Global Solenoid Valve Market Size, Share, Trends, Growth Forecast Report - Segmented By Industry (Aerospace and Defense, Automotive, Oil and Gas, Paper and Pulp, Transportation and Logistics, Chemical, Water and Waste Water, Others), By Usage (Pneumatic, Hydraulic, Fluidic), & Region - Industry Forecast From 2024 to 2032

Global Solenoid Valve Market Size (2024 to 2032)

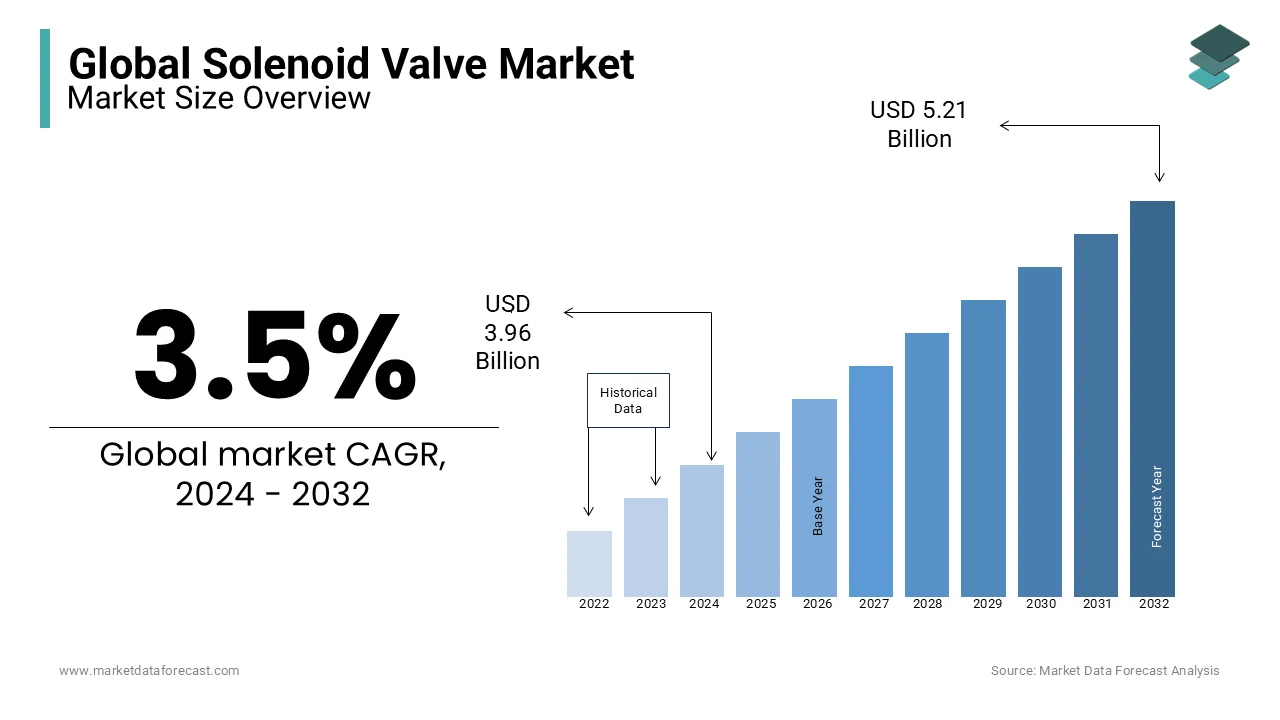

The size of the global solenoid valve market was worth USD 3.83 billion in 2023. The global market is expected to be worth USD 3.96 Billion in 2024 and USD 5.21 Billion by 2032, growing at a CAGR of 3.5% from 2024 to 2032.

Current Scenario of the Global Solenoid Valve Market

Electromechanically controlled solenoid valves are used in automobiles. These valves regulate the flow of air or fluid in-car systems and engines. Solenoids are electronic devices that transform electrical energy into mechanical energy by causing a magnetic response when an electric current passes through the solenoid's wire. These are commonly found in hydraulic and power fluid systems.

Direct-acting valves are used to prevent excessive pressure from building up in a device; pilot-operated valves, also known as indirect valves or servo valves, are used for one flow direction; and two-way valves, which have one intake and one output, are used to allow and halt the fluid flow.

Solenoids can be used for a variety of purposes, including starting an automobile or turning on the sprinkler system. It primarily regulates the fluid flow, motors, and air-powered devices. Solenoids are the most common liquid and gas circuit components. Industrial automation, air hammers, washing machines, gas boilers, hydraulic pumps, compressed air technologies, car wash systems, heating systems, irrigation systems, dental equipment, sprinkler systems, and other applications are just a few of the uses for solenoid valves.

