Global Cotton Market Size, Share, Trends & Growth Forecast Report Segmented By Product (Lint & Cottonseed), Application (Textiles, Medical & Surgical, Feed, Consumer Goods), Equipment Type (Ginning, Spinning), Operation (Automatic, Semi-Automatic), and By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2025 to 2033

Global Cotton Market Size

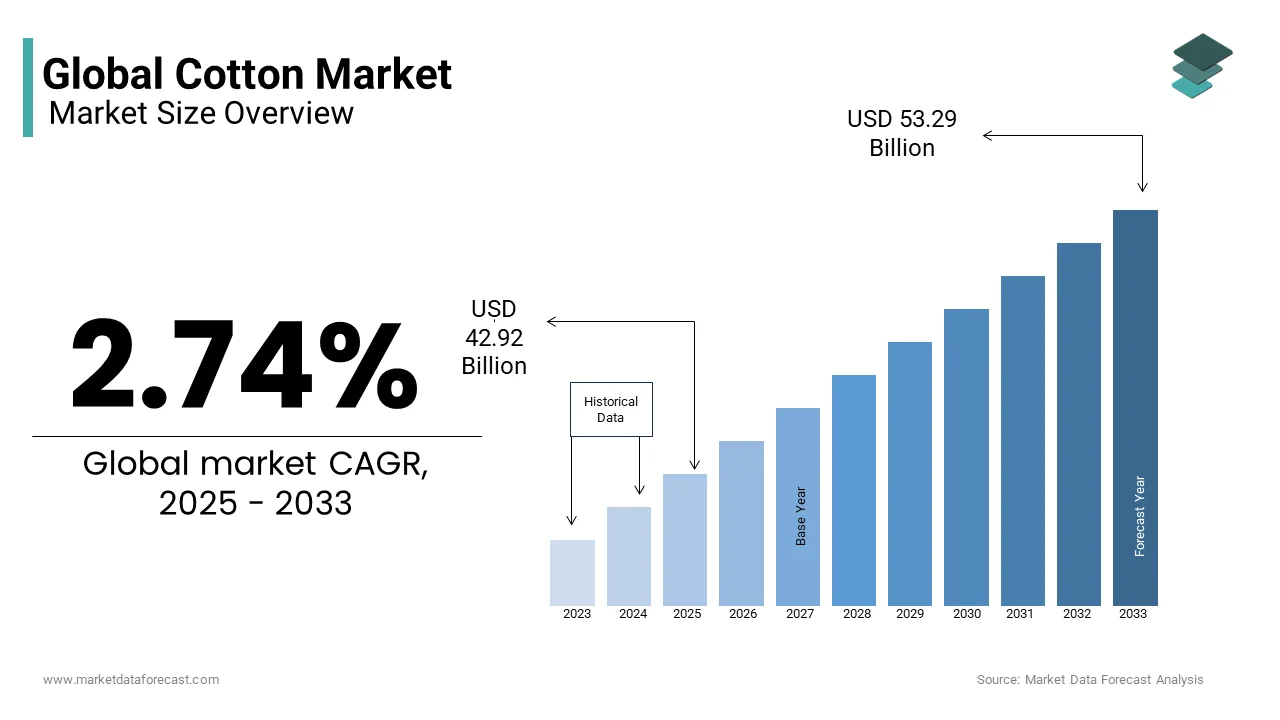

The global cotton market was valued at USD 41.78 billion in 2024 and is anticipated to reach USD 42.92 billion in 2025 from USD 53.29 billion by 2033, growing at a CAGR of 2.74% from 2025 to 2033.

Since the eighteenth century, cotton has been an important aspect of industrial development. It also has a significant impact on the textile sector. It's a high-yielding cash crop that's mass-produced all over the world. Cotton is a major contributor to the worldwide textile mills and clothing manufacturing industries. Cotton is also a highly political crop due to its significance in the global exchange of many developing countries. Cotton may be found in practically every tropical and subtropical region on the planet. Cotton is an attractive crop for arid and semi-arid areas because it is salt and drought-tolerant.

