Global Automotive Valves Market Size, Share, Trends, & Growth Forecast Report, Segmented By Type (Engine Valves, A/C Valve, Brake Valves, Thermostat Valve, Fuel system Valve, Solenoid Valve, Exhaust gas recirculation Valve, Tire Valve, Water Valve and AT control Valve), Application (Engine System, HVAC System, Brake System and Others), Function (Electric, Pneumatic, Hydraulic and Others), Vehicle Type (Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle and Electric Vehicles) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East and Africa), Industry Analysis From 2025 to 2033

Global Automotive Valves Market Size

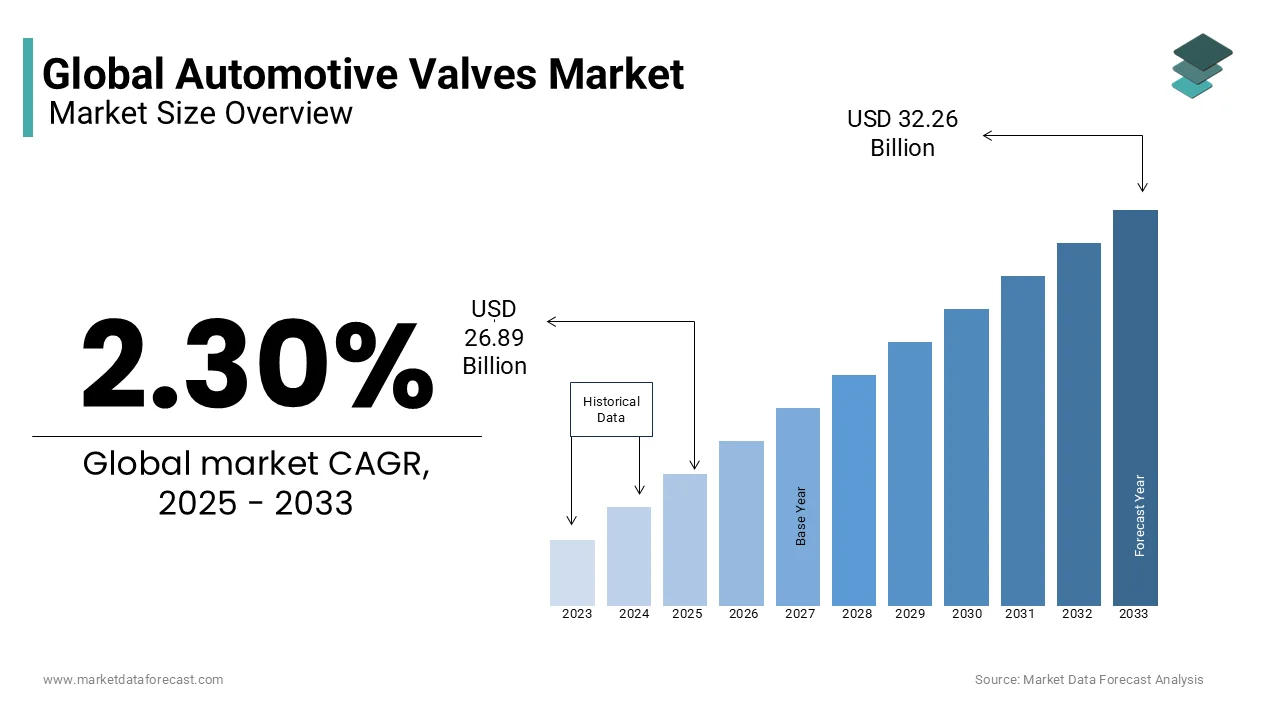

The global automotive valves market was valued at USD 26.29 billion in 2024 and is anticipated to reach USD 26.89 billion in 2025 from USD 32.26 billion by 2033, growing at a CAGR of 2.30% from 2025 to 2033.

CURRENT SCENARIO OF THE GLOBAL AUTOMOTIVE VALVES MARKET

Automobile valves are electromechanical devices that are used to control the flow of gas, liquid, slurry, or other fluid material.

The valves in the engine of the vehicle play a vital role by controlling the flow of liquid or gas into the combustion chamber. The performance and responsiveness of the different systems of the vehicle are directly related to automotive valves. The valve is one of the important components of the vehicle that controls the flow of the fluid thus increasing the performance of the vehicle. In recent scenarios, manufacturers have increased their focus on manufacturing advanced valves that can considerably increase the efficiency of the vehicle and satisfy consumer demand. Various types of valves are installed in the vehicle to support various vehicle functions such as cooling, brakes, door locks, fuel circulation, etc.

MARKET DRIVERS

The driving force of the automotive valves market is the increasing demand for and production of vehicles in emerging markets, as well as the increasing demand for electric cars in developed markets.

The increasing demand for automobiles, the evolution of technologies in vehicles, and stringent emission regulations will drive the growth of the automobile valves market in the forecast period. The growth of the automobile industry is expected to fuel the demand for various automobile components including engine valves, powertrain components, advanced driver assistance systems, etc. The increasing infrastructure and construction activities, export-import, or logistics activities increase the demand for commercial vehicles, which will further increase the demand for automotive valves.

