Global Carbon Black Market Size, Share, Trends & Growth Forecast Report By Type (Furnace Black, Channel Black, Thermal Black, Acetylene Black And Others), Pigment Source (Ivory Black, Vine Black And Lamp Black), Application (Tires, Non-Tire Rubber, Inks & Coating, Plastic And Others), Grade (Standard Grade, Specialty Grade), and Region (North America, Europe, Asia Pacific, Latin America, Middle east and Africa), Industry Analysis (2024 to 2032)

Global Carbon Black Market Size

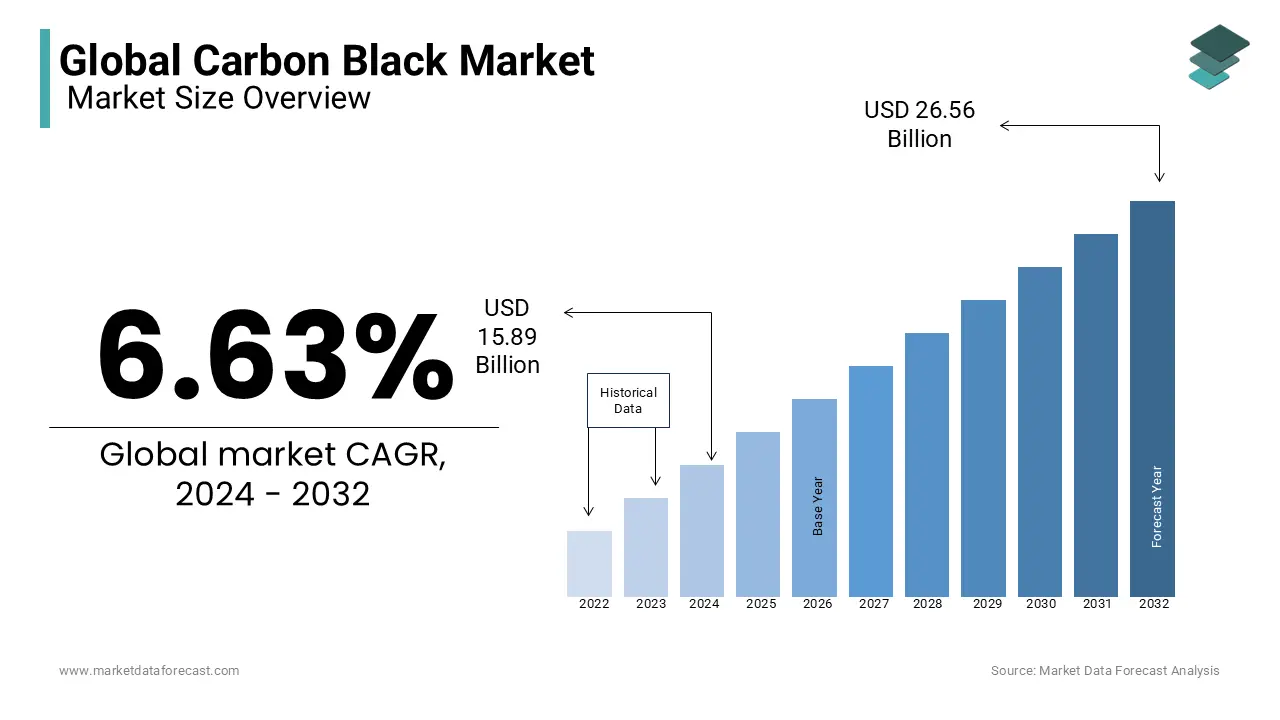

The size of the global carbon black market was valued at USD 14.9 billion in 2023. The global market is further expected to grow from USD 15.89 billion in 2024 to USD 26.56 billion by 2032, growing at a CAGR of 6.63% from 2024 to 2032.

Carbon black is a significant product and is employed in making tires, plastics, mechanical rubber goods, printing inks, and toners. It can absorb UV light and convert it into heat, therefore used in polymer businesses. It is also employed in insulating wires and cables. It finds application in a broad range of rubber products and pigments. It is a cost-effective rubber reinforcing agent used in tires. Carbon black is pure elemental carbon that is like fine or aggregate particles that are made by incomplete combustion or decomposition of hydrocarbons in controlled temperature and pressure. It is usually made with the help of heavy aromatic oils as feedstock, and it is applied in different materials in order to enhance their performance based on physical, electric, and optical properties.

