Global Connected Agriculture Market Size, Share, Trends, COVID-19 Impact & Growth Forecast Report, Segmented By Component (Solution, Platforms and Services), Application (Pre-Production Planning and Management, In-Production Planning and Management, and Post-Production Planning and Management) And Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033

Global Connected Agriculture Market Size

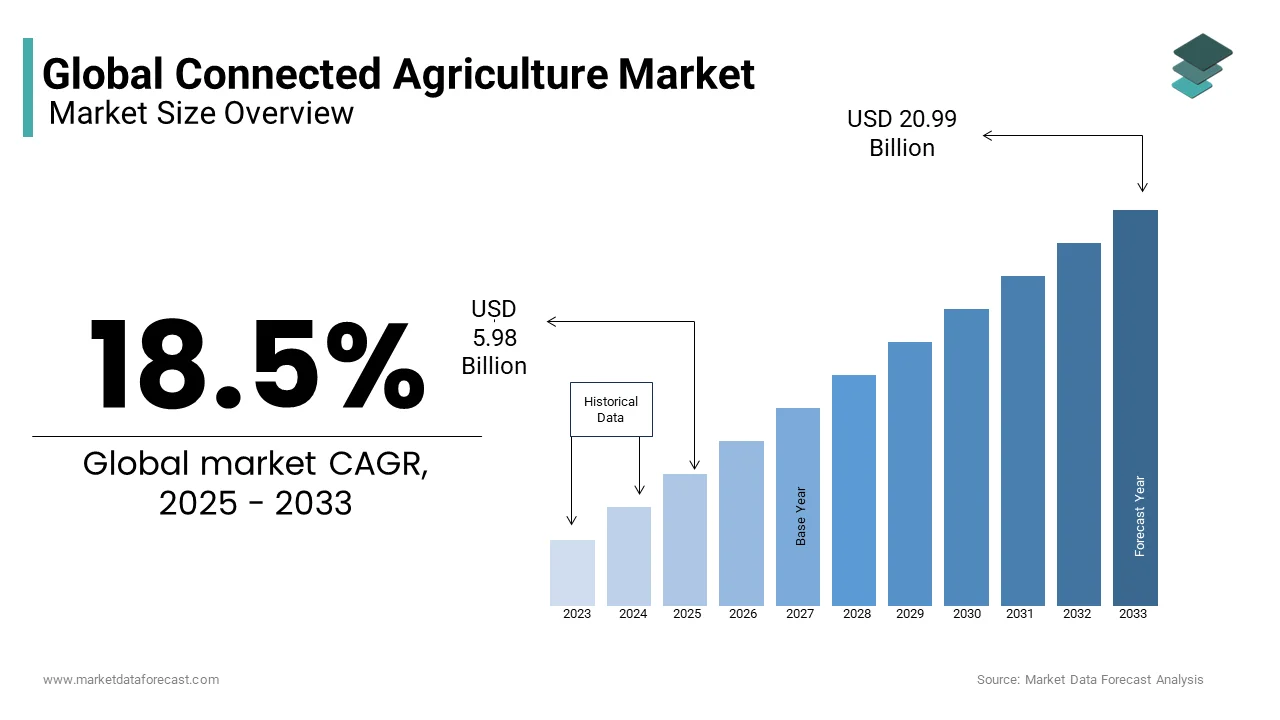

The global connected agriculture market was valued at USD 5.11 billion in 2024 and is anticipated to reach USD 5.98 billion in 2025 from USD 20.99 billion by 2033, growing at a CAGR of 18.5% during the forecast period from 2025 to 2033.

MARKET DRIVERS

The integration of Internet of Things (IoT) devices in farming practices is one of the major factors driving the growth of the connected agriculture market. Sensors, drones, and smart machinery play pivotal roles, facilitating real-time monitoring of crops, soil conditions, and equipment performance. This data-driven approach empowers farmers with actionable insights, enabling prompt responses to dynamic conditions and fostering more effective crop management strategies. Precision agriculture, driven by IoT, enhances resource efficiency, optimizes irrigation, and aids in the early detection of potential issues such as diseases or pest infestations. As a result, farmers can make informed decisions, leading to increased yields and sustainable farming practices.

Growing awareness among farmers is a transformative factor in the connected agriculture market. Initiatives such as training programs, workshops, and educational campaigns play a crucial role in spreading information about the advantages of incorporating technology into farming practices. These efforts contribute to bridging the knowledge gap and empowering farmers to make informed decisions about the adoption of connected agriculture solutions. As awareness expands, there is a shift in the agricultural landscape, with more farmers integrating IoT devices, sensors, and data-driven strategies into their operations. This shift not only improves overall efficiency and productivity but also marks a pivotal step towards the modernization and sustainability of agriculture in response to the evolving needs of the industry.

