Asia Pacific Medium Voltage Drives Market Size, Share, Trends & Growth Forecast Report By Power Range (≤1 MW, 1–3 MW, 3–7 MW, ≥7 MW), Drive (AC, DC, Servo), Application (Pump, Fan, Conveyor, Compressor), End-Use (Oil & Gas, Power Generation, Mining), and Country (India, China, Japan, South Korea, Australia) – Industry Analysis From 2025 to 2033.

Asia Pacific Medium Voltage Drives Market Size

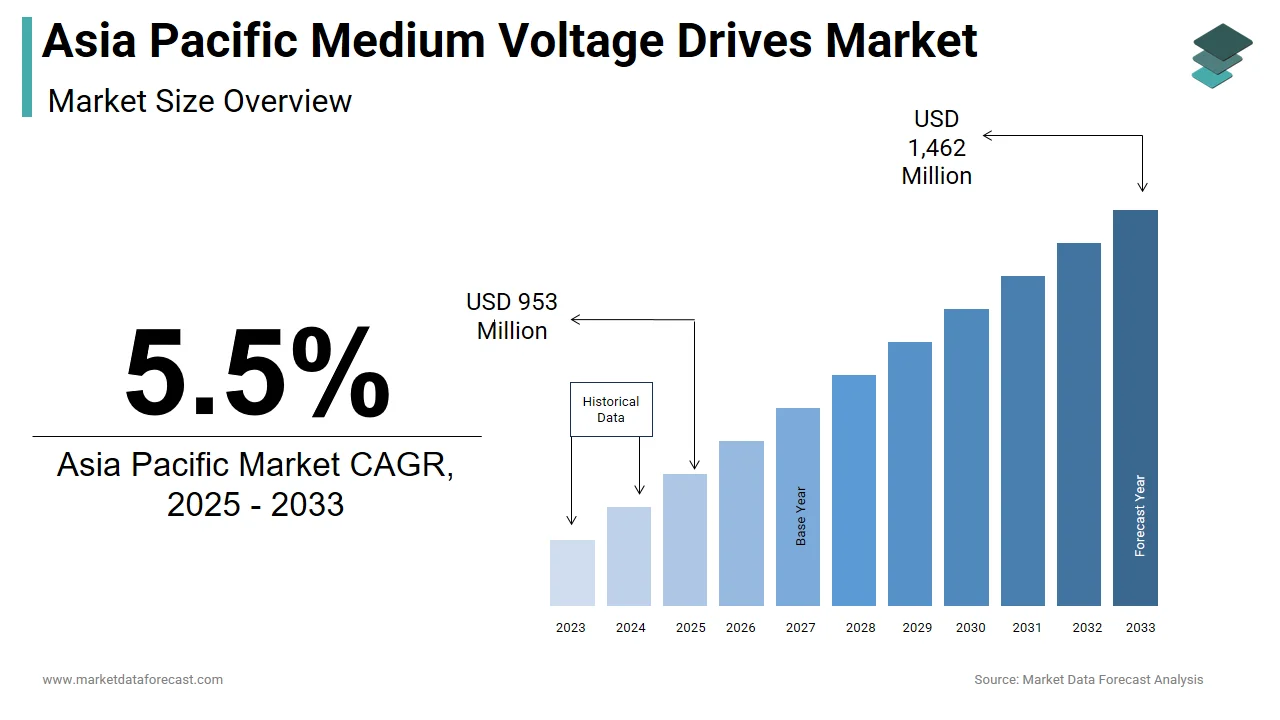

The size of the Asia Pacific medium voltage drives market was worth USD 903 million in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 5.5% from 2025 to 2033 and be worth USD 1,462 million by 2033 from USD 953 million in 2025.

Medium voltage drives (MVDs) are specialized systems designed to control the speed and torque of electric motors operating at voltages ranging from 2.3 kV to 13.8 kV. These drives are indispensable in heavy industries such as oil and gas, power generation, mining, and water treatment, where precise motor control and energy efficiency are paramount. According to the Asian Development Bank, the region’s industrial energy consumption accounts for nearly 40% of total energy usage, with the importance of MVDs in optimizing energy-intensive processes.

