Global Carpet Market Size, Share, Trends & Growth Forecast Report - Segmentation By Material (Nylon, Olefin, Polyester and Others), End User (Residential and Commercial), Sales Channel (Hypermarket & Supermarket, Specialty Store and Online Sales Channel), Price Point (Economy and Luxury), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) – Industry Analysis (2024 to 2032)

Global Carpet Market Size (2024 to 2032)

The Global carpet market was valued at USD 64.75 billion in 2023. The global market size is expected to grow at a CAGR of 4.6% from 2024 to 2032 and be worth USD 97.06 billion by 2032 from USD 67.73 billion in 2024.

Current Scenario of the Global Carpet Market

In fact, 90% of the rugs produced in India are exported. In April-November 2019, India's exports of handmade rugs amounted to INR 64,407.19 crore (USD 916.15 million).

India is currently a leader in the production of handmade rugs in terms of volume and value. Its heritage in handmade rugs is recognized around the world with its recognizable share in global exports. India exports rugs to over 70 countries around the world. The main importers of Indian woven rugs are the USA, Germany, Canada, the UK, Australia, South Africa, France, Italy, Brazil, etc. With the advent of globalization, new opportunities are opening for the developing Indian carpet market.

Carpet weaving is an ancient Indian tradition that dates to 16th-century Persian rugs and rugs. The rugs made are usually hand-knotted and have various patterns in their designs. India's carpet industry is a rural, labor-intensive cottage industry. Indian silk rugs are highly preferred by buyers and weavers because of their originality, color, quality, design, and durability. However, the demand for tufted rugs is expected to increase in the market due to the use of synthetic materials, which makes them cheaper, and the manufacture of rugs is also less labor-intensive. Consumer preferences are changing with time in the international market, and they are now turning towards washable and cheaper rugs.

The global carpet market has undergone a dramatic change in recent years. Optimal prices, fast delivery, and high quality have boosted the world market. Technology intervention backed by sustainability will be the primary driver of growth opportunities in the highly competitive carpet market. Committed industry stakeholders continually advance the production of high-quality, cost-effective, recyclable rugs. In addition, the adoption of innovative technologies has enabled better inventory management, real-time monitoring, efficient manufacturing cycles, and optimization of the supply chain. In addition, the introduction of antimicrobial and antiallergic technology and LED mats have provided new growth avenues for the carpet market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

4.6% |

|

Segments Covered |

By Material, End-user, Sales Channel, Price and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Armstrong Flooring, Inc., Balta Group, Beaulieu International Group NV, Shaw Industries Group, Inc., Brumark, Dorsett Industries, Mannington Mills, Inc., Mohawk Industries, Inc., Tarkett SA and The Dixie Group |

SEGMENTAL ANALYSIS

Global Carpet Market By Material

The nylon segment dominated the market in 2023 and is expected to grow at a promising CAGR during the forecast period.

Nylon is the most preferred fiber type for carpet manufacturing. Nylon fiber rugs have high durability compared to their counterparts and nylon material can withstand high wear and tear for a considerable period.

Global Carpet Market By End-User

The residential segment accounted for a significant share of the worldwide carpet market in 2023 and is estimated to grow at a healthy CAGR during the forecast period owing to the intensive use of these products by households. Several companies provide installation services and after-sales services to attract users to the residential segment and obtain a competitive advantage in the market. Rapid urbanization, innovative marketing strategies used by businesses, and increased spending on home products have driven demand in the residential segment.

Global Carpet Market By Sales Channel

The online channel is expected to grow at a prominent CAGR during the forecast period. Online distribution has become a key sales channel for carpets as the major players in the industry expand their presence in e-commerce.

Global Carpet Market By Price Point

The economy price segment leads in terms of market share and is supposed to maintain its dominant position throughout the forecast period.

