Asia Pacific Marine Diesel Engine Market Size, Share, Trends & Growth Forecast Report By Technology (Low Speed, Medium Speed, High Speed), Application (Merchant – Container Vessels, Tankers, Bulk Carriers, Gas Carriers, RO-RO; Offshore – Drilling Rigs & Ships, Anchor Handling Vessels, Offshore Support Vessels, Floating Production Units, Platform Supply Vessels; Cruise & Ferry – Cruise Vessels, Passenger Vessels, Passenger/Cargo Vessels; Navy), Power (1,000 HP, 1,000–5,000 HP, 5,001–10,000 HP, 10,001–20,000 HP, >20,000 HP), and Country (India, China, Japan, South Korea, Australia, New Zealand, Rest of Asia Pacific) – Industry Analysis From 2025 to 2033.

Asia Pacific Marine Diesel Engine Market Size

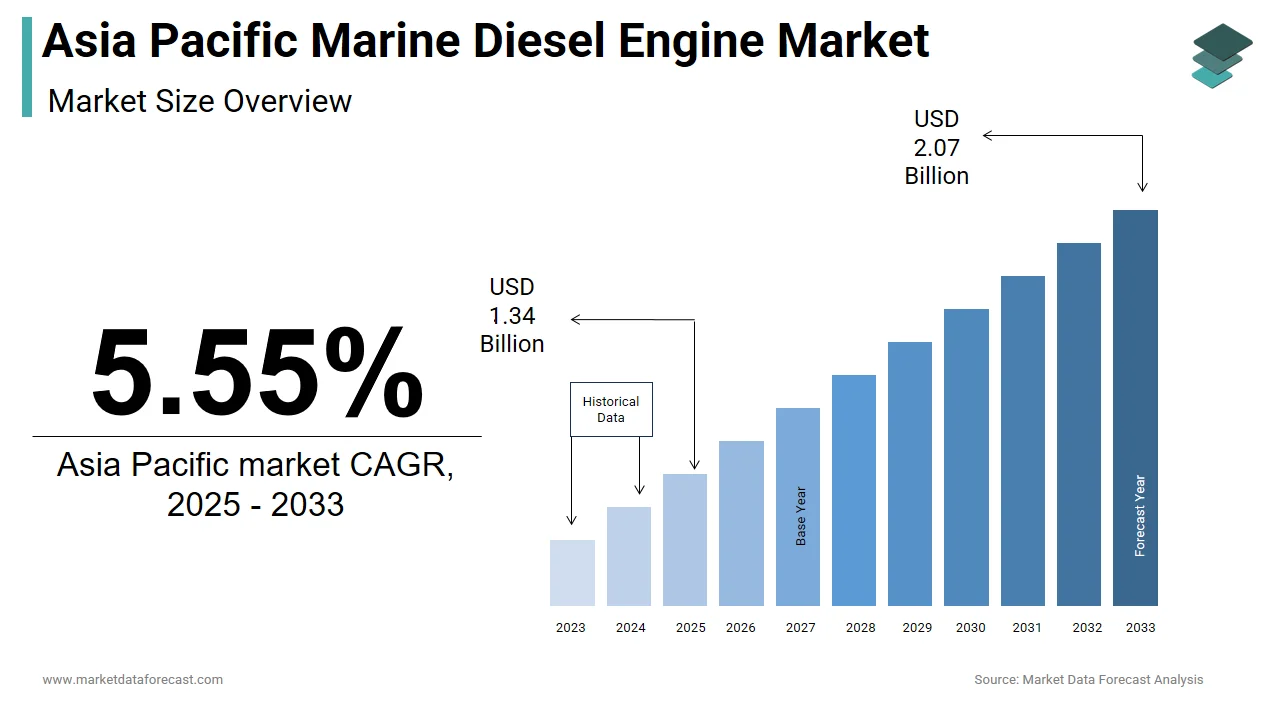

The size of the Asia Pacific marine diesel engine market was worth USD 1.27 billion in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 5.55% from 2025 to 2033 and be worth USD 2.07 billion by 2033 from USD 1.34 billion in 2025.