The region’s rapid industrialization and urbanization have further fueled the adoption of medium voltage drives. As per the World Bank, urban populations in the Asia Pacific are projected to increase by over 200 million by 2030, driving demand for infrastructure projects that rely on MVDs for efficient operation. For instance, large-scale desalination plants in Australia use MVDs to regulate pumps by ensuring sustainable water supply. Similarly, China’s National Energy Administration emphasizes the integration of MVDs in renewable energy projects, such as wind farms, to enhance grid stability.

MARKET DRIVERS

Industrial Automation and Process Optimization

The push toward industrial automation is a primary driver of the Asia Pacific medium voltage drives market. Automation technologies are increasingly adopted in sectors like manufacturing, mining, and utilities to improve operational efficiency and reduce costs. According to the International Federation of Robotics, the Asia Pacific region accounts for over 70% of global industrial robot installations, with many of these systems relying on medium voltage drives for precise motor control. For example, in South Korea’s semiconductor industry, MVDs are integral to maintaining consistent production speeds, which is critical for meeting global demand. Additionally, India’s Ministry of Heavy Industries reports that automation initiatives in steel and cement plants have led to a 25% reduction in energy consumption, which is largely due to the deployment of MVDs. These advancements demonstrate how automation-driven industries are propelling the adoption of medium voltage drives.

Renewable Energy Integration

The integration of renewable energy sources is another significant driver. As the region shifts toward cleaner energy, medium voltage drives are essential for managing variable loads in wind and solar power systems. China’s National Renewable Energy Center states that wind energy capacity grew by 16% in 2022, with MVDs playing a vital role in turbine operations. These applications the pivotal role of MVDs in facilitating the transition to renewable energy and supporting sustainable development.

MARKET RESTRAINTS

High Initial Costs

One of the primary restraints of the medium voltage drives market is the high initial investment required for installation and integration. Medium voltage drives are significantly more expensive than low voltage alternatives, often costing several times more due to their complex design and advanced functionalities. According to the Confederation of Indian Industry, small and medium enterprises (SMEs) in the region face challenges in adopting MVDs due to limited capital availability. For instance, SMEs in Southeast Asia often prioritize short-term cost savings over long-term energy efficiency, deterring widespread adoption. This financial barrier limits the ability of smaller players to leverage MVDs, thereby constraining market growth.

Technical Complexity and Maintenance Challenges

Another restraint is the technical complexity associated with medium voltage drives, which requires specialized expertise for installation and maintenance. The Japan Electrical Manufacturers’ Association notes that improper handling or configuration of MVDs can lead to system failures, resulting in costly downtime. Furthermore, the lack of skilled professionals in emerging economies exacerbates this issue. For example, Vietnam’s Ministry of Industry and Trade reports that only 30% of industrial facilities have access to trained personnel capable of maintaining MVDs. These challenges hinder the seamless adoption of medium voltage drives in regions with underdeveloped industrial ecosystems.

MARKET OPPORTUNITIES

Smart Grid Development

The development of smart grids presents a significant opportunity for the medium voltage drives market. Smart grids rely on advanced technologies to optimize electricity distribution and integrate renewable energy sources, with MVDs playing a crucial role in regulating power flow. According to the U.S. Department of Energy, smart grid investments in the Asia Pacific region are expected to exceed $50 billion by 2030. In countries like Japan and South Korea, where smart grid initiatives are already underway, MVDs are being deployed to enhance grid reliability and efficiency. For instance, Japan’s Ministry of Economy, Trade and Industry emphasizes the use of MVDs in substations to manage fluctuating energy loads. These developments create a fertile ground for MVD manufacturers to expand their footprint in the region.

Expansion into Emerging Economies

Emerging economies in the Asia Pacific offer untapped potential for medium voltage drives, driven by industrialization and infrastructure development. The Asian Infrastructure Investment Bank reports that over $1 trillion is being invested annually in infrastructure projects across Southeast Asia, creating demand for MVDs in sectors like mining, water treatment, and transportation. Similarly, Vietnam’s growing manufacturing sector is adopting MVDs to meet international standards for energy efficiency. These trends position emerging markets as key growth drivers for the medium voltage drives market.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain vulnerabilities pose a significant challenge to the medium voltage drives market, particularly in light of geopolitical tensions and natural disasters. The Federation of Indian Chambers of Commerce and Industry notes that disruptions in the supply of critical components, such as semiconductors and capacitors, have delayed MVD projects in the region. For instance, typhoons in the Philippines frequently disrupt logistics, as reported by the Asian Disaster Preparedness Center, causing delays in MVD installations. These uncertainties complicate planning and execution, that is ultimately impeding market growth and stability.

