Asia Pacific Microinsurance Market Size, Share, Trends & Growth Forecast Report By Product Type (Property, Health, Life, Index, Accidental Death & Disability, Others), Provider (Commercially Viable, Aid/Government Support), Model Type (Partner Agent, Full-Service, Provider Driven, Community-Based, Others), and Country (India, China, Japan, South Korea, Australia) – Industry Analysis From 2025 to 2033.

Asia Pacific Microinsurance Market Size

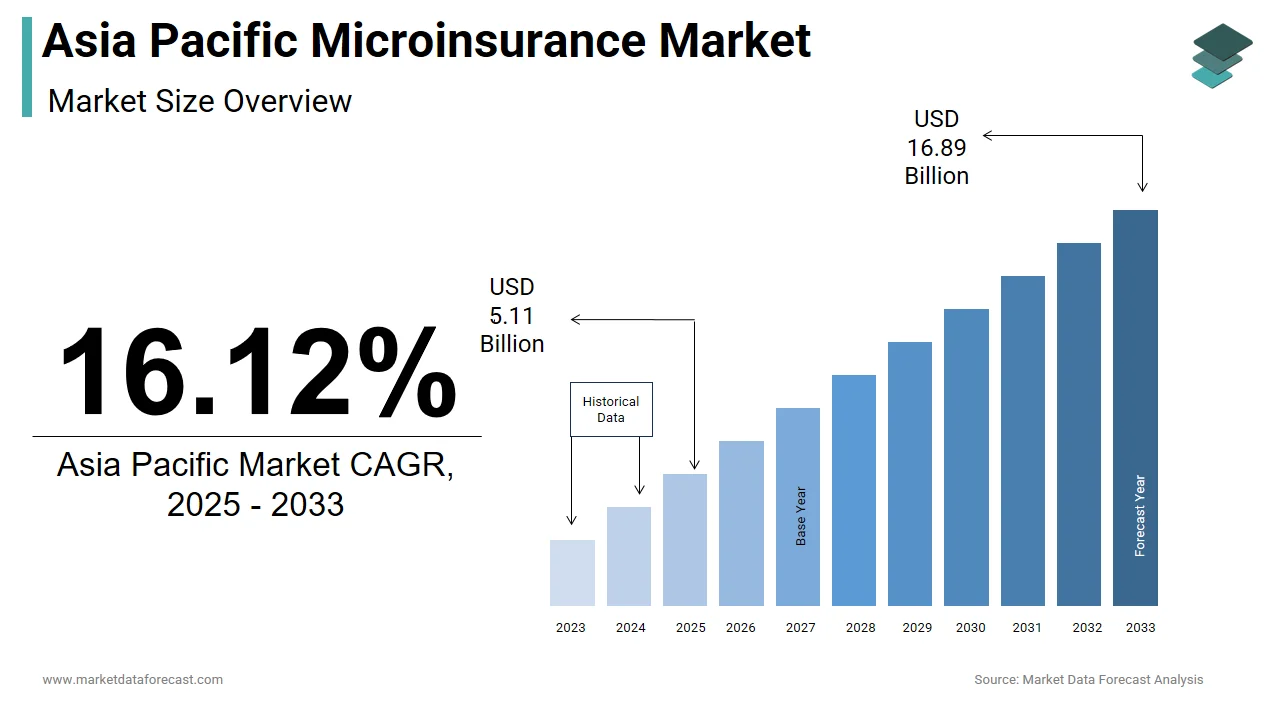

The size of the Asia Pacific microinsurance market was worth USD 4.40 billion in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 16.12% from 2025 to 2033 and be worth USD 16.89 billion by 2033 from USD 5.11 billion in 2025.

Microinsurance in the Asia Pacific region refers to insurance products designed specifically for low-income populations, offering affordable coverage against health, life, agriculture, and property-related risks. Unlike traditional insurance, microinsurance operates on smaller premiums and scales its benefits to meet the financial realities of underserved communities. The market has evolved significantly as a response to widespread economic vulnerability and limited access to formal risk mitigation tools across several developing economies in the region.