MARKET DRIVERS

Surge in Regional Maritime Trade Volumes

The exponential growth in maritime trade volumes across the Asia Pacific serves as a primary driver for the marine diesel engine market. The region is home to some of the busiest shipping lanes globally, including the Strait of Malacca and the South China Sea, which facilitate the movement of goods worth trillions of dollars annually. Marine diesel engines, known for their durability and fuel efficiency, remain the preferred choice for powering large vessels that traverse these routes. Also, the expansion of intra-regional trade agreements, such as the Regional Comprehensive Economic Partnership (RCEP), has further stimulated cargo movements. The RCEP, which includes 15 countries in the Asia Pacific. This surge directly translates into higher investments in new vessel construction and retrofitting existing fleets with advanced marine diesel engines, thereby propelling market growth.

Rising Investment in Green Technologies

Environmental regulations are reshaping the marine diesel engine landscape, with stricter emission norms acting as a catalyst for innovation. The International Maritime Organization’s sulfur cap regulation, which mandates a reduction in sulfur content in marine fuels to 0.5%, has spurred the adoption of cleaner marine diesel engines. This transition is being supported by substantial government funding. Moreover, China’s push for green shipping corridors has resulted in partnerships between shipbuilders and engine manufacturers to develop hybrid propulsion systems.

MARKET RESTRAINTS

High Initial Costs of Advanced Engines

One of the most significant restraints hindering the growth of the Asia Pacific marine diesel engine market is the high initial cost associated with advanced propulsion systems. Modern marine diesel engines equipped with emission-reducing technologies, such as selective catalytic reduction (SCR) systems or exhaust gas recirculation (EGR), often come with a price tag that is 20-30% higher than conventional models. For small-scale operators and emerging economies within the region, such as Vietnam and Indonesia, these costs can be prohibitive. This financial barrier is particularly pronounced in the fishing and coastal shipping sectors, where profit margins are already thin. In addition, retrofitting older vessels with newer engines to comply with environmental regulations can cost upwards significantly per ship, making it an unviable option for many fleet owners.

Stringent Environmental Regulations

While environmental regulations aim to curb pollution, they also pose significant challenges for the marine diesel engine market. The International Maritime Organization’s Energy Efficiency Existing Ship Index (EEXI) requires vessels to meet specific carbon intensity benchmarks, forcing shipowners to either upgrade their engines or face penalties. Compliance often necessitates extensive modifications, which not only increase operational costs but also disrupt shipping schedules. Furthermore, the lack of harmonization in regulations across different countries in the region adds complexity. For example, while Australia enforces strict ballast water management protocols, neighboring nations may adopt less stringent measures, creating inconsistencies.

MARKET OPPORTUNITIES

Expansion of LNG-Powered Marine Engines

The shift toward liquefied natural gas (LNG) as a marine fuel presents a lucrative opportunity for the Asia Pacific marine diesel engine market. LNG-powered engines offer a cleaner alternative to traditional heavy fuel oil, reducing carbon dioxide emissions and sulfur oxides by nearly 100%. This aligns with the region’s growing emphasis on decarbonizing maritime operations. In addition, the development of LNG bunkering infrastructure in hubs such as Singapore and Japan is accelerating adoption.

Growth of Domestic Shipbuilding Industries

The burgeoning domestic shipbuilding industries in the Asia Pacific provide another significant opportunity for the marine diesel engine market. China, South Korea, and Japan collectively account for significant portion of global shipbuilding orders. This dominance ensures a steady pipeline of new vessel construction projects, each requiring advanced marine diesel engines. Furthermore, governments in the region are investing heavily in local shipyards to boost self-reliance. These developments not only enhance regional manufacturing capabilities but also drive demand for cutting-edge marine diesel engines tailored to diverse vessel types.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions have emerged as a critical challenge for the Asia Pacific marine diesel engine market, exacerbated by geopolitical tensions and the lingering effects of the pandemic. Key components required for manufacturing marine diesel engines, such as turbochargers and fuel injection systems, often rely on imports from Europe and North America. Like, a notable increase in lead times for critical engine parts was observed in recent years, impacting production schedules across the region. In addition, port congestion and container shortages have further compounded delays, with the average waiting time at major ports like Shanghai and Singapore increasing. These bottlenecks not only inflate costs but also hinder timely delivery of engines to shipyards, affecting both new builds and retrofitting projects.