Regulatory Compliance and Standardization Issues

Stringent regulatory requirements and the lack of standardized frameworks also challenge the medium voltage drives market. Governments across the region have implemented varying energy efficiency mandates, making it difficult for manufacturers to develop universally compliant products. For example, Australia’s Greenhouse and Energy Minimum Standards Act mandates rigorous testing and certification processes, increasing operational burdens. Similarly, China’s National Development and Reform Commission requires adherence to specific efficiency standards, which can be costly to achieve. These regulatory hurdles limit the ability of companies to innovate and expand rapidly in fragmented markets like Southeast Asia.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Power Range, Drive, Application, End-Use, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

ABB, Danfoss, Delta Electronics, Eaton, Emerson Electric, Fuji Electric, GE Vernova, Hitachi, Hiconics, Honeywell, Nidec, Rockwell Automation, Schneider Electric, Siemens, Teco Electric, TMEIC, Triol, VEM Group, WEG, Yaskawa Electric, and others |

SEGMENTAL ANALYSIS

By Power Range Insights

The ≤ 1 MW power range dominated the Asia Pacific low voltage drives market by holding 45.6% of share in 2024 due to its widespread use in small-scale industrial and commercial applications, such as HVAC systems, pumps, and fans, which are critical for energy-efficient operations. According to the World Bank, over 200 million people will migrate to urban areas in the Asia Pacific by 2030, increasing demand for residential and commercial infrastructure. These developments rely heavily on ≤ 1 MW drives to power HVAC systems, elevators, and water pumps. For instance, India’s Smart Cities Mission, as stated by the Ministry of Housing and Urban Affairs, emphasizes the integration of energy-efficient technologies, with ≤ 1 MW drives playing a pivotal role in achieving sustainability goals.

The > 7 MW power range is lucratively growing with a CAGR of 8.5% in the next coming years. A significant driver is the expansion of renewable energy projects. According to the Global Wind Energy Council, wind turbine installations in the region grew by 16% in 2022, with > 7 MW drives essential for managing high-power turbines. Another factor is industrial modernization. Japan’s Ministry of Economy, Trade and Industry emphasizes the adoption of advanced motor technologies in heavy industries, with > 7 MW drives enabling precise control in energy-intensive processes.

By Drive Insights

The AC drives segment was the largest and held 60.6% of the Asia Pacific low voltage drives market share in 2024 due to their versatility and cost-effectiveness across diverse applications. The U.S. Department of Energy states that VFD-integrated AC drives can reduce energy consumption by up to 40% in industrial settings. In China, the National Development and Reform Commission mandates the use of energy-efficient motors, further solidifying the dominance of AC drives. Another factor is their widespread use in HVAC systems. Australia’s Greenhouse and Energy Minimum Standards Act promotes the adoption of energy-efficient HVAC systems, with AC drives playing a central role in optimizing performance.

The servo drives segment is likely to grow with a CAGR of 9.2% in the next coming years. A key factor is the rise of automation in manufacturing. The Japan Robot Association reports that robotics usage in the region grew by 12% annually, with servo drives enabling precise motion control in robotic systems.

By Application Insights

The pump applications held 30.4% of the Asia Pacific low voltage drives market share in 2024. India’s Ministry of Agriculture states that irrigation systems consume over 18% of the country’s electricity, with low voltage drives optimizing pump performance. Another factor is urban water management. Australia’s Water Services Association reports that cities are investing in smart water systems, with low voltage drives ensuring efficient water distribution.

The conveyor systems segment is lucratively to witness a CAGR of 8.8% in the next coming years. A significant factor is the rise of online retail. Nielsen reports that e-commerce sales in Southeast Asia grew by 18% in 2022, with conveyor systems powered by low voltage drives streamlining warehouse operations. Another factor is industrial automation.

By End-Use Insights

The oil & gas sector was the largest share of the Asia Pacific low voltage drives market by accounting for 25.4% of share in 2024 with the sector’s reliance on motor-driven equipment for extraction, refining, and transportation processes. China’s National Offshore Oil Corporation reports that offshore oil production grew by 10% in 2022, with low voltage drives ensuring efficient operation of pumps and compressors. Another factor is regulatory compliance. India’s Ministry of Petroleum and Natural Gas mandates energy-efficient technologies in refineries, with low voltage drives playing a crucial role in reducing emissions. These drivers ensure oil & gas remains the largest end-use segment.