The Asia Pacific accounts for the largest share of the global microinsurance market due to its vast population of low-income individuals and increasing focus on financial inclusion. According to the International Labour Organization, over 60% of the working population in Asia remains engaged in informal employment, highlighting the urgent need for accessible risk protection mechanisms. In countries like India, Indonesia, and the Philippines, microinsurance is increasingly being integrated into national financial inclusion strategies. As per data from the Asian Development Bank, nearly 1.3 billion adults in the Asia Pacific remain unbanked, further reinforcing reliance on alternative financial services such as microinsurance. Additionally, government-backed initiatives and partnerships with non-governmental organizations have played a pivotal role in expanding outreach. These dynamics collectively shape the evolving definition and scope of the Asia Pacific microinsurance market, emphasizing inclusivity, affordability, and resilience in the face of socio-economic challenges.

MARKET DRIVERS

Rising Financial Inclusion Initiatives Across Developing Economies

One of the most influential drivers fueling the growth of the microinsurance market in the Asia Pacific is the accelerating pace of financial inclusion, particularly through government-led programs and digital innovations. Governments in countries such as India, Indonesia, and the Philippines have launched targeted financial literacy campaigns and digital banking initiatives aimed at bringing unbanked populations into the formal financial system. This has created fertile ground for microinsurance uptake among lower-income segments who previously lacked access to even basic risk protection.

For instance, India’s Pradhan Mantri Jan Dhan Yojana (PMJDY) has enabled over 400 million bank accounts since its inception, many of which are linked to low-cost life and accident insurance schemes. Similarly, the Philippines’ National Strategy for Financial Inclusion has led to a 25% increase in insurance penetration among rural populations between 2019 and 2023. As per the World Bank, mobile money account ownership in Southeast Asia rose by 38% during the same period, enabling easier distribution of microinsurance products through digital channels. These developments indicate a structural shift in how low-income households access financial services, with microinsurance playing a central role. As more citizens engage with formal financial systems, demand for affordable, tailored insurance products is expected to grow steadily across the region.

Increasing Vulnerability to Climate Risks in Rural Agriculture-Based Economies

Another key driver shaping the Asia Pacific microinsurance market is the growing exposure of smallholder farmers and rural populations to climate-induced risks, particularly in countries where agriculture forms a significant portion of GDP and livelihoods. Countries such as Vietnam, Bangladesh, Nepal, and the Philippines are witnessing increased frequency of extreme weather events, including floods, typhoons, and droughts. This has heightened the need for risk-transfer mechanisms that protect vulnerable groups from income shocks caused by environmental disruptions.

According to the Food and Agriculture Organization (FAO), approximately 500 million smallholder farmers operate in Asia, with over 70% lacking any form of crop or livestock insurance. In response, governments and international agencies have been promoting index-based weather insurance schemes that use satellite and meteorological data to trigger payouts automatically when adverse conditions occur. For example, in India, the Pradhan Mantri Fasal Bima Yojana (PMFBY) enrolled over 50 million farmers in 2023 alone, providing them with subsidized crop insurance. Similarly, in Bangladesh, a pilot program supported by the United Nations Capital Development Fund expanded weather-indexed insurance to over 100,000 rice farmers between 2021 and 2023. These efforts reflect a growing recognition of the importance of microinsurance in building resilience against climate volatility, thereby boosting its adoption across rural Asia Pacific markets.

MARKET RESTRAINTS

Low Awareness and Limited Understanding of Insurance Products Among Target Populations

A major restraint affecting the expansion of the Asia Pacific microinsurance market is the persistent lack of awareness and understanding of insurance concepts among low-income populations. Despite increasing digital penetration and financial literacy drives, many potential policyholders in rural and semi-urban areas remain unfamiliar with the principles of risk pooling, premium payments, and claim processes. This knowledge gap often leads to skepticism and mistrust towards insurance providers, resulting in low take-up rates even when products are available.