Skilled Workforce Shortages

Another significant challenge facing the market is the shortage of skilled labor needed to operate and maintain advanced marine diesel engines. The complexity of modern engines, particularly those incorporating hybrid technologies or emission control systems, demands specialized expertise. This shortage is particularly acute in developing nations like Indonesia and the Philippines, where educational infrastructure lags behind industry needs. Furthermore, the aging workforce in countries like Japan poses additional risks.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Technology, Application, Power, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

AB Volvo, Anglo Belgian, Caterpillar, Cummins, Daihatsu Diesel, Deere & Company, DEUTZ, Hyundai, IHI Corporation, Kawasaki Heavy Industries, MAN Energy Solutions, Rolls-Royce, Scania, Siemens, STX Heavy Industries, Wartsila, Yanmar, Yuchai International, and others. |

SEGMENTAL ANALYSIS

By Technology Insights

The low-speed marine diesel engines segment dominated the Asia Pacific market by commanding a 45.8% of the total market share in 2024. These engines are primarily used in large container ships, bulk carriers, and oil tankers, which form the backbone of international trade in the region. One of the key drivers of this segment’s dominance is its unparalleled fuel efficiency. Another significant factor is the growing demand for ultra-large container vessels (ULCVs), which rely exclusively on low-speed engines. These vessels require engines capable of delivering consistent power output while minimizing emissions, a criterion that low-speed engines fulfill effectively. Furthermore, advancements in engine design, such as the integration of exhaust gas cleaning systems, have enhanced their appeal.

High-speed marine diesel engines is projected to grow at a CAGR of 8.2% through 2033. This rapid expansion is fueled by the increasing adoption of smaller vessels, such as patrol boats, ferries, and offshore support vessels. A key driver is the rise in coastal and inland waterway transportation. High-speed engines are ideal for these applications due to their compact size and ability to deliver quick acceleration. Another contributing factor is the defense sector's modernization efforts. These vessels rely on high-speed engines to achieve superior maneuverability and performance. Also, technological innovations, such as lightweight materials and improved thermal efficiency, are enhancing the appeal of high-speed engines.

By Application Insights

The merchant ships segment constituted the largest application in the Asia Pacific marine diesel engine market by accounting for a 55% of the total market share in 2024. This dominance is driven by the region's central role in global trade, with ports in the Asia Pacific handling a large share of the world’s container throughput. Merchant vessels, including bulk carriers, tankers, and container ships, rely heavily on marine diesel engines for propulsion, making them a cornerstone of the market. One of the primary factors propelling this segment is the surge in e-commerce activity. This has led to increased investments in new merchant vessels, many of which are equipped with advanced marine diesel engines. Another critical factor is the push for sustainability. Merchant ship operators are increasingly adopting low-emission marine diesel engines to comply with the International Maritime Organization’s sulfur cap regulations.

The offshore segment is the fastest-growing application in the Asia Pacific marine diesel engine market, with a CAGR of 7.8% through 2033. This progress is caused by the region's expanding offshore oil and gas exploration activities. Offshore support vessels, such as platform supply vessels and anchor handlers, rely on marine diesel engines for reliable performance in challenging environments. Another driving factor is the emergence of offshore renewable energy projects. These projects require specialized vessels equipped with medium- and high-speed marine diesel engines to transport equipment and personnel. Furthermore, advancements in engine technology, such as hybrid propulsion systems, are enhancing operational efficiency.

By Power Insights

The engines with power outputs exceeding 20,000 HP held the largest market share i.e. 40%, in the Asia Pacific marine diesel engine market. These engines are predominantly used in large vessels, such as oil tankers, bulk carriers, and container ships, which dominate the region’s maritime trade. One of the key drivers of this segment’s leadership is the increasing demand for ultra-large container vessels (ULCVs). These vessels require high-power engines to maintain speed and efficiency over long distances. Another factor is the focus on fuel optimization. This is particularly critical for operators navigating volatile fuel markets. In addition, advancements in emission-reducing technologies, such as selective catalytic reduction (SCR) systems, have made high-power engines more environmentally friendly.

Engines in the 1,000 - 5,000 HP range are the fastest-growing segment, with a CAGR of 9.1%. This growth is driven by the rising demand for mid-sized vessels, such as tugboats, fishing trawlers, and small cargo ships. These vessels require engines in this power range for optimal performance and fuel economy. Another significant factor is the expansion of regional ferry services. These vessels rely on medium-power engines to balance speed and operational costs. Moreover, government initiatives to modernize aging fleets are accelerating adoption.

