Global High Throughput Screening Market Size, Share, Trends & Growth Forecast Report By Technology, Application, Product, End User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global High Throughput Screening (HTS) Market Size

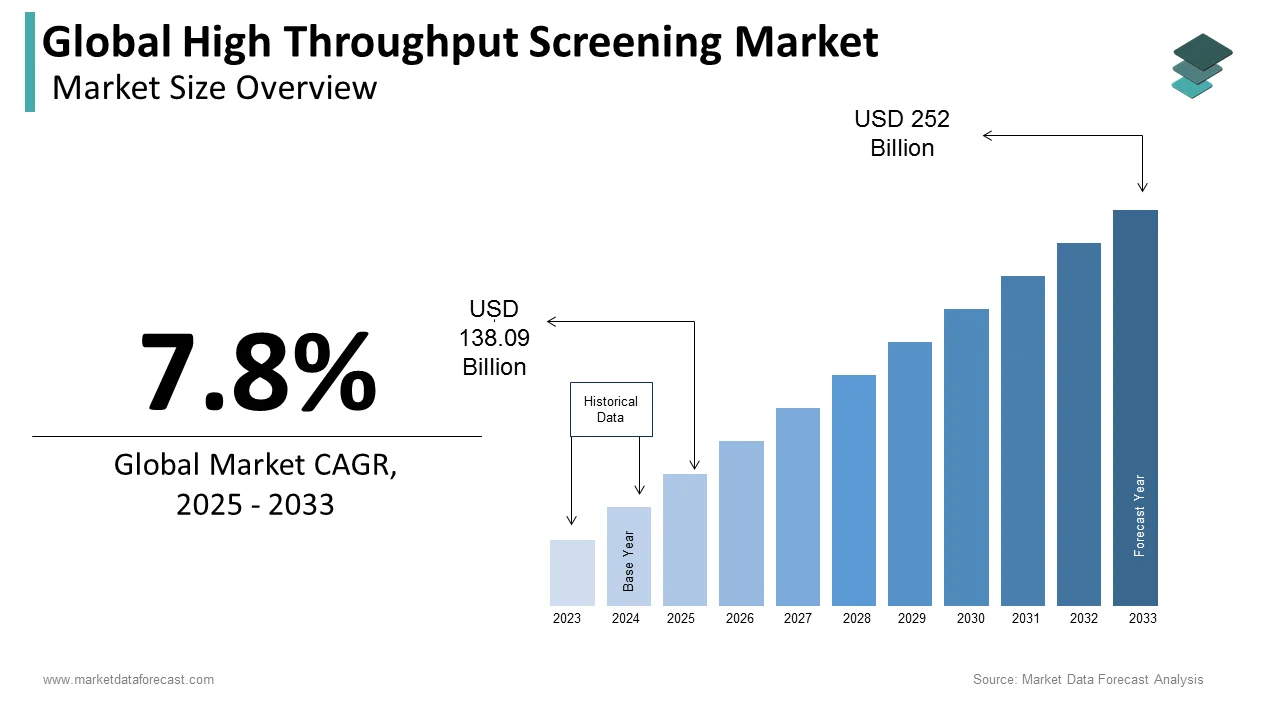

The global high throughput screening market was worth US$ 128.1 billion in 2024 and is anticipated to reach a valuation of US$ 252 billion by 2033 from US$ 138.09 billion in 2025, and it is predicted to register a CAGR of 7.8% during the forecast period 2025-2033.

MARKET DRIVERS

The growing number of initiatives by pharmaceutical and biotechnology companies, rising investments to conduct R&D activities, the increasing adoption of technological developments in the healthcare industry, and rising government support are propelling the global HTS market growth. Through HTS, pharmaceutical companies can improve their drug discovery by increasing testing efficiency and performance. At the same time, academic institutes can continue their work with large data sets in large pharmaceutical companies' public domain. Therefore, the growing adoption of HTS in pharmaceutical & biotechnology companies and educational & research institutes is expected to drive the high throughput screening (HTS) market growth.

