Global Textile Home Decor Market Size, Share, Trends & Growth Forecast Report - Segmented By Product (Bed linen and Bedspread, Floor Coverings, Kitchen and Dining Linen, Bath/Toilet Linen, Upholstery, and Others), Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retail Stores, and Others), and Region (North America, Europe, APAC, Latin America, Middle East, and Africa) – Industry Analysis From 2024 to 2032.

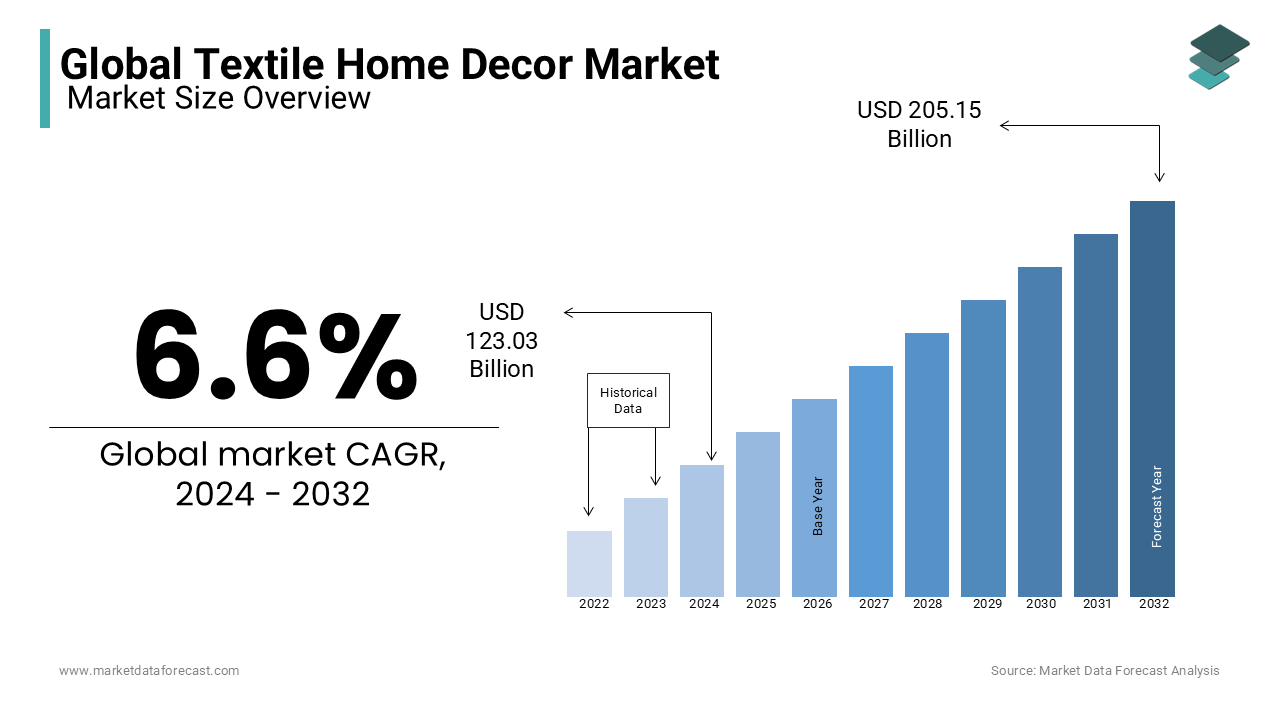

Global Textile Home Decor Market Size (2024 to 2032)

The Global Textile Home Decor Market size was valued at USD 115.41 billion in 2023. The global market size is expected to reach USD 205.15 billion by 2032 from USD 123.03 billion in 2024, growing at a compound annual growth rate (CAGR) of 6.6% during the forecast timeline.

MARKET OVERVIEW

The common home textile items found in households include sheets, pillowcases, blankets, terry towels, tablecloths, carpets, and rugs. Textile home decor refers to textiles that are used for furnishing and decorating our homes. They include a wide range of products, both functional and decorative, which are mainly used to enhance the appearance of our houses. These textiles can be made from natural fibers, like cotton or linen, or man-made fibers, like polyester or acrylic. Home textiles play a vital role in creating a comfortable and visually pleasing environment in our living spaces. They are used for their functional properties, such as providing warmth and comfort, as well as for their aesthetic properties, which help create a certain mood and contribute to mental relaxation. To create durable fabrics, home textiles often use a combination of natural and man-made fibers. Techniques such as weaving, knitting, crocheting, knotting, or pressing fibers together are employed in the production of these textiles. These furnishings are made using specific methods of construction and composition to ensure their quality and usability.

