Global Industrial Valves Market Size, Share, Trends, and Growth Forecast Report - Segmented By Material (Stainless Steel, Cast Iron, Cryogenic, Alloy Based, Brass, Bronze, & Plastic), Valve Type (Ball Valves, Butterfly Valves, Check Valves, Diaphragm Valves, Gate Valves (Standard Plate Gate Valves, Wedge Gate Valves, & Knife Gate Valves), Globe Valves, and Safety Valves), Size (Up to 1 inch, 1–6 inches, 6–25 inches, 25–50 inches, and 50 inches and Above), Industry (Oil & Gas, Water & Wastewater Treatment, Energy & Power, Chemicals, Food & Beverages, Pharmaceuticals, Construction, Agriculture, Pulp & Paper, Metals & Mining, and Others), and Region (North America, Europe, APAC, Latin America, Middle East and Africa) – Industry Analysis from 2024 to 2032.

Global Industrial Valves Market Size (2024 to 2032):

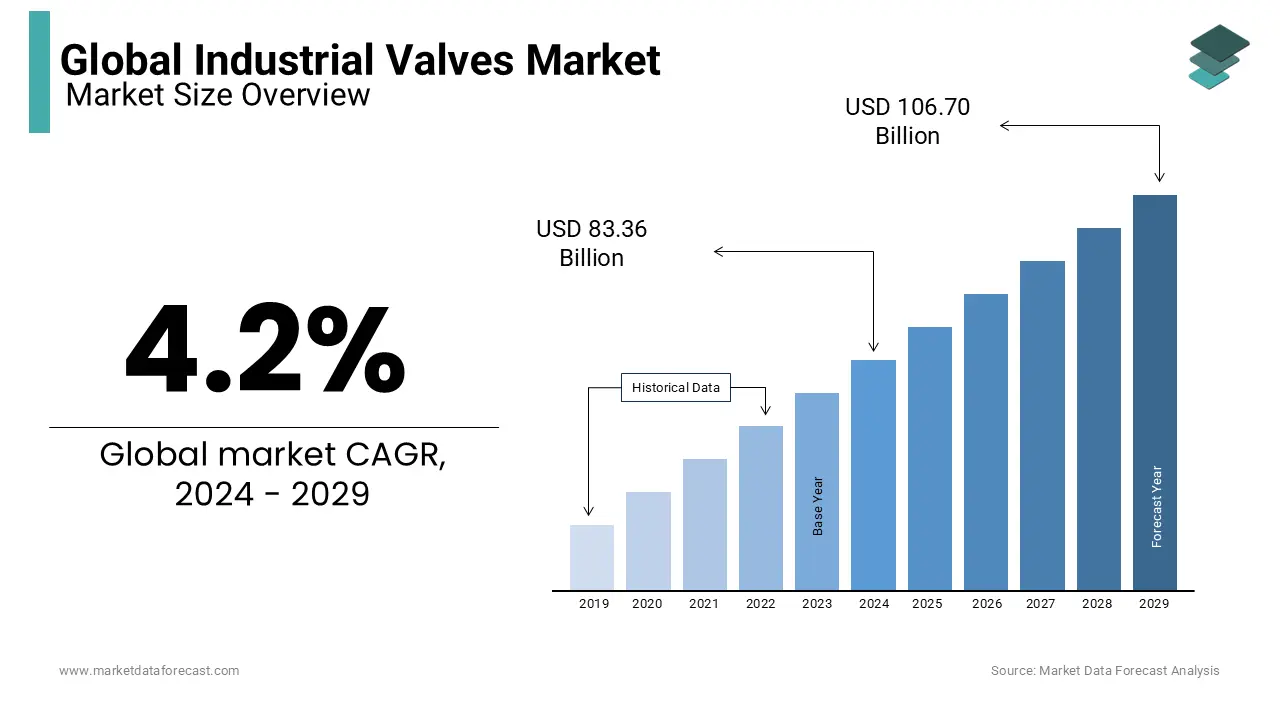

The size of the global industrial valves market was worth USD 80 billion in 2023. The global market is anticipated to grow at a CAGR of 4.2% from 2024 to 2032 and be worth USD 115.85 billion by 2032 from USD 83.36 billion in 2024.

MARKET DRIVERS

The development of smart towns worldwide, the growing need for valves in the medical and pharma sectors, and the quick installation of networked systems to track valve status and identify system breakdowns are the primary drivers propelling the industrial valves market.

Advances in technology have made it possible for businesses to minimize unexpected downtime and other negative events caused by valve failures by utilizing modern technologies such as artificial intelligence (AI) and the Internet of Things (IoT). Experts can monitor industrial valve function and status from a distance due to these valve technologies. As a result of the swift industrialization, companies are implementing sensor-equipped valves to lower maintenance costs overall and decrease the number of failures. Throughout the forecast period, the adoption of industrial values is expected to propel the market.