MARKET RESTRAINTS

Be that as it may, the capital-intensive nature, need for extensive automation techniques, and high regulatory intervention and costs are restraints for the high throughput screening market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.8% |

|

Segments Covered |

By Technology, Application, Product, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Agilent Technologies Inc., Danaher Corporation, Thermo Fisher Scientific Inc., PerkinElmer Inc., Tecan Group Ltd., Millipore, Bio-Rad Laboratories, Hamilton Company, Axxam S.p.A., and Aurora Biomed., and Others. |

SEGMENTAL ANALYSIS

By Technology Insights

Based on technology, the cell-based assay segment is projected to account for the dominating share of the global high throughput screening market during the forecast period. As the 3D cell-based assays exhibit more natural properties while testing the natural environment and other cell-related manipulations, they assisted in drug design and discovery.

The label-free segment is predicted to grow at a lucrative CAGR during the forecast period. The Label-free technology provides a simple process for studying complicated biological pathways and diminishes the liability of drug failure produced by toxicity to assist HTS market growth.

By Application Insights

By application, the target identification segment is predicted to exhibit a notable CAGR in the HTS market during the forecast period.

By Product Insights

The consumables and reagents segment held the largest share of the global high throughput screening market based on the product in 2024 owing to the wide range of reagents and continual product developments and innovations.

By End User Insights

Based on end-users, the pharmaceutical and biotechnology companies segment held the largest market share worldwide in 2024. The widespread use of HTS technology in pharmaceutical and biotechnology companies for drug discovery applications is the primary factor driving segmental growth.

