Asia Pacific Pet Packaging Market Research Report – Segmented By Product Type (Tablet Bottles, Syrup Bottles, Dropper Bottles, Vials Mouthwash Bottles, Handwash & Hand Sanitizer Bottles), Color, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific Pet Packaging Market Size

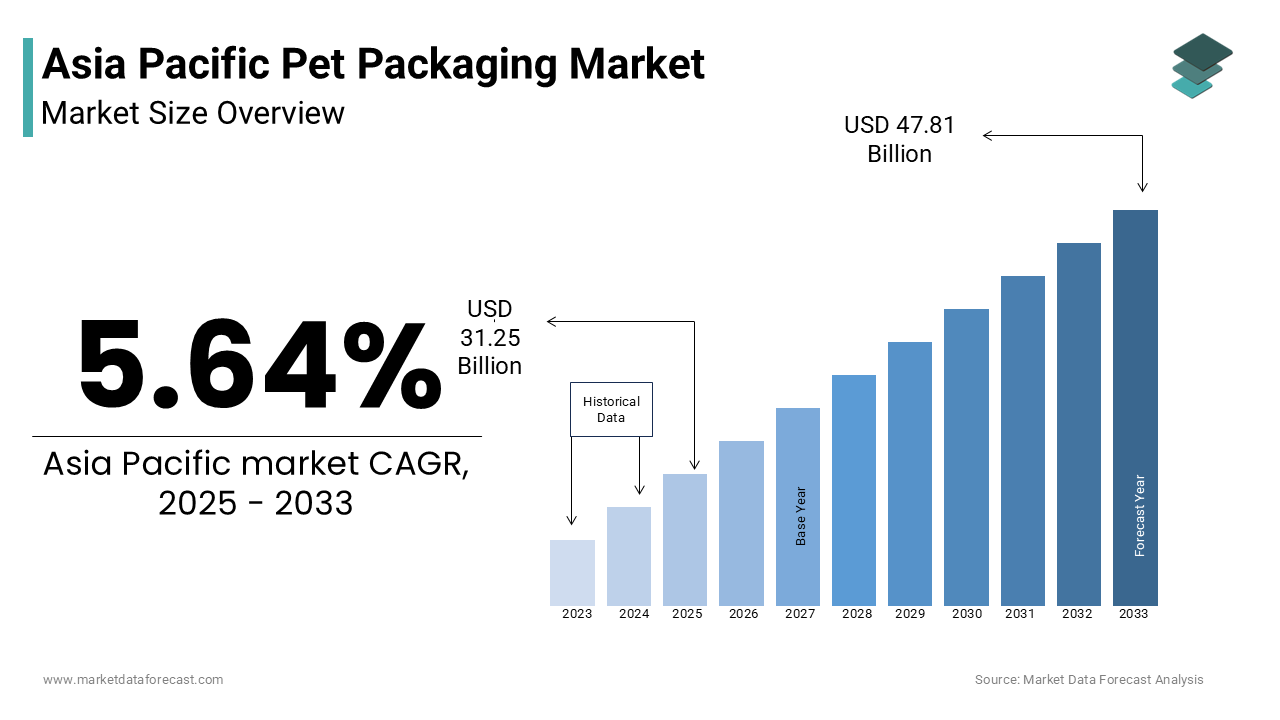

The Asia Pacific Pet Packaging Market was worth USD 29.63 billion in 2024. The Asia Pacific market is expected to reach USD 47.81 billion by 2033 from USD 31.25 billion in 2025, rising at a CAGR of 5.46 % from 2025 to 2033.

The pet packaging includes flexible and rigid packaging formats such as pouches, bags, containers, and cans that prioritize functionality, freshness preservation, convenience, and branding appeal. There is a heightened demand for premium packaging that aligns with evolving consumer expectations regarding aesthetics, sustainability, and product safety with the growing humanization of pets across urban centers in the region. According to the World Animal Protection Organization, pet ownership in Southeast Asia has increased by nearly 20% over the past five years owing to the rising disposable incomes and shifting lifestyle preferences.

MARKET DRIVERS

Rising Pet Humanization and Premiumization Trends

One of the most significant drivers of the Asia Pacific pet packaging market is the increasing trend of pet humanization, wherein pet owners treat their animals as family members and seek out premium products that reflect this emotional bond. This shift has led to greater investment in high-quality, aesthetically appealing packaging that mirrors human food presentation and branding strategies.

