Asia Pacific Pet Care Market Research Report – Segmented By Pet Type (Dog, Cat, Fish, Bird), Type, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific Pet Care Market Size

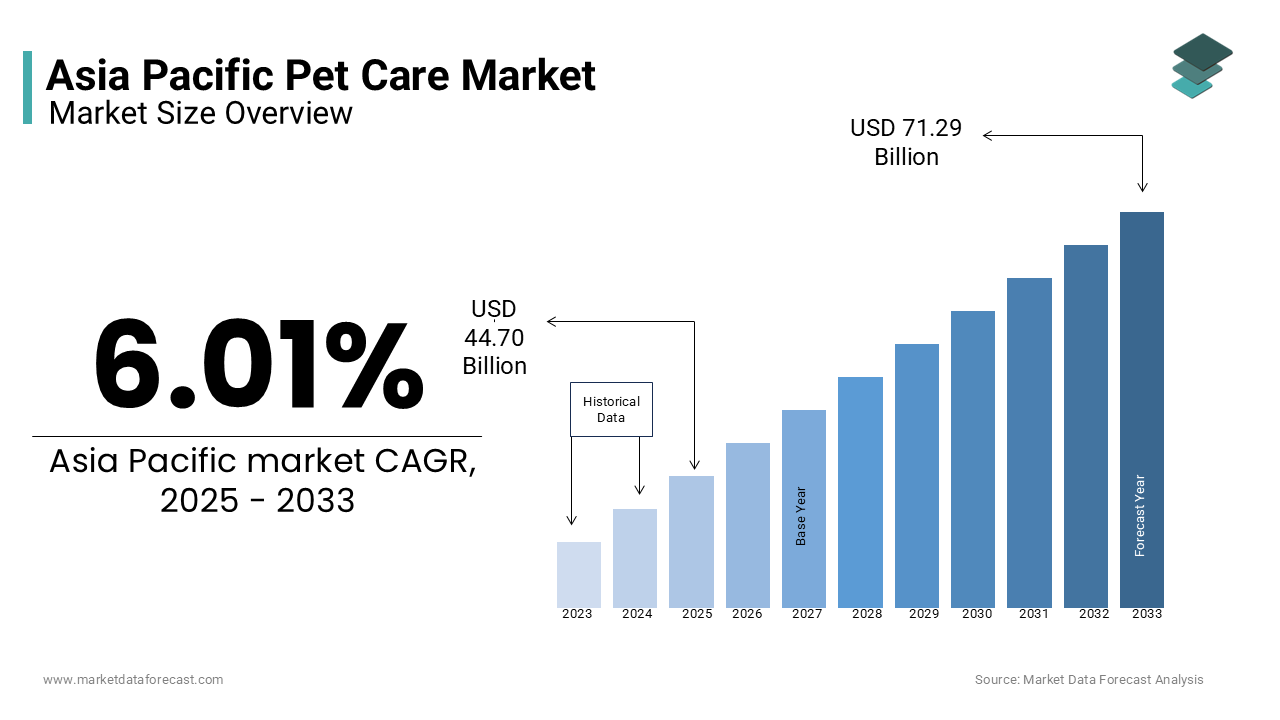

The Asia Pacific pet care market was worth USD 42.16 billion in 2024. The Asia Pacific market is expected to reach USD 71.29 billion by 2033 from USD 44.70 billion in 2025, rising at a CAGR of 6.01% from 2025 to 2033.

The Asia Pacific pet care market growth is driven by evolving consumer attitudes toward pet ownership and increasing urbanization. This expansion is fueled by rising disposable incomes and a growing preference for premium pet products in countries like China, Japan, and Australia. Urban centers such as Tokyo, Sydney, and Shanghai have seen a surge in pet humanization trends, where pets are treated as family members by driving demand for high-quality food, grooming services, and healthcare. Additionally, the proliferation of e-commerce platforms has streamlined access to pet care products, with online sales accounting for nearly 40% of total transactions in 2022.

MARKET DRIVERS

Rising Urbanization and Pet Humanization Trends

Urbanization has emerged as a significant driver of the Asia Pacific pet care market, with over 50% of the region’s population residing in cities as per the United Nations. This demographic shift has led to smaller living spaces and delayed marriages by prompting individuals to seek companionship through pet ownership. Additionally, the rise of nuclear families and single-person households has amplified the need for emotional support animals is propelling the growth of the market.