MARKET RESTRAINTS

High initial costs associated with the concept of connected agriculture are one of the major factors hindering market growth. The acquisition of sensors, IoT devices, and requisite infrastructure demands substantial upfront investments, posing a considerable barrier to entry for small and resource-constrained farmers. This financial constraint hampers the widespread adoption of connected agriculture technologies, limiting the sector's inclusivity and potentially exacerbating the digital divide in the agricultural landscape.

Data security and privacy concerns are further hampering the growth of the connected agriculture market. As the collection and storage of sensitive agricultural data become integral to modern farming practices, farmers express hesitancy in adopting connected technologies. Uncertainty prevails regarding how their valuable data will be utilized, safeguarded, and potentially shared with third parties. This apprehension is well-founded, given the increasing frequency of cyber threats and data breaches. As the industry strives to balance technological innovation with data security, instilling confidence among farmers regarding the responsible handling of their information is paramount for the continued growth and acceptance of connected agriculture solutions.

Impact Of COVID-19 On The Connected Agriculture Market

The COVID-19 pandemic has presented both challenges and opportunities for the connected agriculture market. On the downside, the disruptions in global supply chains and economic uncertainties have affected the purchasing power of farmers, potentially slowing down the adoption of connected agriculture technologies. The pandemic has strained budgets, making it difficult for agricultural stakeholders to invest in expensive IoT devices and infrastructure. Moreover, restrictions on movement and social distancing measures have impeded the deployment of on-site technical support and hindered training programs, impacting the seamless integration of technology into farming practices. But over time, the crisis has underscored the importance of resilient and technology-enabled agriculture. The need for remote monitoring and management has accelerated the adoption of digital solutions, stimulating innovation in precision farming, supply chain optimization, and remote sensing technologies within the connected agriculture sector. This shift is likely to persist as the industry adapts to the evolving landscape post-pandemic.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

18.5% |

|

Segments Covered |

By Component, Application, and Region |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

John Deere, Trimble Navigation, AGCO Corporation, Raven Industries, DeLaval, AgJunction, Farmers Edge, Iteris Inc., Dickey-John Corporation, Topcon Positioning Systems, AG Leader Technology, Trimble Agriculture, The Climate Corporation (Bayer), SST Software, Iteris Inc., Taranis, Gamaya, CropX, PrecisionHawk. |

SEGMENTAL ANALYSIS

By Component Insights

The solutions segment led the connected agriculture market in 2022 and is predicted to witness a healthy CAGR during the forecast period. Connected agriculture solutions are dominating the market as they include precision farming tools, farm management software, and data analytics platforms that enable farmers to make informed decisions based on real-time data. Solutions play a crucial role in driving the connected agriculture market, as they form the backbone of technological integration. The demand for precision farming and data-driven decision-making has led to the dominance of solution providers in the market. Their prevalence is attributed to the fundamental need for farmers to optimize resource usage, monitor crop health, and improve overall operational efficiency.

The platforms segment is projected to hold the second biggest CAGR in the connected agriculture market as it refers to the technological infrastructure that facilitates the seamless integration and functioning of various devices and applications. This includes IoT platforms, communication networks, and cloud-based systems that enable data exchange and processing. The dominance of platforms is evident in their role as enablers for the entire connected agriculture ecosystem.

The services segment is anticipated to capture a substantial share of the global market during the forecast period. Connected agriculture services encompass a range of support offerings such as consulting, training, and maintenance to ensure the efficient implementation and operation of connected technologies on farms. Services are integral to the successful adoption of connected agriculture. The dominance of services is often realized during the post-implementation phase, where ongoing support and training contribute significantly to the long-term success of connected agriculture initiatives.

By Application Insights

The pre-production phase segment held the leading share of the globally connected agriculture market in 2022 as technologies were applied to activities such as land preparation, seed selection, and planning. This involves using data analytics, soil sensors, and predictive modeling to optimize the selection of crops, plan planting schedules, and ensure the efficient use of resources. Pre-production technologies are essential but may not be as dominating as those in other phases. The dominance of this phase depends on the emphasis placed on data-driven decision-making in crop planning and resource optimization.

The in-production segment accounted for the second-largest share of the worldwide market in 2022 and is expected to grow at a healthy CAGR during the forecast period. In-production is actively involved in monitoring and managing crops during the growth cycle. This includes real-time monitoring of soil conditions, crop health, and pest infestations using sensors, drones, and automated machinery. The in-production phase is often considered the most dominating in the connected agriculture market.

