Global Cardiovascular Monitoring & Diagnostic Devices Market Size, Share, Trends & Growth Forecast Report By Product(ECG Systems, Resting ECG Systems, Stress ECG Systems, Event Monitors, Holter Monitors, Implantable Loop Recorders, ECG Management Systems) & Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa), Industry Analysis From 2025 to 2033

Global Cardiovascular Monitoring & Diagnostic Devices Market Size

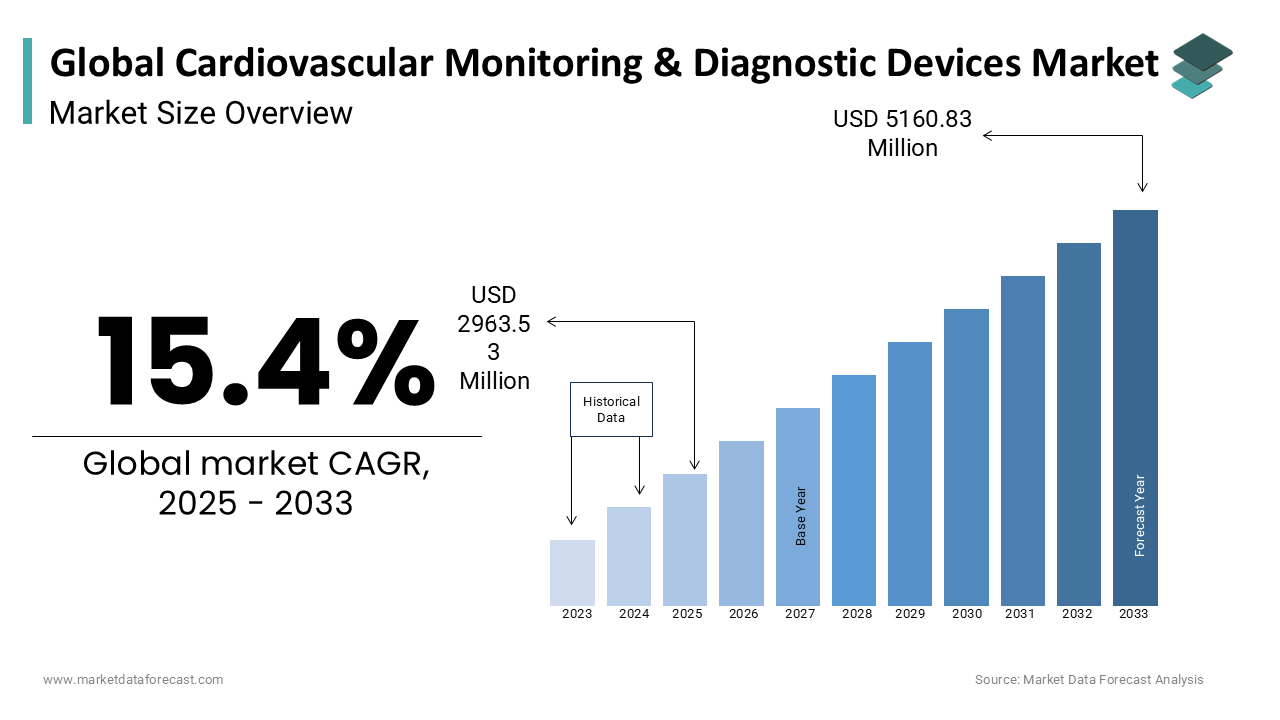

The global cardiovascular monitoring and diagnostic devices market size was valued at USD 2765 million in 2024. The global market is estimated to exhibit a CAGR of 7.18% from 2024 to 2033 and be worth USD 5160.83 million by 2033 from USD 2963.53 million in 2025.

The demand for cardiovascular monitoring and diagnostic devices is eventually rising with the growing number of people diagnosed with heart-related issues. Cardiovascular monitoring devices help monitor the heart by measuring and recording its electrical activity. These recordings help professionals to make necessary treatment options. Advanced technologies in the healthcare sector are attributed to the launching of various devices that lower the risk of life-threatening incidences by diagnosing the disease at an early stage. Launch of monitoring the heart rhythm remotely through small devices that transfer the recording of the heartbeats through wireless technology that reduces the patient’s visits to the doctor. The doctor can review the heart’s health through the recording and promote efficient healthcare options. According to the British Heart Foundation, a quarter of deaths every year in the UK are due to heart disease, which is around 1,40,000 deaths each year. Around 2.3 million people in the UK are suffering from various kinds of heart-related diseases. These statistics are likely to showcase huge opportunities for the cardiovascular monitoring and diagnostic devices market.

