Global Biodiesel Market Research Report - Segmentation By Blend (B100, B20, B10, and B5), Feedstock, Application, and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) - Industry Analysis (2025 to 2033)

Global Biodiesel Market Size

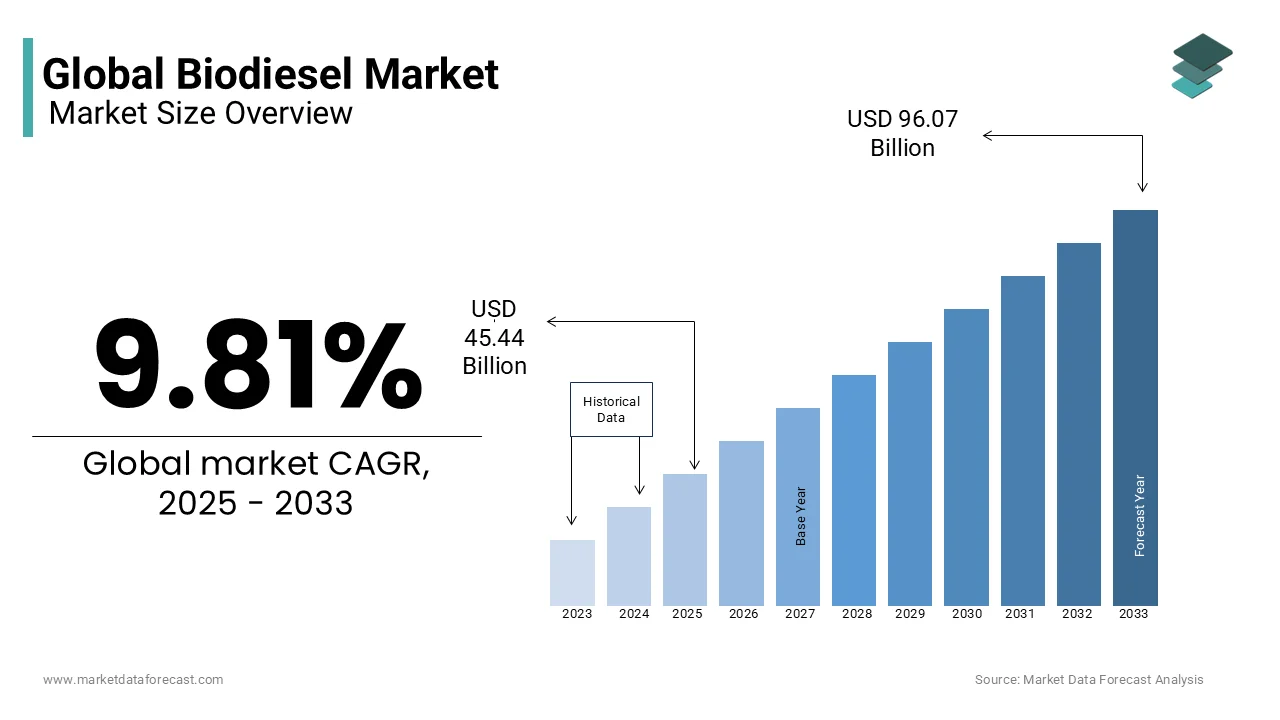

The global biodiesel market size was valued at USD 41.38 billion in 2024, and the global market size is expected to be worth USD 45.44 billion in 2025 and USD 96.07 billion by 2033, growing at a CAGR of 9.81% during the forecast period.

MARKET OVERVIEW

Biodiesel is an extract from plants and animals that is used as fuel in diesel engines and is made via transesterification. Though the usage of biodiesel has spread to multiple industries, the extensive usage of biodiesel has been found in the automobile and trucking industries. Biodiesel does not harm the environment and is completely safe to use. The other advantages associated with biodiesel, such as the fact that it is a renewable energy source and user-friendly, accelerate the adoption of biodiesel across various industries. The adoption of biodiesel is high among the OECD countries. Besides, biodiesel has a significant favorable impact on the U.S. economy, and biodiesel production is believed to be reflected in job opportunities, GDP growth, and increased tax revenue.

