Global Competent Cells Market Size, Share, Trends & Growth Forecast Report By Type (Chemically and Electrocompetent), Application, End-User & Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa), Industry Analysis (2025 to 2033)

Global Competent Cells Market Size

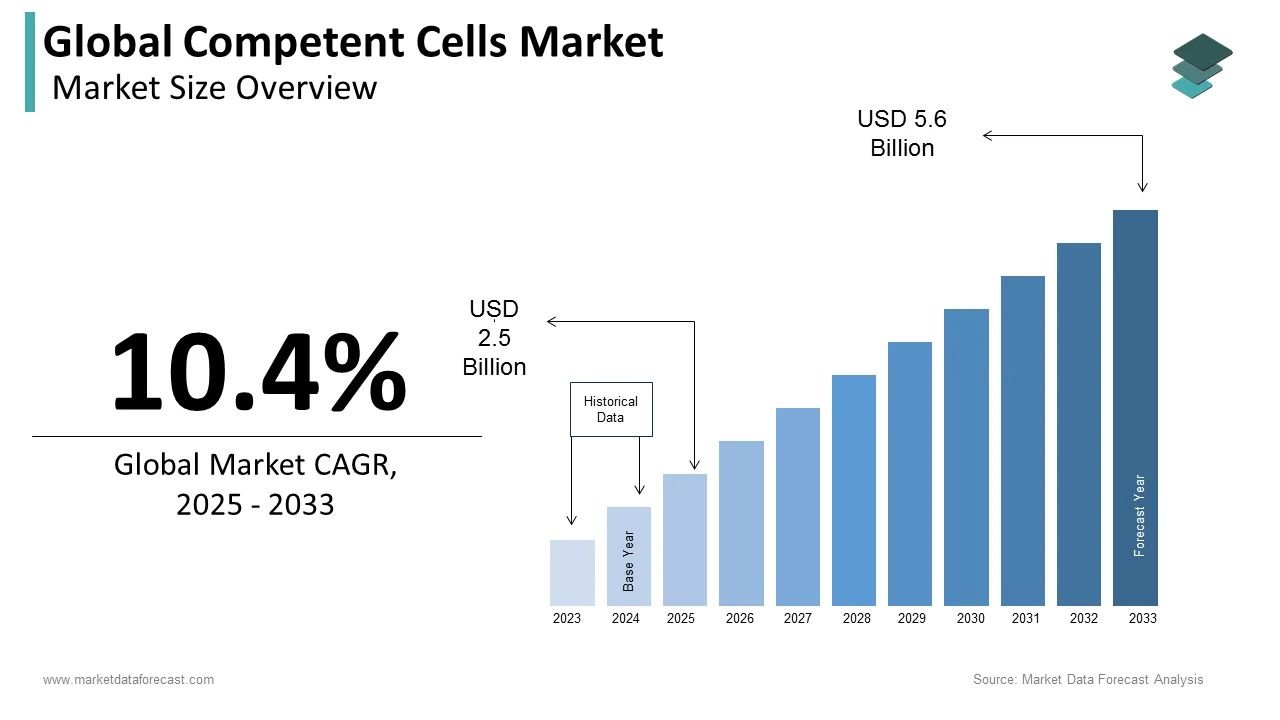

The size of the global competent cells market was valued at USD 2.3 billion in 2024. The global market is expected to progress at a CAGR of 10.4% from 2025 to 2033 and be worth USD 5.6 billion by 2033 from USD 2.5 billion in 2025.

The competent cells, in the true sense, are microbial cells that, through transformation, quickly take up foreign DNA from their environment. Competent cells for Commercial purposes include using bacteria or yeast artificially induced to be competent. There are two types: chemically competent cells, which facilitate the uptake of exogenous DNA by heating and chemical treatment, and electrocompetent cells, which undergo electroporation by electrical impulse generation for the uptake of DNA. The cells that can increase are made competent to get faster results. These cells also find their application in molecular cloning, enabling research on gene expression and protein expression. The US FDA has approved new guidelines for testing retroviral vector-based human gene therapy for a replication-competent retrovirus, which will boost research in the field of competent cells as there is a more critical requirement for retrovirus therapy and vaccines. The competent cell technique can be used to create a vaccine for retrovirus. The synthetic biology company SGI-DNA and Gibson Assembly Reagents have launched Vmax X2 competent cells. It is designed to generate two to four times more soluble protein in half the current reliance on E. coli.