According to a survey conducted by the Asian Development Bank, only 35% of respondents in rural parts of Cambodia, Laos, and Myanmar could correctly explain what insurance entails. Furthermore, low levels of formal education in these regions contribute to difficulties in comprehending policy terms and conditions. A report by the International Association for Microinsurance revealed that less than 20% of microinsurance beneficiaries in South Asia were aware of their full coverage entitlements after purchasing a product. These findings highlight the challenge insurers face in communicating value propositions effectively. Without sustained educational interventions, misconceptions will continue to hinder market growth, making it difficult to scale up microinsurance solutions across the Asia Pacific.

High Distribution Costs Amidst Thin Margins and Operational Challenges

Another significant constraint in the Asia Pacific microinsurance market is the disproportionately high cost of distribution relative to the low premium amounts collected. Due to the fragmented nature of target populations—often residing in remote and rural areas—reaching customers remains both logistically complex and expensive. Traditional distribution channels, such as agents and brokers, incur substantial overheads, while digital alternatives face limitations due to poor internet connectivity and low smartphone penetration in certain regions.

According to the Microinsurance Network, distribution costs can account for over 40% of total expenses in some microinsurance operations, severely squeezing profit margins. In India, a study by the Insurance Regulatory and Development Authority found that the average acquisition cost per policy in rural markets was almost three times higher than in urban centers. This inefficiency discourages private insurers from entering or expanding in underserved areas, limiting market reach. Additionally, inadequate infrastructure and weak agent training further impede effective service delivery. While partnerships with local cooperatives and microfinance institutions have shown promise, they also require careful coordination and regulatory alignment. Until innovative and cost-efficient distribution models are widely adopted, the Asia Pacific microinsurance market will continue to struggle with scalability and profitability.

MARKET OPPORTUNITIES

Expansion of Digital Platforms and Mobile Technology for Product Delivery

A significant opportunity emerging in the Asia Pacific microinsurance market is the rapid proliferation of digital platforms and mobile technologies, which are transforming how insurance products are distributed and consumed. With mobile phone penetration exceeding 80% in most countries across the region, insurers are leveraging mobile networks to offer simplified, on-demand policies that cater to the needs of low-income consumers. This shift is particularly evident in nations like Indonesia, the Philippines, and India, where mobile-based microinsurance platforms are gaining traction.

Data from GSMA indicates that mobile money accounts in the Asia Pacific grew by 38% between 2020 and 2023, facilitating seamless payment integration for insurance premiums and claims settlement. In Indonesia, for example, companies like PasarPolis and Julo have introduced microinsurance products via mobile apps, reaching millions of previously uninsured users. Similarly, in the Philippines, InsurTech firm TropoGo has partnered with telecom operators to bundle insurance with prepaid mobile plans, enhancing accessibility. As per the Asian Development Bank, this digitization of insurance services has reduced customer acquisition costs by up to 30% in select markets, improving operational efficiency. By capitalizing on mobile ecosystems, insurers can not only expand their reach but also enhance user engagement through personalized offerings, paving the way for sustained market growth.

Integration with Social Protection Programs and Government Schemes

The growing alignment of microinsurance with social protection frameworks and public welfare programs presents a compelling opportunity for market expansion across the Asia Pacific. Governments in the region are increasingly recognizing the role of microinsurance in strengthening social safety nets, especially for vulnerable populations exposed to health, agricultural, and disaster-related risks. This convergence is leading to public-private partnerships that facilitate broader insurance coverage with minimal cost burdens on individual policyholders.