Additionally, the influence of social media platforms such as Instagram and Xiaohongshu (Little Red Book) has amplified visual appeal as a critical factor in product selection. As per the Korea Pet Industry Association, pet product sales on e-commerce platforms grew by 25% in 2023, largely driven by packaging that enhances shareability and perceived value. These behavioral shifts are compelling brands to invest in innovative packaging designs and sustainable materials, directly fueling market growth.

Expansion of E-Commerce and Direct-to-Consumer Pet Brands

Another key driver shaping the Asia Pacific pet packaging market is the rapid expansion of e-commerce and the rise of direct-to-consumer (DTC) pet brands. Online retail platforms have become a primary channel for pet product distribution, necessitating packaging solutions that ensure durability during transit while maintaining product integrity and brand identity.

Moreover, logistics challenges in densely populated cities like Bangkok and Mumbai have prompted the use of compact, space-efficient packaging to reduce shipping costs and carbon footprints. As per the Federation of Indian Chambers of Commerce and Industry (FICCI), e-commerce logistics providers reported a 40% increase in inquiries related to pet product packaging optimization in 2023 alone.

MARKET RESTRAINTS

Regulatory Hurdles and Compliance Costs

A major restraint affecting the Asia Pacific pet packaging market is the complex and evolving regulatory landscape governing pet food safety, labeling, and environmental compliance. Governments across the region are implementing stricter packaging standards to ensure consumer transparency and animal health protection, which increases compliance burdens for manufacturers.

For instance, in Australia, the Department of Agriculture and Fisheries has mandated detailed nutritional labeling and traceability requirements for all commercial pet food packaging, leading to higher design and printing costs. Similarly, in India, the Food Safety and Standards Authority of India (FSSAI) has introduced stringent migration limits for packaging materials used in contact with pet food, requiring extensive testing before market entry.

Furthermore, environmental regulations targeting single-use plastics are impacting traditional flexible packaging formats. As per the Ministry of Environment of Japan, new restrictions on non-recyclable films and laminates have forced many small and mid-sized pet food brands to redesign their packaging at considerable expense. These regulatory pressures, though beneficial for long-term sustainability, pose short-term financial and operational constraints that can hinder market expansion, especially for smaller players.

High Cost of Sustainable Packaging Materials

Another significant challenge restraining the Asia Pacific pet packaging market is the elevated cost associated with sustainable packaging materials. While there is a growing consumer preference for eco-friendly options such as compostable films, biodegradable pouches, and recyclable containers, these alternatives often come at a premium compared to conventional plastic-based solutions.

According to Frost & Sullivan, bio-based packaging materials can be up to 30% more expensive than petroleum-derived counterparts, which is making them less accessible for budget-conscious brands and retailers. This cost differential is particularly pronounced in emerging markets like Vietnam and the Philippines, where price sensitivity remains a dominant purchasing factor. Moreover, sourcing sustainable raw materials presents logistical complexities. These economic barriers slow down the adoption of greener packaging formats, especially among independent and regional pet food producers who operate on narrow margins.

MARKET OPPORTUNITIES

Growth of Functional and Smart Packaging Solutions

An emerging opportunity in the Asia Pacific pet packaging market is the development and adoption of functional and smart packaging solutions designed to enhance product performance, convenience, and consumer engagement. Smart packaging, which integrates QR codes, NFC tags, or temperature-sensitive labels, allows consumers to access real-time product information, track ingredient sources, and verify authenticity. Additionally, functional packaging extends beyond convenience to include portion-controlled sachets, single-use packets, and moisture-resistant wraps tailored for exotic pets and senior animals. As per the Korean Institute of Science and Technology, demand for smart packaging in the pet food sector grew by 18% year-on-year, which indicates strong potential for future integration of IoT-enabled packaging features. These advancements offer a competitive edge to brands aiming to differentiate through technology-driven packaging enhancements.

Increasing Demand for Customized and Private Label Pet Packaging

The rise of private label and custom-branded pet packaging presents a lucrative opportunity for the Asia Pacific market. Retailers, online pet stores, and veterinary clinics are increasingly opting for co-packed or white-label products that allow them to maintain brand consistency while catering to niche customer segments.

