Global Dairy Alternatives Market Size, Share, Trends, Growth Report & Analysis By Application (Milk, Cheese, Yogurt, Ice Creams, Creamers), Distribution Channel (Supermarkets, Health Stores, Pharmacies, and Online Stores), and Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Dairy Alternatives Market Size

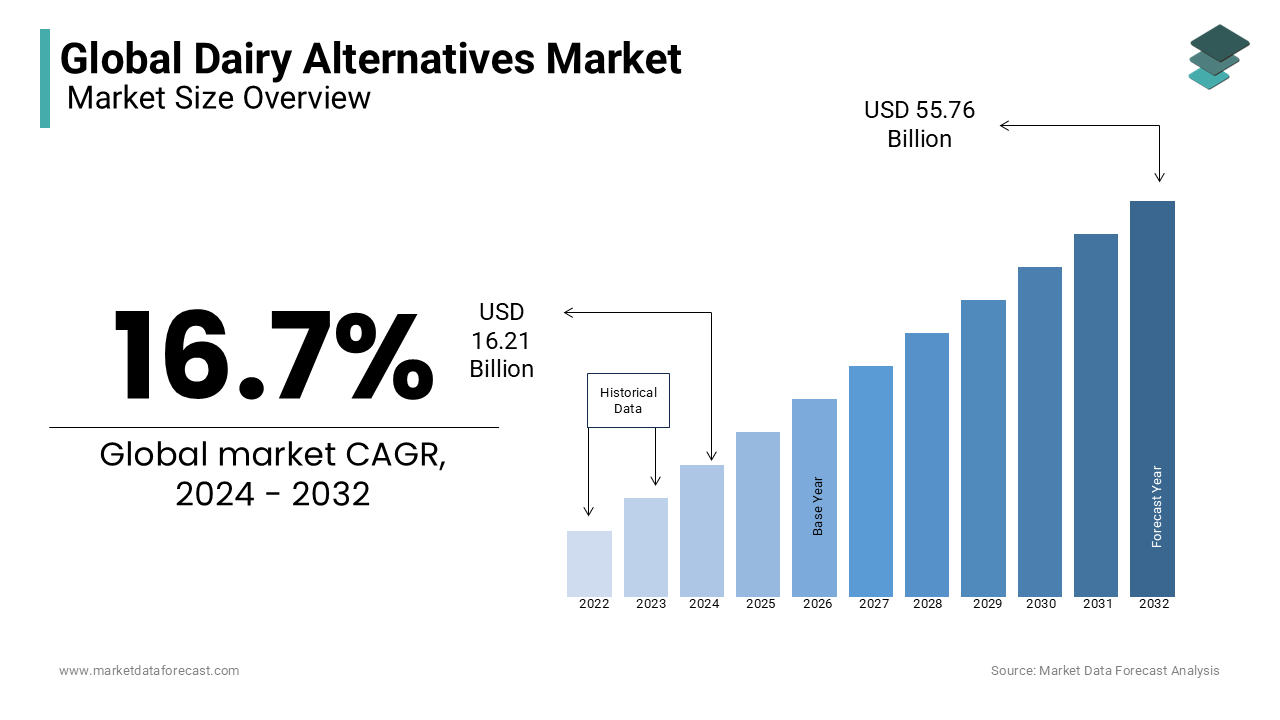

The global dairy alternatives market size was valued at USD 16.21 billion in 2024 and is estimated to reach USD 65.09 billion by 2033 from USD 18.92 billion in 2025, registering a CAGR of 16.7% from 2025 to 2033

Dairy alternatives offer better nutritional benefits compared to traditional dairy products like milk, butter, and cheese, allowing more customers to switch to these products. Contrary to popular belief, studies published in the Food and Nutrition Research Journal show that increased milk consumption does not improve bone density in adults. Dairy substitutes have fewer calories than low-fat milk. In addition, the calcium and potassium content of these dairy substitutes is higher than that of milk, which is one of the main causes of dairy consumption. The results of these studies were incorporated into the marketing strategies by the manufacturers of dairy substitutes to increase sales.