MARKET DRIVERS

Growing Prevalence of CVDs

Cardiovascular diseases are the primary cause of death and witnessing a high rise in prevalence. Many people are being diagnosed with cardiovascular diseases such as periphery artery diseases, coronary artery diseases, congenital heart diseases, and pulmonary conditions, shifting the focus toward preventative healthcare. Increasing the risk of hypertension, heart muscle weakness, increasing the number of people who have diabetes, and obesity are the major factors driving the market. Technological advancements have enabled additional features such as portability in performing various tests, which further add to the growth of the cardiovascular monitoring market. With the newly innovative developments for diagnosing and treating cardiovascular diseases, the cardiac monitoring and diagnostic devices market is growing at a lucrative rate. The demand for cardiac monitoring and diagnostic products is powered by increased awareness of a healthy lifestyle. Increasing expenditure in the manufacturing of medical devices is also one of the compelling reasons for expanding the global market for diagnostic devices and cardiovascular monitoring. At the very same time, the untapped demand is creating new opportunities for the cardiac monitoring and diagnostic devices market throughout the coming period, together with the latest rising technological developments in cardiovascular care and diagnostics.

MARKET RESTRAINTS

Lack of Standardization

Lack of standardization is one of the major factors in the cardiovascular monitoring and diagnostics devices market. In addition to this, the high cost of installation and maintenance of the devices is merely to stymie the growth rate of the market. In developed and emerging countries, the cost of surgeries is very high due to the advancement in technologies, and a lack of support from government officials will certainly degrade the market’s size in the coming years. Lack of awareness of the importance of diagnostic procedures that eventually reduce the risk of heart failure among people, especially in rural areas, is also impeding the value of cardiovascular monitoring and diagnostic devices in the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2023 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product & Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

GE Healthcare, Philips Healthcare, Siemens Healthcare, Boston Scientific Corporation, St. Jude Medical, Inc., Nihon Kohden Corporation, Welch Allyn, Inc., Spacelabs Healthcare, LivaNova PLC, and Hill-Rom Holdings, Inc. |

SEGMENTAL ANALYSIS

By Product Insights

The ECG systems segment accounted for the largest share of the market and is expected to maintain its stronghold in the market during the forecast period due to widespread availability and increasing preference for these devices in developed and developing regions.