Increasing Awareness of Pet Health and Wellness

Growing awareness of pet health and wellness is another key driver of the Asia Pacific pet care market. In countries like South Korea and Australia, pet owners are increasingly investing in routine check-ups, vaccinations, and specialized diets to ensure their pets’ well-being. According to a study by Alltech, over 70% of pet owners in the region prioritize nutritional value when purchasing pet food, with grain-free and hypoallergenic options gaining traction. Furthermore, the integration of telemedicine platforms has revolutionized pet healthcare by enabling remote consultations and reducing costs. For example, Singapore-based Pawssion reported a 35% increase in telehealth users in 2022 with the demand for accessible veterinary services.

MARKET RESTRAINTS

Cultural Resistance to Commercial Pet Care

Cultural resistance to commercial pet care remains a significant restraint in certain parts of the Asia Pacific region. According to Ipsos, over 40% of rural populations in Southeast Asia still rely on traditional methods for pet care, such as homemade food and herbal remedies, viewing commercial products as unnecessary or expensive. This mindset is deeply rooted in cultural practices in agrarian communities where pets are primarily seen as working animals rather than companions. For instance, in Indonesia and Vietnam, less than 20% of pet owners purchase branded pet food, as per a study by Kantar. Additionally, religious beliefs in predominantly Buddhist and Muslim nations often discourage excessive spending on pets, which limits market penetration. These attitudes not only hinder the adoption of premium products but also necessitate extensive awareness campaigns to shift perceptions.

Affordability Concerns Among Low-Income Groups

Affordability concerns present another major restraint among low-income populations in emerging markets. Pet owners in these regions prioritize basic necessities over premium pet products by opting for cheaper alternatives or homemade solutions. Moreover, the high cost of veterinary services and pet insurance exacerbates the issue, with many unable to afford regular healthcare. For example, in rural India, only 15% of pet owners seek professional medical treatment, as reported by the Federation of Indian Animal Protection Organizations. These financial constraints not only restrict market growth but also necessitate the development of affordable product lines by posing a challenge for companies aiming to balance profitability with accessibility.

MARKET OPPORTUNITIES

Expansion into Rural and Tier-2 Markets

Emerging rural and tier-2 markets present a significant opportunity for the Asia Pacific pet care market. The rise of affordable pet food brands and mobile veterinary clinics has begun to bridge this gap by enabling wider access to essential services. Additionally, government initiatives promoting livestock health have indirectly benefited pet care by creating awareness about animal welfare. The veterinary outreach programs in Southeast Asia have improved pet healthcare standards by fostering trust among rural populations.

Integration of Technology and Innovation

The integration of technology and innovation offers transformative opportunities for the Asia Pacific pet care market. For example, Xiaomi’s smart pet feeder gained significant traction in China, with over 1 million units sold in 2022. Additionally, AI-driven apps providing personalized pet care advice have attracted tech-savvy millennials, which is enhancing user engagement. Another factor is the rise of subscription-based models, which offer convenience and recurring revenue streams. These innovations not only cater to evolving consumer preferences but also position companies as pioneers in the digital transformation of pet care.

MARKET CHALLENGES

Fragmented Regulatory Frameworks

Fragmented regulatory frameworks pose a significant challenge to the Asia Pacific pet care market, creating operational inefficiencies for multinational companies. Each country imposes unique labeling, safety, and import requirements, which complicate compliance efforts. For instance, while Japan mandates stringent quality certifications for pet food, countries like Thailand have minimal regulations that is leading to inconsistencies in product standards. Such complexities necessitate significant investments in regulatory expertise by straining resources for smaller players and limiting market entry for new entrants.

Limited Access to Veterinary Infrastructure

Limited access to veterinary infrastructure remains a critical challenge in rural and underdeveloped regions. According to the World Organisation for Animal Health, over 50% of Asia Pacific countries lack adequate veterinary facilities are resulting in untreated illnesses and higher mortality rates among pets. Additionally, the shortage of trained veterinarians exacerbates the issue, with the region having an average of 1 veterinarian per 50,000 pets, far below global standards. Addressing these infrastructural gaps requires substantial investments in training and facilities by posing a daunting task for both governments and private players.