MARKET DRIVERS

The growing demand and increasing biodiesel consumption are major factors accelerating the growth of the worldwide biodiesel market. The U.S., Brazil, Indonesia, China, and Thailand are among the countries that consume the highest amount of biodiesel worldwide. In 2019, the U.S. consumed 118.25 barrels of biodiesel every day. The usage of biodiesel has grown significantly owing to the increased usage of biodiesel in the automotive and power generation industries. In addition, growing concern around environmental health is anticipated to have a favorable impact on the biodiesel market growth. Biodiesel is believed to reduce particulate matter by 47%, hydrocarbon emissions by up to 67%, and less smoke. Particulate matter presents in the form of liquid droplets and can lead to significant health issues when inhaled by people. Furthermore, biodiesel is compatible with the environment and releases limited greenhouse gas emissions when used in vehicles; such advantages associated with biodiesel are increasing the adoption and usage of biodiesel and driving market growth.

The fact that biodiesel is an excellent renewable substitute for petroleum diesel is increasing its usage across multiple industries, further accelerating the market’s growth rate. It is not required to make any functional or technical changes to diesel engines to use biodiesel through them; biodiesel makes good compatibility with diesel engines and, hence, can be used directly in the place of diesel. Vehicle sales are increasing considerably with the year passing and the growing demand for biodiesel from agriculture machinery. Generators, heating, and lighting equipment are projected to fuel the biodiesel market growth. For instance, an estimated 14.3 light vehicles were sold in the United States in 2022.

Various governments worldwide support biodiesel production, which is estimated to reflect the growth of the biodiesel market. For instance, according to the Alternative Fuels Data Centre (AFDC), Advanced Biofuel Feedstock Incentives, Advanced Biofuel Production Grants and Loan Guarantees, Advanced Biofuel Production Payments, Advanced Energy Research Project Grants, Alternative Fuel Infrastructure Tax Credit, Alternative Fuel and Advanced Vehicle Technology Research and Demonstration Bonds, Biodiesel Education Grants, Biodiesel Income Tax Credit are a few of the incentives associated with the usage of biodiesel in the United States.

Furthermore, growing demand to include renewable energy sources in the application of many industries, increasing efforts from various governments to promote the use of biodiesel, and rising demand for clean fuels are expected to boost biodiesel market growth. The automotive and marine industries in the current world use most of the petroleum products extracted from crude oil. With the growing usage, these products emit greenhouse gas (GHG) and pollute the environment considerably. Biodiesel is environmentally friendly and can be used as a replacement for petroleum products. Due to this, the biodiesel market is expected to have lucrative opportunities during the forecast period. Countries such as the U.S., UK, Germany, Thailand, Indonesia, India, and China are focussing more on biodiesel production, and the usage of biodiesel among these countries is growing significantly, which is anticipated to generate an ample number of opportunities in the biodiesel market. In addition, growing R&D activities are estimated to offer growth possibilities.

MARKET RESTRAINTS

High costs associated with biodiesel production are key factors restraining market growth. Furthermore, fluctuations associated with petroleum prices and supply issues associated with crude oil are further anticipated to negatively impact the global biodiesel market growth. In addition, external factors such as wars between countries and the increased influence of political events on the crude oil industry are expected to impact biodiesel market growth significantly.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.81% |

|

Segments Covered |

By Blend, Feedstock, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Archer-Daniels-Midland Company, Ag Processing Inc., Avril Group, Biodiesel Bilbao S.L., Cargill Inc., Emami Agrotech Ltd, FutureFuel Chemical Company, G-Energetic Biofuels Private Limited, Louis Dreyfus Company, Münzer Bioindustrie GmbH, Renewable Energy Group, VERBIO Vereinigte BioEnergie AG, Wilmar International Limited and World Energy LLC., and Others. |

SEGMENTAL ANALYSIS

By Blend Insights

The B100 segment is anticipated to showcase the fastest CAGR in the global biodiesel market during the forecast period. The usage of B100 biodiesel is growing significantly among organizations, and increasing awareness among people regarding the environmental benefits associated with B100 biodiesel is promoting the segment’s growth. In addition, the B100 biodiesel, also called pure biodiesel, gives a greater performance advantage and enhanced maintenance when used in the fleet.

