Global Building-Integrated Photovoltaic Market Size, Share, Trends, & Growth Forecast Report – Segmented By Technology (Crystalline Silicon, Thin Film, and Others), Application (Roofs, Walls, Glass, Façade, and Others), End-Use (Residential, Commercial, and Industrial), and Region – Industry Forecast 2024 to 2032

Global Building-Integrated Photovoltaic Market Size (2024 to 2032)

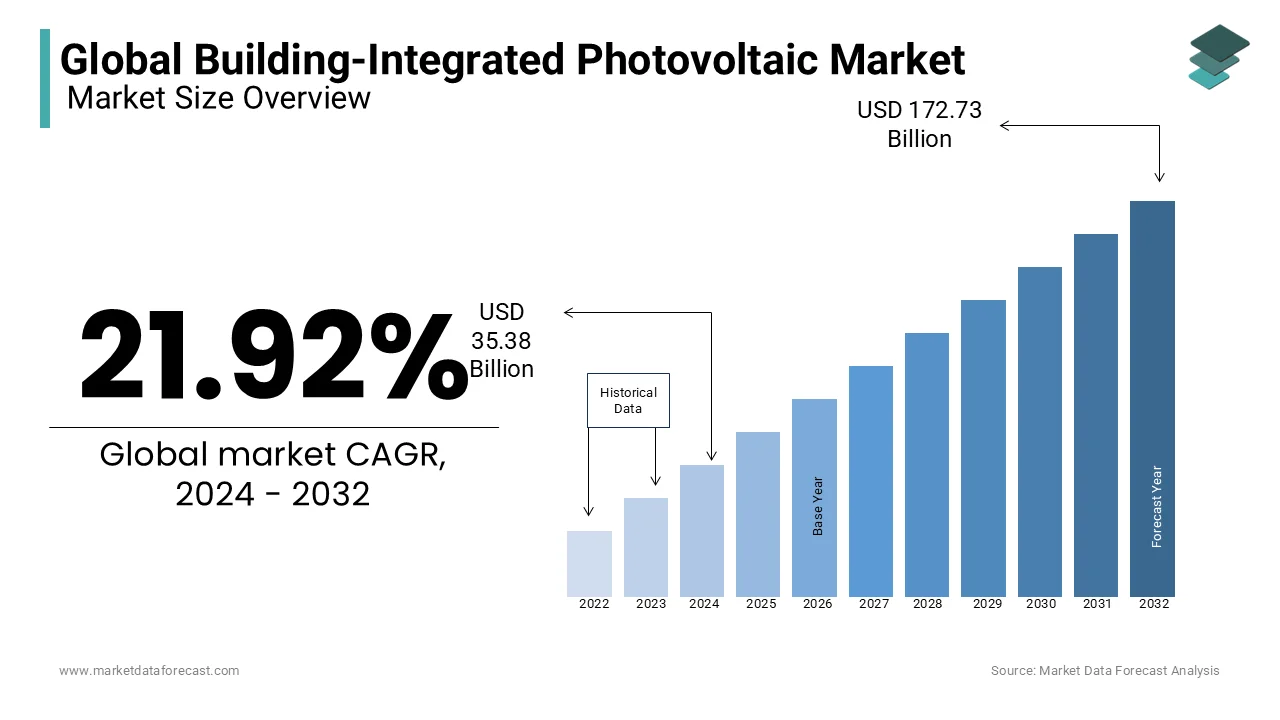

The Global Building-Integrated Photovoltaic Market was worth US$ 29.02 billion in 2023 and is anticipated to reach a valuation of USD 172.73 billion by 2032 from USD 35.38 billion in 2024 and is predicted to register a CAGR of 21.92% during the foreseen period.