In India, the Ayushman Bharat scheme provides hospitalization coverage to over 500 million low-income citizens, demonstrating the potential of state-backed insurance models. Similarly, Thailand’s Universal Coverage Scheme ensures healthcare access for all citizens, integrating elements of microinsurance principles. As per the International Labour Organization, more than 20 countries in Asia have introduced or expanded insurance-linked welfare programs since 2020, covering sectors such as informal labor, disability support, and old-age pensions. In Bangladesh, the government collaborated with NGOs and insurers to roll out flood-index insurance for coastal farmers under the Climate Resilience Investment Facility. These initiatives highlight how public funding and policy direction can catalyze microinsurance adoption. By embedding insurance within established social security systems, policymakers can ensure long-term financial protection for millions while fostering sustainable market development.

MARKET CHALLENGES

Regulatory Fragmentation and Lack of Standardized Frameworks

A critical challenge confronting the Asia Pacific microinsurance market is the absence of harmonized regulatory frameworks across countries, which complicates cross-border operations and hampers product innovation. Each country in the region maintains distinct licensing requirements, consumer protection laws, and reporting standards, creating administrative complexities for insurers seeking to scale regional offerings. This fragmentation discourages multinational insurers from investing in smaller, less predictable markets, limiting the availability of diverse microinsurance products.

As noted by the International Association of Insurance Supervisors, only six out of the 21 Asia Pacific economies have dedicated microinsurance regulations in place. In contrast, other jurisdictions apply generic insurance rules to microinsurance, which often fail to address the unique characteristics of low-income segments. For instance, in Indonesia and the Philippines, regulatory constraints on premium caps and mandatory agent presence have restricted the growth of fully automated digital insurance models. According to the Asian Development Bank, inconsistent tax treatment of microinsurance products further adds to the burden, with some countries imposing levies that make premiums unaffordable for target demographics. These regulatory disparities create an uneven operating landscape, deterring innovation and investment. Until uniform guidelines are developed and adopted across the region, the Asia Pacific microinsurance market will face persistent barriers to consolidation and scalability.

Sustainability and Profitability Concerns in Low-margin Segments

Sustainability remains a pressing challenge for the Asia Pacific microinsurance market, primarily due to the thin profit margins associated with insuring low-income populations. Given the affordability imperative, premium amounts are typically very low, often ranging between USD 1 and USD 10 annually per policyholder. This pricing model makes it difficult for insurers to cover operational costs, maintain profitability, and invest in product enhancement without subsidies or economies of scale.

A report by the Centre for Insurance and Risk Management highlights that over 60% of microinsurance ventures in Asia operate at a loss or break-even point, largely due to high administrative expenses and low claim recovery rates. In India, despite the large subscriber base under government-backed crop insurance schemes, insurer payouts frequently exceed collected premiums, leading to financial strain on both public and private stakeholders. Similarly, in the Philippines, studies show that health microinsurance policies generate less than 30% of the revenue seen in standard insurance products, yet involve comparable administrative effort. Such financial discrepancies discourage mainstream insurers from committing long-term resources to microinsurance portfolios. Unless innovative business models—such as bundling insurance with other financial services or leveraging big data for better risk assessment—are successfully implemented, sustainability concerns will persist as a major impediment to market growth in the Asia Pacific.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, Model Type, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

MILVIK BIMA (Singapore), Pula (Kenya), ZhongAn Online P&C Insurance Co. Ltd. (China), FWD Group (Hong Kong), AIA Group Limited (Hong Kong), SBI Life Insurance Company Limited (India), Etiqa Life and General Assurance Philippines, Inc. (Philippines), MIC Global (USA), CLIMBS Life and General Insurance Cooperative (Philippines), and Grama Vidiyal (IDFC Bharat Ltd).. |

SEGMENTAL ANALYSIS

By Product Type Insights

Health insurance holds the largest share in the Asia Pacific microinsurance market, accounting for nearly 35% of total revenues. This dominance is primarily attributed to the increasing healthcare expenditure among low-income groups, coupled with rising disease burden and limited access to public health services in rural areas. In countries like India, Indonesia, and the Philippines, where out-of-pocket healthcare expenses account for over 60% of total spending, there is a strong need for affordable health coverage that protects families from financial shocks.

