Global Cold Chain Market Size, Share, Trends & Growth Forecast Report Segmented By Type (Transportation, Monitoring Components & Storage), Temperature Type (Chilled And Frozen), Application (Dairy & Frozen Desserts, Meat & Seafood, Fruits & Vegetables, Processed Foods, Bakery & Confectionery), And Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Cold Chain Market Size

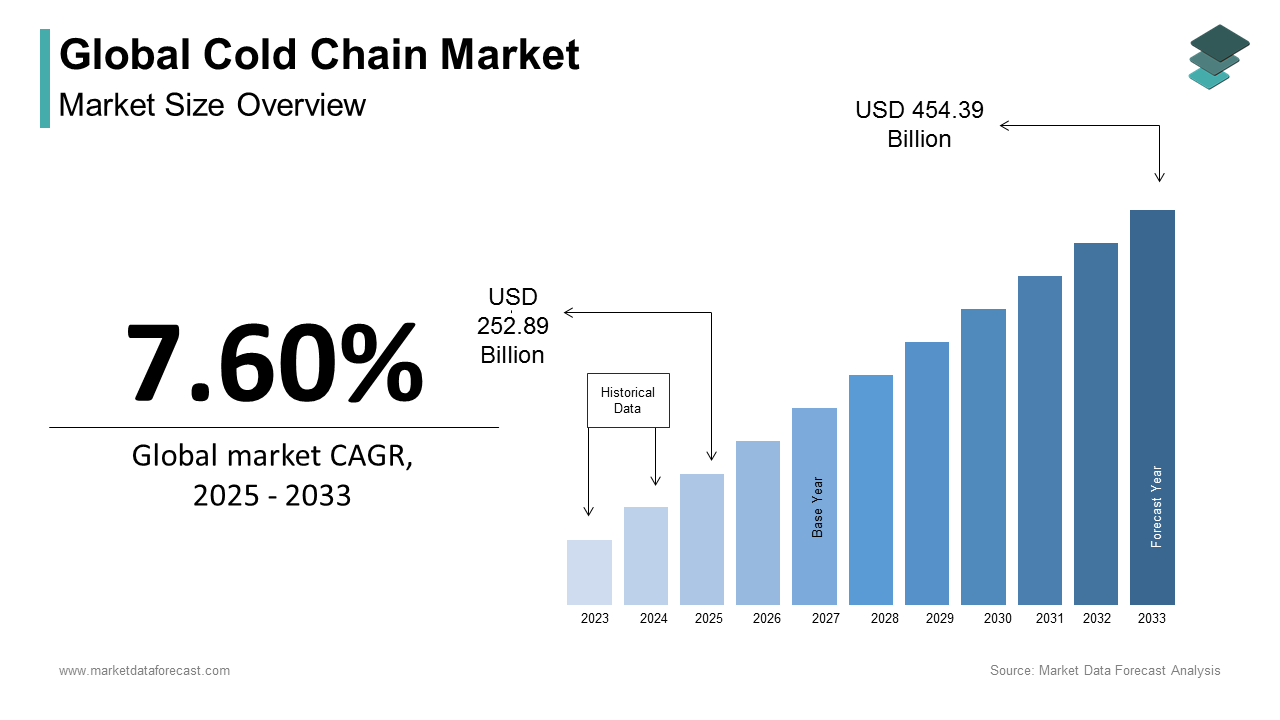

The global cold chain market was assessed to be USD 235.03 billion in 2024. The global market is further expected to reach USD 454.39 billion by 2033 from USD 252.89 billion in 2025, growing at a compound annual growth rate (CAGR) of 7.6% during the forecast timeline.

The cold chain is a system used for the management and transportation of temperature-sensitive products through refrigeration methods and thermal packaging. There are several ways to transport refrigerated products, such as rail vehicles, refrigerated trucks, air cargo, and refrigerated ships. The cold chain is a technology that relies entirely on physical means to maintain adequate temperature conditions. The cold chain is also called the temperature control supply chain.

MARKET DRIVERS

Growing Demand for Perishable Food Transportation and Stringent Food Safety Regulations

The growth of the global cold chain market is driven by numerous initiatives taken by governments around the world to develop a robust infrastructure. Furthermore, the need for transportation and refrigeration facilities and the increase in export and import activities have led large companies to invest heavily in capital. This will have a positive impact on the development of the global cold chain market in the food industry. Furthermore, increasing disposable income and rapid urbanization worldwide have well supported the growth of the entire market. As the population grows worldwide, the demand for processed and convenience foods has increased, fueling the cold chain market in the food industry. The development of international trade in perishable foods will also have a positive impact on the global cold chain market.