MARKET SCENARIO

Solar power-generating components used in the construction of building facades, roofs, and skylights are known as building-integrated photovoltaics (BIPVs). Photovoltaic module integration, a backup generator supply system, a charge controller, a power storage system, and other supporting gear are all examples of these components. In a variety of ways, BIPV materials exceed their traditional counterparts, including onsite power generation, zero emissions, substantial energy savings, improved architectural integration, and optimal shading. BIPVs also help to minimize labor and installation costs by replacing gable roof membranes, skylight glass, and façade cladding, among other things. Building-integrated photovoltaic materials are widely used in the corporate, home, and manufacturing industries due to these benefits.

Renewable energy resources have been rapidly gaining traction in various parts of the world in recent years. Furthermore, the growing global population has provided a foundation for the rise of both the energy and building industries. Solar photovoltaics is one of the most important forms of renewable energy. Solar PV modules utilized in the building's exteriors, such as rooftops, windows, and curtain walls, are known as building-integrated photovoltaics. Building-integrated photovoltaics contribute to the building's economic and aesthetic well-being. Building-integrated photovoltaics are being used to replace traditional building materials in both commercial and residential construction.

MARKET GROWTH

Over the projection period, the presence of a customer base with high discretionary income levels and an increasing inclination for integrated installations in residential and commercial structures in the country is expected to enhance demand for the product.

MARKET DRIVERS

Increased integration of solar energy solutions in commercial infrastructures for architectural optimization and energy conservation is driving demand for building integrated photovoltaic materials.

Furthermore, rising environmental worries about nonrenewable energy resources such as oil and coal are driving up demand for solar power generation. Furthermore, increased demand for green or zero-emission buildings has resulted from rapid modernization in the construction and building sector, as well as an increased focus on clean energy. Furthermore, as consumer knowledge of the numerous environmental benefits of BIPV grows, so does home usage of solar energy harvesting devices.

The sector is predicted to grow over the next five years as national governments increase their efforts to install solar energy panels. Demand for building-integrated photovoltaics is expected to rise as people become more aware of infrastructure development, particularly energy-efficient buildings (BIPV). BIPV is a long-term and cost-effective way to improve the structure's fuel economy, change the façade, and reduce traditional power use. Furthermore, higher household adoption of solar energy harvesting systems has resulted from improved consumer awareness of the health benefits of BIPV. Aside from that, favorable government laws, bolstered by a slew of initiatives emphasizing the need to reduce carbon footprints, have fueled global demand for building-integrated photovoltaics market growth.

MARKET RESTRAINTS

Buildings that use BIPV (building-integrated photovoltaics) technology become energy producers rather than energy consumers.

In order to accomplish this, building technology must be combined with BIPV technology. For curtain walls and other features of structures, photovoltaic (PV) technology is new and pricey. Furthermore, during the projection period, the building-integrated photovoltaics market in Vietnam, the Philippines, and certain African nations is projected to be hampered by a lack of understanding of and inadequate marketing of BIPV products.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

21.92% |

|

Segments Covered |

By Technology, Application, End-Use, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Scheuten Solar, Wurth Solar, Dow Solar, Suntench Power, Belectric, Dyesol Ltd., Hanergy Holding Group Limited, Ertex Solartechnik GmbH, Canadian Solar Inc, and Others. |

SEGMENTAL ANALYSIS

Global Building-Integrated Photovoltaic Market Analysis By Technology

In 2021, the crystalline silicon category dominated the market, accounting for 71.02% of global sales. Smart mounting solutions that replace portions of the roof while maintaining its integrity can be used to integrate crystalline silicon cells into building roofs. This type of integration requires no major investments and is quite efficient. Replacement of roof tiles with crystalline silicon cells is another alternative for integration. Anti-reflective coatings, which aid in the capture of solar energy and give higher efficiency, are also being used on the market. Commercial modules typically convert 13–21% of incoming sunlight into electricity, with crystalline silicon having the best energy conversion efficiency.