MARKET DRIVERS

The demand for textile home decor market items is increasing for two main reasons. First, more people are living alone in different places. For example, in 2022, the U.S. Census Bureau found that more homes had just one person living in them.

The Textile Home Decor Market is getting bigger because more people are using smartphones and doing shopping on the Internet. Smartphones are convenient devices that connect to the internet, allowing people to shop online for home decor items like beds, chairs, etc. This easy and popular way of shopping using smartphones has led to the growth of the textile home decor market.

This means more people need home decor products. Second, many new construction projects are happening in different areas, which also means more people need home decor items for their new homes. These two reasons are causing the textile home decor market to grow.

MARKET RESTRAINTS

In the future, the textile home decor market may not grow as fast because the materials used, like nylon, are becoming more expensive. For example, in India, the price of cotton yarn has gone up by about 40% in recent years. These higher costs make it harder for people to buy textile home decor products, leading to a decrease in demand and affecting the market's growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

6.6% |

|

Segments Covered |

By Product Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Market Leaders Profiled |

Mannington Mills, Inc (U.S.), Companhia de Tecidos Norte de Minas (Brazil), Kurlon (India), American Textile Company. (U.S.), Leggett & Platt, Incorporated (U.S.), Nitori Holdings Co., Ltd. (Japan), Williams-Sonoma Inc. (U.S.), MOHAWK INDUSTRIES, INC. (U.S.), American Signature, Inc. (U.S.), Bombay Dyeing (India), Vescom B.V. (Netherlands), MITTAL INTERNATIONAL (India), Kimball International Inc. (U.S.) |

SEGMENTAL ANALYSIS

Global Textile Home Decor Market By Product Type

Bed linen is the most popular product in the textile home decor market because people are adopting bigger beds and mattresses, influenced by Western culture. Bed linen includes sheets like flat sheets, duvet covers, and pillow covers, designed for both style and comfort. Fitted sheets with elastic corners cover the mattress. People want to make their homes more comfortable and appealing, which is boosting the demand for bed linen.

Global Textile Home Decor Market By Distribution Channel

Specialty stores currently have the biggest presence in the textile home decor market. They are the most prominent segment with the highest share. As in specialty stores, customers get whatever product they want easily and with good quality. However, the e-commerce segment is expected to experience the strongest growth in the future. This is because more people are using the internet and smartphones for online shopping, allowing them to compare products easily and make informed decisions in real time.