SEGMENTAL ANALYSIS

By Pet Type Insights

The dogs segment dominated the Asia Pacific pet care market with 45.3% of the share in 2024. This segment's prominence is driven by the widespread perception of dogs as loyal companions and protectors, particularly in urban areas. A key factor fueling this dominance is the growing trend of pet humanization, where dogs are treated as family members.

The fish segment is likely to experience a CAGR of 18.5% from 2025 to 2033. This rapid expansion is fueled by the increasing popularity of ornamental fish as low-maintenance pets among urban dwellers.

Another driving factor is the rise of aquascaping with a hobby involving the artistic arrangement of aquatic plants and fish tanks. Additionally, advancements in aquarium technology, such as automated filtration systems, have enhanced convenience by attracting tech-savvy consumers.

By Type Insights

The pet food segment dominated the Asia Pacific pet care market by capturing a significant share in 2024. This segment's prominence is driven by rising awareness of pet nutrition and wellness among urban populations. A key factor is the integration of e-commerce platforms, which have streamlined access to premium pet food brands. Additionally, government campaigns promoting animal welfare have indirectly boosted demand for commercial pet food. For instance, Japan’s Ministry of Agriculture reported a 30% increase in pet food adoption rates following educational outreach programs.

The pet products segment is anticipated to hit the highest CAGR of 16.8% from 2025 to 2033. The growth of the segment can be driven by the increasing demand for premium and innovative products among millennials. Another factor is the rise of smart pet care devices, such as automated feeders and GPS trackers. Additionally, subscription-based models offering curated product bundles have gained traction by enhancing user convenience.

REGIONAL ANALYSIS

China was the top performer in the Asia Pacific pet care market, accounting for over 30% of regional revenue as per a report by Euromonitor in 2023. The country’s dominance is driven by its large urban population and rising disposable incomes by enable greater spending on premium pet products. A key factor is the growing trend of pet humanization among millennials. Over 70% of urban households in China view pets as family members by driving demand for imported organic pet food and grooming services. Additionally, the proliferation of e-commerce platforms like Alibaba has streamlined access to pet care products, with online sales accounting for nearly 50% of total transactions.

Japan was positioned second in holding the dominant share of the Asia Pacific pet care market in 2024 owing to its advanced pet care infrastructure and high adoption of premium products. Another factor is the integration of telemedicine platforms, which have revolutionized pet healthcare. As per Deloitte, over 40% of Japanese pet owners use online veterinary services, by reduces costs and improves accessibility. Additionally, government initiatives promoting animal welfare have fostered trust in commercial pet care products.

Australia pet care market growth is driven by its high pet ownership rates and robust regulatory framework. A key factor is the emphasis on pet health and wellness, with premium food and supplements gaining popularity. Another factor is the rise of eco-friendly pet products by aligning with the country’s sustainability goals. Additionally, partnerships with global brands like Mars Petcare have expanded accessibility by enabling seamless cross-border transactions. These developments ensure Australia remains a hub for cutting-edge pet care solutions.

India is an emerging powerhouse in the Asia Pacific pet care market, driven by its young, tech-savvy population and increasing urbanization. A key factor is the rise of affordable pet food brands, which cater to price-sensitive consumers. Another factor is the proliferation of mobile veterinary clinics, which have improved access to healthcare in rural areas. Additionally, collaborations with e-commerce platforms like Flipkart have streamlined access to pet care products and are boosting sales. These efforts position India as a high-potential market with immense growth opportunities.

South Korea is a mature player in the Asia Pacific pet care market with its focus on innovation and premiumization. A key factor is the integration of technology, such as AI-driven pet care apps, which enhance user engagement. Another factor is the rise of pet cafes and social spaces, which have amplified awareness about pet care trends. Over 60% of urban millennials participate in pet-related activities, driving demand for innovative products. Additionally, government initiatives promoting spaying and neutering have improved pet health standards by fostering trust in commercial solutions.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Mars Incorporated, Nestlé Purina PetCare, Colgate-Palmolive (Hill’s Pet Nutrition), Unicharm Corporation, Spectrum Brands (United Pet Group), Royal Canin, WellPet LLC, Blue Buffalo Co. Ltd., The Himalaya Drug Company, and Pet Lovers Centre are some of the key marketplayers in the asia pacific pet care market.

