Asia Pacific Outboard Engines Market Research Report – Segmented By Engine Type (4-Stroke Engines, 2-Stroke Engines, Electric Engines), Fuel Type, Ignition Type Distribution Channel, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific Outboard Engines Market Size

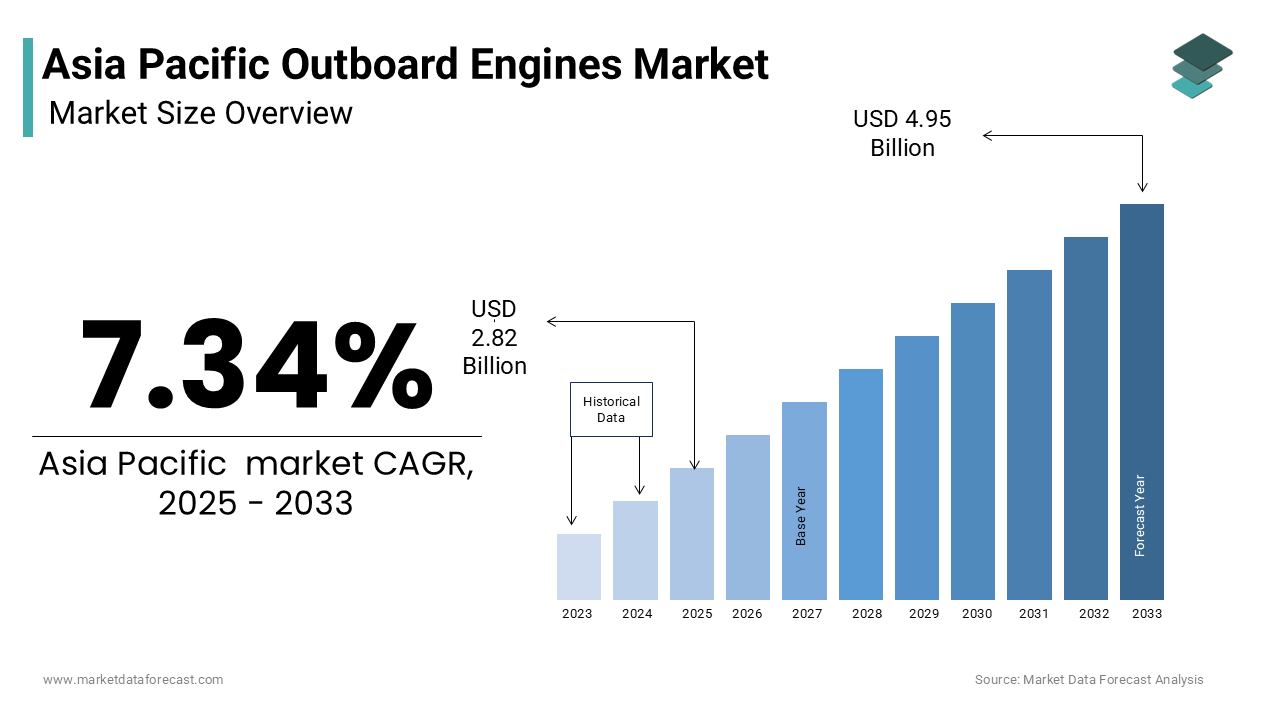

The Asia Pacific Outboard Engines Market was worth USD 2.62 billion in 2024. The Asia Pacific market is expected to reach USD 4.95 billion by 2033 from USD 2.82 billion in 2025, rising at a CAGR of 7.34% from 2025 to 2033.

The Asia Pacific outboard engines market represents a specialized segment within the broader marine propulsion industry, catering to small and medium-sized vessels used for commercial fishing, recreational boating, and transportation across coastal and inland waterways. Outboard engines are self-contained propulsion units mounted externally on boats, offering advantages such as portability, ease of maintenance, and adaptability to various vessel types. The region’s archipelagic geography, extensive coastlines, and reliance on marine activities for economic sustenance make it a significant hub for outboard engine adoption.

