Global Home Decor Market Size, Share, Trends & Growth Forecast Report - Segmentation By Product Type (Furniture, Home Textiles and Floor Coverings), Income Group (Lower Middle Income, Upper Middle Income and High Income), Price Point (Mass and Premium), Distribution Channel (Specialty Stores, Supermarket/Hypermarket, E-Commerce and Others) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) – Industry Analysis (2024 to 2032)

Global Home Decor Market Size

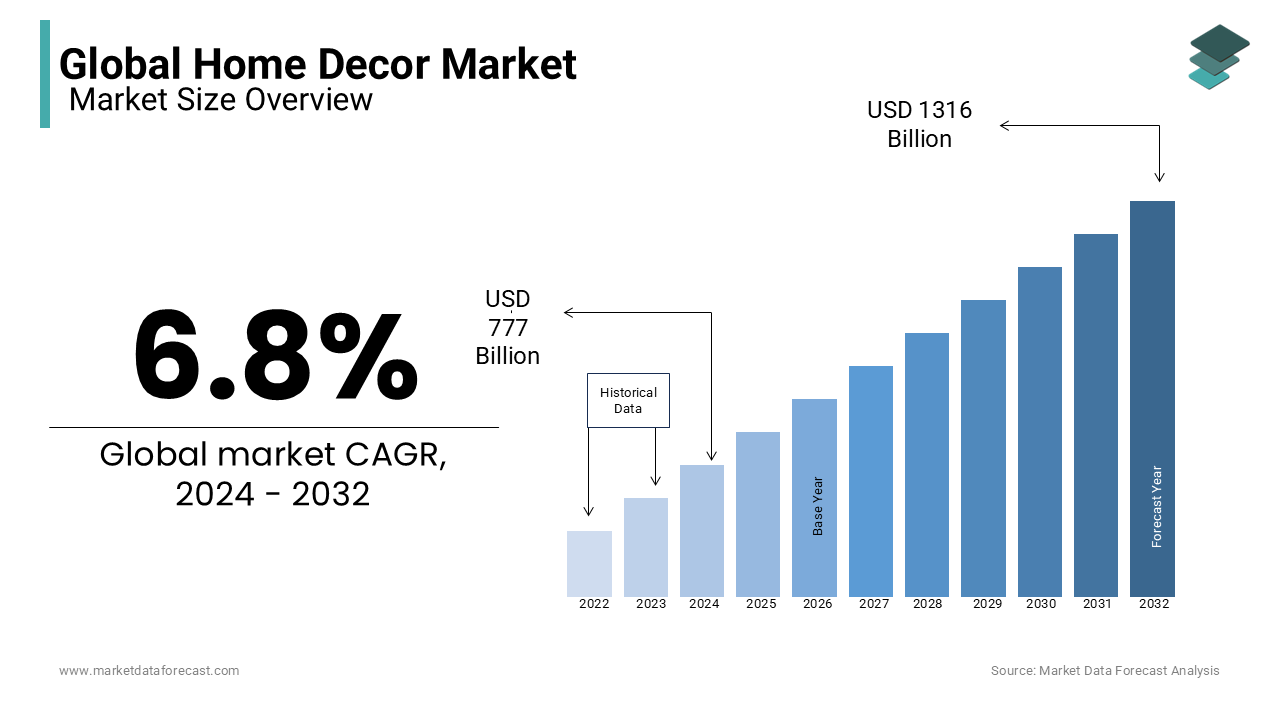

The global home decor market size was worth USD 728 billion in 2023, and the market is anticipated to reach USD 1316 billion by 2032 from USD 777 billion in 2024, registering a CAGR of 6.8% from 2024 to 2032.

Home decor products include various items such as furniture, home textiles, and floor coverings. Depending on the end user, furniture designs can be modified through mechanical and artisanal processes. The adoption of home decor products has been significantly high in developed regions such as the United States, Canada, and Germany while emerging countries such as China, Brazil, and India are steadily increasing.