Global Building-Integrated Photovoltaic Market Analysis By Application

In 2021, the roof installation category dominated the market, accounting for more than 61.46 percent of total revenue. Throughout the predicted period, the roof segment will continue its lead. Because of the increased incidence of light on the roof surface, photovoltaics integrated with building roofs are known to be efficient. Because of their increasing resilience and visual attractiveness, integrated roofs and skylights had the largest market share in 2021. The demand for building integrated roofs is likely to rise throughout the forecast period as better solutions become available.

Global Building-Integrated Photovoltaic Market Analysis By End Use

In 2021, the industrial segment dominated the market with a 40.13% share. The increased use of building-integrated photovoltaics to lessen dependency on non-renewable energy sources is predicted to boost demand for building-integrated photovoltaics in industrial applications. With increased adoption in the European region, the category is expected to grow. Furthermore, in order to improve the aesthetic appeal of buildings, enterprises in developed economies in Europe are increasingly turning to integrated photovoltaics.

REGIONAL ANALYSIS

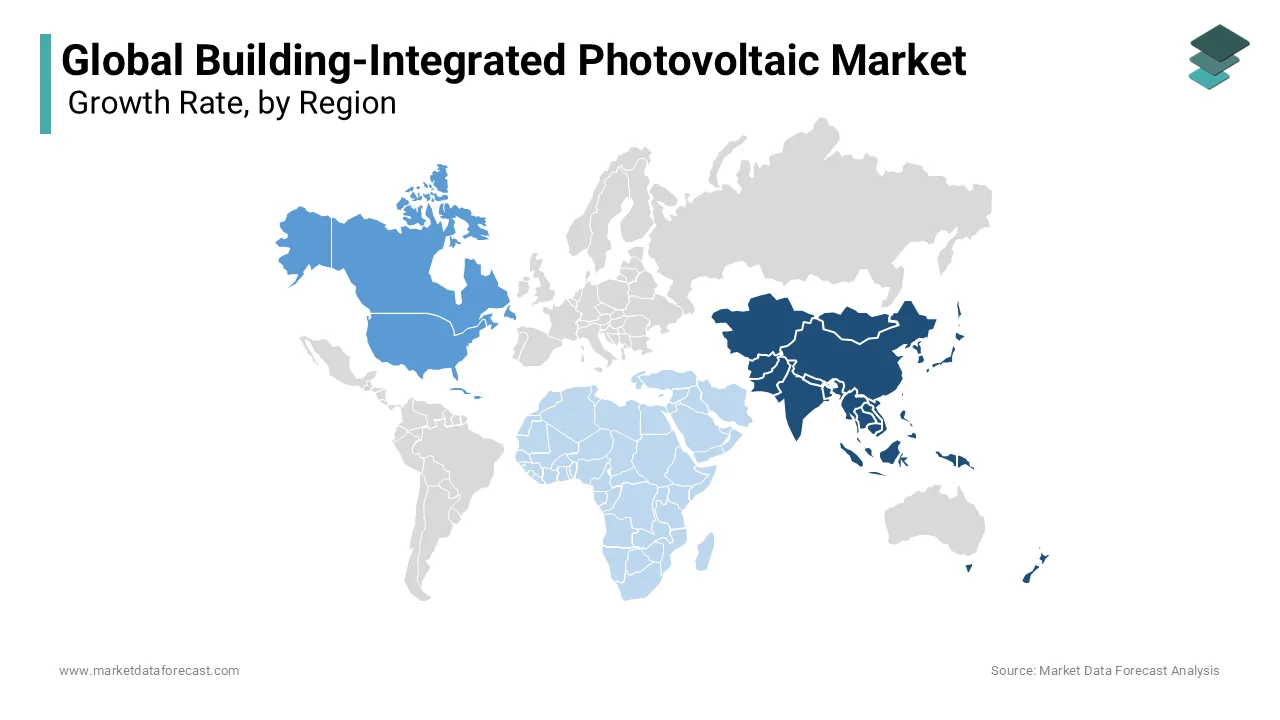

In several industries, the Asia-Pacific region has been extremely successful in deploying solar PV technologies in the most cost-effective manner. The region's technology has attained maturity, with prices continuing to fall. Countries such as China, India, Japan, and ASEAN have shown themselves in the solar power generation field with new creative technology for BIPV, rooftops, and a variety of other uses. China's production size in the PV industry for each technology accounted for more than half of the global total and is projected to continue at the top in the near future. Other regions of the region had similar trends. Other regions of the region had similar trends. AGC Inc., a Japanese glass, chemicals, and high-tech materials company, said in September 2021 that its BIPV glass has been chosen to be placed at the Singapore Institute of Technology's new Punggol campus, which is expected to open in 2024. China Southeast Space Frame Group (SSFG) and back sheet producer First PV formed a new joint venture business in September 2021 to install 950 MW of BIPV capacity in China over the following five years. Hangzhou, Zhejiang province, will be the new company's headquarters. As a result of these developments, Asia-Pacific is predicted to have the fastest growth rate in the next years.

The building-integrated photovoltaic market in North America is predicted to rise as the construction sector in the United States expands due to increased commercial space.