MARKET DRIVERS

Rising Marine Tourism and Recreational Boating Activities

The burgeoning marine tourism sector in the Asia Pacific region serves as a pivotal driver for the outboard engines market. Coastal nations such as Thailand, Malaysia, and Australia have witnessed exponential growth in recreational boating activities, driven by increasing urbanization, higher disposable incomes, and government initiatives to promote tourism. This surge has led to heightened demand for small and medium-sized vessels equipped with outboard engines, which are preferred for their maneuverability and efficiency in shallow waters. Moreover, the proliferation of luxury resorts and island destinations has spurred investments in charter boats and water sports equipment, further boosting engine sales. Manufacturers are capitalizing on this trend by introducing lightweight, high-performance models tailored to recreational users, ensuring sustained market growth.

Commercial Fishing and Aquaculture Expansion

Commercial fishing remains a cornerstone of the Asia Pacific economy, with aquaculture playing an increasingly vital role in meeting global seafood demand. Outboard engines are indispensable for small-scale fishermen who operate in remote and shallow waters where larger vessels cannot navigate. In countries like Indonesia and the Philippines, traditional fishing communities heavily rely on these engines for daily operations. The Asian Development Bank estimates that a large number of people in Southeast Asia depend on fisheries for their livelihoods, highlighting the critical importance of reliable marine propulsion systems. Furthermore, advancements in engine technology, such as fuel-efficient designs and lower emissions, have made them more appealing to cost-conscious operators. These factors collectively drive robust demand for outboard engines, particularly among small-scale and artisanal fishing sectors.

MARKET RESTRAINTS

Stringent Environmental Regulations

Environmental regulations aimed at reducing carbon emissions and marine pollution pose a significant challenge to the outboard engines market. Governments across the Asia Pacific region have introduced stricter emission standards, compelling manufacturers to innovate and develop cleaner technologies. As per the International Maritime Organization, sulfur emissions from marine engines must be reduced globally, impacting the design and production of outboard engines. Compliance with these regulations often requires substantial investment in research and development, leading to increased production costs. For example, Japan’s Ministry of the Environment mandates that all new marine engines adhere to stringent emission norms, which smaller manufacturers may struggle to meet. In addition, the shift toward electric and hybrid propulsion systems, while environmentally beneficial, presents a barrier for companies reliant on traditional combustion engines.

High Initial Costs and Maintenance Expenses

The high initial costs associated with purchasing and maintaining outboard engines act as a deterrent for many potential buyers, especially in rural and underdeveloped areas. Modern outboard engines equipped with advanced features such as electronic fuel injection and digital controls are significantly more expensive than older models. Furthermore, routine maintenance and repairs can add to the financial burden, particularly in remote locations where access to skilled technicians and spare parts is limited. For instance, in Papua New Guinea, local fishermen often resort to second-hand engines due to affordability issues, despite their lower efficiency and reliability. This affordability gap restricts market penetration, especially in economically disadvantaged regions where marine activities are a primary source of income.

MARKET OPPORTUNITIES

Adoption of Electric Outboard Engines

The transition toward sustainable energy solutions presents a lucrative opportunity for the Asia Pacific outboard engines market. Electric outboard engines, powered by lithium-ion batteries, are gaining traction due to their zero-emission capabilities and reduced operational costs. Urban centers like Singapore and Sydney are witnessing increased adoption of eco-friendly marine technologies, driven by government incentives and public awareness campaigns. For instance, Singapore’s Maritime and Port Authority offers subsidies for vessels equipped with green propulsion systems, encouraging businesses to invest in electric outboard engines. Apart from these, advancements in battery technology have extended the range and performance of these engines, making them viable for both recreational and commercial applications.

Growth of Smart Marine Technologies

The integration of smart technologies into outboard engines represents another promising avenue for market expansion. Features such as GPS navigation, real-time diagnostics, and IoT-enabled monitoring systems enhance user experience and operational efficiency. These innovations appeal to tech-savvy consumers and commercial operators seeking to optimize fuel consumption and reduce downtime. For example, Yamaha Motor Corporation has introduced outboard engines with built-in connectivity features that allow users to monitor engine performance via smartphone apps. Such advancements not only improve safety and convenience but also position manufacturers as leaders in technological innovation. Given the region’s rapid digital transformation and increasing internet penetration, the adoption of smart marine technologies is poised to accelerate, creating new revenue streams for the outboard engines market.