Cotton is the most commonly used natural fiber in textiles, accounting for one-third of all fibers produced globally. It may be used to create a variety of fabrics that are robust, water-absorbent, and comfortable. It is well renowned for its versatility, performance, and comfort. Its applications, however, are not limited to textiles. Cotton plants produce lint and seeds, which are used to make fiber, edible oil, and animal feed. More specifically, fiber is derived from cotton lint, with 64 percent of the fiber produced going to clothes, 28 percent to home furnishings, and 8% to industrial uses. Cotton seeds are crushed to produce cholesterol-free oil, which is used in cooking, cosmetics, medicines, and personal care goods. Other industrial applications, including polymers and rubber cotton seeds, are also used to make high-protein meals for animals and fowl. "Cotton is the most widely lucrative non-food crop in the world," according to the World Wildlife Fund.

MARKET DRIVERS

VSS-compliant cotton accounted for 14.1% of the market in 2016, compared to only 1% in 2009. Cotton, which was theoretically VSS-compliant, accounted for 0.8 percent of the market. The increasing demand for cotton products worldwide due to the wide applications and usage of cotton in various industries contributes significantly to global market growth. The growing utilization of cotton in apparel manufacturing, home furnishings, and manufacturing of industrial products is driving the market growth rate. The cotton market is considered a crucial component of the world economy due to its vast impact on the textile, clothing, medical, and other branches of manufacturing industries that boost the global market growth. The expanding textile industry is having a substantial positive impact on the cotton market expansion as the textile industry is the major buyer of cotton and uses the cotton to produce various products like textile apparel, home textiles, and industrial textiles. The rising disposable incomes of the people, particularly in emerging countries, are expected to boost the demand for cotton products, expanding market revenue. The major countries like the United States, China, India, Pakistan, and Brazil are the largest cotton producers, with each country focusing on different types and quality of the crop. For Instance, according to the US Department of Agriculture (USDA), the United States was the leading exporter of cotton worldwide in 2021 and 2022, where the cotton industry had an export volume of about 3.2 million metric tons. Brazil has the second-largest exporting share, with an export volume of 1.72 million metric tons, followed by India and Australia.

The escalating demand for cotton and its expected increase in the coming years due to rapid urbanization, population growth, substantial economic development, and the enlarging use of cotton in end-use industries will provide growth opportunities to the global cotton market. The growing technological advancements in the agricultural industry, particularly the increasing adoption of genetically engineered cotton and the growing investments in R&D activities, are driving productivity growth. Scientists are endeavoring to develop new cotton variants that enhance fiber quality and produce higher yields, which is estimated to boost the market growth rate significantly during the forecast period. The rising demand for organic cotton among people due to increasing interest in eco-friendly alternatives also augments the market growth rate.

MARKET RESTRAINTS

Every step in the worldwide cotton–textile supply chain has been impacted by the pandemic. Many factories and businesses have shuttered as a result of public health instructions, causing many Western apparel designers to cancel or suspend existing orders. As a result, cotton farms and textile industries in many countries are projected to suffer. Several factors, notably the consequences of cotton stockpiling programs and the high sensitivity of cotton output to flooding, have already caused major price volatility in the sector. Despite the greater input prices and the impact on farmer debt levels, many farmers have become reliant on these seeds. Furthermore, cotton plantations have been linked to a number of societal ills, including low worker wages and documented incidences of slave labor.

MARKET CHALLENGES

The rising demand for synthetic fibers is expected to create a decline in the demand for cotton products due to the lower production costs and ease of use of synthetic products, which acts as a challenge for the market players in expanding the market revenue. The continuous change in consumer preferences will negatively impact the market growth as the market needs to adjust accordingly to guarantee precision and applicability. The increasing demand for sustainability in the market is estimated to be costly, and restricting access to small-scale farmers hinders the market growth. The unpredictability of varying prices will be challenging for market expansion due to variations in weather conditions and worldwide demand. The stringent regulations regarding the quality and trade of the cotton will be complex and time-consuming, leading to fluctuations in the cotton products. This is expected to limit the market growth rate. The climatic change is a significant threat to the global cotton market growth as adverse weather conditions like heatwaves, floods, droughts, and rising global water scarcity negatively impact the cotton market growth. For Instance, according to the non-profit Better Cotton Initiative, in 2022, severe flooding in Pakistan damaged around 40% of the year’s cotton harvest.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.40% |

|

Segments Covered |

By product, Application, Equipment, Operation, and Region. |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Unifi Inc, Weiqiao Textile Company Limited, Lu Thai Textile Co. Ltd., Gokak Mills, Vardhman Group, Damodar Group, Banswara Syntex Limited, Shri Vallabh Pittie Group, Oswal Group |

