Global Drug Screening Market Size, Share, Trends & Growth Forecast Report By Sample Type, End-user, Products & Services and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Drug Screening Market Size

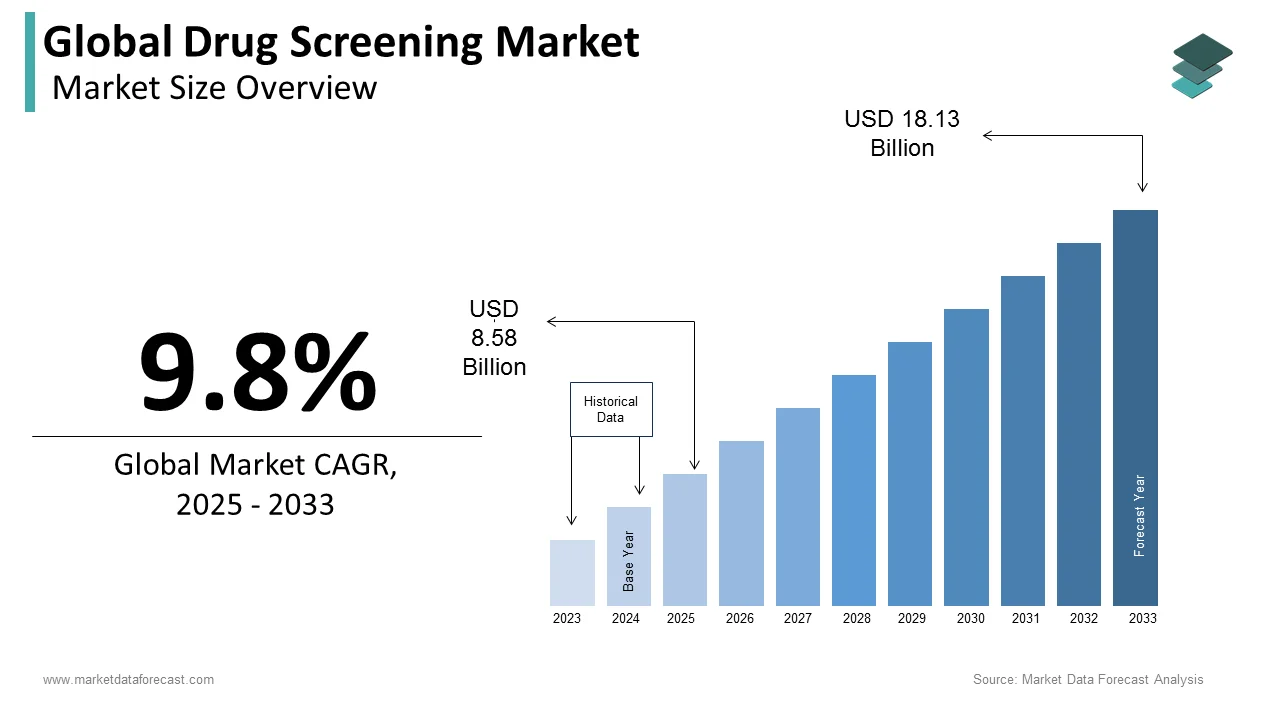

The size of the global drug screening market was worth USD 7.81 billion in 2024. The global market is anticipated to grow at a CAGR of 9.8% from 2025 to 2033 and be worth USD 18.13 billion by 2033 from USD 8.58 billion in 2025.

MARKET DRIVERS

The growing prevalence of drug abuse and illegal applications of drugs propel the global drug screening market growth.

Enforcement of stringent laws for drug and alcohol testing and the emergence of novel and innovative products into the market due to regulatory approvals accelerates the growth rate of the drug screening market. The growing workplace safety concerns have made drug screening tests mandatory at regular intervals. As a result, increasing demand for non-invasive screening devices is resulting in the drug screening market worldwide.

The emergence of novel and valuable drug testing practices at workplaces, such as oral fluid, and the availability of technologically advanced pain management facilities and drug management facilities are expedited to offer lucrative growth opportunities for the key players operating in the drug screening market forecast period. Furthermore, the growing focus of the various governments worldwide is enforcing stringent laws and increasing the funding to adopt advanced and effective screening devices to curb the illegal use of un-prescripted drugs. Favorable regulatory conditions and easy approvals leading to escalation of R&D activities and a rise in product launches are supposed to create more growth opportunities for the stakeholders in the drug screening market.