Cold chain service providers aim to adopt state-of-the-art technology as the demand for food safety in convenience and processed foods increases. That is why cold chains are considered the best business opportunity for years to come, and numerous multinational providers are entering this market to provide better cold chain solutions. Therefore, the adoption of cutting-edge technology will enhance the overgrowth of the global cold chain market. The growing trend to buy perishables online has created new opportunities and challenges. These include innovative solutions to deliver the latest mileage, automated warehouses for inventory management and cost reduction per item, and advanced, low-cost temperature monitoring devices to keep food fresh. Increased consumer demand for perishable food, growth in international trade due to trade liberalization, and expansion of the organized retail food industry are some of the factors driving the global cold chain market growth.

MARKET RESTRAINTS

However, the lack of funds and underdeveloped refrigeration infrastructure in many emerging economies has become a significant bottleneck in the worldwide cold chain market. Issues related to environmental problems due to greenhouse gas emissions are also estimated to challenge the growth of this market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.6% |

|

Segments Covered |

By Type, Type Of Temperature, Application, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Lineage Logistics, AGRO Merchant, Priority Freezer, ITC Ltd, Henningsen, Americold Logistics, Burris Logistics, Nichirei Logistics, Kloosterboer, VersaCold Logistics, Weekly Warehouse, and Swire Refrigeration |

SEGMENTAL ANALYSIS

By Type Insights

The growth of the storage sector is due to the increased preference for packaged foods worldwide. The demand for frozen food is increasing due to changes in consumer patterns and lifestyles. The need for storage solutions is supposed to grow in the coming years. Cold chain systems are essential for the supply of food, beverages, and health care products.

By Type of Temperature Insights

The frozen section is anticipated to dominate the market during the outlook period. Cold chains for chilled and frozen food often include no product interruption in a low-temperature environment during each stage of the value chain (for example, harvesting, harvesting, packaging, processing, storage, transportation, and marketing) until reaching the end-user. The frozen sector occupied a relatively larger market share in 2018 and is supposed to continue this in the future, owing to aspects like extending shelf life from days to weeks due to large-scale cooling of food for preservation.

By Application Insights

The processed food sector is presumed to show the highest growth during the projection period due to continued innovation in packaging materials. Advances in packaging materials extend the shelf life of food.