Current Scenario of the Global Home Decor Market

The global market for home decor has taken a remarkable shift, and the demand for home decor products has grown significantly in the recent past. The rapid urbanization, changes in consumer preferences and the rise of e-commerce have contributed to the rising popularity of home decor and are responsible for the increased adoption of the home decor trend. In the present era, people have been increasingly preferring to have personalized living spaces and investing considerably in home improvement, which is resulting in an increasing demand for home decor products worldwide. To address the growing demand for home decor products, the key market participants have been engaging in strategies such as product differentiation through innovation, digital marketing initiatives and omnichannel retail strategies to provide seamless shopping experiences.

MARKET DRIVERS

Y-O-Y in urbanization and apartment living is majorly fuelling the home decor market growth.

The shift in consumer trends towards an urban lifestyle due to the increasing rate of urbanization has fuelled demand for home decor products and services and this trend is likely to continue during the forecast period and contribute to the home decor market growth. The change in lifestyle entails adequately adapting furniture and appliances to high-end products of excellent quality. The statistics published by the United Nations say, that approximately 55% of the world's population resided in urban areas in 2018 and increasing gradually with each year passing, which is estimated to result in the increasing demand for home decor products and services and propel the market growth in the coming years.

Y-O-Y growth in the real estate industry is boosting the home decor market growth.

The real estate industry has been experiencing promising growth worldwide and is resulting in an increasing demand for the services of home decor and favours the home decor market growth. The global real estate industry is anticipated to grow at a CAGR of 6.68% from 2024 to 2032 and this growth is expected to fuel the demand for home decor services and products. The growth of the interior design industry has paved the way for premium and luxury home decor products that provide an enjoyable experience for visitors. These high-end, novelty products help bring spiritual and aesthetic pleasure and add sophistication to consumers living at home. The global interior design market is projected to showcase a CAGR of 8.48% from 2024 to 2030. The demand for interior design services is primarily driven by the increasing consumer preferences for personalized and aesthetically pleasing living spaces, which is also boosting the demand for home decor products and contributing to global market growth.

The rising desire from people for home renovation is favoring the growth of the home decor market.

The growing preference of consumers for home renovation fuels the availability of various interior design products such as wood or marble floors, decorative lighting and environmentally friendly furniture and drives the home decor market growth. According to studies, an estimated 70% of consumers reported that they take home improvement as a priority and willingly invest in improving the aesthetics and functionality of their living spaces. The rising penetration of e-commerce and smart devices such as mobile phones and tablets with easy payment and dispensing options boosted the adoption of online home decor products as a means of purchase and this trend is expected to accelerate further in the coming years and propel the global home decor market growth. For instance, online sales for home decor products have been experiencing an increase of 20% on an annual basis.

MARKET RESTRAINTS

Home decor products are often available at higher prices, making it difficult for consumers of all income levels to purchase. The higher cost of raw materials associated with products such as wood and leather that are essential in delivering the home decor services majorly hampers the global market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

6.8% |

|

Segments Covered |

By Product Type, Income group, Price Point, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

|

Market Leaders Profiled |

Inter IKEA Systems B.V., Kimball International Inc., Herman Miller, Inc., home24, Hanssem Corporation, Koninklijke Philips N.V., Conair Corporation, Suofeiya Home Collection Co., Ltd., Springs Window Fashions LLC, and Siemens AG. |

SEGMENTAL ANALYSIS

By Product Type Insights

The furniture segment led the market and accounted for 51.7% of the worldwide market share in 2023.

The lead of the furniture segment in the global home decor market is expected to continue throughout the forecast period. The growth of the furniture segment is majorly attributed to the growing demand for multifunctional and space-saving furniture solutions. The availability of a wide range of furniture options over e-commerce platforms and increasing innovation in furniture items by the key market participants are further boosting the growth rate of the furniture segment in the global market. For instance, online sales currently hold 30% of the total furniture sales worldwide.