MARKET RESTRAINTS

However, the high costs associated with the equipment used for drug screening are showcasing a negative impact on the market growth. Notably, the adoption of drug screening devices and testing practices is practiced at a low rate in underdeveloped and developing countries due to budget limitations. Another factor that is challenging the growth of the drug screening market is that breath analyzers are unreliable in many cases. It has a history of providing inaccurate results. Furthermore, the consumption of drugs and alcohol is strictly prohibited. It is very minimal in Islamic nations due to religious reasons, another major factor resisting the growth of the global drug screening market.

Impact of COVID-19 on the global drug screening market

The outbreak of COVID-19 affects worldwide on the drug screening market. Drug screening tests determine if a person is under the influence of drugs at a certain point in time. Drug screening is an integral part of deciding drugs present in an individual for proper evaluation and treatment. Drug screening is often done by respective authorities at schools, hospitals, and employment places, for individuals and athletes. In employment, drug screening is done as pre-employment testing for prospective employees. Due to COVID-19 issues, there are still travel bans and restrictions being continued across the globe; hence, the drug screening market has taken a break from airport testing due to travel ban issues worldwide. However, hospital drug screening centers are also at risk as COVID-19 patients have been isolated and treated in every hospital allotted worldwide.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By sample type, products & services, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Market Leaders Profiled |

Thermo Fisher Scientific Inc., Express Diagnostics Int’l Inc., Abbott Laboratories, Siemens AG, Alere Inc., Quest Diagnostics Incorporated, Laboratory Corporation of America Holdings, Biorad Laboratories Inc., Shimadzu, and Omega Laboratories |

SEGMENTAL ANALYSIS

Global Drug Screening Market Analysis By Sample Type

Based on the sample type, the urine sample segment occupied the largest share of the global data screening market in 2024 and the domination of the segment is expected in the coming years. Urine samples are one of the popular methods due to their ease of collection and cost-effectiveness. The widespread adoption in various settings, including workplace drug testing, clinical diagnostics, and drug rehabilitation programs further propel the growth of the urine segment in the drug screening market. The non-invasiveness of urine collection and the ability of urine samples to detect a wide range of drug classes further contribute to the growth rate of the urine segment.

The blood segment is expected to grow at a healthy CAGR during the forecast period. The growing need for immediate and accurate drug testing in emergency situations, pre-employment screenings, and legal proceedings drives the growth of the blood segment in the worldwide market.

Global Drug Screening Market Analysis By End-user

Based on end-user, the hospital segment accounted for the largest share of the global drug screening market in 2024 and the domination of the hospital segment in the global market is expected to continue in the coming years. The growing awareness about the harmful effects of drug abuse on overall health, rising adoption of drug screening as a preventive measure to ensure patient safety and effective treatment outcomes by healthcare professionals and stringent regulations and policies by the governments contribute to the growth of the hospital segment in the global market. The prevalence of substance abuse, including illicit drugs and prescription medications further fuels the growth rate of the hospital segment.

The workplace segment is expected to grow at a high CAGR during the forecast period owing to the increasing number of mandatory drug screening tests in the recruitment process of many companies. The growing adoption of drug screening by organizations in various industries such as transportation, construction, and healthcare to ensure a drug-free workplace environment and reduce the risk of accidents and promote employee well-being primarily propel the growth of the workplace segment.

Global Drug Screening Market Analysis By Products & Services

Based on products & services, the breathalyzer segment had the leading share of the global market in 2024 and is expected to grow at a notable CAGR during the forecast period. The strict enforcement of alcohol-related laws, the need for accurate and non-invasive alcohol testing and the rising focus on maintaining a safe environment drive the growth of the breathalyzer segment in the worldwide market.

The rapid test device segment is another lucrative segment among all and is predicted to account for a considerable share of the global market during the forecast period. The growing demand for immediate and on-site drug testing and the increasing need for efficient and convenient screening methods contribute to the growth of the rapid test device segment.