MARKET DRIVERS

The growing awareness among consumers of lactose intolerance and dairy allergies is primarily promoting the growth of the dairy alternatives market. The rising prevalence of cardiovascular disease, obesity, diabetes, and gastrointestinal illness and increasing consumer spending on healthy foods, essential calories, nutrition, lactose, and sugar-free diets are bolstering the growth of the dairy alternatives market. Increased consumer interest in nutritional values, such as low in calories and high in protein and vitamins provided by milk substitutes or dairy alternatives, is likely to have a positive impact on the market. Soy milk contains various minerals such as iron, calcium, phosphorous, zinc, sodium, potassium, and magnesium. This product is very popular with heart patients because it lowers cholesterol levels. Also, soy milk contains the same amount of protein as milk and has fewer calories than whole milk and skim milk. Therefore, like soymilk consumption increases, overall industrial demand is expected to increase. A preliminary study of the company's performance on substitute dairy products showed that soy, rice, and almond milk yields were approximately 6% higher than conventional milk and milk yields, attracting the attention of startups and food companies.

The European dairy industry has become a market leader, especially in Western Europe. Due to the growing consumer demand for plant-derived dairy products, the global industry is supposed to grow at a significant rate. As consumer health awareness increases along with improving disposable incomes in countries such as Brazil, India, China, and Japan, consumption of soy milk, almond milk, coconut milk, and rice is assumed to increase during the outlook period. The growing interest in animal rights and environmental protection is raising the preference for veganism. It is presumed to lead the industry during the projection period.

Furthermore, government policies to improve the agricultural sector will have a positive impact on market growth by increasing the availability of raw materials and lowering prices. Changes in the supply of raw materials are suspected to be a primary concern for market growth. The raw materials used in the manufacture of milk substitutes are nuts and edible grains, and most of the production is used for direct consumption. As a result, the availability of raw materials can be a crucial factor affecting the industry.

MARKET RESTRAINTS

Though the demand for dairy alternatives like almond milk, soy milk, and others is constantly growing, some people are more likely to depend only on dairy products, which are high in protein and cost. Dairy alternative products are plant-based options, and the cost is very high when compared with dairy products, subsequently limiting the growth rate of the market. Except for people who are lactose intolerant, there is no other reason to stop consuming dairy products like cow milk. It is a fact that there is no harm in drinking animal-based milk as it is highly nutritious and cost-effective. Therefore, the demand for dairy alternatives is still at a slower pace in rural areas, which may impede the market's growth rate.

Some brand products of dairy alternatives may contain fewer micronutrients compared to dairy products, which is slowing down the market's growth rate. In addition, people suffering from celiac disease cannot intake oat milk and others even though they are gluten-free, which is likely to impede the growth rate of the dairy alternatives market. There is likely no evidence that plant-based dairy products have high advantages and nutritional value, which is also a factor that degrades the growth rate of the dairy alternatives market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

16.7% |

|

Segments Covered |

By Application, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Vitsoy International Holding Limited, CP Kelko, Daiya Foods Inc, WhiteWave Foods Company, Nutriops S.L, OT AB, Eden Foods, Freedom Food Group Co Ltd, Blue Diamond Grower Inc, Hain Celestial Group and Others. |

SEGMENTAL ANALYSIS

By Application Insights

The milk segment is leading with the highest share of the dairy alternatives market. The availability of non-dairy products is gradually increasing with the reduced production rate of animal-based dairy products. This is eventually creating scope to depend on plant-based dairy products, especially in urban cities. People in developed and emerging countries are showing huge interest in the adoption of a variety of products that are produced from plant-based sources, which is gearing up the growth rate of the market. The growing interest in non-dairy milk products with various flavors like oats, almonds, soy, and cashews is lucratively amplifying the demand for dairy alternative products. In 2023, according to the Associated Chambers of Commerce and Industry of India, there are more than 300 unique products under 56 brands that are completely related to the plant-based alternatives to dairy products in India.

The yogurt segment is set to hit the highest CAGR by the end of 2029. Key strategies by companies to launch new varieties of plant-based derivatives to replace traditional dairy products are solely to propel the growth rate of the market during the forecast period. Yogurt is an essential product for fitness freaks as it consists of more fiber and less total sugar when compared with dairy yogurt. Therefore, the yogurt segment is attributed to having the fastest growth rate during the forecast period.

The ice cream segment is attributed to growing steadily throughout the forecast period. Ice cream is one of the favorite products of many people across the world. Ice creams made of plant-based derivatives are more likely to attract people who seek to stay healthy by eating low-calorie food products.