The home textiles segment held 30.7% of the global market share in 2023 and is expected to grow at a healthy CAGR during the forecast period. The growing preference from consumers for luxurious and personalized home furnishings is primarily propelling the growth of the home textiles segment in the global market.

By Distribution Channel Insights

The specialty stores segment occupied the highest share of the global market in 2023.

The ability of specialty stores to offer personalized shopping experiences, expert advice, and exclusive product ranges is one of the key factors driving the growth of the specialty stores segment. The growing trend of DIY home decor projects and the increasing number of interior design enthusiasts choosing specialty stores to buy home decor products are further boosting the growth rate of the specialty stores segment in the worldwide market.

The e-commerce segment is expected to experience a CAGR of 10.42% during the forecast period.

Factors such as the convenience of shopping from anywhere at any time using online platforms, the ability to compare prices and product reviews and access to a diverse range of products are majorly driving the growth of the e-commerce segment. The global online marketplaces such as Amazon, Alibaba and Wayfair have been using technological advancements such as data analytics and AI-driven recommendation engines to personalize the shopping experience and boost sales for home decor products, which is propelling the expansion of the e-commerce segment.

REGIONAL ANALYSIS

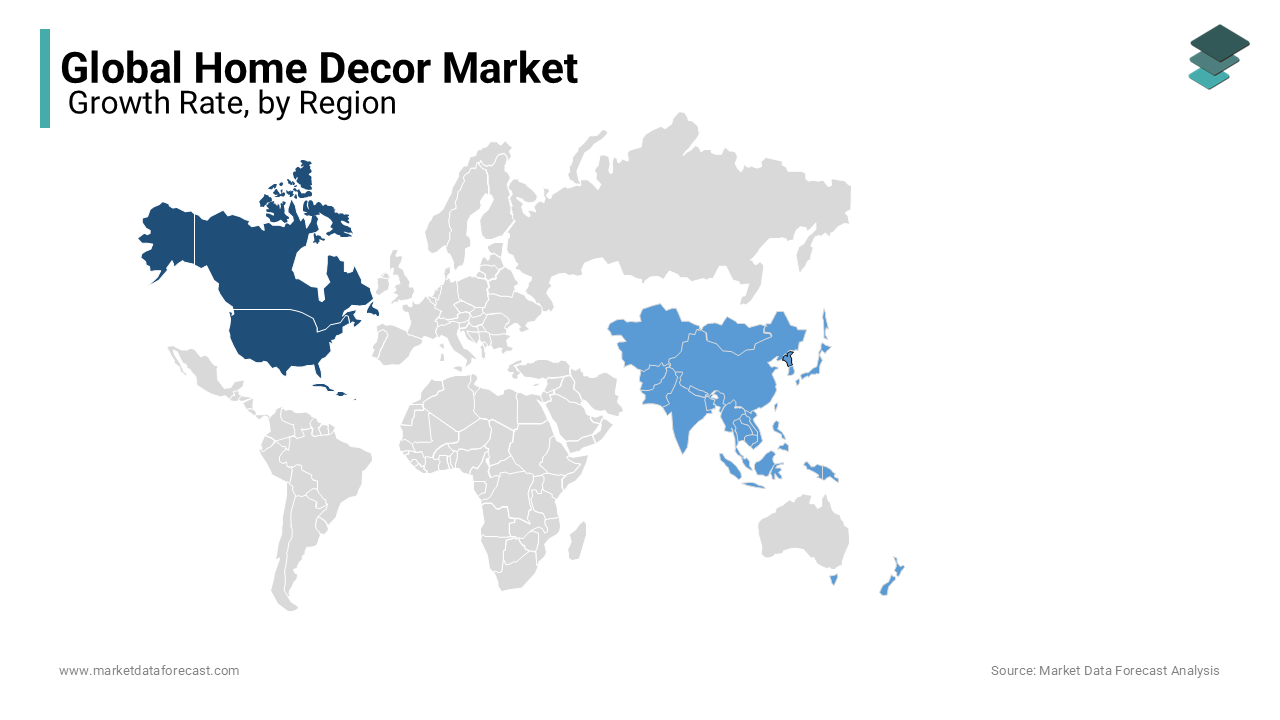

North America dominated the market in 2023 globally and accounted for 37.7% of the global market share.

