Global Electric Commercial Vehicle Market Size, Share, Trends & Growth Forecast Report, Segmented By Propulsion (BEV, HEV, PHEV and FCEV), Vehicle Type (Bus, Truck, Van and Pick-up Trucks), Range (0-150 miles, 151-250 miles, 251-500 miles, 500 miles and above), Component (Electric Motor, EV Battery and Hydrogen Fuel Cell) and Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa), Industrial Analysis (2025 to 2033)

Global Electric Commercial Vehicle Market Size

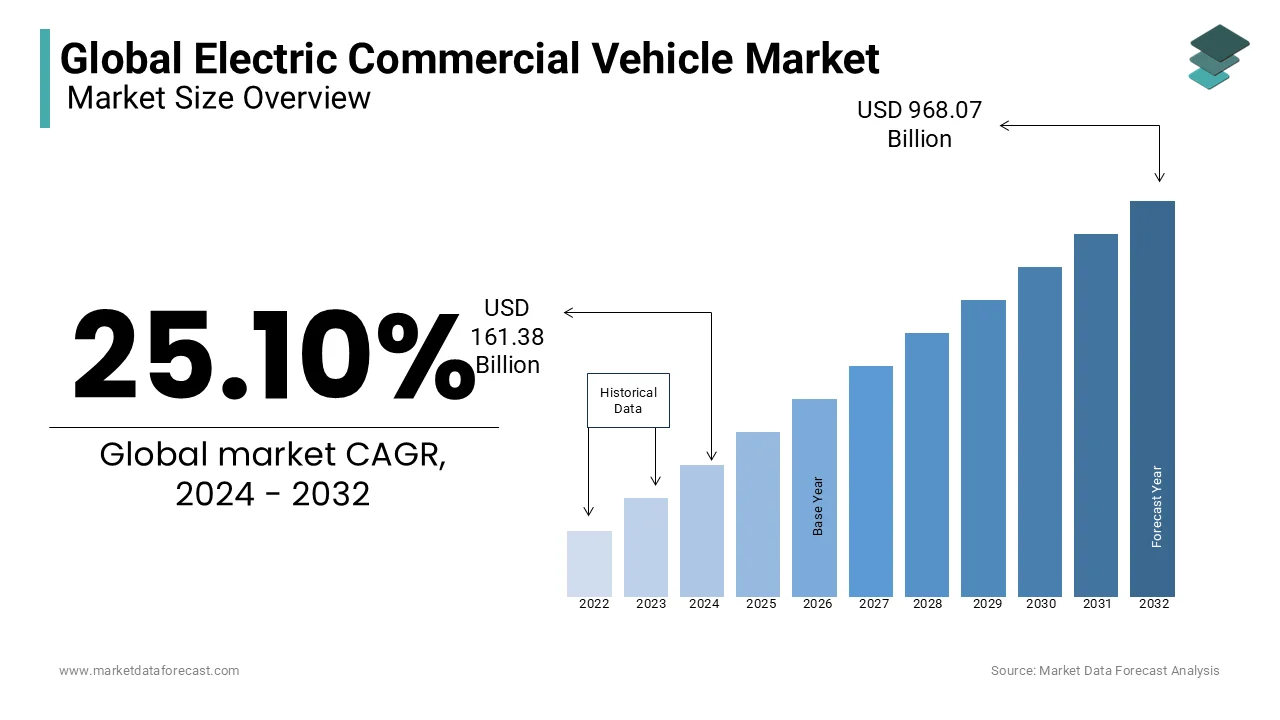

The global electric commercial vehicle market was valued at USD 161.38 billion in 2024 and is anticipated to reach USD 201.89 billion in 2025 from USD 1211.06 billion by 2033, growing at a CAGR of 25.10% during the forecast period from 2025 to 2033.

An electric commercial vehicle is a self-driving transportation machine used for goods and as passengers using power stored in batteries with the assistance of both electric motors working in tandem and combustion engine or electric motors. Electric vehicles are electrified using collector system off-vehicle sources of electricity or chargeable batteries, solar panels, etc.