MARKET DRIVERS

The solenoid Valve Market expansion has been aided by their lightweight, compact design, as well as their cost-effectiveness.

Due to the lack of a diaphragm, direct-acting solenoid valves are finding widespread use in the market. This ensures that the valves stay closed even when there is no pressure exerted. Because of its basic principles, valves are used in a wide range of industries. These solenoid valves may be used for a wide range of tasks, including shutting down, filling, dosing, and venting. These valves' market expansion has been aided by their lightweight, compact design, which is also cost-effective. Because there is no diaphragm to ensure that the valves remain closed even when there is no applied pressure, direct-acting solenoid valves are gaining popularity in the market. Valves are used in a variety of industrial industries because they function on basic principles.

Furthermore, in demanding applications for neutral and clean liquids, gases, and vapors, direct-acting or direct-operated valves are a cost-effective alternative. These solenoid valves can be used for shut-off, filling, dosing, and venting.

During the projected period, the global solenoid valve market is predicted to develop at a stable rate. Growing worries about water pollution and the necessity to remove organic contaminants from dirty water are driving the worldwide solenoid valve market. As a result, the need for wastewater treatment has skyrocketed. Solenoid valves are widely used in water treatment facilities to accomplish various tasks, fueling market expansion.

MARKET RESTRAINTS

Solenoid valves are utilized in the upstream, midstream, and downstream activities of the oil and gas sectors. Exploration and extraction of crude oil are examples of upstream operations, whereas filtration and purification of oil and gas are examples of downstream activities. In the oil and gas business, solenoid valves are a critical resource. They're utilized in everything from digging an oil well to extracting and transporting crude oil, as well as heating systems, control systems, safety systems, fractional distillation, and catalytic cracking. As a result, they have seen widespread acceptance. However, the probable drop in demand for fossil fuels and oil has caused a slowdown in the industry, with a number of oil rigs being shut down. Despite the fact that this slowdown has abated, demand will continue to fall over the projection period, resulting in poor Solenoid Valve market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

3.5% |

|

Segments Covered |

By Usage, Industry, Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Peter Paul Electronics Co., Inc, Parker Hannifin Corp, ASCO Valve, Inc, Fim Valvole s.r.l, Emerson, LISK IRELAND LIMITED, Kendrion, Humphrey Products Corporation, Humphrey Products Corporation, Bürkert Fluid Control Systems, NSF Controls Ltd |