The domination of North America in the worldwide market is anticipated to continue during the forecast period and is majorly attributed to the increasing desire for personalized design spaces and the rising popularity of TV shows. Factors such as strong economy and consumer spending, changing interior design preferences, growth of online shopping and rising focus on sustainability propel the growth of the North American market. The U.S. is the most promising regional segment in North America for home decor products and services. Canada is another prominent regional market for home decor products and services in the North American region and is anticipated to occupy a considerable share of the regional market in the coming years.

The Asia Pacific region is projected to showcase a promising CAGR during the forecast period.

The growing middle-class population with higher disposable incomes, rapid urban development, growing e-commerce industry across the Asia-Pacific region, increasing accessibility to decor products and booming real estate sector fuel demand for interior decor and propel the growth of the Asia-Pacific market.

Europe is predicted to occupy a substantial share of the worldwide market during the forecast period. Factors such as the growing urban population and smaller living spaces and rapid adoption of smart home technologies drive the growth of the European home decor market.

KEY PLAYERS IN THE GLOBAL HOME DECOR MARKET

IKEA Systems B.V., Kimball International Inc., Herman Miller, Inc., home24, Hanssem Corporation, Koninklijke Philips N.V., Conair Corporation, Suofeiya Home Collection Co. Ltd., Springs Window Fashions LLC and Siemens AG are some of the major companies in the global home decor market. The global home decor market is highly fragmented due to multiple vendors among international and regional players. The rapid development of the real estate industry is resulting in the increasing demand for services such as interior design and home decor and contributing to these markets likewise. The global home decor market has seen promising growth in the recent past and is expected to grow steadily during the forecast period owing to the popularity of interior design products such as furniture, home textiles, and flooring among worldwide consumers.

RECENT HAPPENINGS IN THE MARKET

- In August 2020, Ashley Furniture announced that it was expanding its operations at its Verona and Saltillo facilities. The expansions will create 130 jobs at both facilities. Ashley will invest $ 13 million in its Verona plant, and this includes the construction of a building and the purchase of new equipment.

- In August 2020, The Home Depot announced that it would open three new distribution centers in Georgia over the next 18 months to meet the growing demand for flexible pickup and delivery options for commercial and DIY customers.

MARKET SEGMENTATION

This research report on the global home decor market has been segmented and sub-segmented based on product type, income group, price point, and region.

By Product Type

- Furniture

- Home Textiles

- Floor Coverings

By Distribution Channel

- Supermarkets and Hypermarkets

- Specialized Stores

- E-Commerce

- Others

By Income Group

- Lower Middle Income

- Upper Middle Income

- High Income

By Price Point

- Mass

- Premium

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What are the current trends in the home decor market?

The current trends in the home decor market include sustainable and eco-friendly materials, minimalist designs, bohemian aesthetics, and the incorporation of smart technology into home decor items.

2. How is the home decor market experiencing growth?

The home decor market is experiencing growth due to increasing disposable income, urbanization, and a growing desire for personalized living spaces. Additionally, the rise of online shopping platforms has made it easier for consumers to access a wide variety of home decor products.

3. What are some emerging trends to watch out for in the home decor market?

Some emerging trends in the home decor market include the use of natural materials like rattan and bamboo, biophilic design principles that connect indoor spaces with nature, and the blending of traditional craftsmanship with modern design techniques. Additionally, personalized and customizable home decor solutions are gaining popularity among consumers seeking unique and one-of-a-kind pieces for their homes.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com