The growing population and urbanization worldwide are assisting the growth of the industrial valves market.

Gas is supplied to both residential and non-residential structures through several new pipeline projects. Gas distribution networks are using industrial valves more and more to regulate the flow of gas. The rising demand for intelligent water supply valves with AI integration will propel the industrial valves market forward. AI can be incorporated into different applications in a water distribution network, like forecasting future scenarios to handle unforeseen events, selecting the best available options to solve a problem or remove any bottleneck, and predicting flow at one location at one time based on previous location information. A significant portion of fugitive emissions at oil refineries are due to industrial valves, according to both the European Union's Industrial Emissions Directive and America's Environmental Protection Agency. They recognized how regularly opened rising stem valves are the primary source of most of these emissions. Therefore, seizing the opportunity to cut down on escaping gases from transmission lines, Celeros Flow Technology introduced a novel valve-packing technology in September 2023.

Increased automation because of the rapid industrialization and expansions of existing facilities are the major drivers for the growth of the global industrial valves market over the forecast period. Rising demand for equipment to control the flow is estimated to impact market growth positively. The growing adoption of smart technology and diagnostics in the industrial valves to monitor process variables such as upstream & downstream pressure stem position, temperature, and flow rate is likely to be fuelling the worldwide industrial valve market growth during the outlook period.

MARKET RESTRAINTS

Inadequate standardization and certification are hindering the growth of the industrial valve market.

This is causing problems in the backward and forward integration with the field machines. Valve manufacturers are searching for low-cost production locations, but due to high rejection rates and late delivery, the quality of products decreases. New standards must be developed to guarantee the processes and products meet quality requirements as the supply chain grows. Additionally, few countries have restricted entry into the valve manufacturing sector. For instance, China has introduced a pre-production license system prohibiting businesses from producing and selling their products in compliance with the requirements of the valve production license.

Production technology barriers are major obstacles for companies wanting to succeed in the luxury industrial valves market. Companies are investing in advanced manufacturing techniques to enhance valve performance and reliability, but they must overcome the difficulties in developing and implementing these advanced technologies.

Financial limitations present a big problem for prospective companies in the high-end industrial valve market. Businesses must invest heavily in modern manufacturing facilities to ensure quality, efficient production processes, and accuracy in valve manufacture. Also, high charges for the certification process and acquisition and retention of qualified personnel are all restricting the market from expanding.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

4.2% |

|

Segments Covered |

By Industry, Type, Material, Size, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Emerson (US), Weir Group PLC (UK), Flowserve (US), Cameron Schlumberger (US), IMI PLC (UK), Spirax Sarco (UK), Crane Co. (US), Kitz Corporation (Japan), Metso Corporation (Finland), Neway Valve (Suzhou) Co., Ltd. (China), Velan Inc. (Canada), Samson AG (Germany), AVK Holding A/S (Denmark), Avcon Controls (India), Forbes Marshall (India), Swagelok (US), Ham–Let (Israel), Dwyer Instruments (US), KIM Valves (Australia), and Apollo Valves (US)., and Others. |

SEGMENTAL ANALYSIS

Global Industrial Valves Market Analysis By Industry

The energy & power segment was the dominant segment under this category of the industrial valves market. Control valves are essential parts of power plants. Tight shutoffs are necessary for valves in the energy and electricity sectors to handle high-integrity slurry. Specialized valves are used in the power and energy sector for a variety of purposes.

Global Industrial Valves Market Analysis By Type

The global valves segment holds a significant share of the industrial valves market. The primary benefit of Globe valves is their low leakage. The adoption rate of these valves is significantly higher across a variety of industries due to their additional benefits, which include improved full-closing characteristics, quicker opening and closing times, and positive shutdown drives.

Global Industrial Valves Market Analysis By Material

The stainless steel segment is the leading segment under this category of the industrial valves market. Because of its effective mechanical qualities and strong resistance to sulfides, stress corrosion, and cracking, steel has emerged as the most popular material used to make valves. These valves are quite sturdy and dependable, which is one of the key advantages over valves made of other metals. Instrumentation valves made from stainless steel 316 can be utilized at any temperature that won't break down when running in extremely hot or cold temperatures. Stainless steel valves are utilized in various industries like irrigation, industrial processes, residential use, military, and transport for controlling water levels.

Global Industrial Valves Market Analysis By Size

The 1-6 inches segment is the largest segment, holding a substantial share of the industrial valves market. As they provide less flow turbulence and offer lower pressure drops, they are becoming more popular in various critical and severe service applications across multiple industries, including oil and gas, energy and power, water and wastewater treatment, chemicals, pulp and paper, and food and beverage.

REGIONAL ANALYSIS

The North American industrial valves market is driven by factors such as COVID-19, rising nuclear power plant renovations, connected networks, automation, and smart city development, resulting in increased demand in the healthcare and pharmaceutical industries. The market is also fueled by several other reasons, like the growing need for safety applications and expanding R&D efforts regarding the use of actuators in valves for automation.