MARKET CHALLENGES

Fluctuating Fuel Prices and Supply Chain Disruptions

Volatile fuel prices and supply chain disruptions pose significant challenges to the Asia Pacific outboard engines market. Traditional gasoline-powered engines remain the dominant choice for most users, making them susceptible to fluctuations in fuel costs. In addition, geopolitical tensions and natural disasters have disrupted supply chains, leading to shortages of critical components such as fuel injectors and propellers. For instance, the 2021 Suez Canal blockage delayed shipments of marine parts to Southeast Asia, causing delays in production schedules. These uncertainties not only increase operational costs but also erode consumer confidence, prompting some users to delay purchases or explore alternative modes of transportation.

Limited Awareness and Technical Expertise

A lack of awareness and technical expertise among end-users in rural and semi-urban areas hampers the widespread adoption of advanced outboard engines. Many small-scale fishermen and recreational users remain unfamiliar with the benefits of modern technologies, such as fuel-efficient designs and digital controls. Like, a significant portion of fishermen in rural Indonesia cited limited access to training and technical support as a major barrier to upgrading their equipment. This knowledge gap is compounded by inadequate infrastructure, such as repair facilities and spare parts availability, in remote regions. Bridging this divide requires targeted educational initiatives and partnerships with local governments to provide training programs and establish service centers.

SEGMENTAL ANALYSIS

By Engine Type Insights

The 4-stroke engine segment dominated the Asia Pacific outboard engines market by commanding a market share of 65% in 2024. This dominance is attributed to its superior fuel efficiency, lower emissions, and quieter operation compared to 2-stroke engines. The widespread adoption of 4-stroke engines is particularly evident in countries like Japan and Australia, where stringent environmental regulations mandate the use of cleaner propulsion systems. One driving factor behind the dominance of 4-stroke engines is their alignment with regional sustainability goals. For instance, Japan has introduced subsidies for vessels equipped with eco-friendly engines, encouraging businesses to upgrade their fleets. Apart from these, advancements in engine design have improved performance metrics, making 4-stroke engines more appealing to both commercial and recreational users. As per Yamaha Motor Corporation, the average lifespan of a 4-stroke engine exceeds 10 years, offering long-term cost savings that resonate with budget-conscious operators.

A further critical aspect is the growing demand for recreational boating, particularly in affluent urban centers. Similarly, marine tourism in Southeast Asia considerably grew annually between 2019 and 2022, fueling the purchase of high-performance engines. Recreational users prioritize reliability and ease of maintenance, attributes synonymous with 4-stroke engines.

The segment of electric outboard engines is emerging as the fastest-growing in the Asia Pacific market, with a projected CAGR of 12% through 2033. This rapid expansion is driven by technological advancements, increasing environmental consciousness, and government initiatives promoting green energy solutions. Urban hubs like Singapore and Sydney are at the forefront of this transition, with local authorities offering incentives for electric-powered vessels. A main element propelling the growth of electric engines is their zero-emission capability, which aligns with regional decarbonization efforts. Singapore’s Maritime and Port Authority has allocated substantial amount to support the adoption of sustainable marine technologies, including electric propulsion systems. Furthermore, improvements in battery technology have enhanced the range and efficiency of these engines, addressing earlier concerns about limited operational capacity. For example, lithium-ion batteries now offer a range of up to 50 nautical miles on a single charge, making them viable for short-distance fishing and recreational activities.

Another significant driver is the declining cost of electric components. This affordability has expanded their appeal to small-scale fishermen and recreational users, who previously viewed them as prohibitively expensive. As awareness of their benefits grows, electric engines are expected to capture an increasingly larger share of the market.