Strict government regulations on emissions are expected to boost the automobile valve market. Due to this regulation, the demand for a new automobile is increasing which in turn increases the demand for valves for new automobile production and for the replacement of valves in existing automobiles. The increasing adoption of technologically advanced vehicles such as electrified vehicles and anti-locking system vehicles fuels the growth of the automotive valves market in the forecast period.

MARKET RESTRAINTS

The global automotive valve market is significantly dependent on the number of cylinders used in the vehicle. The recent trend of downsizing the automobile industry is going to act as a restraint in the growth of the automotive valves market, especially engine valves.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.30% |

|

Segments Covered |

By Value Type, Function Type, Application, Vehicle Type, and Region. |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities. |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Robert Bosch GmbH, Continental AG, Denso Corporation, BorgWarner Inc., Schaeffler AG, Eaton, Federal-Mogul Corporation, MAHLE GmbH, Jinan Worldwide Auto-Accessory Limited ICP, Magna International Inc, and Others. |

SEGMENTAL ANALYSIS

By Valve Type Insights

The engine valves are going to dominate the market during the forecast period due to the increased production of vehicles with advanced engines. Solenoid valves are also expected to drive the automotive valves market growth because of the increasing electrification of vehicles.

By Function Type Insights

The global automotive valves market is segmented into electric, pneumatic, and hydraulic valves, including mechanical and pilot operated. Hydraulic function-type valves are going to dominate the market as they provide full closure of the engine valves at the maximum engine speed.

By Application Insights

The engine system is expected to dominate the market in the forecast period as automobile valves play a vital role in the engine system as it allows or stops the fluid or gas flow from cylinder to internal combustion.

By Vehicle Type Insights

The passenger car segment is expected to hold the largest market of automotive valves due to the increasing demand for passenger cars. The increasing focus and adoption of technologically advanced electric vehicles are also going to drive the automotive valve market.

REGIONAL ANALYSIS

The Asia Pacific is expected to hold the largest share of the global automobile vales market in the forecast period. Developing economies like India and China are expected to play a major role in increasing vehicle production. China leads the world's largest electric vehicle market in terms of volume and also there is increasing construction and infrastructure activities in China are expected to increase the demand for a commercial vehicle, which in turn will increase the growth of the automotive valve market in the future and also the increasing safety systems to be implemented in an automobile like anti-locking system, automatic transmission and start-stop system is expected to add to the demand of valves.

North America is the largest market for automotive valves due to the huge demand and sale of automobiles in this region. Thus, new and existing automobiles will generate the demand for valves in the projected period between 2021 and 2027. Additionally, the increasing commercial activities such as mining, export-import, construction, etc in this region increase the demand for commercial automobiles which will further propel the market of automotive valves in the future.

In Europe, the stringent emission rule is expected to boost the market of automobile valves because strict governmental norms will lead to an increase in the sale of vehicles as well as valves.

KEY MARKET PLAYERS

Some of the leading companies operating in the global automotive valves market are Robert Bosch GmbH, Continental AG, Denso Corporation, BorgWarner Inc., Schaeffler AG, Eaton, Federal-Mogul Corporation, MAHLE GmbH, Jinan Worldwide Auto-Accessory Limited ICP, Magna International Inc. Eaton had the largest share of the world’s automotive valve equipment in terms of sales revenue.

RECENT HAPPENINGS IN THIS MARKET

- In March 2021, Eaton launched next-generation sodium-filled hollow-head valves in order to improve fuel economy, reduce emissions, and increase gas-powered engines. The valves feature a unique design that helps in lowering the cylinder chamber temperature while mitigating engine knock.

- Bosch Rexroth has launched the RM10-MPP and RM15-MPP mid-pressure load-sensing valve platforms. These new launches are compact, general-purpose, cost-effective, and multi-application load-sensing directional control valves.

MARKET SEGMENTATION

This research report on the global automotive valves market is segmented and sub-segmented into the following categories.

By Values Type

- Engine (Inlet or Outlet) Valves

- Air Conditioner Valve

- Fuel System Valve

- Solenoid Valve

- Exhaust Gas Recirculation Valve

- Thermostat Valve

- Tire Valve

- Water Valve

- AT Control Valve

- Brake Valves

By Function Type

- Electric

- Pneumatic

- Hydraulic

- Others

- Mechanical

- Pilot Operated

By Application

- Engine System

- HVAC System

- Brake System

- Other (Tire, Body, etc.)

By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Electric Vehicle

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current size of the Global Automotive Valves Market?

As of the latest data, the Global Automotive Valves Market is valued at USD 26.89 billion in 2025.

Which regions are the major contributors to the Global Automotive Valves Market?

Asia-Pacific and North America are the leading contributors to the global automotive values market.

Are there specific challenges faced by the Automotive Valves Market in Latin America, especially in Brazil?

Challenges in Brazil include adapting automotive valves to diverse fuel types, meeting environmental standards, and addressing the evolving automotive landscape.

What role does the electric vehicle market play in shaping the Automotive Valves Market in North America?

The growth of the electric vehicle market in North America influences the demand for automotive valves used in electric powertrains and emission control systems.

who are the key market players involved in the global Automotive Valves Market?

Robert Bosch GmbH, Continental AG, Denso Corporation, BorgWarner Inc., Schaeffler AG, Eaton, Federal-Mogul Corporation, MAHLE GmbH, Jinan Worldwide Auto-Accessory Limited ICP, Magna International Inc.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]