MARKET DRIVERS

The expansion of the global ECV market is especially attributed to the increasing concern over greenhouse emission (GHG) emissions. The rising level of pollution and exhausting resources have motivated manufacturers to style electric commercial vehicles. Governments across the world are encouraging the utilization of electric commercial vehicles, thus increasing the demand in this market in the next few years.

The growth of the global electric commercial vehicle market is often attributed to the rising focus of nations on the electrification of their conveyance fleets and the increasing interest in zero-emission vehicles within the logistics sector. Improvements in battery pack techniques and electric powertrains are several of the main factors driving the expansion of the global electric commercial vehicle industry. Functions like an increase in pollution and environmental hazards, stringent government regulations, and stiff competition have compelled automotive OEMs to form fuel-efficient and environment-friendly vehicles. However, the electric commercial vehicle market is predicted to witness significant growth in the future.

MARKET RESTRAINTS

The lack of sufficient charging stations for electric vehicles may be a key factor expected to hamper the growth of the global electric commercial vehicles market. Additionally, the high cost related to the primary development of these vehicles is another factor expected to hinder the growth of the target market over the foreseen phase.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

25.10% |

|

Segments Covered |

By Propulsion, Electric Vehicle, Range, Component, and Region. |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

AB Volvo, Alexander Dennis Ltd., Alstom–NTL, Anhui Ankai Automobile Co. Ltd., Ashok Leyland Ltd., Bluebus SAS, Bozankaya A.S., BYD Co. Ltd., Caetanobus - Fabrico De Autocarros E Carrocarias S.A., Chariot Motors, Dongfeng Motor Corp., Ebusco B.V., Nanjing Golden Dragon Bus Co. Ltd., Proterra Inc., and Tata Motors Ltd. The major electric truck manufacturers are Cummins Inc., E-Force One AG, Hino Motors Ltd. Isuzu Motors Ltd., Iveco S.p.A., Nikola Corp., Nissan Motor Co. Ltd., Scania AB, Workhorse Group Inc, and Others. |

SEGMENTAL ANALYSIS

By Propulsion Type Insights

Based on propulsion, the battery electric vehicles (BEV) segment is predicted to carry the most important share within the global ECV market, in both volume and value, over the foreseen period, due to the rising government support within the sort of subsidies, incentives, and other financial benefits, to market the adoption of eco-friendly commercial electric vehicles.

By Vehicle Type Insights

The electric van segment is predicted to be the fastest market as there's a high interest in electric vans from the logistics sector, especially within the European region. The surge in the need for electric vans in the logistics industry and specialization in the electrification of the conveyance fleet is driving the electric commercial vehicle market in Europe. The expansion of the logistics and e-commerce sectors is predicted to drive the marketplace for electric vans during the foreseen phase. The usage of electrical vans within the logistics sector would minimize the value of transportation. Various foremost logistics companies in Europe and North America have started using electric vans for shipping and delivery purposes.