COUNTRY LEVEL ANALYSIS

China stood at the forefront of the Asia Pacific marine diesel engine market by holding a 30.4% of the regional share. The country’s dominance stems from its status as the world’s largest shipbuilder. One key driver is the government’s strategic investments in maritime infrastructure. The Belt and Road Initiative, for instance, has spurred the construction of new ports and shipping routes, creating a steady demand for marine diesel engines. Another factor is the emphasis on technological innovation. Chinese manufacturers, such as Weichai Power, have developed next-generation engines with enhanced fuel efficiency and reduced emissions. Furthermore, the country’s robust domestic demand, driven by its export-oriented economy, ensures sustained growth in the marine diesel engine market.

Japan ranks second in the Asia Pacific market. The country’s prominence is attributed to its cutting-edge shipbuilding technologies and focus on sustainability. A key growth driver is Japan’s leadership in LNG-powered vessels.

South Korea ’s success is driven by its specialization in constructing high-value vessels, such as LNG carriers and ultra-large container ships. Another factor is the government’s support for green shipping initiatives. This initiative has accelerated the adoption of advanced marine diesel engines, particularly those incorporating dual-fuel capabilities. Furthermore, the country’s strategic location along major trade routes ensures steady demand for marine propulsion systems.

India is growing quickly. The country’s growth is fueled by its expanding shipbuilding industry and increasing reliance on maritime trade. Another key driver is the defense sector’s modernization. These vessels require advanced marine diesel engines, creating lucrative opportunities for domestic and international manufacturers. Additionally, the government’s push for indigenous manufacturing under the "Make in India" initiative is fostering innovation in engine design.

Australia holds a smaller share of the Asia Pacific market. The country’s market position is bolstered by its focus on offshore energy projects and sustainable shipping practices. Another factor is the adoption of renewable energy technologies. These projects require vessels equipped with high-efficiency engines, creating a niche market for advanced marine diesel engines. Furthermore, Australia’s stringent environmental regulations are encouraging the adoption of cleaner propulsion systems, aligning with global sustainability trends.

KEY MARKET PLAYERS

Some of the noteworthy companies in the Asia Pacific marine diesel engine market profiled in this report are AB Volvo, Anglo Belgian, Caterpillar, Cummins, Daihatsu Diesel, Deere & Company, DEUTZ, Hyundai, IHI Corporation, Kawasaki Heavy Industries, MAN Energy Solutions, Rolls-Royce, Scania, Siemens, STX Heavy Industries, Wartsila, Yanmar, Yuchai International, and others.

TOP LEADING PLAYERS IN THE MARKET

MAN Energy Solutions

MAN Energy Solutions is a global leader in marine propulsion systems, renowned for its innovative low-speed and medium-speed diesel engines. The company has played a pivotal role in shaping the Asia Pacific market by introducing cutting-edge technologies like dual-fuel engines and emission-reducing solutions. Its commitment to sustainability aligns with regional environmental regulations, making it a preferred partner for shipbuilders and operators. MAN's extensive service network across the region ensures reliable after-sales support, further solidifying its dominance.

Wärtsilä Corporation

Wärtsilä Corporation is a key player known for its versatile marine diesel engines that cater to diverse applications, from merchant ships to offshore vessels. The company’s focus on hybrid propulsion systems and smart maritime solutions has positioned it as a pioneer in the Asia Pacific market. Wärtsilä’s emphasis on digitalization and lifecycle services enables fleet operators to optimize performance and reduce operational costs.

Caterpillar Inc.

Caterpillar Inc. is a major contributor to the marine diesel engine market, offering high-speed engines tailored for smaller vessels and offshore applications. The company’s robust product portfolio and commitment to fuel efficiency have made it a trusted name in the Asia Pacific region. Caterpillar’s dedication to customer-centric solutions, including customized engine designs and comprehensive maintenance packages, enhances its competitive edge.

TOP STRATEGIES USED BY KEY PLAYERS IN THE MARKET

Innovation-Driven Product Development

Key players in the Asia Pacific marine diesel engine market are heavily investing in research and development to introduce eco-friendly and technologically advanced engines. By focusing on hybrid propulsion systems, dual-fuel capabilities, and emission-reducing technologies, these companies are addressing stringent environmental regulations and evolving customer preferences.