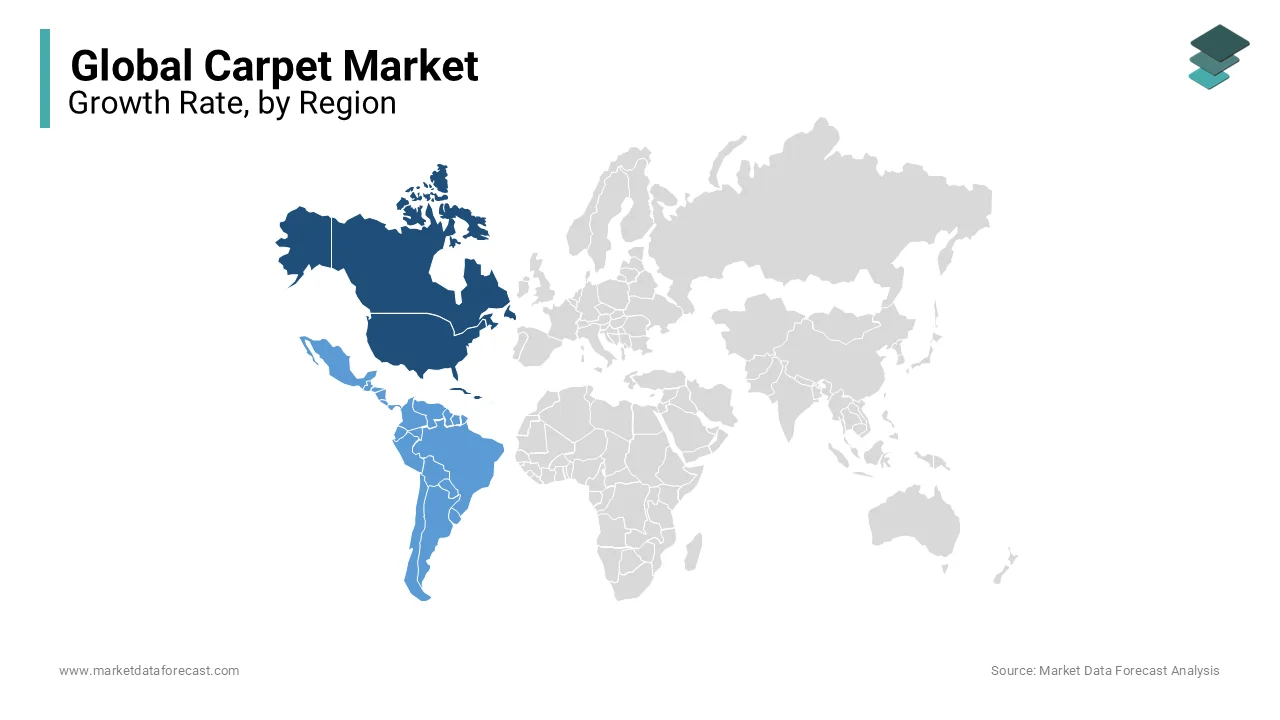

REGIONAL ANALYSIS

North America leads the market in terms of market share throughout the forecast period. However, it is estimated that the LAMEA region will lead to the growth of the global carpet market during the forecast period.

KEY MARKET PLAYERS

Armstrong Flooring, Inc., Balta Group, Beaulieu International Group NV, Shaw Industries Group, Inc., Brumark, Dorsett Industries, Mannington Mills, Inc., Mohawk Industries, Inc., Tarkett SA and The Dixie Group are some of the major players in the global carpet market.

DETAILED SEGMENTATION OF THE GLOBAL CARPET MARKET INCLUDED IN THIS REPORT

This research report on the global carpet market has been segmented and sub-segmented into the following categories.

By Material

- Nylon

- Olefins

- Polyester

- Others

By End-User

- Residential

- Commercial

By Sales Channel

- Hypermarkets

- Supermarkets

- Specialty Stores

- Online Sales Channels

By Price Point

- Economy

- Luxury

By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current size of the global carpet market?

The global carpet market size was worth USD 61.9 bn in 2022.

Which regions are the primary contributors to the global carpet market share?

Key regions include North America, Europe, and Asia-Pacific, with Asia-Pacific experiencing significant growth.

What are the emerging trends in the carpet market?

Emerging trends include the adoption of sustainable and eco-friendly materials, custom and designer carpets, and the integration of smart technology.

How has the COVID-19 pandemic impacted the carpet market?

The COVID-19 pandemic initially caused a slowdown in the industry, but with work-from-home trends, there's a growing demand for home and office carpets.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com