Global Commercial Aqua Feed Market Size, Share, Trends & Growth Forecast Report, Segmented By End User (Fish, Molluscs And Crustaceans), Ingredient (Soybean, Corn, Fish Meal, Fish Oil And Additives), Additive (Antibiotics, Vitamins, Anti-Oxidants, Amino Acids, Feed Enzymes And Feed Acidifiers), And By Region (North America, Europe, Latin America, Asia-Pacific, Middle East and Africa), Industry Analysis From 2025 to 2033

Global Commercial Aqua Feed Market Size

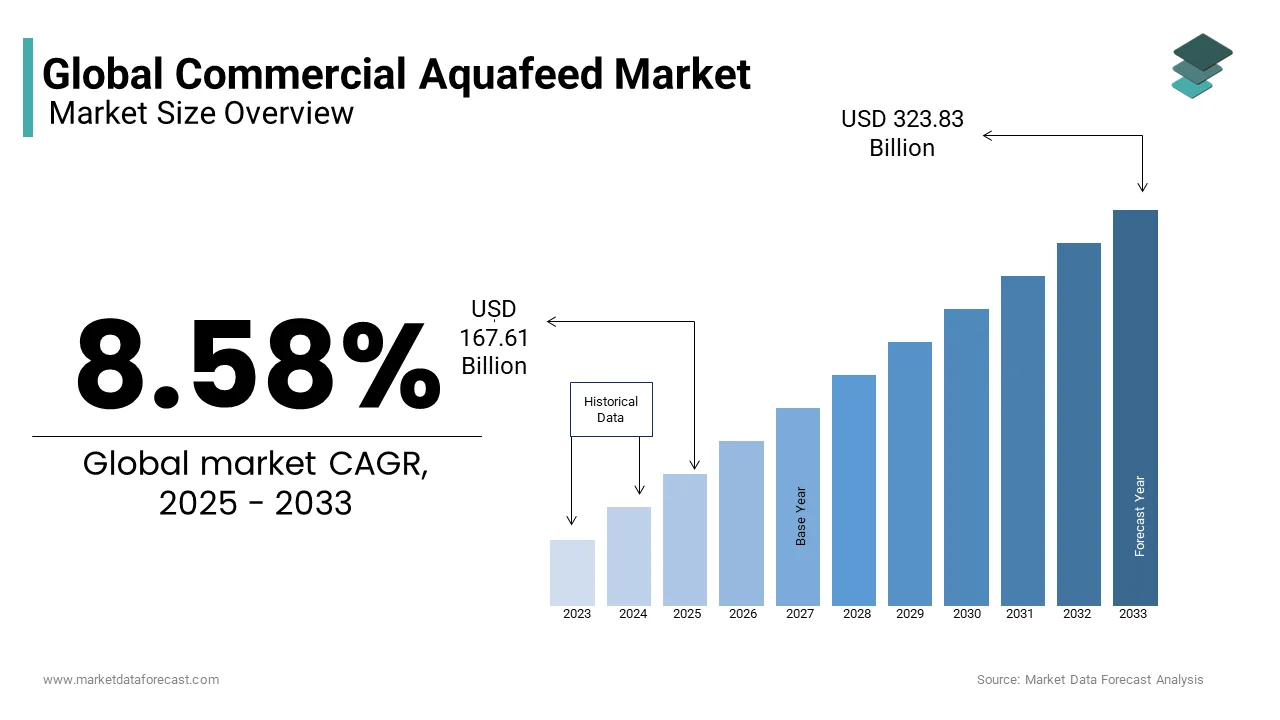

The global commercial aquafeed market was valued at USD 154.37 billion in 2024 and is anticipated to reach USD 167.61 billion in 2025 from USD 323.83 billion by 2033, growing at a CAGR of 8.58% during theforecast period from 2025 to 2033.

Manufactured feeds are a significant part of the modern aquaculture industry. They provide the balanced nutrition needed by farm fish. The feeds are available in the form of granules or pellets and provide nutrition in a stable and concentrated form, enabling the fish to feed efficiently and grow up to their full potential.

Many of the fish brought up in farms around the world today are carnivorous, such as the Atlantic salmon, trout, sea bass, and turbot. In the early development of fish feeding, which has evolved into modern aquaculture, fishmeal, and fish oil were key components of the feeds for these species. They are combined with other ingredients such as vegetable proteins, cereal grains, vitamins, and minerals, and made into feed pellets. Wheat, for example, is widely used as it helps to bind the ingredients in the pellets.

The growth of the caseinate market is mainly driven by factors such as population growth, rising disposable income, and rapid urbanization, and is facilitated by the strong expansion of fish production and more efficient distribution channels. As for the restraints of the market, large-scale storage of the same for farms is still a problem, and the high costs are also a turn-off for the market. The industry has to come up with innovative solutions for these problems for the market to grow freely.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.58% |

|

Segments Covered |

By End User, By Ingredients, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Archer Daniels Midland Company, Ridley Corporation Limited, Cargill Nutreco N.V, Avanti Feeds Ltd, Purina Animal Nutrition LLC, Nutriad, Alltech, Biostadt India Limited, Aller Aqua A/S, Biomar, BIOMIN Holding GmbH, Norel Animal Nutrition, Dibaq A.S, De Heus Animal Nutrition. |

REGIONAL ANALYSIS

The Commercial Aquafeed Market was dominated by North America in 201,6, with the region accounting for 36% of the overall market share. North America was followed next in line by Europe and Asia-Pacific. Asia-Pacific is expected to grow rapidly in the coming year, as is evident from the high CAGR value for the region. Another promising region for the market is Latin America, which is expected to show high growth rates in the coming years.

KEY MARKET PLAYERS

Archer Daniels Midland Company, Ridley Corporation Limited, Cargill, Nutreco N.V., and Avanti Feeds Ltd are well-established and financially stable players that have been operating in the industry for several years. Other players include Purina Animal Nutrition LLC, Nutriad, Alltech, Biostadt India Limited, Aller Aqua A/S, Biomar, BIOMIN Holding GmbH, Norel Animal Nutrition, Dibaq A.S, Dand e Heus Animal Nutrition. Some of the market players dominate the global commercial aqua feed market.

MARKET SEGMENTATION

This research report on the global commercial aqua feed market is segmented and sub-segmented into the following categories.

By End User

- Fish

- Mollusks

- Crustaceans

By Ingredients

- Soybean

- Corn

- Fish Meal

- Fish Oil

- Additives

- Antibiotics

- Vitamins

- Anti-Oxidants

- Amino Acids

- Feed Enzymes

- Feed Acidifiers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]