Asia Pacific Wind Turbine Market Size, Share, Growth, Trends, And Forecasts Report, Axis, Location, Connectivity, Rating, Application, And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Wind Turbine Market Size

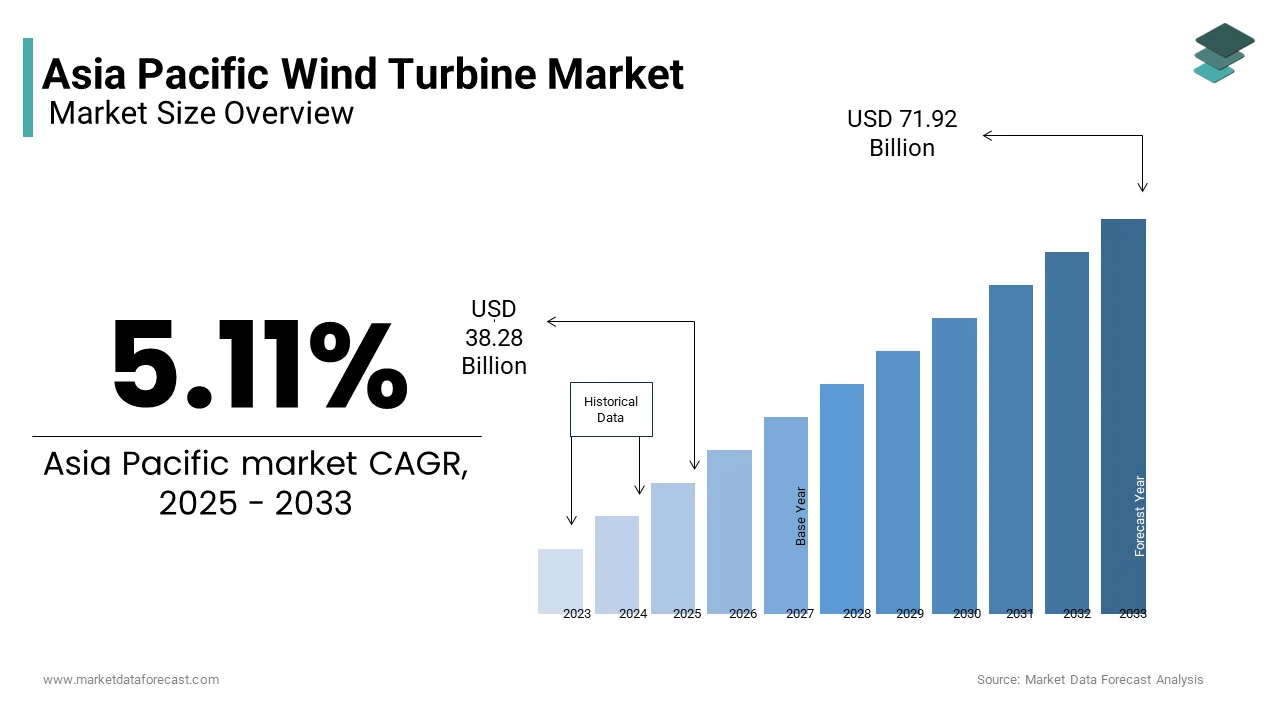

The Asia Pacific wind turbine market was valued at USD 35.37 billion in 2024 and is anticipated to reach USD 38.28 billion in 2025 from USD 71.92 billion by 2033, growing at a CAGR of 8.20% during the forecast period from 2025 to 2033.

The Asia Pacific wind turbine market growth is driven by escalating energy demands and ambitious sustainability goals. According to the International Energy Agency, the region accounts for over 50% of global wind energy capacity additions, with China alone contributing nearly 70% of regional installations. The proliferation of onshore and offshore wind farms is reshaping the energy landscape in countries like India, Australia, and Vietnam. Additionally, the push for carbon neutrality is amplifying investments in wind energy. Furthermore, the rise of hybrid energy systems, integrating wind with solar and storage solutions, is enhancing grid reliability.