The marine sector is the fastest-growing end-use segment, with a projected CAGR of 9.5%. This growth is fueled by the increasing adoption of electric propulsion systems in ships. A key factor is the push toward sustainable shipping. The International Maritime Organization emphasizes the transition to energy-efficient vessels, with low voltage drives enabling precise control of propulsion systems. Another factor is port electrification. Japan’s Ministry of Land, Infrastructure, Transport and Tourism reports that ports are integrating low voltage drives to optimize crane and conveyor operations, ensuring efficient cargo handling.

COUNTRY LEVEL ANALYSIS

China led the Asia Pacific medium voltage drives market with 40.4% of the share in 2024 owing to its status as the world’s largest industrial hub, with industries ranging from manufacturing to renewable energy relying heavily on MVDs. The National Renewable Energy Center states that wind energy capacity grew by 16% in 2022, with MVDs integral to turbine operations. Additionally, China’s Belt and Road Initiative promotes infrastructure development across Asia, which is creating demand for MVDs in power and water systems.

India is positioned second by holding 20.3% of the Asia Pacific medium voltage drives market share in 2024 with the rapid industrialization and focus on renewable energy drive MVD adoption. The Ministry of Heavy Industries reports that automation initiatives in steel and cement plants have led to a 25% reduction in energy consumption, largely due to MVDs. Furthermore, India’s Smart Cities Mission emphasizes the integration of MVDs in water treatment and HVAC systems by ensuring steady growth in demand.

Japan's medium voltage drives market growth is swiftly emerging with prominent growth opportunities in the next coming years. Additionally, Japan’s Ministry of Economy, Trade and Industry emphasizes the use of MVDs in renewable energy projects, such as solar farms, to enhance grid stability.

South Korea's medium voltage drives market growth is driven by its robust electronics and shipbuilding industries. The Ministry of Oceans and Fisheries reports that the country’s marine sector increasingly adopts MVDs for hybrid propulsion systems, which is aligning with global sustainability goals. Additionally, South Korea’s semiconductor industry relies on MVDs for precise motor control in manufacturing processes.

Australia's medium voltage drives market is likely to have huge growth opportunities with its focus on mining and renewable energy driving MVD adoption. According to the Clean Energy Council, solar farms require MVDs to stabilize power output, while the mining sector uses them for conveyor and crusher systems. Additionally, Australia’s Water Services Association emphasizes the use of MVDs in desalination plants by ensuring sustainable water supply.

KEY MARKET PLAYERS

Some of the noteworthy companies in the APAC medium voltage drives market profiled in this report are ABB, Danfoss, Delta Electronics, Eaton, Emerson Electric, Fuji Electric, GE Vernova, Hitachi, Hiconics, Honeywell, Nidec, Rockwell Automation, Schneider Electric, Siemens, Teco Electric, TMEIC, Triol, VEM Group, WEG, Yaskawa Electric, and others.

TOP LEADING PLAYERS IN THE MARKET

ABB Ltd.

ABB Ltd. is a global leader in industrial automation and electrification, with a significant presence in the Asia Pacific low voltage drives market. The company’s contribution to the global market lies in its innovative drive solutions that cater to diverse industries, including manufacturing, utilities, and infrastructure. ABB’s focus on sustainability and energy efficiency has positioned it as a preferred partner for businesses seeking to reduce operational costs while meeting environmental standards. Its modular product designs and integration capabilities enable seamless adoption across applications by ensuring long-term value for customers.

Siemens AG

Siemens AG plays a pivotal role in advancing digitalization and automation in the Asia Pacific region. Known for its cutting-edge technologies, Siemens provides low voltage drives that are integral to smart factories and renewable energy projects. The company’s focus on integrating IoT and AI into its offerings enhances operational efficiency and predictive maintenance capabilities.

Schneider Electric SE

Schneider Electric SE is renowned for its commitment to energy-efficient solutions, making it a key player in the Asia Pacific low voltage drives market. The company’s EcoStruxure platform enables intelligent motor management, empowering businesses to optimize energy usage and reduce downtime. Schneider’s dedication to innovation and customer-centric solutions has strengthened its global reputation.