SEGMENTAL ANALYSIS

By Product Insights

In the forecast period, the lint sector is expected to account for the highest proportion of the cotton processing market. The fiber extracted from cotton seeds during the ginning process is known as lint. The rise of urbanization and changes in consumer lifestyles have resulted in increased demand for textiles, which is expected to fuel the lint segment's expansion even more. Furthermore, rising consumer awareness of product quality is expected to boost the cotton processing market in the future years.

By Application Insights

The cotton processing market is divided into textiles, medicinal & surgical, feed, consumer goods, and others based on application. From 2022 to 2027, the textiles category is expected to be the fastest-growing segment in the cotton processing market. This is attributable to rising per capita income and shifting customer preferences, which is propelling market expansion. Furthermore, increased government investments and policy backing have driven the rise of the textile sector in nations like India and China.

By Equipment Type Insights

Over the forecast period, the spinning segment is expected to be the leading market in the cotton equipment processing market. This is owing to rising yarn usage in the textile, medicinal, and consumer products industries. Consumer expectations are rising, which is stimulating technological advancements that will result in higher-quality items. Consumer preferences are evolving, and technology improvements are propelling the market forward.

By Operation Insights

Over the forecast period, the automatic sector of the cotton processing ginning equipment market is expected to develop at the quickest rate. This is owing to machine makers' adoption of new technologies to increase mill productivity. Automatic equipment has cut labor costs and enhanced ginning mill profit margins. As a result, the automatic category is expected to increase even more in the coming years.