By Distribution Channel Insights

The supermarket segment is esteemed in holding a prominent share of the dairy alternatives market. There are many kinds of dairy alternative products that can be easily available in the nearest supermarkets in the cities. The growing prominence of shifting towards non-dairy products is ascribed to boosting the market's growth rate. Online stores are expected to have the fastest growth rate during the forecast period. Feasibility in purchasing products through online stores simply through a smartphone is leveling up the segment's growth rate. Quick adoption of advanced techniques in the food and beverage industry is the sole way to increase the market's growth rate. The high usage of smartphones is also ascribed to amplifying the online store's segment's growth rate.

REGIONAL ANALYSIS

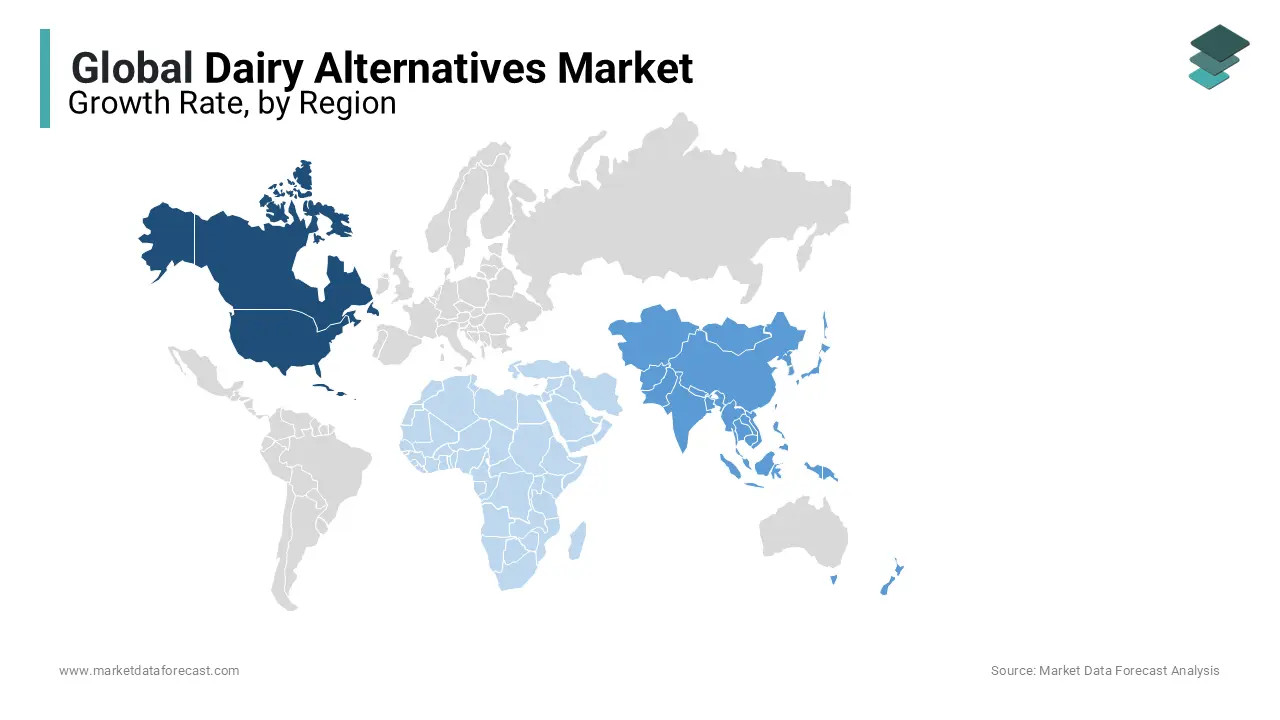

North America is leading with the largest share of the dairy alternatives market owing to rising people's focus on eating only healthy food items. The need to eat high nutritional value food products is growing with the increasing risk factors due to various chronic diseases, which is outraging the demand for the shift towards dairy alternatives. According to the National Institutes of Health, more than 36% of Americans have lactose malabsorption, and these people cannot easily digest milk products due to the presence of lactose. The easy availability of unique and high-quality products in online stores is straightly prompting the growth rate of the market in developed countries like the US and Canada.