MARKET DRIVERS

Government Policies and Incentives

Government initiatives promoting renewable energy are a primary driver of the Asia Pacific wind turbine market. For example, China’s "14th Five-Year Plan" mandates a 25% increase in renewable energy capacity by 2025, as per the National Development and Reform Commission. This has led to a surge in wind farm projects, with over 50 GW of new capacity added in 2022 alone. Similarly, India’s Production Linked Incentive (PLI) scheme offers subsidies for domestic wind turbine manufacturing, boosting local production by 30%, according to the Confederation of Indian Industry. These policies are complemented by tax incentives and feed-in tariffs. In Australia, the Renewable Energy Target (RET) has spurred investments in wind energy, with the Clean Energy Council reporting a 40% increase in wind turbine installations since 2020.

Declining Technology Costs

The reduction in wind turbine costs is another key driver, which is making wind energy increasingly competitive against fossil fuels. For instance, South Korea’s offshore wind projects now offer electricity at $60 per MWh, as per the Korea Energy Agency, which is making them cost-effective alternatives to coal. Advancements in turbine technology, such as larger rotor diameters and higher hub heights, have further improved efficiency.

MARKET RESTRAINTS

High Initial Capital Investment

One of the primary restraints hindering the Asia Pacific wind turbine market is the high upfront cost of wind farm development. According to PricewaterhouseCoopers, constructing an offshore wind farm can require investments exceeding $3 billion is deterring smaller players and developing economies. For instance, Vietnam’s wind energy sector faces challenges due to limited access to financing by resulting in delayed project timelines. This financial barrier is compounded by the long payback periods associated with wind projects. Additionally, regulatory hurdles often increase project costs that is complicating development.

Land Acquisition and Environmental Concerns

Another significant restraint is the difficulty in acquiring land for wind farms and addressing environmental concerns. As per the International Union for Conservation of Nature, over 30% of proposed wind projects in India face delays due to conflicts with wildlife habitats and local communities. Similarly, offshore wind projects encounter marine ecosystem disruptions. As per a study by the World Wildlife Fund, noise pollution from turbine installations threatens marine biodiversity, by leading to stricter environmental regulations.

MARKET OPPORTUNITIES

Expansion of Offshore Wind Projects

The expansion of offshore wind projects presents a transformative opportunity for the Asia Pacific wind turbine market. According to the Global Wind Energy Council, offshore wind capacity in the region is projected to grow by 25% annually through 2030, with countries like Japan and South Korea leading the charge. For instance, Japan’s Ministry of Economy, Trade and Industry plans to install 10 GW of offshore wind capacity by 2030 by creating immense demand for advanced turbine technologies. Additionally, floating offshore wind farms are gaining traction in deep-water regions.

Hybrid Energy Systems Integration

The integration of wind turbines into hybrid energy systems offers another promising opportunity. According to the International Renewable Energy Agency, combining wind with solar and battery storage can enhance grid stability and reduce reliance on fossil fuels. For example, Australia’s Hornsdale Power Reserve integrates wind energy with Tesla’s battery system is achieving higher efficiency. Similarly, India’s Solar-Wind Hybrid Policy encourages co-location of wind and solar farms, driving demand for versatile turbine designs. A study by Deloitte notes that hybrid systems can improve energy output by up to 40%, which is making them attractive for utilities and industries. These innovations position hybrid energy systems as a key avenue for expanding wind turbine adoption.

MARKET CHALLENGES

Grid Integration and Infrastructure Limitations

Grid integration remains a significant challenge for the Asia Pacific wind turbine market, particularly in developing economies. According to the International Energy Agency, over 40% of wind energy generated in rural areas of Southeast Asia is lost due to inadequate transmission infrastructure. Additionally, the intermittent nature of wind energy complicates grid management. These limitations not only hinder project feasibility but also deter investments, which is posing a critical barrier to market growth.