The post-production segment is estimated to witness a healthy CAGR during the forecast period. Post-production technologies in connected agriculture focus on activities after harvesting, including storage, processing, and distribution. This involves the use of data analytics for inventory management, quality control, and supply chain optimization. While post-production technologies are crucial for ensuring the quality and efficient distribution of agricultural products, their dominance may be secondary to in-production technologies.

REGIONAL ANALYSIS

North America is the most dominating region in the connected agriculture market, characterized by advanced technological infrastructure and a strong focus on precision farming. The adoption of IoT devices, drones, and data analytics is widespread, enhancing farm efficiency and productivity. North America tends to be more dominant in the connected agriculture market due to the high level of technological adoption, extensive research and development, and the presence of key market players. The region's advanced farming practices and favorable regulatory environment contribute to its leadership in the connected agriculture landscape.

Europe is a second significant player in the connected agriculture market, leveraging technologies to promote sustainable and efficient farming practices. Precision agriculture, smart farming initiatives, and government support contribute to the adoption of connected agriculture technologies in the region. Europe is a strong contender in the connected agriculture market, with a focus on sustainable and environmentally friendly farming practices.

The Asia Pacific region is experiencing a third growing interest in connected agriculture, driven by the need to address food security challenges, adopt modern farming practices, and improve agricultural productivity. Countries like China and India are investing in smart farming technologies. The region's large agricultural sector, increasing awareness of technology benefits, and government initiatives contribute to its growing influence. Continued adoption is expected as technology becomes more accessible.

Latin America is gradually embracing connected agriculture technologies to enhance productivity and address challenges such as unpredictable weather conditions and resource constraints. Precision farming and IoT adoption are on the rise. Factors such as the focus on sustainable farming practices and the need for improved yields contribute to the region's growing relevance in the connected agriculture market.

The Middle East and Africa are exploring connected agriculture to address issues related to water scarcity, climate variability, and sustainable resource management. Precision agriculture and smart irrigation are key focus areas. Innovations in water-efficient technologies and sustainable farming practices contribute to the region's significance in the evolving landscape of connected agriculture.

KEY MARKET PLAYERS

John Deere, Trimble Navigation, AGCO Corporation, Raven Industries, DeLaval, AgJunction, Farmers Edge, Iteris Inc., Dickey-John Corporation, Topcon Positioning Systems, AG Leader Technology, Trimble Agriculture, The Climate Corporation (Bayer), SST Software, Iteris Inc., Taranis, Gamaya, CropX, PrecisionHawk. They are playing a dominant role in the global connected agriculture market.

RECENT HAPPENINGS IN THE MARKET

- In 2023, John Deere continued to advance its precision farming solutions. This could involve integrating more data-driven technologies, such as advanced sensors and artificial intelligence, into their equipment.

- In 2023, Trimble focused on further integration of GPS technology, data analytics, and automation to enhance farm management and decision-making.

- In 2023, CNH Industrial continued to invest in precision agriculture. Developments may include the incorporation of more connectivity features and data analytics tools.

- In 2023, DeLaval, specializing in dairy farming solutions, may have worked on enhancing connectivity in their systems. This could include innovations in sensor technologies for monitoring livestock health and productivity.

MARKET SEGMENTATION

This research report on the global connected agriculture market has been segmented and sub-segmented into the following categories.

By Component

- Solution

- Platforms

- Services

By Application

- Pre-Production

- In-Production

- Post-Production

By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Frequently Asked Questions

What is the current size of the global connected agriculture market?

The global connected agriculture market is valued at USD 5.98 billion in 2025.

Which regions are leading in terms of market share for connected agriculture solutions?

North America and Europe currently lead in market share for connected agriculture solutions, driven by the adoption of IoT, AI, and other digital technologies in farming practices.

How is the connected agriculture market in Asia Pacific responding to the need for sustainable and efficient farming practices?

In Asia Pacific, the connected agriculture market is responding to the need for sustainable and efficient farming practices by offering solutions for precision irrigation, crop monitoring, and supply chain optimization to improve productivity and reduce environmental impact.

What factors are hindering the growth of the connected agriculture market in Latin America?

In Latin America, factors such as limited access to digital infrastructure, high upfront costs of technology adoption, and the complexity of integrating connected solutions with existing farming practices are hindering the growth of the market.

Who are the key players dominating the connected agriculture market in North America?

Companies such as Trimble Inc., Deere & Company, and Raven Industries are among the key players dominating the connected agriculture market in North America.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com