MARKET DRIVERS

Growing Demand for Specialty-Grade Carbon Black

Escalating calls for specialty-grade carbon black for employment as a pigment in coatings, plastics, and other businesses have augmented dominating carbon black makers to boost their production capacity for specialty–grade carbon black. Factors that drive the expansion of the global carbon black market are the rise in the call for carbon black from tire and construction & manufacturing businesses, where it is employed to offer strength to industrial rubber compounds and other equipment. In addition to that, it has physical properties like color stability, solvent resistance, and thermal stability, which is why it is broadly employed in the paint and coating businesses. A significant driver in the carbon black market is the expansion in the automotive industry.

Rising Usage of Carbon Black In Various Industries

The high development in the chemical and automobile business and naturally available primary resources are actively driving the global carbon black market. The flourishing construction and manufacturing segments are also driving the market expansion. These segments highly use industrial rubber and other related equipment, of which carbon black forms a major part. Furthermore, in the paints and coatings business, it is employed in jet-black paints, which act as a protective coating for different products. Apart from this, as the mixture of carbon black and cement leads to improved uniformity, surface hardness, tensile strength, and compressive strength, there has been a rise in the demand for carbon black in the construction business.

MARKET RESTRAINTS

Changes in prices of raw materials and dangerous gases emitted into the atmosphere throughout the making of carbon black are key restraining factors for the worldwide carbon black market. The external alteration of carbon black by other materials like precipitated silica or nano-silica is another restraint of the carbon black business.

MARKET OPPORTUNITIES

The rise in the call for carbon black, owing to its UV protection and conductive properties in plastics, is estimated to create the latest opportunities for the expansion of the market.

MARKET CHALLENGES

The market is challenged by changing rules leading to the replacement of carbon black with silica as a reinforcing agent in tire manufacturing. However, bolstering the automotive aftermarket and construction segment in rising economies is posing a significant opportunity for further expansion of the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

6.63% |

|

Segments Covered |

By Application, Type, pigment source, grade, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Phillips Carbon Black Limited (India), Black Bear Carbon BV (Netherlands), Longxing Chemical Group, Birla Carbon/Thai Carbon Black Public Company Limited (Thailand), Mitsubishi Chemical Corporation (Japan), Pyrolyx AG (Germany), Cabot Corporation (U.S.), Nippon Steel & Sumikin Chemical Co. Ltd. (Japan), OCI Company Ltd. (South Korea), Continental Carbon Company (US) |

SEGMENTAL ANALYSIS

By Type Insights

This is due to the fact that furnace black is the most widely used type of carbon black due to its ability to be mass-produced with different particle sizes and structures.

By Pigment Source Insights

The vine and lamp black pigments are produced from the charring of dried grape stems and soot of oil lamps, respectively.

By Application Insights

The tires section of applications is responsible for the majority of the market income. The wide range of applications in the automobile industry is the reason for its leading growth rate in the aforementioned forecast period. Applications in the automobile industry include inner-liners, sidewalls, carcasses, and thread,s among others.

By Grade Insights

Among the two types of grades, the standard grade segment has witnessed fast growth as they are widely used in most applications, whereas specialty grade carbon black also has a growth rate close to that of standard grade.