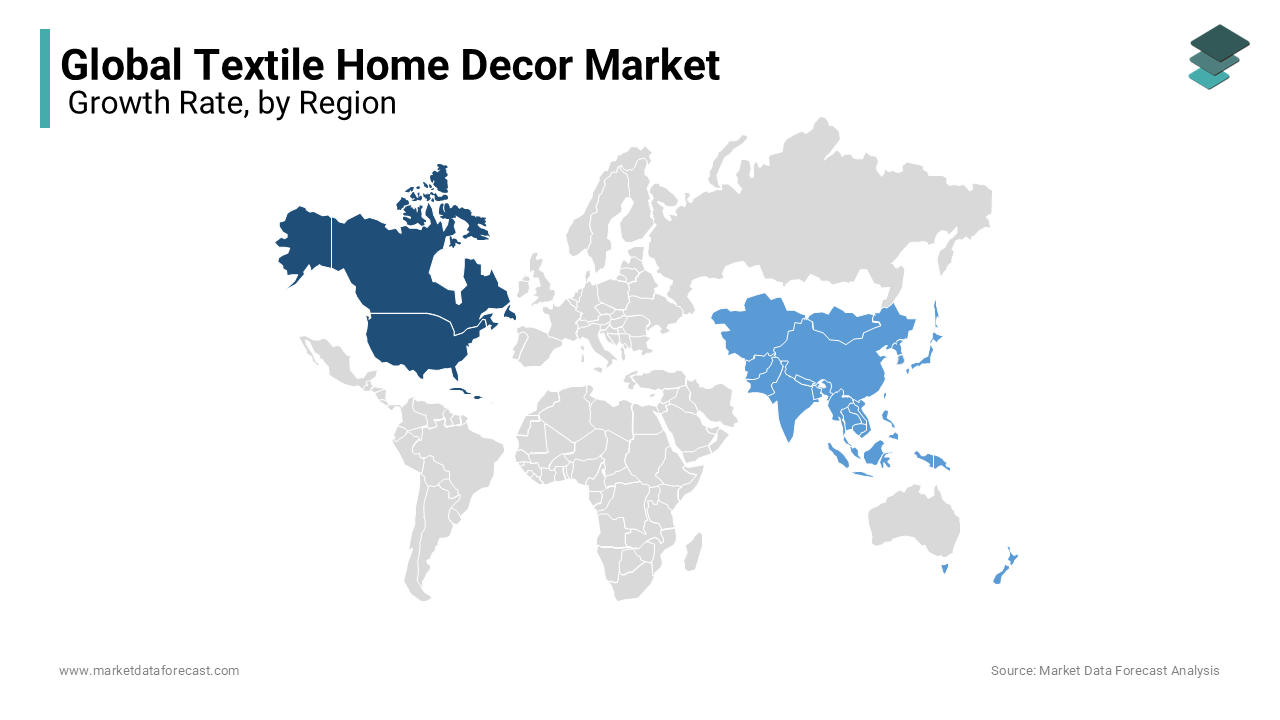

REGIONAL ANALYSIS

North America dominates the textile home decor market. The North American market is expected to have the largest revenue share in the textile home decor market. This is because consumers in the region have a lot of spending power, and there is an extensive distribution network, making it easy to find and buy textile home decor products. This helps the market grow in this area. The Asia Pacific market is also predicted to have significant growth in revenue during the forecast period, especially in countries like India and China, which are major suppliers of textile home decor products. This growth is due to more people moving to cities and adopting modern lifestyles in the region.

KEY PLAYERS IN THE GLOBAL TEXTILE HOME DECOR MARKET

Mannington Mills, Inc (U.S.), Companhia de Tecidos Norte de Minas (Brazil), Kurlon (India), American Textile Company. (U.S.), Leggett & Platt, Incorporated (U.S.), Nitori Holdings Co., Ltd. (Japan), Williams-Sonoma Inc. (U.S.), MOHAWK INDUSTRIES, INC. (U.S.), American Signature, Inc. (U.S.), Bombay Dyeing (India), Vescom B.V. (Netherlands), MITTAL INTERNATIONAL (India), Kimball International Inc. (U.S.)

RECENT HAPPENINGS IN THE MARKET

- In 2021, Kroger acquired Bed Bath & Beyond to create a new online marketplace. This partnership allows both companies to expand their offerings on Kroger's Ship marketplace by including products from Bed Bath & Beyond and Buybuy Baby. Customers can now find storage, bedding, and baby furniture from these brands. Kroger shoppers will also have access to Bed Bath & Beyond's store brands and popular national brands.

- Also, in 2021, Kimball International Inc., a company specializing in commercial furniture, announced plans to enhance its warehousing operations. They intend to build a 220,000-square-foot warehouse at their industrial complex in Dubois County.

DETAILED SEGMENTATION OF THE GLOBAL TEXTILE HOME DECOR MARKET INCLUDED IN THIS REPORT

This research report on the global textile home decor market has been segmented and sub-segmented based on product type, distribution channel, and region.

By Product Type

- Bed linen and Bedspread

- Floor Coverings

- Kitchen and Dining Linen

- Bath/Toilet Linen

- Upholstery

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail Stores

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the size of the textile home decor market?

The textile home decor market is expected to reach USD 175.53 billion by 2028, which is USD 105.27 billion in 2022.

Who are the key market players in the textile home decor market?

Mannington Mills, Inc (U.S.), Companhia de Tecidos Norte de Minas (Brazil), Kurlon (India), American Textile Company. (U.S.), Leggett & Platt, Incorporated (U.S.), Nitori Holdings Co., Ltd. (Japan), etc.

Which region dominates the textile home decor market?

North America dominates the textile home decor market

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com