According to the World Bank, approximately 80 million people in Southeast Asia face catastrophic health expenditures annually. This has spurred demand for micro health insurance products that offer hospitalization benefits, outpatient care, and preventive services at subsidized rates. Additionally, government-backed schemes such as India’s Ayushman Bharat, which provides coverage to over 500 million citizens, have significantly expanded the reach of health-based microinsurance. As per the Asian Development Bank, health-focused policies now cover more than 150 million low-income individuals across Asia, up from under 70 million in 2018. These figures underscore the critical role of health insurance in driving the broader growth of the regional microinsurance market.

Index insurance is emerging as the fastest-growing segment in the Asia Pacific microinsurance market, projected to expand at a compound annual growth rate (CAGR) of approximately 14.2% between 2023 and 2030. This rapid growth is driven by its innovative design, which links payouts to predefined indices such as weather patterns, crop yields, or livestock mortality rates rather than individual claims, reducing administrative costs and fraud risks.

The adoption of index-based insurance is particularly strong in agriculture-dependent economies like Vietnam, Bangladesh, and Nepal, where climate volatility has intensified the need for efficient risk transfer mechanisms. According to the Food and Agriculture Organization (FAO), over 60% of smallholder farmers in South and Southeast Asia remain uninsured despite exposure to frequent natural disasters. Programs like the Weather-Based Crop Insurance Scheme (WBCIS) in India have successfully enrolled millions of farmers using satellite and rainfall data, improving payout efficiency. As reported by the International Fund for Agricultural Development (IFAD), index insurance penetration increased by nearly 90% in the region between 2019 and 2023, fueled by digital integration and partnerships with local cooperatives. These factors are accelerating its expansion and positioning index insurance as a transformative force in the sector.

By Model Type Insights

The full-service model constitutes the largest distribution channel in the Asia Pacific microinsurance market, capturing approximately 38% of the total market share. This model involves insurers providing end-to-end services, including product design, underwriting, premium collection, and claims settlement, often through dedicated agents or intermediaries. Its dominance stems from the ability to offer comprehensive solutions tailored to specific customer needs, particularly in mature markets where regulatory frameworks support structured insurance operations.

In countries like Japan, Australia, and South Korea, the full-service model is preferred due to well-established insurance infrastructures and high consumer trust in formal financial institutions. According to the Insurance Regulatory and Development Authority of India (IRDAI), over 60% of life and health microinsurance policies in India are distributed through direct insurer channels and licensed agents, reinforcing the model's effectiveness. Similarly, in Australia, where insurance penetration exceeds 70%, major players utilize full-service models to deliver bundled financial protection services to both urban and semi-rural populations. The Asian Development Bank reports that in 2023, nearly 85 million policyholders in the region were covered under full-service arrangements, facilitated by insurer-led networks and digital enhancements. These dynamics underline why this model continues to lead in terms of market size and operational scale.

The partner agent model is currently the fastest-growing distribution channel in the Asia Pacific microinsurance market, registering a CAGR of approximately 16.8% between 2022 and 2023. This model leverages existing community-based agents, microfinance institutions (MFIs), non-governmental organizations (NGOs), and mobile money providers to distribute microinsurance products, thereby reducing operational costs and expanding outreach to remote, underserved populations.

This growth is largely driven by the integration of microinsurance into existing financial service delivery platforms. For example, in Indonesia and the Philippines, banks and telecom companies have partnered with insurers to offer bundled insurance products alongside loans and mobile top-ups, enhancing accessibility and affordability. According to the Microinsurance Network, over 40 million policies were distributed through partner agents in 2023 alone, with MFIs playing a key role in reaching low-income clients in rural Bangladesh and Nepal. Furthermore, the World Bank highlights that agent-assisted insurance sales in India grew by 22% year-on-year during the same period, supported by digital training tools and commission incentives. Such collaborations are proving instrumental in overcoming last-mile delivery challenges and boosting adoption, making the partner agent model one of the most promising avenues for future market expansion.