Asia Pacific dairy alternatives market is deemed to hit the highest CAGR by the end of 2029. India and China are the most populous countries in the world, and the demand to adopt dairy alternatives is growing at a faster rate. The decreased production rate of dairy milk in these countries substantially leverages the need for dairy alternatives. The launch of various unique products in favor of the consumer's preferences is another factor that escalates the market's growth rate. Also, rising support from government authorities for approving high-quality products based on consumer safety is likely to highlight the growth rate of the market in the coming years in India and China. Frequently changing lifestyles in urban areas in these countries account for the launching of a huge number of dairy alternative products that further propel the market's growth rate.

Europe is expected to lead the market share next to North America during the forecast period. According to recent survey reports, one in three Europeans is inclined to drink plant-based dairy alternatives drinks, especially for people aged 25-35. The UK and Spain are the largest consumers of dairy alternatives, and the market share in these countries has been increasing at a higher rate in the past few years. High disposable income, along with rapid urbanization, are also a few common attributes for the market to grow in these countries.

Latin America and the Middle East & Africa are expected to have a steady growth pace during the forecast period due to the increasing prominence on avoiding unhealthy foods and completely focusing on improving health to prevent obesity-related issues.

KEY MARKET PLAYERS

Vitsoy International Holding Limited, CP Kelko, Daiya Foods Inc., WhiteWave Foods Company, Nutriops S.L, OT AB, Eden Foods, Freedom Food Group Co Ltd, Blue Diamond Grower Inc., and Hain Celestial Group are a few of the notable companies in the global dairy alternatives market.

RECENT HAPPENINGS IN THE MARKET

- In 2023, Daiya Foods Inc., a British Columbia dairy alternative company, launched an innovative product, dairy-free cheese, using fermentation technology part. The new Daiya oat cream blend is striking promising results in the market and attracting huge customers with its dairy-like melt and deliciously balanced cheesy flavor. The dairy-free cheese is made with gluten-free oats and is free from many allergens, including dairy, soy, wheat, and gluten, which was verified by the Non-GMO Project.

MARKET SEGMENTATION

This research report on the global dairy alternatives market has been segmented and sub-segmented based on application, distribution channel and region.

By Application

- Milk

- Cheese

- Yogurt

- Ice Creams

- Creamers

By Distribution Channel

- Supermarkets

- Health Stores

- Pharmacies

- Online Stores

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What are the key sources taken into account in this analysis, and which segments are expected to increase at a promising rate in the future?

Soy has the largest market share in the dairy substitutes industry, followed by almonds and coconut. Almond, on the other hand, is expected to increase at the fastest rate in the next five years, thanks to a number of attributes such as high nutritious content and easy raw material availability. It has the reputation of being a clean-label ingredient, as well as being soy-free, gluten-free, and lactose-free.

What kind of data does the competitive landscape section provide?

Company profiles for the players listed below contain information such as a business overview that includes information on the company's business segments, financials, geographic presence, and revenue mix. In addition to product offerings, key developments associated with the company, SWOT analysis, and MnM view to elaborate analyst views on the company, the company profiles section provides information on product offerings, key developments associated with the company, SWOT analysis, and MnM view to elaborate analyst views on the company. The Hain Celestial (US), Blue Diamond Growers (US), SunOpta (Canada), Sanitarium Health and Wellbeing Company (Australia), Danone (France), and Freedom Foods Group are among of the market's major participants (Australia).

What factors are driving the market for dairy alternatives?

The expansion of the vegan customer base, as well as increased demand for dairy alternatives-based goods from lactose-intolerant consumers, are two significant reasons driving the dairy alternatives market. In addition, the global market is being driven by an increase in the consumption of dairy alternatives for weight loss.

Who are the major participants in the market for dairy alternatives?

The Hain Celestial Group, Inc., SunOpta Inc., Danone, Oatley, Vitasoy International Holdings Limited, DAIYA FOODS INC., Melt Organic, Living Harvest Foods Inc., Ripple Foods, and Earth's Own Food Company Inc. are some of the prominent competitors in the dairy alternatives market.

In the dairy alternatives market, which area had the biggest share?

In 2020, Asia Pacific dominated the worldwide dairy alternatives market, accounting for over 44.0 percent of global revenue.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com