Strategic Collaborations and Partnerships

To expand their footprint in the Asia Pacific, leading manufacturers are forming alliances with regional shipyards, technology providers, and governments. These collaborations facilitate knowledge exchange, enhance production capabilities, and ensure compliance with local standards. For instance, partnerships with domestic players enable international firms to gain insights into regional demands while fostering innovation through shared expertise, creating a win-win scenario for all stakeholders involved.

Comprehensive After-Sales Services

Providing end-to-end lifecycle support has emerged as a critical strategy for strengthening market presence. Companies are investing in training programs, spare parts distribution networks, and predictive maintenance solutions to ensure seamless operations for their customers.

COMPETITION OVERVIEW

The Asia Pacific marine diesel engine market is characterized by intense competition, driven by the region’s status as a global maritime hub. Key players, including multinational giants and regional manufacturers, vie for dominance by leveraging their technological prowess, extensive service networks, and adaptability to local needs. Multinational corporations often emphasize innovation, introducing advanced engines that comply with environmental regulations, while local players focus on cost-effective solutions tailored to regional requirements. The market’s competitive landscape is further shaped by collaborations between international firms and domestic shipyards, enabling knowledge transfer and capacity building. Additionally, the rise of green shipping initiatives has intensified rivalry, as companies strive to offer sustainable propulsion systems. With increasing demand for efficient and eco-friendly engines, participants are adopting strategies such as product diversification, strategic partnerships, and enhanced after-sales services to strengthen their foothold.

RECENT MARKET DEVELOPMENTS

- In January 2024, MAN Energy Solutions launched a new dual-fuel marine engine series designed to meet the International Maritime Organization’s sulfur cap regulations. This move aimed to address the growing demand for cleaner propulsion systems in the Asia Pacific region.

- In March 2024, Wärtsilä Corporation partnered with a leading South Korean shipyard to co-develop hybrid propulsion systems for offshore vessels. This collaboration was intended to enhance the adoption of sustainable technologies in the regional market.

- In May 2024, Caterpillar Inc. expanded its service network in Southeast Asia by establishing three new training centers for marine engine maintenance. This initiative sought to improve customer satisfaction and strengthen its regional presence.

- In July 2024, Hyundai Heavy Industries acquired a minority stake in a Chinese marine engine manufacturer to bolster its supply chain capabilities in the Asia Pacific. This acquisition aimed to streamline production and reduce lead times for engine deliveries.

- In September 2024, Mitsubishi Heavy Industries introduced a next-generation medium-speed engine equipped with advanced emission control systems. This launch targeted fleet operators seeking compliance with regional environmental standards while optimizing fuel efficiency.

MARKET SEGMENTATION

This Asia Pacific marine diesel engine market research report is segmented and sub-segmented into the following categories.

By Technology

- Low Speed

- Medium Speed

- High Speed

By Application

- Merchant

- Container Vessels

- Tankers

- Bulk Carriers

- Gas Carriers

- RO-RO

- Others

- Offshore

- Drilling RIGS & Ships

- Anchor Handling Vessels

- Offshore Support Vessels

- Floating Production Units

- Platform Supply Vessels

- Cruise & Ferry

- Cruise Vessels

- Passenger Vessels

- Passenger/Cargo Vessels

- Others

- Navy

- Others

By Power

- 1,000 HP

- 1,000 - 5,000 HP

- 5,001 - 10,000 HP

- 10,001 - 20,000 HP

- > 20,000 HP

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of Asia Pacific

Frequently Asked Questions

1. What drives growth in the Asia Pacific marine diesel engine market?

Growth in the Asia Pacific marine diesel engine market is driven by surging maritime trade, shipbuilding expansion, and stricter emission regulations pushing demand for efficient, low-emission engines

2. What challenges affect the Asia Pacific marine diesel engine market?

The Asia Pacific marine diesel engine market faces high costs for advanced engines, complex regulatory compliance, supply chain disruptions, and a shortage of skilled labor for maintenance

3. What opportunities exist in the Asia Pacific marine diesel engine market?

Opportunities in the Asia Pacific marine diesel engine market include LNG and hybrid engine adoption, domestic shipbuilding investments, and retrofitting older vessels for greener operations

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com