COUNTRY-LEVEL ANALYSIS

India holds the dominant position in the Asia Pacific microinsurance market, commanding approximately 28% of the overall market share. This leadership is underpinned by a combination of proactive government interventions, large-scale financial inclusion initiatives, and a rapidly growing InsurTech ecosystem. With over 800 million adults in the informal economy, the demand for affordable insurance solutions remains high, especially in rural and semi-urban areas.

Key government programs such as Pradhan Mantri Jan Dhan Yojana (PMJDY), Ayushman Bharat, and Pradhan Mantri Fasal Bima Yojana (PMFBY) have played a pivotal role in embedding insurance within broader welfare frameworks. As per the Ministry of Finance, PMJDY-linked accidental insurance schemes have already provided coverage to over 400 million bank account holders. Moreover, the Indian microinsurance market saw a 22% increase in policy enrollments in 2023, driven by digital onboarding and mobile-based distribution. According to IRDAI, the number of microinsurance policies issued crossed 120 million in 2023, up from 98 million the previous year. These figures illustrate India’s robust foundation and sustained momentum as the largest microinsurance market in the Asia Pacific region.

China ranks second in the Asia Pacific microinsurance market with an estimated 16% market share. Although traditionally viewed as a developed insurance market, China has increasingly focused on inclusive insurance models to address the needs of its vast rural population and informal workforce. A significant portion of the adult population in western and central provinces lacks adequate insurance coverage, prompting the government and private insurers to develop targeted microinsurance solutions.

As outlined by the China Banking and Insurance Regulatory Commission (CBIRC), microinsurance subscriptions grew by 11% in 2023, with particular emphasis on agricultural and health-related products. In rural Sichuan and Yunnan provinces, index-based crop insurance schemes have gained traction, protecting smallholder farmers against climate-induced losses. Additionally, the rise of digital payment platforms such as Alipay and WeChat Pay has enabled seamless insurance transactions, further expanding reach. According to the Asian Development Bank, over 60 million rural Chinese households purchased some form of microinsurance in 2023, marking a doubling over the past five years. These developments reflect China’s evolving microinsurance landscape and its continued progress toward broader financial inclusion.

Indonesia occupies the third-largest position in the Asia Pacific microinsurance market, holding around 9% of the regional share. The country’s dynamic microinsurance sector is being driven by a young, digitally savvy population, widespread informal employment, and increasing government collaboration with private insurers. With over 60 million micro-enterprises and a significant rural population dependent on agriculture, Indonesia presents a substantial opportunity for microinsurance expansion.

The Government of Indonesia has been actively promoting financial inclusion through the National Strategy for Financial Literacy and Education (NSFLE), leading to a surge in insurance awareness and uptake. According to Otoritas Jasa Keuangan (OJK), the Indonesian Financial Services Authority, microinsurance policies sold through digital platforms grew by 45% in 2023 compared to the previous year. Companies such as PasarPolis and LinkAja have introduced mobile-first insurance bundles targeting gig workers, small traders, and farmers. Additionally, a report by the Asian Development Bank notes that only 3% of Indonesia’s 140 million informal workers had insurance coverage in 2020, indicating massive untapped potential. These factors collectively contribute to Indonesia’s strong growth trajectory in the microinsurance domain.

The Philippines accounts for approximately 7% of the Asia Pacific microinsurance market, establishing itself as a key player due to its proactive regulatory environment and expanding insurtech landscape. The country’s high vulnerability to natural disasters, along with a large informal labor force, has created a pressing need for affordable, accessible insurance products tailored to low-income populations.