By Fuel Type Insights

The gasoline-powered outboard engines segment held the largest share of the Asia Pacific market by accounting for a substantial portion of total sales in 2024. This influence is primarily due to their widespread availability, affordability, and compatibility with a broad range of vessel sizes. Gasoline engines are particularly prevalent in rural and semi-urban areas, where they serve as the primary propulsion system for small-scale fishing and transportation. According to the Food and Agriculture Organization, a large majority of the region’s fish production comes from artisanal fisheries, most of which rely on gasoline engines due to their cost-effectiveness. One more point contributing to he popularity of gasoline engines is their ease of maintenance. Unlike diesel engines, which require specialized repair facilities, gasoline engines can be serviced locally, making them ideal for remote regions. For instance, in Indonesia, a significant percentage of traditional fishing communities use gasoline-powered outboard engines. Another contributing factor is the relatively low upfront cost of gasoline engines. This affordability makes them accessible to small-scale operators who cannot afford higher initial investments. Apart from these, the abundance of gasoline fuel stations across the region ensures reliable supply chains, further strengthening the segment's position.

The electric outboard engines segment is experiencing exponential growth in the Asia Pacific market, with a CAGR of 12%. This surge is fueled by environmental regulations, technological advancements, and shifting consumer preferences toward sustainable alternatives. Countries like Japan and South Korea are leading the charge, with manufacturers investing heavily in research and development to enhance product offerings. A major driver of this growth is the increasing emphasis on reducing marine pollution. Governments are responding by introducing policies that encourage the adoption of electric propulsion systems. For example, South Korea’s Green Ship Program provides subsidies for vessels equipped with eco-friendly engines, accelerating market penetration. A different aspect is the growing popularity of recreational boating among urban millennials. As per Deloitte Insights, the number of recreational boaters aged 25-40 increased notably between 2019 and 2022, with many preferring environmentally friendly options. Electric engines, with their quiet operation and zero emissions, cater perfectly to this demographic. Besides, advancements in charging infrastructure have made electric engines more practical, further boosting their adoption rates.

By Ignition Type Insights

The electric ignition systems segment prevailed in the Asia Pacific outboard engines market by holding a market share of a 60.6% in 2024. This preference is due to their reliability, ease of use, and compatibility with modern engine designs. Electric ignition systems are particularly popular in urbanized regions like Japan and South Korea, where consumers prioritize convenience and performance. One driving factor is the seamless integration of electric ignition with advanced engine technologies. As per Yamaha Motor Corporation, a large share of new outboard engines sold in Japan feature electric ignition systems, enabling features such as remote start and real-time diagnostics. These capabilities enhance user experience, making them attractive to both recreational and commercial operators. Furthermore, the durability of electric ignition systems reduces downtime, ensuring consistent performance in demanding environments. A critical factor is the growing adoption of smart marine technologies. Features such as GPS navigation and IoT-enabled monitoring systems are only compatible with electric ignition, driving its dominance.

The manual ignition systems segment is witnessing steady growth, with a CAGR of 5%. This growth is primarily driven by their affordability and suitability for small-scale applications. Rural areas in countries like Indonesia and the Philippines continue to rely heavily on manual ignition systems due to their simplicity and low cost. A key factor propelling this growth is the prevalence of traditional fishing practices. These systems require minimal technical expertise, making them ideal for operators with limited access to training or spare parts. Apart from these, the absence of electronic components reduces the risk of malfunctions, ensuring uninterrupted operations. A further factor is the affordability of manual ignition systems. This cost advantage, coupled with their rugged design, ensures sustained demand in economically disadvantaged regions.

By Distribution Channel Insights

The commercial distribution channel possessed the largest share of the Asia Pacific outboard engines market, accounting for approximately 55% of total sales, as per industry estimates. This dominance is driven by the region’s heavy reliance on maritime activities for economic sustenance. One driving factor is the extensive use of outboard engines in small-scale fisheries. The Food and Agriculture Organization reports that aquaculture production in the region is projected to grow over the next decade, necessitating advanced marine technologies. Outboard engines are indispensable for small-scale fishermen operating in shallow waters, where larger vessels cannot navigate. This dependency amplifies demand for robust and reliable propulsion systems tailored to commercial needs. Another factor is the growing importance of maritime trade. Commercial operators prioritize engines that offer fuel efficiency and durability, attributes synonymous with modern outboard engines.