MARKET DRIVERS

Growing Demand for Recombinant DNA Technique Products

There are many applications of recombinant DND techniques, such as gene therapy, vaccine production, cancer treatment, and treatment of retrovirus. The advancement in molecular engineering and growing research in therapeutic products used to treat several diseases are likely to bolster the market demand. In addition, the profitable expansion of emerging countries, which results in the growth of profitable opportunities for the competent cell market players, and increased public investment in research activities would further drive the market growth. Growing demand for recombinant proteins and molecular replicated products, progress in molecular cloning technology with the advent of innovations, and numerous government policies and support for life science research are the main factors propelling the competent cells market development during the forecast period. In addition, products derived from recombinant DNA technology have applications in developing a wide range of therapeutic products such as protein therapies and vaccines, human growth hormone and human insulin, which is resulting in a strong demand for these competent cells, leading to drive of the global market for competent cells.

The rise in the potential of various biotechnology and Genetic engineering companies to offer treatments with advanced technology for various diseases that were not possible before by expansion in the reach of medical care is foreseen to drive the market growth. The industry is further expected to be driven by the advances in successful research and development on pharmaceutical drugs for treating various diseases, increased government spending on research programs, and a favorable reimbursement and regulatory environment. In addition, as diseases grow, governments in most countries have increased their attention on upgrading healthcare facilities and discovering therapies for specific diseases. As a result, they've expanded their investment in biotechnology firms and simplified regulations to encourage the discovery of therapies for serious diseases.

Shortly, increased investment in DNA cloning technologies studies in academic research centers and using these products in therapeutics is expected to boost market growth. In addition, increased government and industry investments and the launch of novel product categories are expected to fuel demand growth.

MARKET RESTRAINTS

High Costs

The high cost of research and the advanced infrastructure required for the competent cell technique is restraining the growth of the competent cells market. Moreover, the high cost of the technology involved requires significant investments, which is very low in many developing countries and other economies, which could obstruct market growth. In addition, these techniques require a skilled professional, which is also slowing down the growth of the global competent cells market. Due to the need for the cells to stay cold, creating competent cells is challenging. Because the cells are so sensitive and fragile while being made competent, this is essential. Keeping the temperature low throughout processing helps to avoid cell death.

Impact of COVID-19 On The Global Competent Cells Market

In this time of COVID – 19 pandemic, the competent cell technique can be used in the research as a bacterial artificial chromosome used to study the stature of coronavirus. Therefore, it could boost the market growth of the competent cell market. Growing focus on recombinant protein expression and other cell cloning activities, such as the mutagenesis of the COVID-19 virus, is leading to the increased human response by biopharmaceutical innovators racing the virus genome. The countries in the Asia Pacific, such as India and China, are investing more in researching competent cell technology. The increasing demand for cells capable of making cloned copies of viral plasmids is accelerating investing heavily in research and development, which in turn is driving the market growth of competent cells.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Analysed |

By Type, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Analysed |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Market Leaders Profiled |

BioDynamics Laboratory, Inc. (Japan), GCC Biotech (India), SMOBIO Technology (Taiwan) |

SEGMENTAL ANALYSIS

By Type Insights

The chemically competent cells segment is projected to account for the largest share of the global competent cells market. Chemically competent cells, to facilitate the binding of plasmid DNA to the competent cell membrane, are treated with calcium chloride and are alternately heated in a water bath or heat shock to open pores for plasmid allowance to enter the cell membrane. These serve as the best solution for cloning and subcloning applications.