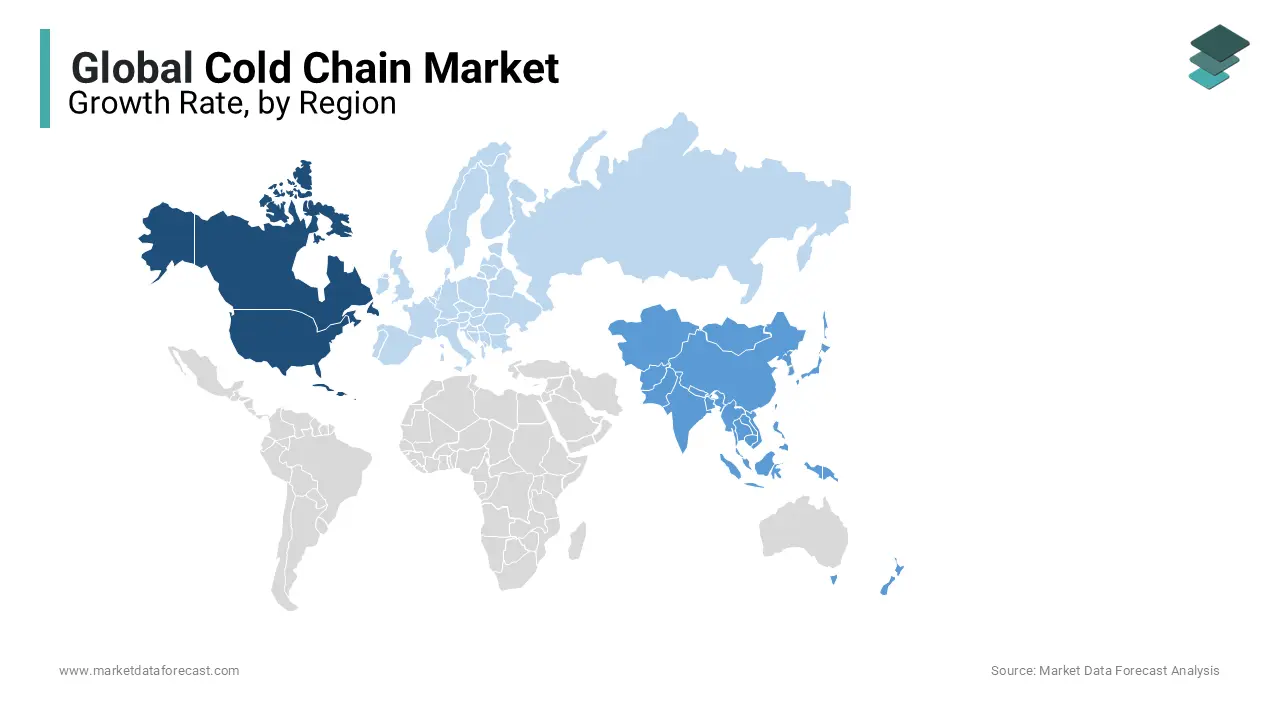

REGIONAL ANALYSIS

The North American cold chain market is likely to grow at the highest CAGR during the forecast period. Market growth is primarily due to the large consumer base and increased penetration of connected devices. The market offers excellent opportunities for new entrants. Europe is the second-largest cold chain market. The Asia Pacific cold chain market is foreseen to show significant growth during the prediction period due to increased agricultural production. The government must improve its logistics and warehousing infrastructure and strengthen its leadership and investment in the development of seafood storage, packaging, and processing technology, which is an essential factor in improving the growth of the cold chain market in the Asia Pacific during the forecast period. Standard government guidelines for fresh food packaging, storage, and transportation are expected to drive growth in the Latin American cold chain market during the estimated period. As frozen meat products increase in popularity and foreign direct investment increases, the cold chain market in the Middle East and Africa is growing.

KEY MARKET PARTICIPANTS

Companies playing a dominating role in the global cold chain market include Lineage Logistics, AGRO Merchant, Priority Freezer, ITC Ltd, Henningsen, Americold Logistics, Burris Logistics, Nichirei Logistics, Kloosterboer, VersaCold Logistics, Weekly Warehouse, and Swire Refrigeration. Henningsen Cold Storage is an international cold chain company that provides the necessary services such as warehouses, sole suppliers, transportation facilities, and transportation providers.

RECENT HAPPENINGS IN THE MARKET

- In January 2018, VersaCold, Canada, opened a new distribution center in Milton, Ontario. The new center handles around 30 entries per day and 60 departures per day.

- June 2018: Lineage Logistics acquired Wisconsin-based refrigeration provider Service Refrigeration (SCS). SCS has four portfolios of refrigerated rental warehouses in the Southeast strategic market.

- December 2017: Americold added a new Clearfield plant by adding more than 9.5 million ft3 of temperature-controlled storage space, adding the total capacity of the campus to approximately 22 million ft3.

- In December 2017, AGRO Merchants (USA) acquired Grocontinental Limited (UK), a provider of refrigeration and logistics services. The agreement strengthened AGRO's position as a leading provider of refrigeration and logistics in the UK and Ireland.

MARKET SEGMENTATION

This research report on the global cold chain market has been segmented and sub-segmented based on type, type of temperature, application, and region.

By Type

- Transportation

- Monitoring Components

- Storage

By Type of Temperature

- Chilled

- Frozen

By Application

- Fruits and vegetables

- Fruit pulp and concentrates

- Dairy Products

- Meat and seafood

- Processed foods

- Bakery and confectionery

- Pharmaceuticals

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What are the key components of the cold chain?

The key components of the cold chain include refrigerated storage facilities, refrigerated transport vehicles (trucks, ships, and planes), temperature monitoring devices, packaging materials, and logistics management systems.

2. What are the main challenges facing the cold chain industry?

Challenges include infrastructure limitations, such as inadequate refrigerated storage and transportation facilities, energy efficiency concerns, regulatory compliance, last-mile delivery challenges, fluctuations in fuel and energy prices, and the need for continuous technological advancements.

3. How is technology influencing the cold chain market?

Technology innovations such as IoT (Internet of Things) sensors, RFID (Radio-Frequency Identification) tracking, GPS (Global Positioning System) monitoring, data analytics, and blockchain are revolutionizing the cold chain industry by enabling real-time temperature monitoring, improving traceability, enhancing transparency, and optimizing logistics operations.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com