REGIONAL ANALYSIS

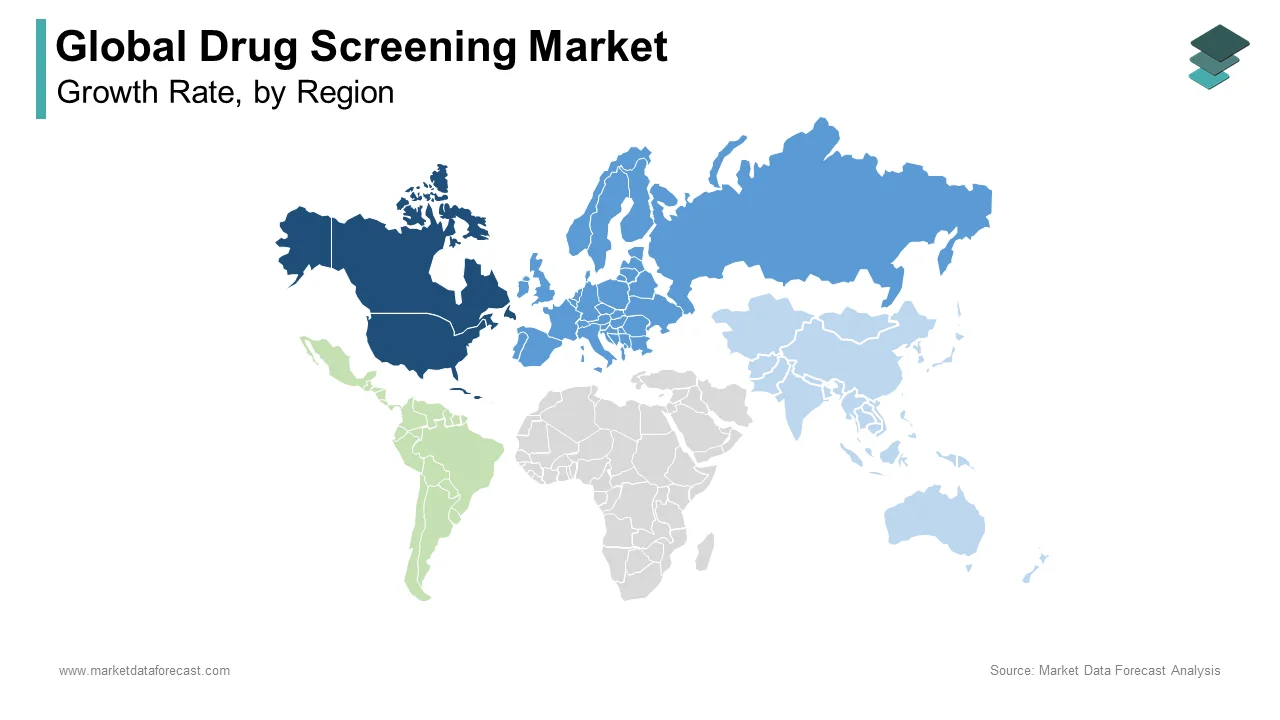

The North American data screening market had the largest global market share in 2024 and is predicted to dominate throughout the forecast period.

The growing cases of drug and alcohol abuse and stringent government regulations for drug screening and testing in the North American region drive the growth of the North American market growth. The popularity and demand for quick testing devices in North America are likely high as the government is expected to regularize the policies for unlawful drug usage. The presence of key market players and advancements in drug testing technologies further fuel market growth in North America. The U.S. held the largest share of the North American market in 2024 and the domination of the U.S. in the North American region is likely to continue during the forecast period. The growth of the U.S. market is primarily driven by the stringent regulations enforced by regulatory agents like the Drug Enforcement Agency (DEA) of the United States in the region.

The drug screening market in Europe accounted for the second-highest revenue share in the global drug screening market, followed by markets in the Asia Pacific and Latin America, respectively. The rising emphasis on workplace drug testing, particularly in industries such as transportation, manufacturing, and healthcare drives the drug screening market growth in the European region. The growing number of initiatives from the governments of European countries to reduce drug abuse and the rapid adoption of advanced drug screening technologies contribute to the European market growth. The growing number of clinical drug trials and increasing need for drug testing in healthcare settings further boost the growth rate of the market in Europe. The UK, Germany and France are predicted to hold the leading share of the European market during the forecast period.