However, during the forecast period, the electrocompetent cells segment is predicted to rise at the fastest CAGR. Electrocompetent cells are also expected to hold a significant share in the market due to their better transformation efficiency in a much shorter time, despite being expensive, since this procedure involves an electroporation technique to allow DNA penetration.

By Application Insights

Based on the application, the cloning segment dominates the competent cells market since it produces antibiotics, vaccines, and proteins by using DNA copies of cells, organs, and even complete animals. It is also used to create pest-resistant plants and transgenic animals and in gene therapy. Bacterial transformation is used in DNA cloning, in which the bacteria take up the genetic material. This method is commonly used in molecular biology applications. This sector has grown due to the government's increasing support and investments. The protein expression sector is also prophesied to show a high market growth since these competent cell packages allow the efficient and inexpensive expression optimization by simultaneous tests of multiple strains with the gene of interest, such as BL21(DE3) for non-toxic proteins and BL21(DE3) pLysS for toxic and non-toxic proteins.

By End User Insights

Based on End-User, due to increased research spending in biotechnological applications, the academic research institutes segment is expected to account for the largest share of the market. However, the pharmaceutical and biotechnology companies segment is expected to expand the most during the forecast period. This is because pharmaceutical companies are expected to contribute to intelligent automation technology to support augmented manufacturing, like personalized medicine, localized 3D printing of treatments, etc. In addition, the rising investments in research for developing genomics and proteomics-based products are also driving this segment's growth.