SEGMENTAL ANALYSIS

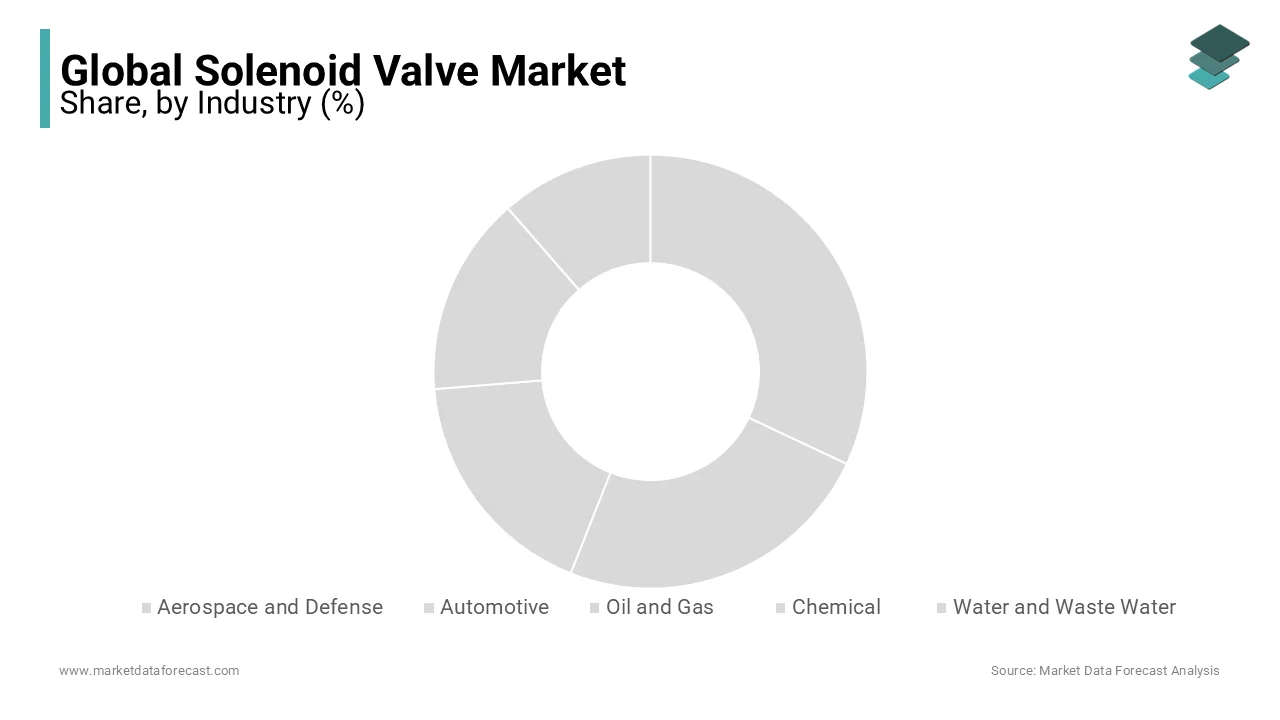

Global Solenoid Valve Market By Industry

In the automotive industry, solenoid valves are used in air intake systems, exhaust systems, HVAC body, locking and safety systems, engine control, lubrication, steering, suspension, and transmission systems. Security systems, automated gearbox drive options, and air conditioning controllers are just a few of the applications. Globally, the automobile sector is expanding at a steady clip, with demand coming mostly from emerging markets and manufacturing transferring there. The global automobile sector has been seeing reasonably good growth and profitability, with yearly sales in a few places approaching pre-recession levels.

Global Solenoid Valve Market By Usage

In a hydraulic system, a hydraulic solenoid valve is a solenoid-controlled valve that opens, closes, or changes the direction of liquid flow. The valve is made up of many chambers, also known as ports. By moving the spool inside the valve, the solenoid opens and closes the ports. Hydraulic valves are divided into three categories: directional control valves, pressure control valves, and flow control valves. Directional control valves guide the flow of the hydraulic system in a certain direction. They have the ability to stop or resume the flow of fluid. Directional control valves can change the flow channel of a fluid inside a hydraulic circuit. Pressure reduction valves lower or release pressure when fluid flows through the system. A hydraulic solenoid valve is a solenoid-controlled valve that opens, closes, or changes the direction of liquid flow in a hydraulic system. The valve is made up of many chambers (sometimes called ports). By moving the spool inside the valve, the solenoid opens and closes ports. Hydraulic valves may be divided into three types: directional control valves, pressure control valves, and flow control valves. Directional control valves guide the flow of fluid in the hydraulic system in a certain direction. They may stop or resume the flow of fluid. Directional control valves in a hydraulic circuit can change the fluid's flow route. Pressure reduction valves lower or release the pressure as the fluid passes through the system.