TOP STRATEGIES USED BY KEY PLAYERS IN THE MARKET

Strategic Partnerships and Collaborations

Key players in the market frequently engage in partnerships with local governments, research institutions, and industry stakeholders to co-develop tailored solutions. These collaborations help companies address specific regional challenges, such as energy efficiency mandates or infrastructure development projects. Firms can enhance their product offerings and strengthen their market position by leveraging local expertise and resources.

Product Innovation and Customization

To meet the dynamic needs of end-users, companies invest heavily in R&D to introduce innovative and customized products. For instance, manufacturers are developing smart low voltage drives equipped with IoT capabilities to support predictive maintenance and real-time monitoring. This focus on innovation not only differentiates brands but also aligns with the growing demand for sustainable and efficient solutions in the region.

Expansion into Emerging Markets

Players are increasingly targeting emerging economies within the Asia Pacific region, such as Vietnam, Indonesia, and Thailand, where industrialization and urbanization are driving demand. By establishing local manufacturing facilities and distribution networks, companies aim to reduce costs and improve accessibility. This strategy allows them to capture untapped opportunities and solidify their presence in high-growth markets.

COMPETITION OVERVIEW

The Asia Pacific low voltage drives market is characterized by intense competition, with both global giants and regional players vying for dominance. Global leaders like ABB, Siemens, and Schneider Electric leverage their technological expertise and extensive distribution networks to maintain their stronghold. Meanwhile, regional players focus on cost-effective solutions and localized services to cater to price-sensitive markets. The competitive landscape is further shaped by rapid technological advancements, with companies striving to integrate smart features and IoT capabilities into their products. Additionally, stringent regulatory frameworks promoting energy efficiency have compelled manufacturers to innovate continuously. Supply chain disruptions and raw material price volatility add complexity, forcing players to adopt agile strategies.

RECENT MARKET DEVELOPMENTS

- In April 2024, ABB Ltd. launched a new line of medium voltage drives designed specifically for renewable energy applications in India. This move aimed to capitalize on the country’s growing focus on solar and wind power projects, enhancing ABB’s market presence in the region.

- In June 2023, Siemens AG partnered with a leading Australian utility provider to supply advanced medium voltage drives for water treatment plants. This collaboration strengthened Siemens’ visibility in the region’s infrastructure sector and expanded its customer base.

- In September 2023, Schneider Electric SE acquired a local manufacturer in Vietnam to expand its production capabilities for cost-effective medium voltage drives. This acquisition enabled the company to better serve Southeast Asia’s burgeoning industrial market and increase its regional footprint.

- In January 2024, WEG Group introduced a series of IoT-enabled medium voltage drives tailored for smart factories in South Korea. This initiative aligned with the country’s push toward Industry 4.0 technologies, allowing WEG to position itself as a leader in innovative solutions.

- In November 2023, Toshiba Corporation signed an agreement with a Japanese robotics firm to develop specialized medium voltage drives for automated systems. This partnership reinforced Toshiba’s prominence in precision motor technology and expanded its application portfolio.

MARKET SEGMENTATION

This Asia Pacific medium voltage drives market research report is segmented and sub-segmented into the following categories.

By Power Range

- ≤ 1 MW

- 1 MW - 3 MW

- 3 MW - 7 MW

- 7 MW

By Drive

- AC

- DC

- Servo

By Application

- Pump

- Fan

- Conveyor

- Compressor

- Extruder

- Others

By End-Use

- Oil & gas

- Power generation

- Mining & metals

- Pulp & paper

- Marine

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What drives the Asia Pacific medium voltage drives market?

The Asia Pacific medium voltage drives market is driven by rapid industrialization, urbanization, automation in heavy industries, and the integration of renewable energy projects requiring efficient motor control.

2. What challenges affect the Asia Pacific medium voltage drives market?

The Asia Pacific medium voltage drives market faces high initial investment costs, technical complexity requiring skilled professionals, supply chain disruptions, and fragmented regulatory standards across countries.

3. What opportunities exist in the Asia Pacific medium voltage drives market?

The Asia Pacific medium voltage drives market offers opportunities in smart grid development, infrastructure expansion in emerging economies, and growing adoption of energy-efficient and IoT-enabled drive solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]