According to Euromonitor International, private label pet food accounted for nearly 25% of total sales in Australia and New Zealand in 2023, with major chains like Woolworths and Petco launching exclusive packaging lines. These products require highly customizable packaging formats that support unique branding, ingredient storytelling, and targeted marketing. Similarly, in India, organized retail and omnichannel pet stores such as Petsy. in and Dogsee Chew are leveraging contract packaging to introduce region-specific formulations and eco-conscious packaging. This trend offers packaging manufacturers an avenue to expand revenue streams through design customization, volume contracts, and extended partnerships with emerging pet brands.

MARKET CHALLENGES

Technological Complexity in Developing Recyclable Multi-Layer Films

One of the foremost challenges confronting the Asia Pacific pet packaging market is the technological complexity involved in developing recyclable multi-layer films that balance performance with sustainability. Traditional flexible pet food packaging often consists of multiple polymer layers to provide barrier protection against moisture, oxygen, and light, but these structures are difficult to recycle due to material incompatibility. Efforts to replace these with mono-material structures have faced hurdles in achieving equivalent shelf life and mechanical strength. Moreover, converting existing manufacturing lines to accommodate recyclable film compositions requires significant capital investment. As per the Malaysian Plastics Manufacturers Association, retrofitting extrusion and lamination equipment to produce mono-polymer films could cost up to USD 500,000 per line, deterring smaller converters from transitioning. These technical and financial barriers hinder widespread adoption of truly circular packaging solutions in the pet care sector.

Fragmented Supply Chain and Logistics Constraints

The Asia Pacific pet packaging market faces logistical and supply chain fragmentation in rural and semi-urban areas where distribution networks are underdeveloped. Unlike other consumer goods sectors with well-established cold chains and warehousing infrastructure, pet product packaging must navigate diverse climatic conditions, last-mile delivery inefficiencies, and inconsistent storage facilities. In countries like Indonesia and the Philippines, where island geography complicates transportation, brands face additional costs in ensuring packaging resilience against humidity, vibration, and temperature fluctuations. As per the Vietnam Chemical Association, local resin suppliers struggle to meet the specifications required for high-barrier pet food packaging, forcing manufacturers to rely on imported inputs. These supply-side constraints create bottlenecks in scaling production and meeting rising demand efficiently.

SEGMENTAL ANALYSIS

By Product Type Insights

The tablet bottles segment accounted in holding 28.6% of the Asia Pacific pet packaging market share in 2024, with the rising consumption of veterinary supplements, prescription medications, and functional pet health products that require secure, child-resistant, and moisture-proof packaging. According to the Petcare Federation of India, over 45% of pet owners in Tier-1 Indian cities now regularly administer joint care, digestive support, and immunity boosters to their pets, which is necessitating durable tablet packaging. Additionally, regulatory requirements in countries like Australia and Japan mandate tamper-evident closures and clear dosage instructions on medication bottles, further reinforcing the use of rigid plastic containers.

The handwash and hand sanitizer bottles segment is likely to experience a CAGR of 13.6% from 2025 to 2033. This rapid expansion is driven by heightened hygiene awareness among pet owners and the increasing need for post-petting sanitation solutions in households and commercial pet facilities. A primary growth catalyst is the surge in pet grooming salons and veterinary clinics adopting hygiene-focused protocols. Moreover, manufacturers are introducing dual-purpose bottles that combine pet-safe disinfectants with moisturizing agents, appealing to eco-conscious consumers.

By Color Insights

The transparent packaging segment accounted in holding 42.3% of the Asia Pacific pet packaging market share in 2024 due to consumer preference for visual confirmation of product contents, which enhances trust and purchasing confidence for premium pet food and treat items. According to Statista, online pet product sales in Southeast Asia grew by over 30% in 2023, with transparent pouches and jars dominating listings due to their ability to showcase vibrant kibble colors and textures. Additionally, transparency supports brand authenticity and ingredient storytelling, particularly for natural and organic pet food segments. In Japan, the Ministry of Agriculture, Forestry and Fisheries reported that 70% of surveyed pet owners preferred transparent packaging for high-end freeze-dried raw diets, citing freshness perception as a key factor.