The recreational distribution channel is the fastest-growing segment with a CAGR of 8%. This growth is fueled by rising disposable incomes, urbanization, and increasing interest in marine tourism. Coastal nations like Malaysia and Thailand are witnessing a surge in recreational boating activities, driven by government initiatives to promote tourism. A key factor driving this growth is the proliferation of luxury resorts and island destinations. Like, marine tourism in Southeast Asia grew notably between 2019 and 2022, fueling demand for recreational vessels equipped with outboard engines. Recreational users prioritize lightweight, high-performance models that offer superior maneuverability, making them ideal for charter boats and water sports equipment. Another factor is the growing popularity of eco-tourism. Eco-conscious tourists are increasingly seeking sustainable travel options, driving the adoption of electric outboard engines.

REGIONAL ANALYSIS

China stood as the largest contributor to the Asia Pacific outboard engines market by accounting for 25.9% of regional sales. The country’s vast coastline and extensive inland waterways make it a hub for marine activities, ranging from commercial fishing to recreational boating. A main driver of China’s dominance is its robust manufacturing base, which supplies affordable and reliable outboard engines to domestic and international markets. In addition, government initiatives to modernize the fishing industry have spurred demand for advanced propulsion systems.

Japan continues to be a key player in the regional market. The country’s advanced technological infrastructure and stringent environmental regulations have positioned it as a leader in eco-friendly marine solutions. A major factor driving Japan’s prominence is its focus on innovation, with companies like Yamaha and Honda pioneering electric and hybrid propulsion systems.

India is a lucrative market that is driven by its extensive coastline and reliance on fisheries for livelihoods. Affordable pricing and easy maintenance make gasoline-powered engines particularly popular in rural areas. Also, government schemes aimed at modernizing the fishing sector have accelerated market growth.

Australia accounts for considerable portion of the regional market, with recreational boating being a key driver. The country’s affluent population and love for marine tourism have fueled demand for high-performance engines. Furthermore, strict emission standards have encouraged the adoption of 4-stroke and electric engines.

Indonesia holds a smaller market share of approximately 12%, driven by its archipelagic geography and dependence on maritime trade. In addition, government initiatives to improve port infrastructure have boosted demand for reliable marine propulsion systems.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Yamaha Motor Co., Ltd., Honda Motor Co., Ltd., Suzuki Motor Corporation, and Brunswick Corporation are some of the key market players in the Asia Pacific outboard engines market.

The Asia Pacific outboard engines market is characterized by intense competition, driven by the presence of established global brands and emerging regional players. Companies are vying for market leadership by leveraging their technological expertise, extensive distribution networks, and customer-centric strategies. The competitive landscape is shaped by rapid advancements in marine propulsion technologies, increasing demand for fuel-efficient and eco-friendly engines, and stringent regulatory frameworks. To maintain their edge, key players are continuously innovating and expanding their product portfolios to cater to diverse applications across recreational boating, commercial fishing, and tourism sectors. Additionally, the growing emphasis on sustainability and digital transformation has prompted companies to adopt smart features and green technologies.

Top Players in the Asia Pacific Outboard Engines Market

Yamaha Motor Co., Ltd.

Yamaha Motor Co., Ltd. is a dominant player in the Asia Pacific outboard engines market, renowned for its innovative and reliable marine propulsion systems. The company’s product portfolio spans a wide range of engine capacities, catering to both recreational boating and commercial fishing industries. Yamaha’s commitment to quality and performance has made it a trusted brand globally, with its engines being widely adopted in regions with extensive coastlines and waterways. By focusing on eco-friendly technologies, Yamaha has introduced fuel-efficient and low-emission engines that align with global environmental standards. Its strong distribution network and after-sales service further enhance its market presence.

Mercury Marine

Mercury Marine is a key contributor to the Asia Pacific outboard engines market, offering advanced propulsion systems that combine power, efficiency, and durability. The company’s cutting-edge technologies, such as digital controls and lightweight designs, have set new benchmarks in the industry. Mercury Marine’s focus on sustainability is evident in its development of cleaner and quieter engines, which appeal to environmentally conscious consumers. With a strong emphasis on research and development, the company consistently introduces products tailored to meet the diverse needs of recreational and commercial users. Its strategic partnerships with boat manufacturers and dealerships have strengthened its global footprint.

