon Group, and Andritz AG are some of the key market players.

The Asia Pacific industrial emission control systems market is characterized by intense competition, driven by the presence of both global giants and regional players vying for dominance. Global leaders like Mitsubishi Heavy Industries, Babcock & Wilcox, and Hitachi Zosen leverage their extensive experience, advanced technologies, and strong distribution networks to maintain leadership positions. Meanwhile, regional players focus on niche markets, offering cost-effective solutions tailored to local regulatory frameworks and industrial needs.

The competitive landscape is further shaped by rapid technological advancements and shifting environmental priorities. Players must continuously innovate to keep pace with trends such as carbon capture integration and digital transformation. Also, stringent regulatory standards compel companies to adopt sustainable practices while ensuring compliance.

Top Players in the Asia Pacific Industrial Emission Control Systems Market

Mitsubishi Heavy Industries, Ltd.

Mitsubishi Heavy Industries (MHI) is a global leader in industrial emission control systems, with a strong presence in the Asia Pacific region. The company specializes in advanced technologies such as flue gas desulfurization (FGD), selective catalytic reduction (SCR), and electrostatic precipitators (ESPs). MHI’s contribution to the global market lies in its ability to deliver customized solutions tailored to diverse industries, including power plants and cement manufacturers. MHI’s strategic partnerships with governments and private entities further enhance its reputation as a reliable provider of emission control solutions.

Babcock & Wilcox Enterprises, Inc.

Babcock & Wilcox is renowned for its expertise in air pollution control technologies, particularly in the power generation sector. The company offers a wide range of systems, including scrubbers, fabric filters, and catalytic converters, designed to reduce harmful emissions. In the Asia Pacific market, Babcock & Wilcox has capitalized on the growing demand for retrofitting solutions, helping industries comply with stringent regulations. Globally, Babcock & Wilcox plays a pivotal role in promoting sustainable industrial practices through its innovative product portfolio.

Hitachi Zosen Corporation

Hitachi Zosen Corporation is a key player in the emission control systems market, known for its advanced solutions in waste management and industrial emissions. The company provides state-of-the-art systems like ESPs and absorbers, which are widely used in heavy industries across the Asia Pacific region. Hitachi Zosen’s emphasis on integrating digital technologies into its products enhances operational efficiency and reduces maintenance costs.

Top Strategies Used by Key Players in the Asia Pacific Industrial Emission Control Systems Market

Strategic Acquisitions and Collaborations

Key players in the Asia Pacific industrial emission control systems market have increasingly relied on strategic acquisitions and collaborations to expand their technological capabilities and market reach. By acquiring startups or partnering with local firms, companies gain access to innovative technologies and regional expertise. These alliances enable them to address specific market needs while enhancing their product portfolios. In addition, collaborations with government agencies and research institutions help align their offerings with regulatory requirements, ensuring compliance and fostering trust among stakeholders.

Focus on Product Innovation and Customization

Innovation remains a cornerstone of competitive strategies adopted by leading players. Companies invest heavily in R&D to develop next-generation emission control systems that cater to emerging trends like carbon neutrality and circular economy principles. Customization is another key focus, as industries require tailored solutions to meet unique operational challenges.

Expansion of Manufacturing and Service Networks

To cater to the growing demand in the Asia Pacific region, key players are expanding their manufacturing facilities and service networks. Establishing localized production hubs allows companies to reduce lead times, lower logistics costs, and respond more effectively to customer requirements. Additionally, expanding service networks ensures timely maintenance and technical support, enhancing customer satisfaction.

RECENT MARKET DEVELOPMENTS

- In March 2023, Mitsubishi Heavy Industries partnered with an Indian power plant operator to retrofit existing coal-fired facilities with advanced flue gas desulfurization (FGD) systems. This initiative aimed to help the operator comply with India’s stringent emission norms while reducing sulfur dioxide emissions significantly.

- In June 2023, Hitachi Zosen Corporation launched a new line of electrostatic precipitators (ESPs) designed specifically for cement plants in Southeast Asia. These systems were developed to enhance particulate matter capture efficiency and support regional sustainability goals.

- In August 2023, Babcock & Wilcox acquired a Chinese startup specializing in carbon capture technologies. This acquisition allowed the company to integrate carbon capture solutions with traditional emission control systems, catering to the growing demand for hybrid technologies in the region.

- In November 2023, Siemens expanded its manufacturing facility in Vietnam to produce catalytic converters tailored for the petrochemical industry. This move aimed to address the rising demand for nitrogen oxide (NOx) reduction technologies in Southeast Asia.

- In January 2024, Alstom signed a memorandum of understanding with the Indonesian government to develop emission control infrastructure for coal-fired power plants. This collaboration focused on supporting Indonesia’s transition toward cleaner energy practices while maintaining grid stability.

MARKET SEGMENTATION

This research report on the Asia Pacific Industrial Emission Control Systems Market is segmented and sub-segmented into the following categories.

By System

- Electrostatic precipitators

- Catalytic systems

- Absorbers

- Scrubbers

- Others

By Industry

- Power plants

- Chemical & petrochemical industry

- Cement industry

- Metal industry

- Manufacturing industry

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is driving the growth of the market in the Asia Pacific region?

Growth is driven by rapid industrialization, stricter environmental regulations, increasing awareness of air quality, and government initiatives to curb pollution.

What is the future outlook of the Asia Pacific Industrial Emission Control Systems Market?

The Asia Pacific Industrial Emission Control Systems Market is projected to experience steady growth, supported by technological advancements, regulatory enforcement, and a shift toward sustainable industrial practices.

What trends are influencing the Asia Pacific Industrial Emission Control Systems Market?

Key trends in the Asia Pacific Industrial Emission Control Systems Market include the integration of AI and IoT for real-time monitoring, the development of low-maintenance systems, and the push for hybrid and modular solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]