The Asia Pacific pet care market is highly competitive and is driven by the presence of global giants like Mars Petcare and Nestlé Purina, alongside regional players catering to local needs. Global firms leverage their technological expertise and extensive portfolios to attract urban consumers, while local operators capitalize on cultural insights and affordability. This rivalry has spurred significant innovations, such as AI-driven nutrition apps and eco-friendly products. However, challenges like fragmented regulations and limited veterinary infrastructure persist, creating barriers for new entrants. Despite these hurdles, the dynamic landscape fosters continuous improvement, with companies investing heavily in partnerships, marketing, and R&D to differentiate themselves.

Top Players in the Asia Pacific Pet Care Market

Mars Petcare

Mars Petcare is a leading player in the Asia Pacific pet care market by offering a wide range of products under brands like Pedigree and Whiskas. The company has focused on expanding its footprint in emerging markets through localized product lines. In 2023, Mars launched a low-cost pet food range in India by targeting price-sensitive consumers while maintaining nutritional quality. Additionally, the company partnered with local e-commerce platforms to enhance distribution, ensuring wider accessibility. Mars Petcare’s emphasis on sustainability, such as introducing recyclable packaging, has strengthened its reputation among eco-conscious consumers.

Nestlé Purina PetCare

Nestlé Purina PetCare has established itself as a key innovator in the Asia Pacific market, leveraging its premium brands like Pro Plan and Fancy Feast. In 2023, the company introduced AI-driven pet nutrition apps in Japan and South Korea, allowing users to customize diets for their pets based on health data. Furthermore, Purina expanded its production facilities in Thailand to meet growing demand in Southeast Asia.

Royal Canin (Mars Group)

Royal Canin specializes in premium pet food tailored to specific breeds and health conditions, making it a preferred choice for veterinarians and pet owners. In 2023, the company collaborated with veterinary clinics in Australia to launch telemedicine services, improving access to pet healthcare. Additionally, Royal Canin introduced grain-free formulas in China, catering to the growing demand for hypoallergenic diets. The company also invested in educational campaigns to promote pet wellness, fostering trust among consumers. These strategies have positioned Royal Canin as a leader in specialized pet care solutions.

Top Strategies Used by Key Market Participants

Key players in the Asia Pacific pet care market employ diverse strategies to maintain their competitive edge. Localization is a major focus, with companies tailoring products to regional preferences and affordability levels. Partnerships with e-commerce platforms have streamlined distribution by enhancing accessibility for urban consumers. Additionally, investments in technology, such as AI-driven apps and smart pet devices, have improved user engagement. Companies also prioritize sustainability by adopting eco-friendly packaging and plant-based ingredients to align with consumer values.

RECENT MARKET DEVELOPMENTS

- In March 2023, Mars Petcare launched a low-cost pet food range in India, by targeting rural markets and increasing accessibility for price-sensitive consumers.

- In June 2023, Nestlé Purina introduced AI-driven pet nutrition apps in Japan by enabling personalized diet plans based on individual pet health data.

- In August 2023, Royal Canin partnered with Australian veterinary clinics to offer telemedicine services by enhancing pet healthcare accessibility in remote areas.

- In November 2023, Mars Petcare collaborated with Alibaba to expand its e-commerce presence in China, streamlining distribution and boosting sales.

- In January 2024, Nestlé Purina opened a state-of-the-art production facility in Thailand by increasing capacity to meet rising demand in Southeast Asia.

MARKET SEGMENTATION

This research report on the pet care market is segmented and sub-segmented into the following categories.

By Pet Type

- Dog

- Cat

- Fish

- Bird

By Type

- Product

- Food

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What factors are driving the growth of the pet care market in Asia Pacific?

Key drivers include rising pet adoption, growing humanization of pets, increasing disposable incomes, awareness about pet health and wellness, and the expansion of online pet product retail.

What challenges does the Asia Pacific Pet Care Market face?

Challenges include price sensitivity in emerging markets, lack of veterinary infrastructure in rural areas, and unorganized retail sectors in some countries.

What is the future outlook of the Asia Pacific Pet Care Market?

The market is expected to grow significantly, driven by increased pet ownership, urbanization, higher spending on pet well-being, and innovation in pet foods and services.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com