The amber-colored packaging segment is likely to grow with a CAGR of 9.8% throughout the forecast period due to its functional advantages in protecting light-sensitive formulations such as liquid vitamins, probiotics, and CBD-infused pet oils. A key growth driver is the increasing use of amber glass and plastic bottles in veterinary supplement packaging. Furthermore, amber packaging aligns with the clean-label movement, often associated with natural and holistic wellness brands. As per Euromonitor International, pet CBD product sales in Australia and New Zealand rose by 20% in 2023, with most brands opting for amber dropper bottles to enhance perceived quality and shelf stability.

REGIONAL ANALYSIS

China was the largest contributor to the Asia Pacific pet packaging market with a 31.3% share in 2024. One of the main growth drivers is the rapid expansion of the domestic pet food manufacturing sector. According to the China Pet Industry Alliance, the number of registered pet food brands in China surpassed 5,000 in 2023, many of which are leveraging flexible pouches, stand-up bags, and resealable containers to differentiate themselves in competitive retail environments.

Additionally, e-commerce has become a critical distribution channel, prompting brands to invest in visually appealing and logistics-friendly packaging. As per Alibaba Group, pet product sales on Tmall and Taobao grew by 28% in 2023, with custom-designed packaging playing a significant role in customer retention and repeat purchases.

India was positioned second in the Asia Pacific pet packaging market by capturing 14.3% of the share in 2024. A major growth factor is the shift toward premium pet nutrition and vet-recommended supplements. According to the Indian Pet Care Association, the number of pet owners seeking out branded pet food increased by 20% between 2021 and 2023, which is directly boosting demand for specialized packaging formats such as sachets, resealable pouches, and tamper-proof bottles.

Additionally, government initiatives promoting food safety and traceability have led to stricter labeling norms for pet food packaging. As per the Food Safety and Standards Authority of India (FSSAI), new regulations introduced in 2023 require detailed nutritional information and batch tracking, encouraging manufacturers to adopt digitally printed and compliant packaging solutions.

Japan's pet packaging market is gearing up with huge opportunities in the coming years. With its advanced packaging technologies and high consumer expectations, Japan remains a key innovator in sustainable and premium pet packaging solutions. One of the key strengths of Japan’s market is its focus on functional and eco-friendly packaging. According to the Japan Flexible Packaging Association, over 50% of new pet food launches in 2023 featured compostable films or recyclable mono-material structures, reflecting strong alignment with national sustainability goals.

Moreover, Japanese pet owners exhibit a strong preference for convenience-driven packaging features such as zip-lock closures, tear notches, and portion-controlled packs. As per the Japan Pet Food Association, nearly 40% of surveyed consumers cited packaging ease-of-use as a decisive factor in repurchasing decisions.

South Korea's pet packaging market growth is driven by strong demand from premium pet brands and an expanding pet service ecosystem. The country’s compact urban lifestyle and digital-savvy consumers make it a hotspot for innovative and visually striking packaging designs.

Additionally, South Korean retailers are pushing for private label pet food lines with customized packaging to cater to niche dietary preferences such as grain-free, hypoallergenic, and senior pet formulas. As per the Korea Fair Trade Commission, private label pet product SKUs increased by 25% in 2023, indicating a strategic shift toward brand differentiation through packaging.

Australia is likely to grow at a steady pace in the coming years with its strong regulatory environment and commitment to environmental responsibility. One of the main drivers is the country’s strict packaging waste reduction policies. In addition, Australian pet owners show a strong preference for eco-conscious packaging choices. As per Roy Morgan Research, over 55% of surveyed pet owners indicated a willingness to pay a premium for biodegradable or recycled-content packaging in 2023.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Indorama Ventures, ALPLA Group, Amcor Plc, Berry Global Inc., Plastipak Holdings, Manjushree Technopack Ltd., Jindal Poly Films Ltd., Polyplex Corporation Ltd., Zhuhai Zhongfu Enterprise Co., Ltd., Gerresheimer AG, Senpet Polymers LLP, and Radico Khaitan Ltd.

The competition in the Asia Pacific pet packaging market is shaped by a mix of global packaging giants and agile regional manufacturers striving to capture market share through innovation, localization, and sustainability initiatives. As pet ownership rises and consumers become more discerning about product quality and packaging aesthetics, companies are under pressure to offer differentiated, functional, and environmentally responsible packaging solutions. The market sees intense rivalry not only in pricing but also in design, material sourcing, and performance features, particularly among flexible packaging providers. Regulatory changes related to food safety and recyclability are further influencing competitive strategies, pushing firms to invest heavily in R&D and compliance measures. Additionally, the growth of e-commerce and private label pet brands is altering traditional supplier-buyer dynamics, encouraging packaging companies to engage directly with retailers and online platforms. This dynamic environment fosters both opportunity and challenge, where agility, innovation, and responsiveness to shifting consumer trends determine long-term success.

