Global Car Care Products Market Size, Share, Trends, & Growth Forecast Report, Segmented Product Type (Polishing & Waxing, Cleaning & Caring, and Sealing Glaze & Coating), Distribution Channel (DIFM/Service Centers and DIY/Retail Stores), Solvent Type (Foam-Based Solvents and Water-Based Solvents), Consumption (Autocare Shops, Individual Sources, and Service Centers & Garages), Application (Exterior and Interior) And By Region (North America, Europe, Latin America, Asia-Pacific, Middle East and Africa), Industry Analysis From 2025 to 2033

Global Car Care Products Market Size

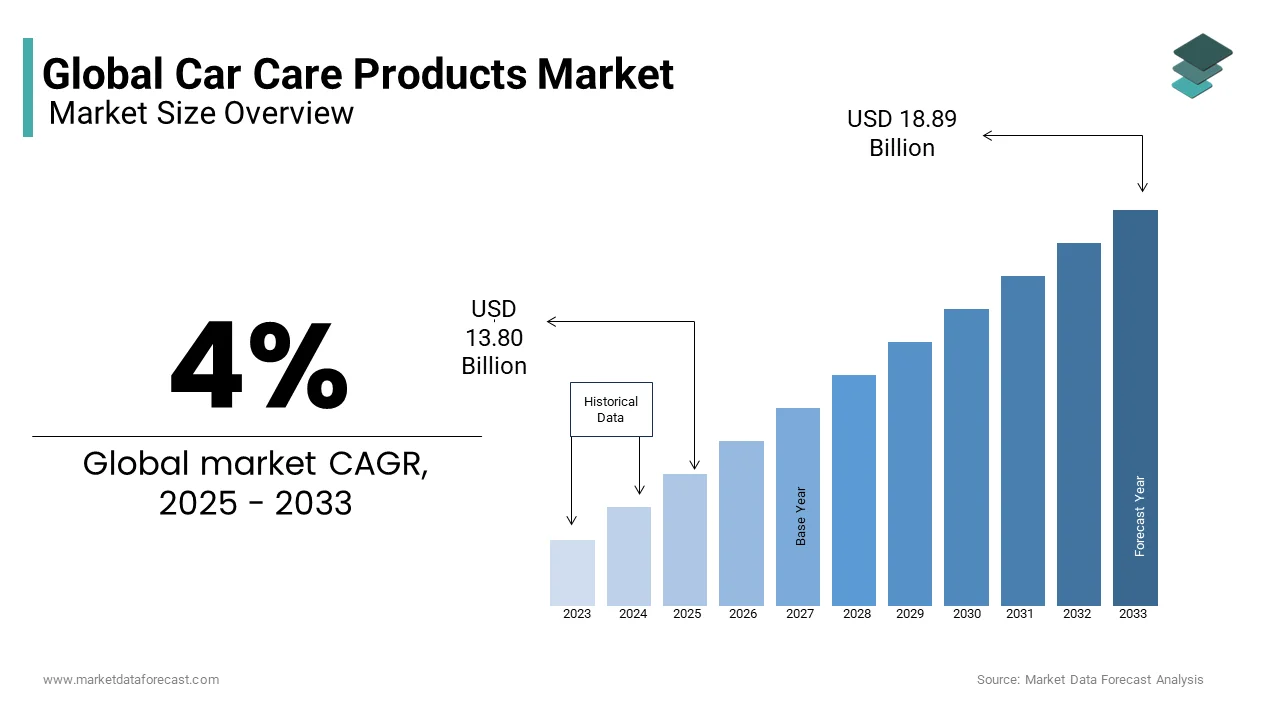

The global car care products market was valued at USD 13.27 billion in 2024 and is anticipated to reach USD 13.80 billion in 2025 from USD 18.89 billion by 2033, growing at a CAGR of 4.0% during the forecast period from 2025 to 2033.

Car care products are high-performing chemicals that are used to increase the aesthetic appearance of the cars alongside improving the longevity of the vehicles. Aside from this, these products not only enhance the shine and gloss of the vehicles while protecting the visual appeal of the cars. Growth in the availability of water-based solvents, consumer awareness towards vehicle maintenance, demand in new car sales, increase in the income of consumers, advancements in car wash technology, etc., are a number of the main factors for the expansion of the market.

MARKET DRIVERS

Major driving factors of the global car care products market are in the rising phase via service and manufactures in connected, autonomous, shared, and electrified, are going to be the long term of the industry and involve significant additional investments, and so as to finance. Consumers became extra aware of the benefits of car wash services, like improved shine and safety. Also, the rise in environmental awareness among consumers is supporting the expansion of automobile care products. A replacement phase of consolidation and partnerships is predicted within the global auto industry. A surge in demand in emerging markets is supporting the mid-term perspectives of the car business. Intensifying consumer appetite for alternative-fuelled vehicles and new mobility services via care products also boosts this business expansion.