Supply Chain Disruptions and Raw Material Volatility

Supply chain disruptions and volatility in raw material prices represent another critical challenge for the Asia Pacific wind turbine market. According to the World Economic Forum, the ongoing semiconductor shortage has impacted the production of advanced control systems by delaying deliveries and increasing costs. Similarly, fluctuations in rare earth elements, essential for turbine magnets, have created uncertainty. A study by the International Energy Agency reveals that prices of neodymium and dysprosium surged by over 50% between 2021 and 2023, which is significantly affecting production expenses. These challenges are compounded by geopolitical tensions and trade restrictions, which disrupt supply chains further. For instance, the U.S.-China trade war has led to tariff impositions on critical components is forcing manufacturers to seek alternative suppliers at higher costs. Such disruptions strain customer relationships and erode trust in the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.20% |

|

Segments Covered |

By Axis, Location, Connectivity, Rating, Application And Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC |

|

Market Leaders Profiled |

Envision group, Enercon, General Electric, Goldwind, Mingyang Smart Energy Group Co., Ltd., Nordex, Siemens Gamesa Renewable Energy, Suzlon Energy, Senvion, Vestas, Zhejiang Windey Co., Ltd. |

SEGMENTAL ANALYSIS

By Location Insights

The Onshore wind turbines segment was the largest by occupying a prominent share in 2024 due to their cost-effectiveness and ease of installation compared to offshore alternatives. India’s onshore wind capacity grew by 12% annually from 2020 to 2023 with the favorable policies like accelerated depreciation benefits, as per the Ministry of New and Renewable Energy. The availability of vast land areas in rural regions further amplifies adoption. Additionally, advancements in turbine technology, such as taller towers and larger rotors, have improved efficiency.

The offshore wind turbines segment is likely to grow with a CAGR of 25.4% from 2025 to 2033. This growth is fueled by the region’s extensive coastlines and increasing investments in deep-water projects. For example, China’s offshore wind capacity surged with the subsidies and ambitious renewable energy targets. Similarly, Japan’s floating offshore wind projects are gaining traction, unlocking over 500 GW of potential capacity, as per the Japan Wind Power Association. Additionally, technological advancements, such as floating platforms, are enabling installations in deeper waters. These innovations position offshore wind as the segment with the highest growth potential, supported by rising demand for clean energy.

COUNTRY ANALYSIS

Top Leading Countries In The Market

China was the top performer in the Asia Pacific wind turbine market with 60.3% of share in 2024 with the massive investments in renewable energy to wind projects annually. For instance, the country installed 50 GW of new capacity in 2022, as per the National Development and Reform Commission, accounting for nearly half of global additions. Additionally, policies like the "14th Five-Year Plan" mandate a 25% increase in renewable energy capacity by 2025, ensuring sustained growth.

India wind turbine market growth is propelled by initiatives like the Production Linked Incentive (PLI) scheme and Solar-Wind Hybrid Policy. According to the Ministry of New and Renewable Energy, the country’s wind power capacity exceeded 40 GW in 2023, with Tamil Nadu and Gujarat leading installations. Moreover, declining technology costs have made onshore wind farms increasingly viable by attracting private sector investments.

KEY MARKET PLAYERS

The major players in the Asia Pacific wind turbine market include Envision group, Enercon, General Electric, Goldwind, Mingyang Smart Energy Group Co., Ltd., Nordex, Siemens Gamesa Renewable Energy, Suzlon Energy, Senvion, Vestas, Zhejiang Windey Co., Ltd.

Top Players in the Market

Vestas Wind Systems

Vestas is a leading innovator in the Asia Pacific wind turbine market, renowned for its advanced onshore and offshore solutions. The company has strengthened its presence through strategic partnerships with regional governments. In 2023, Vestas collaborated with India’s Ministry of New and Renewable Energy to deploy high-efficiency turbines in Tamil Nadu, enhancing energy output by 25%. Additionally, the company launched its EnVentus platform by offering scalable designs tailored for diverse wind conditions.

Goldwind

Goldwind is a prominent player in the region, specializing in cost-effective and reliable wind turbine technologies. In early 2024, Goldwind introduced its GW165-4.0 MW model, designed for low-wind-speed regions in China and Vietnam. By partnering with local utilities, Goldwind has expanded its footprint in Tier-II cities, where demand for affordable renewable energy is surging. Goldwind’s focus on innovation and localization has solidified its reputation as a leader in sustainable energy solutions.