REGIONAL ANALYSIS

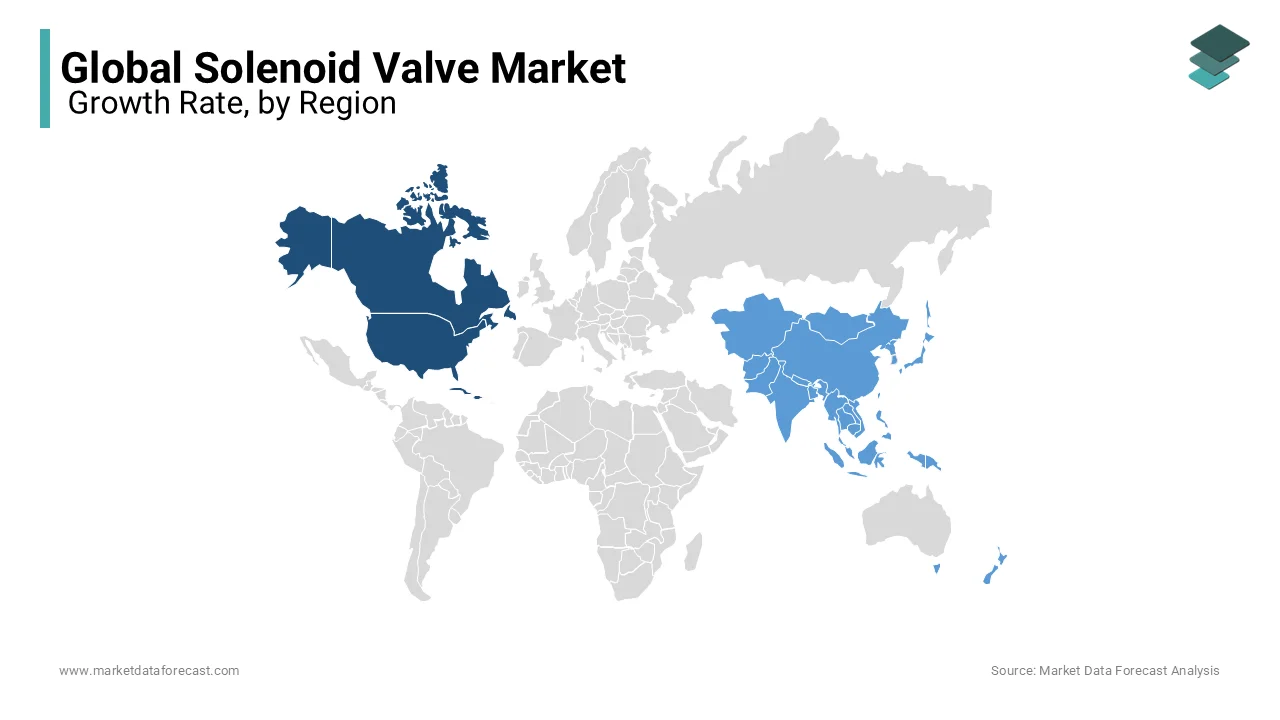

North America dominated the global solenoid valve market share during the projected period. During the estimated period, APAC is expected to increase at the fastest rate of 3.9 percent.

Many sectors, including water supply management, food and drinks, and chemicals, are rapidly adopting automation solutions. As a result, the solenoid valve market is expected to develop. The solenoid valve market in this area has been driven by rising water and wastewater, oil and gas industries, automotive, and other factors in the country. According to the latest EIA figures, US crude oil output will average 12.1 million barrels per day in 2019. The oil and gas industry's extensive use of solenoid valves has fueled the market expansion. Solenoid valves provide several advantages that enable the industry to regulate machinery, dose, mix, or restrict the flow of liquids or gases. Furthermore, companies use solenoid valves to regulate the flow of fluid and generate motions in the process in automated systems. The growing need for clean and sanitary water supplies in the country is driving up demand for water treatment plants, which is driving up demand for solenoid valves. Growing industries and their requirements for process automation, such as liquid or gas flow, are expected to drive demand for solenoid valves in the nation.

KEY MARKET PLAYERS

Major Key Players in the Global Solenoid Valve Market are Peter Paul Electronics Co., Inc., Parker Hannifin Corp, ASCO Valve, Inc., Fim Valvole s.r.l., Emerson, LISK IRELAND LIMITED, Kendrion, Humphrey Products Corporation, Bürkert Fluid Control Systems, NSF Controls Ltd and others.

RECENT HAPPENINGS IN THE MARKET

- At the Hitex Exhibition Centre in Hyderabad, Danfoss Industries Pvt. Ltd. showcased the ICSH 2-Step Solenoid Valve. The innovation is expected to change the standard for industrial refrigeration and cooling applications. The ICSH 2 Step Solenoid Valve is a very effective and frequent technology used in industrial refrigeration for safe and gentle gas injection. It was created with the safety issues associated with pumping hot gas into evaporators in mind.

- Eaton introduced a small, streamlined solenoid valve in April 2019 to improve the fluid control precision of off-highway vehicles. When compared to comparable five-ported directional control valves in the market, the new ESVL9 screw-in cartridge valve (SiCV) incorporates an integrated load-sense check control and delivers a 21 percent manifold reduction in size.

DETAILED SEGMENTATION OF THE GLOBAL SOLENOID VALVE MARKET INCLUDED IN THIS REPORT

This research report on the global solenoid valve market has been segmented and sub-segmented based on industry, usage, and region.

By Industry

- Aerospace and Defense

- Automotive

- Oil and Gas

- Chemical

- Water and Waste Water

- Others

By Usage

- Pneumatic

- Hydraulic

- Fluidic

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the primary applications of solenoid valves?

Solenoid valves are widely used in various industries, including automotive, oil and gas, water and wastewater treatment, chemicals and petrochemicals, pharmaceuticals, food and beverages, and HVAC systems. They are crucial for controlling the flow of liquids and gases in these applications.

How is the rise of automation impacting the solenoid valve market?

The rise of automation in various industries is significantly boosting the demand for solenoid valves. Automated systems require precise control of fluid flow, which solenoid valves provide, thereby enhancing operational efficiency, reducing downtime, and lowering maintenance costs.

What are the key challenges facing the solenoid valve market?

Key challenges include the high cost of advanced solenoid valves, the complexity of integrating these valves into existing systems, and the need for regular maintenance to ensure optimal performance. Additionally, the market faces competition from alternative valve technologies.

How are manufacturers addressing the demand for customized solenoid valves?

Manufacturers are addressing the demand for customized solenoid valves by offering tailored solutions that meet specific industry requirements. This includes designing valves with particular materials, sizes, and functionalities to cater to unique applications, thus providing greater flexibility and performance.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]