REGIONAL ANALYSIS

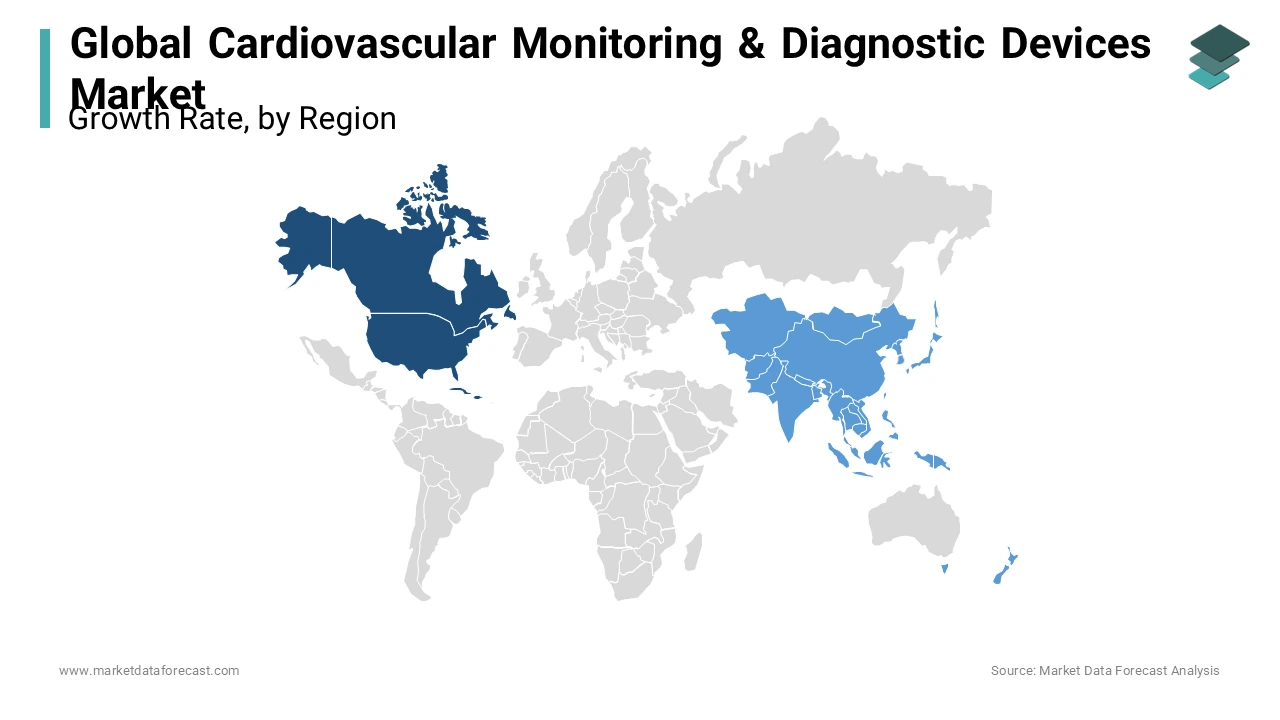

North America is the largest market for cardiovascular diagnostic and monitoring devices market. It is expected to sustain its substantial share owing to its favorable reimbursement policies and high awareness about available diagnosis and treatment methods among patients and physicians.

Asia-Pacific is estimated to be the fastest-growing region during the forecast period due to raising awareness about accessible devices' effectiveness in successfully curing several cardiovascular conditions and increasing healthcare spending.

Also, developing and emerging economies like China and India provide lucrative opportunities for growth for the market players during the forecast period.

KEY MARKET PLAYERS

GE Healthcare and Phillips Healthcare dominated the global Cardiovascular Monitoring and Diagnostic Devices Market, accounting for an approximately 50% share. Other major players covered in the report are Siemens Healthcare, Boston Scientific Corporation, St. Jude Medical, Inc., Nihon Kohden Corporation, and Welch Allyn, Inc.

RECENT MARKET DEVELOPMENTS

-

Abbott Laboratories (US) has a fair share of the market for cardiac monitoring and heart rhythm control products. The company spends heavily on R&D programs to improve its market position. In 2018, Abbott spent 7.5 percent of its overall income (USD 2.30 billion) in R&D activities, of which the Cardiovascular & Neuromodulation division invested USD 1 billion. Implementation of this project is progressing, although it may hamper the brand value of its goods sold in this market.

-

SCHILLER China set up its sales and marketing department in Guangzhou in 2018. The new site has taken the company's activities closer to consumers in southern and eastern China.

- In early 2019, ZOLL Medical signed a definitive agreement to buy Cardiac Science Corporation (CSC) to reinforce its position in the automated external defibrillator section.

- At the end of 2020, Rivacor VR-T, Rivacor DR-T, Rivacor HF-T QP, Actor DX, Actor CRT-DX Bipolar, and Acticor CRT-DX obtained FDA approval.

MARKET SEGMENTATION

This research report on the global cardiovascular monitoring and diagnostic devices market has been segmented and sub-segmented into the following categories.

By Product

- ECG Systems

- Resting ECG Systems

- Stress ECG Systems

- Event Monitors

- Holter Monitors

- Implantable Loop Recorders

- ECG Management Systems

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle-East and Africa

Frequently Asked Questions

What is the current size of the cardiovascular monitoring and diagnostic devices market?

The global cardiovascular monitoring and diagnostic devices market was valued at USD 2760.85 million in 2024.

What are the factors driving the growth of the cardiovascular monitoring and diagnostic devices market?

The increasing prevalence of cardiovascular diseases, rising demand for non-invasive diagnostic techniques, technological advancements, and the growing geriatric population are some of the key factors driving the growth of the cardiovascular monitoring and diagnostic devices market.

Who are the key players in the cardiovascular monitoring and diagnostic devices market?

Abbott Laboratories, GE Healthcare, Philips Healthcare, Medtronic, Inc., and Siemens Healthcare GmbH are some of the notable companies in the cardiovascular monitoring and diagnostic devices market.

What are the challenges faced by the cardiovascular monitoring and diagnostic devices market?

The high cost of these devices, lack of reimbursement policies in some regions, and the shortage of skilled healthcare professionals are some of the major challenges faced by the cardiovascular monitoring and diagnostic devices market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com