MARKET RESTRAINTS

High costs act as a uniform and serious deterrent across the world. Developing countries and less-developed countries are less likely to use care tools because of their lack of awareness and buying power. The usage of specific care tools also poses disadvantages. For instance, frequent application of car polish degenerates the wax layering, which ultimately makes the car more vulnerable to corrosion. Beautification could also cause damage to the car's exterior. Pressure washers could create dents on the car's surface which is likely to impact the expansion of automotive care negatively.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.0% |

|

Segments Covered |

By Product Type, Solvent Type, Application, Consumption, Distribution Channel, and Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

3M Corp, Northern Labs, Liqui-Moly GmbH, Soft99 Corporation, Autoglym, Simoniz USA, Sonax Gesellschaft MBH, Tetrosyl Ltd., Turtle Wax Inc., Guangzhou Billabong Car Care Industries Company Ltd., Armored Auto Group, Illinois Tool Works, Auto Magic, Bullsone, Jopasu Systems Pvt Ltd, and Würth Group, and Others. |

SEGMENTAL ANALYSIS

By Product Type Insights

The product segment comprises various products like wheel care, interior and exterior care, paint cleaning and protection, paint restoration for old vehicles, etc. Recent innovations like bio-based car wash detergents and soaps are creating an impactful trend and shaping the merchandise innovation strategies of manufacturers. Simple use and comparatively affordable price points still influence sales potential for cleaning and care products.

By Solvent Type Insights

Major care manufacturers have pushed much more toward water-based solvents because the market is price-sensitive. Therefore, the raw materials needed for this sort of solvent cost less. Many countries within the world face acute water shortages, and hence governments have imposed rules and regulations regarding the usage of water for the car wash. Many care products, like shampoos, polish wax, etc., don't require water to wash the surface after their application but are often wiped off the surface with a dry cloth/microfiber cloth.

By Application Insights

Interior car service includes more effort and time than exterior detailing. An unclean interior cabin not only features a bad odor but also adds to operational complications. Dirty air exhaust spreads allergies through the cabin, stains and grit cause the sensors and switches to fail, and screened windows can obstruct the view of the driving force. Hence cleaning car interiors is entirely just washing with soap and water. Cleaning of interiors like the dashboard, floor mats, carpets, upholstery, etc., is achieved through steam cleaning and vacuuming techniques.

By Distribution Channel Insights

Service centers account for a prominent share of the global car care products market and are likely to witness steady growth in the coming years.

REGIONAL ANALYSIS

The demand for car care products has seen rapid increases in the U.S. North America projected growth with a market share of 32.33%. Europe is the largest supplier because of the steadily growing regional marketplace for care products and holds a 38.05% share within the global market.

Asia Pacific is predicted to carry the most important share of the market during the forecast period. Over the last decade, the Asia Pacific automotive industry has undergone the best transformation in its history. Asia is taking an increasing share of worldwide vehicle sales and is the only major market expected to ascertain continued strong growth in both the medium and future in China, India, Malaysia, and other developing markets in Southeast Asia. In China, for instance, the rising demand will continue driving the steady growth of the Chinese auto market, with the markets for brand-spanking new purchases and replacement of vehicles growing rapidly.

KEY MARKET PLAYERS

3M Corp, Northern Labs, Liqui-Moly GmbH, Soft99 Corporation, Autoglym, Simoniz USA, Sonax Gesellschaft MBH, Tetrosyl Ltd., Turtle Wax Inc., Guangzhou Billabong Car Care Industries Company Ltd., Armored Auto Group, Illinois Tool Works, Auto Magic, Bullsone, Jopasu Systems Pvt Ltd, Würth Group. These are some of the market players dominating the car care products market.

RECENT HAPPENINGS IN THE MARKET

- Automotive lubricant brand, Castrol India Limited (Castrol) has come up with 3M India Limited (3M) to bring a variety of market-leading vehicle care products to the automotive aftermarket.

- Mercedes-Benz introduces a waterless car cleaning solution alongside a variety of eco-friendly care products in India.

- Maruti Suzuki India has introduced its Ecstar brand within the Indian car market. Ecstar is the company's global brand of coolants, lubricants, and care products.

MARKET SEGMENTATION

This research report on the global car care products market is segmented and sub-segmented into the following categories.

By Product Type

- Cleaning and Caring

- Polishing and Waxing

- Sealing glaze and coating

- Other products

By Solvent Type

- Water-Based Solvents

- Foam-Based Solvents

By Application

- Interior

- Exterior

By Consumption

- Autocare Shops

- Service Centre and Garages

- Individual Sources

By Distribution Channel

- DIY/Retail Stores

- DIFM/Service Centres

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is driving the growth of the global car care products market?

Rising vehicle ownership and demand for maintenance are fueling market growth.

Which car care product segment holds the largest market share?

Cleaning and detailing products lead due to high consumer preference.

Who are the key players in the global car care products industry?

Major brands include 3M, Turtle Wax, Meguiar’s, and Armor All.

Which regions dominate the car care products market?

North America and Europe hold strong positions due to a high car culture.

How is e-commerce impacting the car care product sales?

Online platforms are boosting accessibility and driving global sales.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com