REGIONAL ANALYSIS

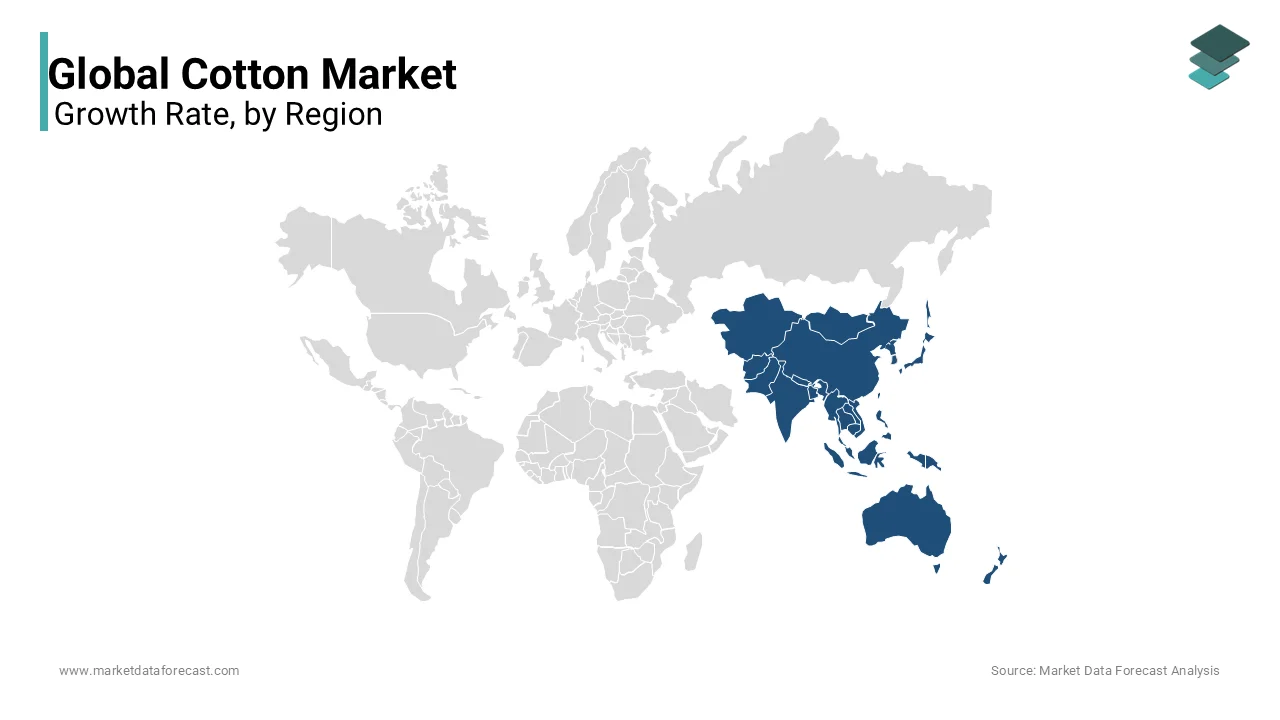

Over the forecast period, in terms of cotton production and export, the United States is a prominent player in the global market. Approximately 20.0 million bales of cotton were produced in the United States in 2019-2020, accounting for nearly USD 7.0 million of the total value. The United States is the world's biggest cotton exporter, accounting for 37.8% of all worldwide cotton exports (2019). It helps to support the global textile industry while also allowing home farmers to market their crops through global trade. The export levels of the United States have increased dramatically since 2016. This is due to high-quality crop production paired with low levels of production from other growers. In addition, the United States is a major exporter of cotton items.

China and India combined accounted for 50.9 percent of global cotton production, with the United States coming in second. Due to the dropping price trend in the international market, global cotton production is predicted to expand at a slower rate than consumption over the forecast period. Because of the country's underdeveloped textile sector, the majority of cotton produced in the United States is exported. Although Asia dominates global cotton production, the majority of the cotton produced is consumed locally. China has the greatest market share, accounting for 29.0 percent of global cotton output and roughly 49.0 percent of milled cotton consumed. Similarly, the textile sector dominates in India, as it utilizes the majority of the cotton produced in the country.

Over the next decade, Bangladesh and Vietnam are likely to be the leading importers. Both countries are expected to boost their imports by more than 43% by 2029. They will account for more than 40% of global imports when combined. Cotton is a significant export crop for Sub-Saharan Africa, which presently accounts for 15% of world exports (with West Africa accounting for about 75% of production and shipments). The top producing countries, Burkina Faso, Benin, Mali, and Côte d'Ivoire, have seen their volumes increase as a result of increased land area and government backing.

KEY MARKET PLAYERS

Unifi Inc, Weiqiao Textile Company Limited, Lu Thai Textile Co. Ltd., Gokak Mills, Vardhman Group, Damodar Group, Banswara Syntex Limited, Shri Vallabh Pittie Group, Oswal Group. Some of the market players dominate the global cotton market.

RECENT HAPPENINGS IN THIS MARKET

- The Indian government has eliminated the 5% basic customs charge on cotton imports in order to boost domestic supplies of the fiber, which a severe scarcity has severely hampered in the country's textiles and garments value chain.

- According to the Spinners Association (Gujarat), or SAG, an investment of Rs 3,500 crore would be made in Gujarat over the next year and a half, with 7 lakh new spindles installed to improve the state's spinning capacity.

MARKET SEGMENTATION

This research report on the global cotton market is segmented and sub-segmented into the following categories.

By Product

- Lint

- Cottonseed

By Application

- Textiles

- Medical & Surgical

- Feed

- Consumer goods

By Equipment Type

- Spinning

- Ginning

By Operation

- Automatic

- Semi-Automatic

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East And Africa

Frequently Asked Questions

What is the current market size of the global cotton market?

The global cotton market size was valued at USD 42.92 billion in 2025

What are the challenges faced by the global cotton market?

The rising demand for synthetic fibers is expected to create a decline in the demand for cotton products due to the lower production costs and ease of use of synthetic products, which acts as a challenge for the market players in expanding the market revenue.

What segments are added in the global cotton market?

Segments of products, applications, equipment, and operations have been added to the global cotton market.

Who are the market players that are dominating the global cotton market?

Unifi Inc, Weiqiao Textile Company Limited, Lu Thai Textile Co. Ltd., Gokak Mills, Vardhman Group, Damodar Group, Banswara Syntex Limited, Shri Vallabh Pittie Group, Oswal Group

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com