Top Players in the Asia Pacific Pet Packaging Market

One of the leading players in the Asia Pacific pet packaging market is Amcor plc, a global leader in responsible packaging solutions. The company has a strong presence across the region, offering sustainable and innovative packaging formats tailored for pet food and veterinary products. Amcor focuses on developing recyclable flexible packaging that aligns with evolving consumer expectations around environmental responsibility while ensuring product freshness and durability.

Another major player is Sonoco Products Company, known for its diverse portfolio of rigid and flexible packaging solutions designed for the pet care industry. In Asia Pacific, Sonoco has been actively expanding its footprint through localized production units and strategic partnerships with regional pet food manufacturers to meet rising demand for premium packaging formats such as resealable pouches and stackable containers.

Bemis Company Inc., now part of Amcor following its acquisition in 2019, continues to play a significant role in shaping the pet packaging landscape in the region. Prioritizing advanced barrier films and stand-up pouches, Bemis brought expertise in high-performance flexible packaging that enhances shelf appeal and extends product life. Its legacy continues to influence Amcor’s innovation strategy in pet food and treat packaging across Asia Pacific.

Top Strategies Used by Key Market Participants

A primary strategy adopted by leading companies in the Asia Pacific pet packaging market is product innovation and customization, focusing on developing specialized packaging formats that cater to evolving consumer preferences such as convenience, sustainability, and brand differentiation.

Another key approach is expanding regional manufacturing capabilities and forming strategic alliances with local pet food brands by allowing global players to better serve diverse markets and respond quickly to changing regulatory and logistical demands.

The companies are increasingly investing in sustainable packaging development and eco-friendly material sourcing, aligning with global environmental goals and responding to growing consumer demand for recyclable and biodegradable packaging options within the pet care sector.

RECENT MARKET DEVELOPMENTS

- In March 2024, Amcor launched a new line of fully recyclable stand-up pouches specifically designed for premium pet food brands in Japan and South Korea, aiming to support regional sustainability commitments while enhancing shelf appeal and consumer convenience.

- In July 2023, Sonoco expanded its production facility in Shanghai to include a dedicated line for multi-layer flexible pet food packaging, reinforcing its ability to serve China’s growing demand for high-barrier, durable packaging solutions tailored for wet and dry pet foods.

- In November 2024, Huhtamaki, a major global packaging provider, entered into a joint venture with an Indian pet food manufacturer to co-develop compostable sachets for single-serve pet treats, aligning with the country’s increasing focus on plastic waste reduction and eco-conscious branding.

- In February 2023, UFlex established a new research and development center in Singapore focused on flexible pet packaging innovations, including oxygen barriers, resealable closures, and digital printing technologies aimed at improving product longevity and visual appeal.

- In September 2024, Constantia Flexibles introduced a range of lightweight, tamper-evident aluminum-laminated pouches for pet supplements in Australia, targeting the growing demand.

MARKET SEGMENTATION

This research report on the Asia Pacific pet packaging market is segmented and sub-segmented into the following categories.

By Product Type

- Tablet Bottles

- Syrup Bottles

- Dropper Bottles

- Vials

- Mouthwash Bottles

- Handwash & Hand Sanitizer Bottles

By Color

- Transparent

- Green

- Amber

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is driving the growth of the PET packaging market in Asia Pacific?

The key growth drivers include rising demand for packaged food and beverages, increasing urbanization, growing e-commerce, sustainability initiatives, and cost-effective lightweight packaging solutions.

What are the key trends in the Asia Pacific PET packaging market?

Key trends include a shift toward recyclable and sustainable packaging, lightweight and durable materials, adoption of rPET (recycled PET), and smart packaging innovations.

What is the future outlook for the PET packaging market in Asia Pacific?

The market is expected to grow steadily, driven by sustainability trends, increased consumption of ready-to-eat and on-the-go products, and rising awareness of eco-friendly packaging solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com