Suzuki Marine (Suzuki Motor Corporation)

Suzuki Marine, a division of Suzuki Motor Corporation, is a prominent player in the Asia Pacific outboard engines market, known for its high-performance and fuel-efficient engines. The company’s products are designed to cater to a wide range of applications, from small fishing boats to large commercial vessels. Suzuki Marine’s commitment to quality and affordability has positioned it as a leading brand in emerging markets across the region. By focusing on technological advancements, such as lean-burn systems and noise reduction features, Suzuki has enhanced the user experience while promoting environmental sustainability. Its robust distribution network and localized manufacturing capabilities ensure timely delivery and superior customer support.

Top Strategies Used by Key Market Participants

1. Product Innovation and Customization

Key players in the Asia Pacific outboard engines market are heavily investing in product innovation and customization to meet the evolving demands of consumers. By introducing advanced features such as digital controls, fuel injection systems, and compact designs, companies aim to enhance performance and user convenience. Customization options allow manufacturers to cater to specific regional requirements, such as engines optimized for shallow waters or harsh marine environments. This focus on innovation not only strengthens brand loyalty but also differentiates products in a competitive market. Besides, the integration of eco-friendly technologies, such as low-emission engines, aligns with global sustainability goals, appealing to environmentally conscious customers.

2. Strategic Partnerships and Collaborations

Strategic partnerships and collaborations are pivotal strategies used by market players to expand their reach and enhance their offerings. Companies are teaming up with boat manufacturers, distributors, and local governments to strengthen supply chains and improve market penetration. These alliances enable players to leverage complementary strengths, access new customer bases, and address logistical challenges. For instance, collaborations with regional fishing communities help companies develop engines tailored to commercial fishing needs.

3. Expansion of Manufacturing and Distribution Networks

Expanding manufacturing and distribution networks is another key strategy adopted by leading players to strengthen their market position. By establishing production facilities in strategic locations across the region, companies can reduce costs, improve supply chain efficiency, and better serve local markets. Localized manufacturing also allows for greater customization and quicker response to customer needs, enhancing brand loyalty. Additionally, expanding distribution networks ensures wider availability of products, particularly in remote and underserved areas.

REGIONAL ANALYSIS

- In January 2023, Yamaha Motor Co., Ltd. launched a new line of lightweight outboard engines designed for small recreational boats. This move aimed to cater to the growing demand for portable and user-friendly marine propulsion systems in Southeast Asia.

- In May 2023, Mercury Marine announced a partnership with a leading boat manufacturer in Australia to develop integrated propulsion systems for luxury yachts. This collaboration focused on enhancing performance and reducing environmental impact through advanced engineering solutions.

- In August 2023, Suzuki Marine expanded its manufacturing facility in Thailand to meet the rising demand for commercial-grade outboard engines in the fishing industry. This expansion underscored the company’s commitment to supporting regional economic activities.

- In November 2023, Honda Marine acquired a mid-sized distributor in Indonesia to strengthen its distribution network across the Asia Pacific region. This acquisition enabled Honda to improve market access and enhance customer service in emerging markets.

- In March 2024, Tohatsu Corporation introduced a modular outboard engine system tailored for small-scale fishing operations in Vietnam. This initiative addressed the growing need for affordable and efficient marine propulsion solutions, bolstering the company’s market share in rural coastal areas.

MARKET SEGMENTATION

This research report on the Asia Pacific outboard engines market is segmented and sub-segmented into the following categories.

By Engine Type

- 4-Stroke Engines

- 2-Stroke Engines

- Electric Engines

By Fuel Type

- Gasoline Engines

- Diesel Engines

- Electric Engines

By Ignition Type

- Electric Ignition

- Manual Ignition

By Distribution Channel

- Commercial Channel

- Recreational Channel

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What factors are driving the growth of the Asia Pacific Outboard Engines Market?

Key growth drivers include rising marine tourism, increasing fishing activities, growing demand for recreational boating, and advancements in engine technologies such as fuel efficiency and lower emissions.

What trends are shaping the Asia Pacific Outboard Engines Market?

Trends include the growing adoption of electric and hybrid outboard engines, digital integration in control systems, and lightweight engine designs for fuel economy.

What is the outlook for the Asia Pacific Outboard Engines Market?

The market is expected to grow steadily due to increased marine activity, government investment in marine infrastructure, and innovations in engine performance and sustainability.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com