By Feedstock Insights

The vegetable oil segment has shown significant domination in the global market and accounted for 94.6% of the global biodiesel market in 2024. The domination of the vegetable oil segment is anticipated to continue throughout the forecast period. The feedstock is collected from vegetable oils such as rapeseed oil, soybean oil, and palm oil for biodiesel production. Biodiesel produced from vegetable oil releases less GHG emissions and costs less. Various countries across the world use different oils to produce biodiesel. For instance, soybean oil in the United States, rapeseed oil in European countries, and palm oil in APAC countries have been used in biodiesel production.

By Application Insights

The fuel segment led the biodiesel market and captured a dominating share of 76.4% of the global market in 2024. The domination of the fuel segment is attributed to the increased demand for biodiesel from the automotive, marine, agriculture, and railway industries. In addition, diesel usage is increasing among commercial vehicles, and many have started using biodiesel as a replacement for traditional diesel, knowing the advantages associated with biodiesel, such as less emission of GHG and improved efficiency, and higher lubricity. Therefore, the fuel segment is anticipated to register a healthy CAGR during the forecast period.

On the other hand, the power generation segment is forecasted to register the fastest CAGR among all the segments in the global biodiesel market during the forecast period. The demand for biodiesel in the power generation segment is growing significantly owing to the increased usage of biodiesel in generators as they release fewer toxic gasses and growing initiatives by the governments to promote the consumption of biodiesel.