Siemens Gamesa Renewable Energy

Siemens Gamesa has established itself as a pioneer in offshore wind turbines, catering to both commercial and industrial sectors. In late 2023, Siemens Gamesa launched its SG 14-222 DD model, offering higher efficiency for deep-water installations in Japan and South Korea. The company also partnered with renewable energy firms in Australia to integrate wind turbines with hybrid energy systems, enhancing grid reliability. Through investments in R&D, Siemens Gamesa has developed advanced floating platforms, positioning itself at the forefront of offshore wind innovation.

Top Strategies Used By Key Players In The Market

Key players in the Asia Pacific wind turbine market employ strategies such as product innovation, strategic collaborations, and sustainability initiatives. Product innovation is central, with companies launching advanced turbine models tailored for low-wind-speed and offshore environments. Strategic partnerships with governments and industries have been pivotal, enabling tailored solutions for diverse applications. Additionally, sustainability remains a core focus, with manufacturers adopting eco-friendly materials and promoting carbon-neutral operations. These strategies collectively enhance market penetration and customer engagement.

COMPETITION OVERVIEW

The Asia Pacific wind turbine market is highly competitive, driven by technological advancements and increasing demand for clean energy solutions. Established players like Vestas, Goldwind, and Siemens Gamesa dominate through continuous innovation, while regional manufacturers offer cost-effective alternatives. The market is witnessing a surge in offshore wind projects, creating opportunities for differentiation. Regulatory mandates promoting renewable energy further intensify rivalry, pushing companies to invest in R&D. Additionally, emerging markets like Vietnam and Indonesia are attracting investments by fostering a dynamic competitive landscape.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Vestas partnered with India’s Ministry of New and Renewable Energy to deploy high-efficiency turbines in Tamil Nadu by enhancing energy output by 25%.

- In June 2023, Goldwind launched its GW165-4.0 MW model by targeting low-wind-speed regions in China and Vietnam.

- In January 2024, Siemens Gamesa unveiled its SG 14-222 DD model, which is designed for deep-water installations in Japan and South Korea.

- In March 2024, GE Renewable Energy introduced its Cypress onshore wind platform by offering scalable solutions for Australia’s hybrid energy systems.

- In May 2024, MingYang Smart Energy expanded its offshore wind portfolio, which is integrating AI-driven predictive maintenance for projects in Southeast Asia.

MARKET SEGMENTATION

This research report on the Asia Pacific wind turbine market is segmented and sub-segmented into the following categories.

By Axis

- Horizontal (HAWTs)

- Up-wind

- Down-wind

- Vertical (VAWTs)

By Location

- Onshore

- Offshore

By Connectivity

- Grid connected

- Stand alone

By Rating

- 100 kW

- 100 kW to 250 kW

- > 250 kW to 500 kW

- > 500 kW to 1 MW

- 1 MW to 2 MW

- > 2 MW

By Application

- Residential

- Commercial & Industrial

- Utility

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is driving the rapid growth of the wind turbine market in the Asia Pacific region?

The surge is fueled by strong government renewable energy targets, rising energy demand, falling wind technology costs, and increasing private sector investment in clean energy infrastructure.

Which countries in Asia Pacific are leading the wind turbine market and why?

China dominates with massive onshore and offshore capacity, while India, Australia, and Vietnam are rapidly scaling up due to favorable policy frameworks, grid upgrades, and access to strong wind corridors.

What types of wind turbines are being deployed across Asia Pacific?

Both onshore turbines (widely used for cost-efficiency and faster deployment) and offshore turbines (growing in markets like China, Japan, and South Korea) are being adopted, with a trend toward larger, high-capacity units.

What challenges are hindering wind energy expansion in the region?

Key challenges include land acquisition issues, slow permitting processes, grid integration limitations, and supply chain disruptions for key turbine components like blades and gearboxes.

What trends will shape the future of the Asia Pacific wind turbine market?

Expect growth in floating offshore wind tech, digital twin-enabled turbine monitoring, local manufacturing initiatives, and stronger cross-border energy cooperation to support regional grid balancing.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]