Europe's industrial valves market is anticipated to expand further with a higher CAGR during the forecast period. Oil refineries are growing as a result of rising oil consumption. The expanding number of oil refineries has increased the requirement for high-pressure-resistant valves with minimal operating waste. For instance, to shorten lead times and satisfy the demand for pressure relief valves worldwide, Protectoseal invested $5 million in production in December 2023. In 2022, it bought UK-based Elmac Technologies to expand its product line and production capacity.

Asia Pacific industrial valves market is estimated to witness a faster growth rate during the forecast period. China and India are providing strong development prospects for the industrial valves market, which is predicted to grow significantly. This is because industrial infrastructure has grown greatly over the past few years, and material costs have been low. With a large revenue share of more than 35 percent, the Asia Pacific leads the world economy in specialty chemicals.

The Latin American industrial valves market is expected to propel further during the forecast period. The growing adoption of the ball and butterfly valves among companies is moving the market forward in the region. Butterfly valves are in high demand from the industrial valve market players due to growing urbanization and the expansion of wastewater treatment facilities. South America's oil production has increased dramatically over time. 7.5 million barrels of oil are produced daily. Such trends are driving the growth of the industrial valves market in the region.

The Middle East and African industrial valves market is projected to achieve a higher growth rate during the forecast period. The demand for industrial valves is majorly driven by the expansion and growth of sectors, including manufacturing, petrochemicals, oil and gas, power generation, water and wastewater treatment, and water treatment. The increasing focus on sustainability and environmental concerns has led to a surge in the sales of industrial valves in green technology.

KEY PLAYERS IN THE GLOBAL INDUSTRIAL VALVES MARKET

Companies playing a prominent role in the global industrial valves market include Emerson (US), Weir Group PLC (UK), Flowserve (US), Cameron Schlumberger (US), IMI PLC (UK), Spirax Sarco (UK), Crane Co. (US), Kitz Corporation (Japan), Metso Corporation (Finland), Neway Valve (Suzhou) Co., Ltd. (China), Velan Inc. (Canada), Samson AG (Germany), AVK Holding A/S (Denmark), Avcon Controls (India), Forbes Marshall (India), Swagelok (US), Ham–Let (Israel), Dwyer Instruments (US), KIM Valves (Australia), and Apollo Valves (US), and Others.

RECENT HAPPENINGS IN THE GLOBAL INDUSTRIAL VALVES MARKET

- In December 2023, a long-term joint venture was formed between Tecnik Fluid Controls and ITT, and the first investment of 3 billion US dollars was made for the production of valves for the Indian pharmaceutical industry. Also, ITT plans to buy valves from the joint venture for supply and distribution in the US market and transfer technology for valve manufacturing in India.

- In December 2023, Chinese company Jiangsu Colves Fluid Control and its Italian distribution company Colves Fluid Control were purchased by ACI Somagep to improve production quality and supply chain management. It is a member of the Parlym group and an industrial valves distribution partner for Europe and Africa.

DETAILED SEGMENTATION OF THE GLOBAL INDUSTRIAL VALVES MARKET INCLUDED IN THIS REPORT

This research report on the global industrial valves market has been segmented and sub-segmented based on industry, type, material, size, and region.

By Industry

- Oil & Gas

- Water & Wastewater Treatment

- Energy & Power

- Chemicals

- Food & Beverages

- Pharmaceuticals

- Construction

- Agriculture

- Pulp & Paper

- Metals & Mining

- Others

By Type

- Ball Valves

- Butterfly Valves

- Check Valves

- Diaphragm Valves

- Globe Valves

- Plug Valves

- Safety Valves

- Gate Valves

- Standard Plate Gate Valves

- Wedge Gate Valves

- Knife Gate Valves

By Material

- Stainless Steel

- Cast Iron

- Cryogenic

- Alloy Based

- Brass

- Bronze

- Plastic

By Size

- 1 inch

- 1–6 inches

- 6–25 inches

- 25–50 inches

- 50 Inches and Above

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. What factors drive the demand for industrial valves?

The demand for industrial valves is driven by factors such as industrialization, infrastructure development, energy exploration, and the need for efficient fluid control in various processes. Demand is also influenced by regulatory requirements and advancements in valve technology.

2. What are the challenges facing the industrial valves market?

Challenges in the industrial valves market include price volatility of raw materials, stringent environmental regulations, and the need for regular maintenance and replacement. Additionally, global economic conditions and geopolitical factors can impact the market.

3. What trends are shaping the future of the industrial valves market?

Trends in the industrial valves market include the adoption of smart valves, the integration of Industrial Internet of Things (IIoT) technologies, a focus on sustainable practices, and advancements in materials and manufacturing processes.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]