REGIONAL ANALYSIS

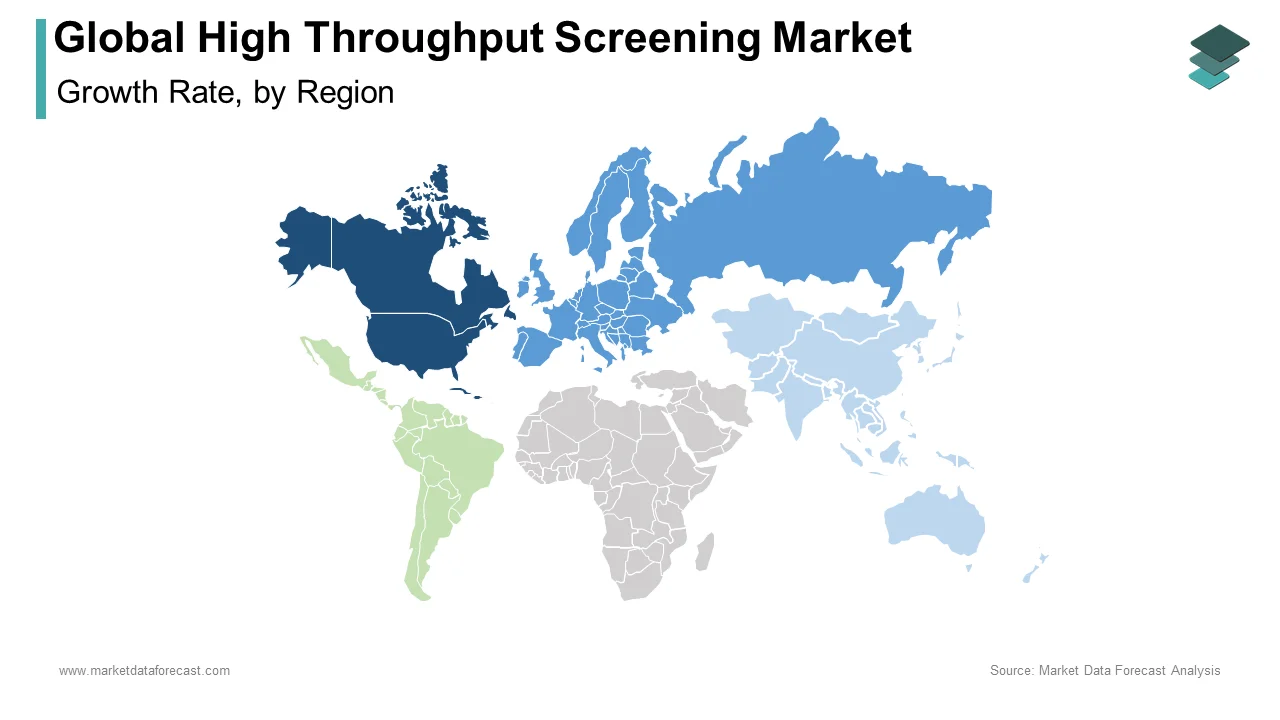

Regionally, North America held the largest share of the global high throughput screening market, followed by Europe and the Asia Pacific in 2024. During the forecast period, the North American high throughput screening market is estimated to continue holding a dominating share of the worldwide market owing to the massive spending on pharmaceutical R&D, high adoption of HTS and government funding, and major companies in North America.

The high throughput screening market in Europe is anticipated to grow at a healthy CAGR during the forecast period due to advancements in a high number of assay kits and reagents used in top throughput screening techniques and liquid automation handling technology, the emergence of novel technological platforms.

The APAC high throughput screening market is expected to register the highest CAGR during the forecast period. Factors such as growing R&D spending, the rising trend of outsourcing drug discovery services, growing public-private partnerships and increasing government funding favor market growth in the Asia-Pacific.

However, the Latin America high throughput screening market is projected to witness lucrative growth in the coming years. The market in Latin America is estimated to be driven by the growing adoption of technological advancements that lead to innovative technologies and platforms like analytical tools that deal with massive amounts of data.

The high throughput screening market in MEA is expected to hold a moderate share in the worldwide market during the forecast period due to the growing. demand for high throughput screening devices in stem cell research for assessing excretion, metabolism, distribution, absorption characteristics, and investigation of functional activity.

KEY MARKET PARTICIPANTS

Companies playing a prominent role in the global high throughput screening market include Agilent Technologies Inc., Danaher Corporation, Thermo Fisher Scientific Inc., PerkinElmer Inc., Tecan Group Ltd., Millipore, Bio-Rad Laboratories, Hamilton Company, Axxam S.p.A., Aurora Biomed, and Others.

RECENT MARKET DEVELOPMENTS

- In December 2015, Axxam S.p.A (Italy), a leader in integrated life science development products, entered into a research partnership with the University of Texas Neurodegeneration Consortium to find and develop new small-molecule modulators of an unidentified Alzheimer's G-protein coupled receptor. The Neurodegeneration Consortium will use this collaboration to access Axxam's HTS research platforms.

MARKET SEGMENTATION

This research report on the global high throughput screening market has been segmented and sub-segmented based on the technology, application, product, end-user, and region.

By Technology

- Cell-based Assays

- 2D

- 3D Cell Culture

- Lab-on-a-chip

- Ultra-High-Throughput Screening

- Label-Free Technology

- Bioinformatics

By Application

- Target Identification

- Primary Screening

- Toxicology

- Others

By Product

- Consumables & Reagents

- Instruments

- Software & Services

By End User

- Pharmaceutical & Biotechnology Companies

- Academic & Government Research Institutes

- Contract Research Organizations

- Other End Users

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the growth rate of the high throughput screening market?

The global high throughput screening market is expected to grow at a CAGR of 7.8% from 2025 to 2033.

What are the key factors driving the growth of the high throughput screening market?

The growing demand for new drugs and therapies, the growing prevalence of chronic diseases, and the need for faster and more efficient drug discovery processes are majorly driving the growth of the high throughput screening market.

Which regions are leading the high throughput screening market?

North America, Europe and Asia-Pacific are expected to occupy the largest share of the worldwide market in the coming years.

Who are some of the key players in the high throughput screening market?

Agilent Technologies, Inc., Danaher Corporation, Thermo Fisher Scientific, Inc., PerkinElmer, Inc., and Merck KGaA are some of the notable companies in the high throughput screening market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com