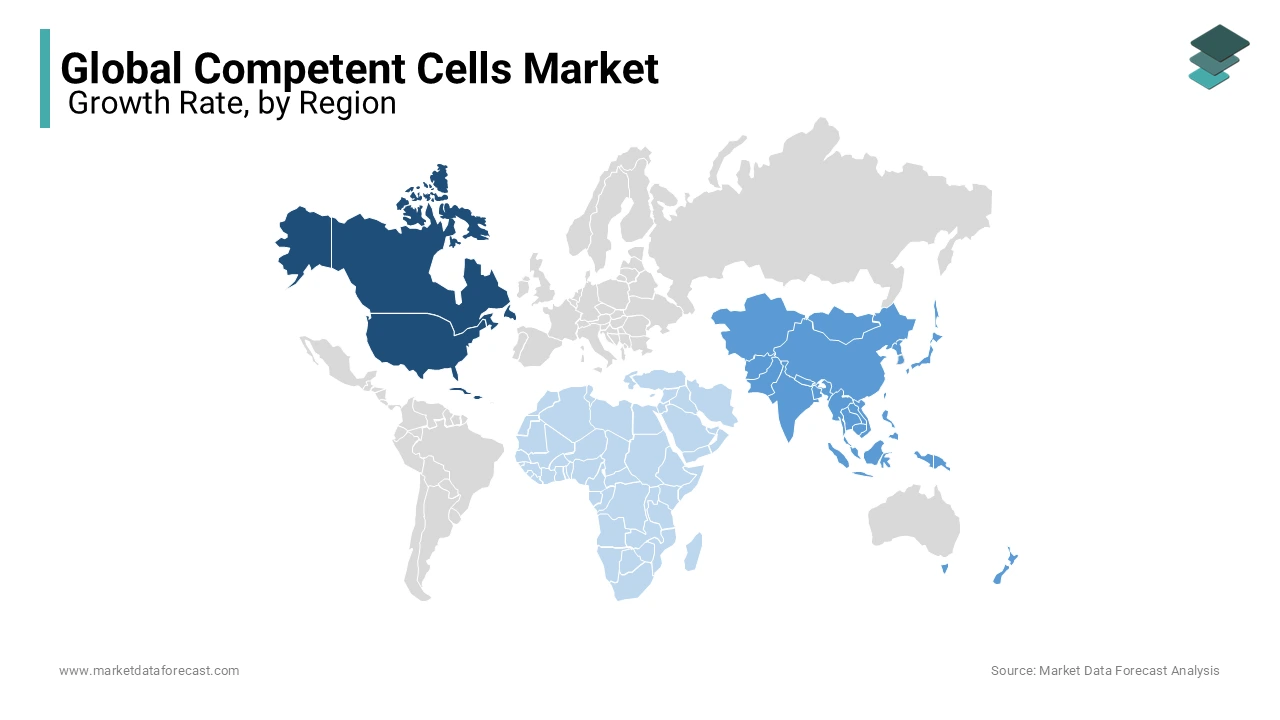

REGIONAL ANALYSIS

North America is estimated to constitute the largest global competent cells market share. At the same time, the Asia Pacific region is expected to witness the fastest growth and overtake North America, the second-largest market shareholder, during the forecast period. The Asia-Pacific competent cells market is expected to account for most of the global competent cells market during the forecast period. The rise in research activities in developing economic countries like India and the increase in investments by key players in the manufacturing of various competent cells are likely to drive the competent cell market in the Asia Pacific region. Extensive studies on DNA cloning technology in the field and the existence of key market players are credited with the development. The Asia-Pacific region is expected to expand significantly because of the developing healthcare and research infrastructure, especially in the region's emerging countries. Latin America is also foreseen as an emerging region in the markets for competent cells due to increased public investment in research and development activities. Due to the growing economies in Africa, Genetic engineering and biotechnology have broadened the healthcare field, which provides significant market opportunities by allowing for the treatment of previously incurable diseases. Furthermore, Middle Eastern and African countries anticipate accelerating the use of competent cells during the forecast period due to growing awareness of advanced technologies among pharmaceutical and biotechnology company manufacturers and the population.

KEY MARKET PARTICIPANTS

Some of the prominent companies operating in the global competent cells market profiled in this report are BioDynamics Laboratory, Inc. (Japan), GCC Biotech (India), SMOBIO Technology (Taiwan), Thermo Fisher Scientific, Inc. (the U.S), QIAGEN N.V. (Germany), OriGene Technologies (U.S.), Merck KGaA (Germany), Promega Corporation (U.S.), Bioline (U.K.) and Zymo Research (U.S.).

RECENT HAPPENINGS IN THIS MARKET

-

In October 2022, Competence Center was opened by the brilliant LEAD team in Germany, working with many German partner companies. It is based on stable supply chains and long-term strategic collaborations with the highest quality and standardized solutions, whose global presence has won the trust of several major European critical players in a short time.

-

In October 2022, Immune-Onc Therapeutics, Inc., a privately-held clinical-stage cancer immunotherapy company, announced its entrance into clinical trial collaboration with BeiGene for Immune-Onc's first myeloid checkpoint inhibitors evaluation, anti-PD-1 antibody, tislelizumab, by developing novel biotherapies targeting myeloid checkpoints, which leads to T cell activation in vitro, enhances dendritic cell function and inhibits the tumor growth in an in vivo immunocompetent model.

MARKET SEGMENTATION

This market research report on the global competent cells market has been segmented and sub-segmented based on the type, application, and end-user.

By Type

- Chemically

- Electrocompetent

By Application

- Cloning

- Subcloning & Routine Cloning

- Phage Display Library Construction

- Toxic/Unstable DNA Cloning

- High-Throughput Cloning

- Protein Expression

- Other Applications

- Mutagenesis

- Large Plasmid Transformation

- Single-Stranded DNA Production

- Lentiviral Vector Production

By End User

- Pharmaceutical Companies

- Academia

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much is the global Competent Cells Market going to be worth by 2033?

As per our research report, the global Competent Cells Market size is projected to be USD 5.5 billion by 2033.

At What CAGR, the global Competent Cells Market is expected to grow from 2025 to 2033?

The global Competent Cells Market is estimated to grow at a CAGR of 10.40% from 2025 to 2033.

Which region is anticipated to witness considerable growth in the Competent Cells Market?

Geographically, the APAC Competent Cells Market is predicted to have the fastest growth rate in the global market from 2025 to 2033.

Does this report include the impact of COVID-19 on the Competent Cells Market?

Yes, we have studied and included the COVID-19 impact on the global Competent Cells Market in this report.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]