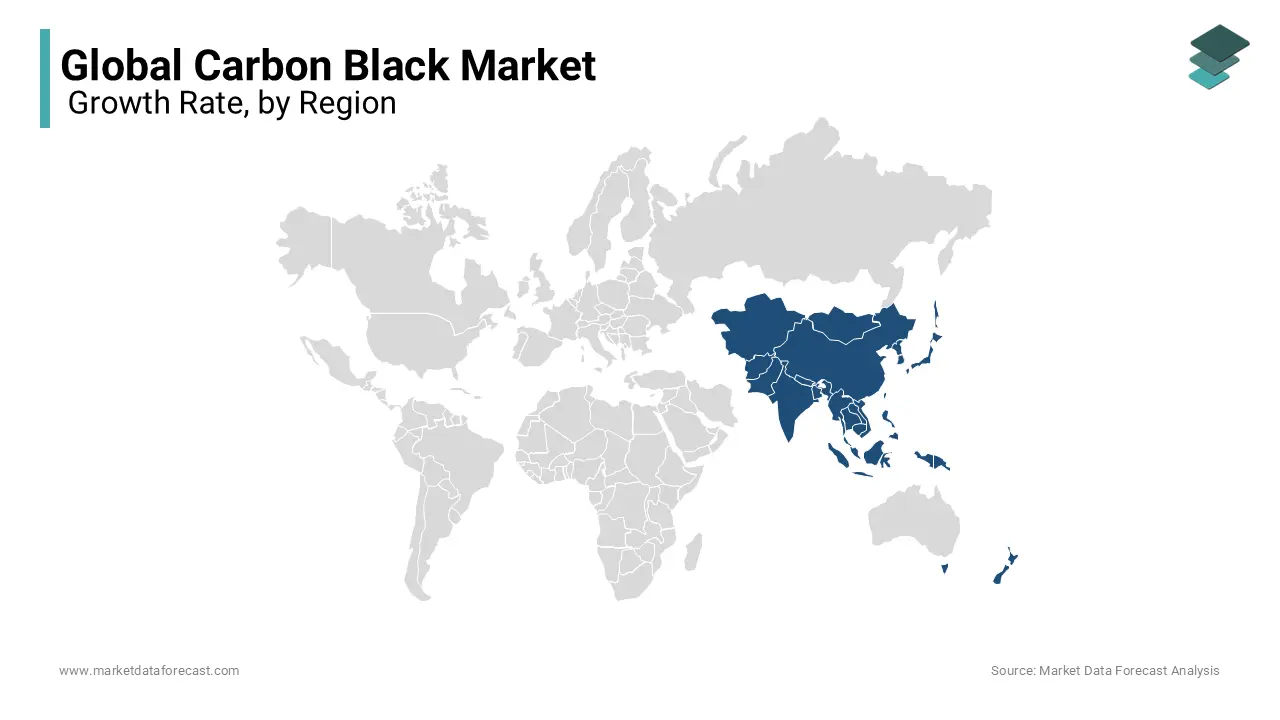

REGIONAL ANALYSIS

Asia Pacific Carbon Black Market had the largest global market share in the year 2023 and is expected to be the fastest-growing market in the forecast period. Due to its high CAGR, increasing demand for growing industries, and the scope of future opportunities, mainly in developing countries like Japan, India, and China. The market value of Europe and North America is much lower than that of Asia Pacific. Asia-Pacific dominates the business share in the global carbon black market and also has makers producing carbon black at the lowest cost. China is the biggest manufacturer and supplier of carbon black worldwide and customers more than one-third of the total global carbon black market volume. The competitive scenario regarding the pricing of carbon black is showcasing to lower the carbon black business by several companies in North America and Europe as countries in the Asia-Pacific region is producing carbon black at relatively lower prices. This has resulted in the migration of production facilities of producers to Asia-Pacific in order to remain competitive in the market by minimizing production expenses. The rising application of the material in several sectors of plastic, such as molding, film, pipe, fiber, and cable, is growing the global carbon black market size.

KEY MARKET PLAYERS

Phillips Carbon Black Limited (India), Black Bear Carbon BV (Netherlands), Longxing Chemical Group, Birla Carbon/Thai Carbon Black Public Company Limited (Thailand), Mitsubishi Chemical Corporation (Japan), Pyrolyx AG (Germany), Cabot Corporation (U.S.), Nippon Steel & Sumikin Chemical Co. Ltd. (Japan), OCI Company Ltd. (South Korea), Continental Carbon Company (US), Omsk Carbon Group (Russia), Shandong Huadong Rubber Materials Co., Ltd. (China), Orion Engineered Carbons SA (Luxembourg), Imerys Carbon & Graphite (Switzerland), Tokai Carbon Co., Ltd. (Japan), and Asahi Carbon Co. Ltd. (Japan) is the leading shareholders of the Global Carbon Black market. These companies are currently focused on expansion strategies to improve their market value and position.

RECENT HAPPENINGS IN THE MARKET

-

Cabot China Limited, a wholly-owned subsidiary of Cabot Corporation (NYSE: CBT), agreed to buy Shenzhen Sanshun Nano New Materials Co., Ltd (SUSN), a dominating carbon nanotube (CNT) producer in China, for around $115 million in enterprise worth, which includes liabilities and contingent payments, company officials declared.

MARKET SEGMENTATION

This research report on the global carbon black market has been segmented and sub-segmented based on type, pigment source application, grade, and region.

By Type

- Acetylene

- Furnace

- Channel

- Thermal

- Others.

By Pigment Source

- Ivory Black

- Vine Black

- Lamp Black

- Ivory black

By Application

- Tyres

- Non-Tyre Rubber

- Inks & Coatings

- Plastic

- Others

By Grade

- Standard Grade

- Specialty Grade.

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]