Because of the region's growing tourism, the Middle East and Africa region are likely to see a continuous increase in commercial structures. The Middle East and Africa region's construction industry is likely to boost the building-integrated photovoltaics market in the future years.

KEY PLAYERS IN THE GLOBAL BUILDING-INTEGRATED PHOTOVOLTAIC MARKET

Companies playing a prominent role in the global building-integrated photovoltaic market include Scheuten Solar, Wurth Solar, Dow Solar, Suntench Power, Belectric, Dyesol Ltd., Hanergy Holding Group Limited, Ertex Solartechnik GmbH, Canadian Solar Inc., and Others.

RECENT HAPPENINGS IN THE GLOBAL BUILDING-INTEGRATED PHOTOVOLTAIC MARKET

- Hevel Group, a Russian solar module, and cell producer have unveiled a novel heterojunction-based building-integrated PV solution. Hevel claims that the BIPV product, developed at its Research and Development Centre (R&D Centre), is made up of cells with efficiencies of up to 24.2%, outperforming regular monocrystalline and polycrystalline PV products.

- Taipower, Taiwan's power utility, owns the Sun Rock building. MVRDV, a Dutch design firm, covered it with 4,000 square meters of PV panels. The Sun Rock building, located near Taichung in the Changhua Coastal Industrial Park, serves as a storage and repair facility for renewable energy equipment.

DETAILED SEGMENTATION OF THE GLOBAL BUILDING-INTEGRATED PHOTOVOLTAIC MARKET INCLUDED IN THIS REPORT

This research report on the global building-integrated photovoltaic market has been segmented and sub-segmented based on technology, application, end use and region.

By Technology

- Crystalline Silicon

- Thin Films

- Others

By Application

- Roofs

- Walls

- Glass

- Façade

- Others

By End Use

- Residential

- Commercial

- Industrial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What can be the total Building-Integrated Photovoltaic market value?

The building-integrated photovoltaic market was worth USD 29.02 billion in 2023, and it will reach a valuation of USD 172.73 billion by 2032.

Mention the market which has the largest share in the building-Integrated photovoltaics market?

The Asia-Pacific region have the largest market share of the global building-Integrated photovoltaics market.

Name any three Building-Integrated Photovoltaic market key players?

Scheuten Solar, Wurth Solar and Dow Solar are the three building-Integrated photovoltaics key players.

What is the major effecting factor in the global Building-Integrated Photovoltaic market?

Increasing inclination for integrated installations in residential and commercial structures are influencing elements in the worldwide building-Integrated photovoltaics market.

What is a restraining factor in the global Building-Integrated Photovoltaic market?

A lack of understanding of and inadequate marketing of BIPV products can hamper the market growth.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com