The Insurance Commission of the Philippines (ICP) has been instrumental in fostering microinsurance development, issuing guidelines that encourage innovation while ensuring consumer protection. As per the ICP, microinsurance policies in the country increased by 19% in 2023, with notable growth observed in health, life, and disaster-specific coverage. In partnership with telecommunications firms and cooperatives, insurers have launched mobile-based insurance offerings that cater to unbanked Filipinos. According to the Asian Development Bank, only about 20% of Filipino households had any form of insurance in 2022, highlighting the potential for further expansion. Additionally, the government’s push to integrate microinsurance into social protection programs, particularly in typhoon-prone regions, is expected to drive continued growth in the sector.

Vietnam is emerging as a significant contributor to the Asia Pacific microinsurance market, holding approximately 5% of the total market share. The country’s growing economic profile, coupled with increasing recognition of financial risk management among lower-income groups, has catalyzed the expansion of microinsurance products. A large proportion of Vietnam’s population works in agriculture and informal sectors, making them highly susceptible to income shocks and health emergencies.

The Vietnamese government has taken strategic steps to promote financial inclusion through initiatives such as the National Financial Inclusion Strategy, which aims to bring 80% of the adult population into the formal financial system by 2025. According to the State Bank of Vietnam, microinsurance penetration increased by 14% in 2023, with notable growth in health and agriculture-linked policies. The Ministry of Agriculture and Rural Development also launched pilot crop insurance programs in Mekong Delta provinces affected by flooding, reaching over 300,000 farmers in 2023 alone. As reported by the Asian Development Bank, less than 10% of Vietnam’s rural farmers possess any form of insurance, indicating substantial room for growth. These developments highlight Vietnam’s potential to become a stronger contender in the regional microinsurance landscape.

KEY MARKET PLAYERS

Some of the noteworthy companies in the APAC microinsurance market profiled in this report are MILVIK BIMA (Singapore), Pula (Kenya), ZhongAn Online P&C Insurance Co. Ltd. (China), FWD Group (Hong Kong), AIA Group Limited (Hong Kong), SBI Life Insurance Company Limited (India), Etiqa Life and General Assurance Philippines, Inc. (Philippines), MIC Global (USA), CLIMBS Life and General Insurance Cooperative (Philippines), and Grama Vidiyal (IDFC Bharat Ltd).

TOP LEADING PLAYERS IN THE MARKET

Bajaj Allianz General Insurance Co. Ltd.

Bajaj Allianz General Insurance is a leading player in India’s microinsurance market and has significantly contributed to the broader Asia Pacific region by offering customized, affordable insurance products tailored for low-income groups. The company has been instrumental in integrating microinsurance with digital platforms and banking partnerships, enhancing accessibility across rural and semi-urban areas. Bajaj Allianz collaborates closely with financial institutions, NGOs, and government bodies to distribute health, crop, and accidental insurance policies at scale, thereby playing a key role in advancing financial inclusion.

Prudential plc (Prudential Corporation Asia)

Prudential operates extensively in the Asia Pacific under its regional arm, Prudential Corporation Asia, offering inclusive insurance solutions that cater to underserved populations. The company has pioneered mobile-enabled insurance models, particularly in markets like Indonesia, the Philippines, and Vietnam, enabling mass outreach. Through strategic digital partnerships and localized product innovation, Prudential has enhanced microinsurance affordability and awareness, positioning itself as a major contributor to inclusive finance in the region and influencing global best practices in accessible insurance distribution.

Telenor Microinsurance (Telenor Pakistan / Telenor Group)

While originally based in Pakistan, Telenor's microinsurance initiatives have had a ripple effect in the Asia Pacific, especially through its Thai subsidiary, Telenor Microinsurance in collaboration with local insurers. Leveraging mobile networks, Telenor delivers bite-sized insurance products such as life, health, and accident coverage to millions of low-income mobile subscribers. This model has inspired replication across other emerging Asian markets, making Telenor a notable innovator in technology-driven microinsurance and contributing to the evolution of digitally enabled insurance ecosystems globally.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One major strategy employed by key players in the Asia Pacific microinsurance market is strategic partnerships with mobile network operators and fintech firms . By collaborating with telecom companies and digital payment platforms, insurers can reach previously inaccessible customer segments through mobile-based distribution channels. These alliances enhance affordability and convenience, driving wider adoption of microinsurance products among low-income populations.