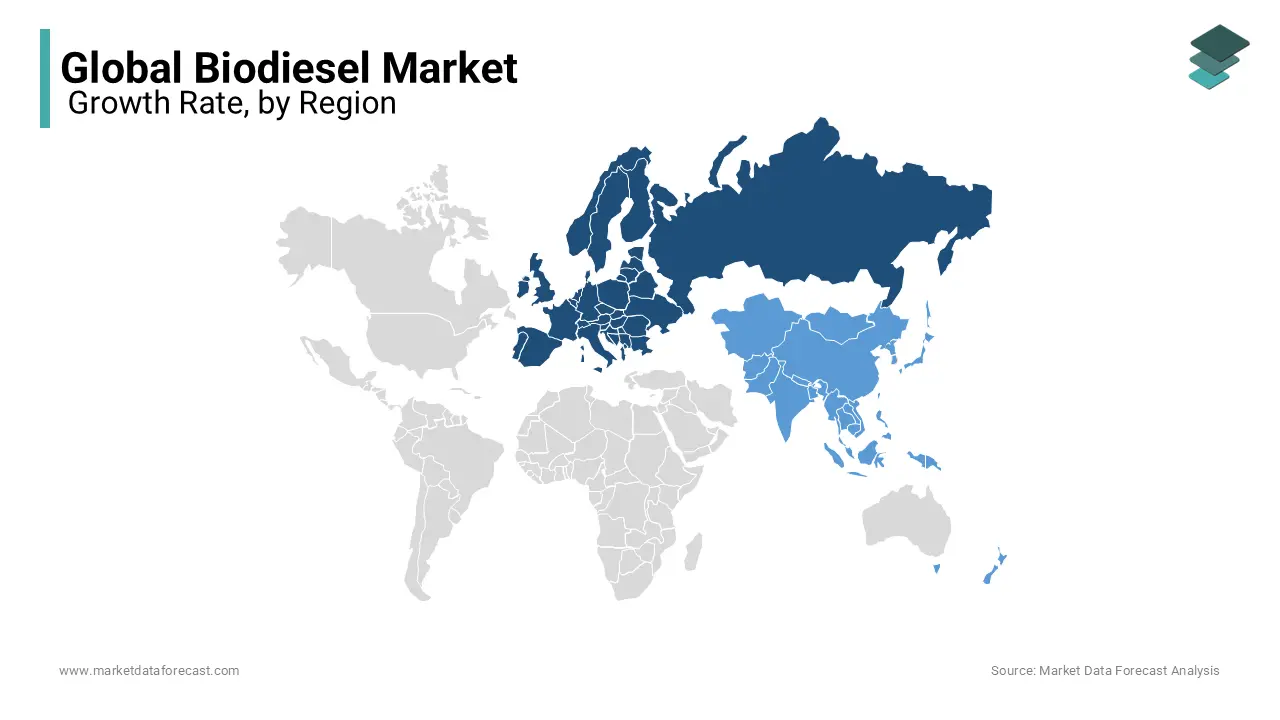

REGIONAL ANALYSIS

Geographically, the European region accounted for almost half the global market share in 2024. Europe is one of the promising regions in the global biodiesel market. Europe mainly uses rapeseed oil to produce biodiesel. The domination of Europe in the global market can be credited to the growing support from the E.U. governments and increased awareness of biodiesel among organizations. Europe is one of the early regions that started the adoption and usage of biodiesel, and governments of this region are putting significant effort into promoting the usage of biodiesel concerning environmental health. In this region, the German biodiesel market had the largest share in 2021 and is expected to continue holding a promising share during the forecast period. Germany has a greater capacity for feedstock production among all the European countries, giving it the competitive advantage to register as the lead in the European region.

The Asia-Pacific regional market is predicted to showcase the highest CAGR in the global market during the forecast period. Countries such as Thailand, Malaysia, and Indonesia play a vital role in the APAC market. A significant number of vehicles in Thailand are powered by diesel. Hence, the need for biodiesel is expected to be more in Thailand and making it one of the lucrative regions in the Asia-Pacific biodiesel market. On the other hand, countries such as Malaysia and Indonesia are responsible for 80% of palm oil production and are the primary source of biodiesel production in these countries. Therefore, Malaysia and Indonesia are expected to showcase healthy growth during the forecast period.

Furthermore, the increasing efforts from governments to encourage the consumption of clean fuels to limit GHG emissions and dependency on crude oil further promote the biodiesel market in Asia-Pacific. The Indian biodiesel market is expected to showcase healthy growth during the forecast period owing to the increasing initiatives by the Indian government related to biodiesel. For instance, the Indian government is looking forward to blending around 5% biodiesel by the finish of 2022.

KEY MARKET PLAYERS

Archer-Daniels-Midland Company, Ag Processing Inc., Avril Group, Biodiesel Bilbao S.L., Cargill Inc., Emami Agrotech Ltd, FutureFuel Chemical Company, G-Energetic Biofuels Private Limited, Louis Dreyfus Company, Münzer Bioindustrie GmbH, Renewable Energy Group, VERBIO Vereinigte BioEnergie AG, Wilmar International Limited and World Energy LLC are some of the leading companies in the global biodiesel market.

RECENT HAPPENINGS IN THE MARKET

- In December 2020, Neste and Carson entered a partnership and paved the way for cities to reduce GHG emissions.

- In February 2022, SLD Pumps & Power decided to use biodiesel to run their equipment fleet across the nation. This move by the company reduced their mineral diesel usage significantly.

- In April 2021, Continental Refining Company (CRC) further increased its investment of 20 million USD in the biodiesel project. This strategic move by the company aimed at installing a biodiesel facility at CRC.

- In January 2022, ExxonMobil bought a 49.9% stake in a biofuel manufacturer from Norway.

MARKET SEGMENTATION

This research report on the global biodiesel market has been segmented and sub-segmented based on the product, technology, application, and region.

By Blend

- B100

- B20

- B10

- B5

By Feedstock

- Vegetable Oils

- Animal Fats

- Used Cooking Oil (UCO)

- Other Feedstock

By Application

- Fuel

- Power Generation

- Other Applications

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the size of the global biodiesel market?

The global biodiesel market is expected to be worth USD 144.8 billion by 2027.

What are the factors driving the global biodiesel market?

Growing awareness around biodiesel and increasing government initiatives are propelling the biodiesel market growth.

What is the segmentation of the global biodiesel market by blend?

The global biodiesel market is segmented into B100, B20, B10, and B5.

Which region had a leading share in the global biodiesel market in 2021?

Europe held a significant share of the global market in 2021.

Who are the key players in the global biodiesel market?

FutureFuel Corp.; Ecodiesel Colombia S.A.; Manuelita S.A., TerraVia Holdings, Inc., Renewable Biofuels, Inc., Ag Processing, Inc., Archer Daniels Midland Company (ADM), Wilmar International Ltd., Bunge Ltd., Cargill, Inc., Louis Dreyfus Company, Biox Corp., Munzer Bioindustrie GmbH, Neste Oyj and Renewable Energy Group, Inc. are leading players in the biodiesel market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com