The Asia Pacific drug screening market is projected to witness the fastest CAGR growth among all the regions worldwide during the forecast period owing to the increasing number of drug and alcohol addicts, rising disposable income, and growing awareness regarding alcohol and drug screening in emerging economies such as China, India, and Japan. The growing prevalence of drug abuse and addiction, especially among the youth population, the rising awareness about the importance of drug testing in workplaces and the implementation of strict regulations by government authorities contribute to the growth of the APAC market. The rapid adoption of advanced drug screening devices and technologies in countries like China, Japan, and India further propels market growth in the Asia Pacific. In developed markets such as the USA, the UK, Australia, and others, drug tests are considered much more reliable and accurate than simple drug screens. However, these tests are a lot pricier, i.e., USD 200, and take longer to perform, i.e., around 1-7 days. However, these tests are far more demanding for pre-employment services, rehabilitation services, sports & training academies and others.

The Latin American drug screening market is anticipated to hold decent occupancy in the global market during the forecast period. The growing awareness about the consequences of drug abuse and the need for workplace drug testing programs drive the Latin American market growth. The initiatives from the governments of Latin America to combat drug-related issues, such as drug trafficking and substance abuse further fuel the demand for drug screening services and propel the Latin American market growth. The presence of a large workforce in industries like construction, transportation, and mining promotes market growth in the Latin American region.

The MEA drug screening market is estimated to grow at a steady CAGR in the coming years. Factors such as the growing prevalence of drug abuse, rising awareness about workplace safety and the implementation of drug testing programs drive the market growth in the Middle East and African region. Stringent regulations by government authorities and the growing focus on maintaining a drug-free workplace environment further contribute to regional market growth.

KEY MARKET PLAYERS

Thermo Fisher Scientific Inc., Express Diagnostics Int’l Inc., Abbott Laboratories, Siemens AG, Alere Inc., Quest Diagnostics Incorporated, Laboratory Corporation of America Holdings, Biorad Laboratories Inc., Shimadzu, and Omega Laboratories are some of the major companies in the global drug screening market.

RECENT MARKET HAPPENINGS

- Care Health America Corporation completed the acquisition of Express Diagnostics internationally in 2018. As a result, Care Health has expanded its product portfolio, and even the customers of Express Diagnostics will have access to the products offered by both companies. Another key objective of their deal is to provide advanced and rapid diagnostics with reduced costs to the people and distribution partners.

- Alere Inc. launched a product called icup RX drug screen in 2017. The device conducts urine tests and detects almost five abused or misused prescription drugs. The rapid screening allows the specialists to streamline the testing process and manage patients at de-habilitation centers. In addition, professionals believe that selection is essential to identify the kind of drug the patient takes to apply a comparative treatment method.

DETAILED SEGMENTATION OF THE GLOBAL DRUG SCREENING MARKET INCLUDED IN THIS REPORT

This market research report on the global drug screening market has been segmented and sub-segmented based on the sample type, products & services, end-user, and region.

By Sample Type

- Hair

- Blood

- Urine

- Others

By End-user

- Hospitals

- Workplaces

- Criminal Justice

- Law Enforcement

By Products & Services

- Breathalyzer

- Rapid Test Device

- Immunoassay Analyser

- Chromatography

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How much was the global drug screening market worth in 2024?

The global drug screening market size was valued at USD 7.81 billion in 2024.

Which region had the largest share of the global drug screening market in 2024?

North America accounted for the most significant share of the global market in 2024.

Does this report include the impact of COVID-19 on the drug screening market?

Yes, we have studied and included the COVID-19 impact on the global drug screening market in this report.

Which are the companies playing a key role in the drug screening market?

Thermo Fisher Scientific Inc. Express Diagnostics Int’l Inc., Abbott Laboratories, Siemens AG, Alere Inc., Quest Diagnostics Incorporated, Laboratory Corporation of America Holdings, Biorad Laboratories Inc., Shimadzu, and Omega Laboratories are some of the prominent companies in the drug screening market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com