Another prominent approach involves product innovation tailored to local needs. Insurers are designing context-specific solutions that align with the risk profiles and cultural contexts of different regions. Whether it's weather-indexed agricultural insurance in flood-prone areas or seasonal health coverage in rural communities, such customization enhances relevance and uptake, strengthening market presence.

Lastly, leveraging digital technologies for streamlined operations has become crucial. Companies are utilizing artificial intelligence, data analytics, and blockchain to improve underwriting accuracy, automate claims processing, and reduce operational costs. These innovations not only boost efficiency but also build consumer trust, ensuring sustainable growth in competitive microinsurance landscapes.

COMPETITION OVERVIEW

The competition in the Asia Pacific microinsurance market is characterized by a dynamic mix of traditional insurers, emerging insurtech startups, and non-insurance entities such as banks, telecom operators, and microfinance institutions. As demand for affordable risk protection grows, market participants are increasingly focusing on expanding their rural footprint and enhancing digital capabilities to differentiate themselves. Traditional insurers are leveraging their established networks and regulatory expertise, while new-age players are disrupting conventional models with innovative product designs and agile delivery mechanisms. Additionally, cross-sector collaborations are becoming more prevalent, allowing companies to tap into existing customer bases and distribution infrastructures. However, intense rivalry exists due to overlapping target demographics and similar value propositions, compelling firms to continuously refine their offerings and distribution strategies. With governments promoting financial inclusion and regulators encouraging product diversification, the competitive landscape remains highly fragmented yet evolving rapidly, requiring constant adaptation to maintain a strong market position.

RECENT MARKET DEVELOPMENTS

- In February 2024, ICICI Lombard General Insurance partnered with Paytm to launch mobile-based microinsurance products targeting unbanked and semi-urban consumers, aiming to expand digital access and affordability.

- In May 2024, Sompo Holdings expanded its microinsurance presence in Southeast Asia by entering into a joint venture with a local insurer in Thailand, focusing on climate-risk-related insurance products for smallholder farmers.

- In July 2024, AIA Group introduced a suite of modular microinsurance plans in Vietnam, designed to be integrated with mobile wallets and banking apps, enabling flexible premium payments and instant claim settlements.

- In September 2024, Bharti AXA General Insurance collaborated with self-help groups across rural India to distribute health and accident cover through community-level agents, enhancing last-mile connectivity and trust-building.

- In November 2024, Ping An Insurance launched an AI-powered microinsurance platform in China specifically for migrant workers, offering customizable coverage options and real-time policy management via a mobile interface.

MARKET SEGMENTATION

This Asia Pacific microinsurance market research report is segmented and sub-segmented into the following categories.

By Product Type

- Property Insurance

- Health Insurance

- Life Insurance

- Index Insurance

- Accidental Death and Disability Insurance

- Others

By Provider

- Microinsurance (Commercially Viable)

- Microinsurance Through Aid/Government Support

By Model Type

- Partner Agent Model

- Full-Service Model

- Provider Driven Model

- Community-Based/Mutual Model

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What drives the Asia Pacific microinsurance market?

The Asia Pacific microinsurance market is driven by financial inclusion initiatives, rising awareness among low-income populations, government-backed programs, and digital innovations like mobile-based insurance distribution

2. What challenges affect the Asia Pacific microinsurance market?

The Asia Pacific microinsurance market faces challenges such as low awareness in rural areas, high distribution costs, regulatory fragmentation, and the difficulty of sustaining profitability with low premiums

3. What opportunities exist in the Asia Pacific microinsurance market?

The Asia Pacific microinsurance market offers opportunities in mobile and digital platform expansion, public-private partnerships for social protection, and innovative products like index-based and bundled insurance solutions

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]