REGIONAL ANALYSIS

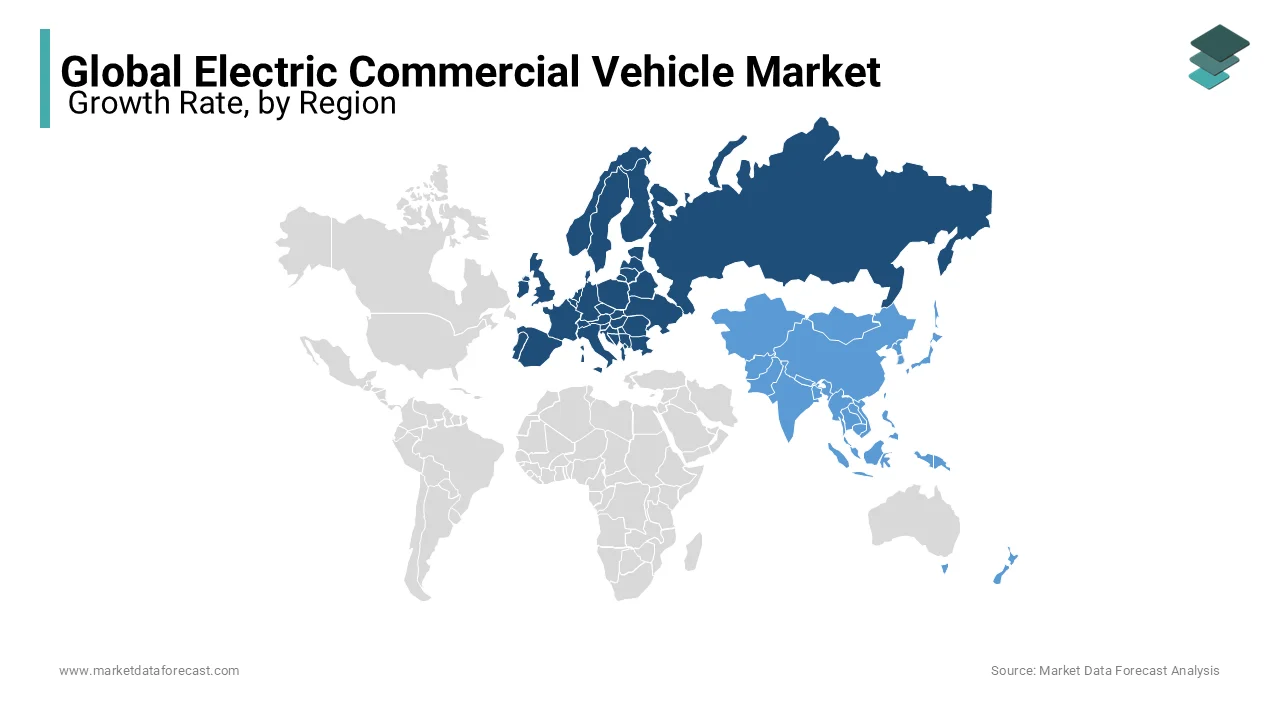

The European electric commercial vehicle market is estimated to be the fastest growing because of the high adoption rate of electrical vans within the logistics sector in the region. Factors like an increase in pollution and environmental hazards, stringent government regulations, and stiff opposition have compelled automotive OEMs to form fuel-efficient and environment-friendly vehicles. During this pursuit, automotive OEMs and component producers are exploring ways to develop and style commercial vehicles that will meet the standards of fuel efficiency and vehicle emission.

The Asia Pacific area is the most considerable electric commercial vehicle market in the world. It comprises several of the fastest developing and developed economies in the world, like China, India, and Japan. The market growth within the area is often credited to the lead of the Chinese industry in electric bus making and the availability of leading OEMs in the country, resulting in the exponential growth of the electric commercial vehicle business in the Asia Pacific. The massive demand for electric buses, favorable regulations for electric commercial vehicles, and the rapidly growing logistics sector are expected to spice up the electric commercial vehicle market in the vicinity.

KEY MARKET PLAYERS

Some of the major players engaged in the electric commercial vehicles market across the globe include AB Volvo, Alexander Dennis Ltd., Alstom–NTL, Anhui Ankai Automobile Co. Ltd., Ashok Leyland Ltd., Bluebus SAS, Bozankaya A.S., BYD Co. Ltd., Caetanobus - Fabrico De Autocarros E Carrocarias S.A., Chariot Motors, Dongfeng Motor Corp., Ebusco B.V., Nanjing Golden Dragon Bus Co. Ltd., Proterra Inc., Tata Motors Ltd, Cummins Inc., E-Force One AG, Hino Motors Ltd, Isuzu Motors Ltd, Iveco S.p.A., Nikola Corp., Nissan Motor Co. Ltd., Scania AB, Workhorse Group Inc.

RECENT HAPPENINGS IN THE MARKET

- Volvo has introduced the beginning of sales of its Volvo FL and Volvo FE electric trucks in specific markets in Europe, meeting the rising interest in sustainable transport solutions in city environments.

- Alexander Dennis is growing the UK’s largest range of low and 0-emission buses with the new Enviro (400ER) stove hybrid double-deck bus. Evolved with BAE Systems, the Enviro400ER offers geofenced 0 emission capability, making it a perfect solution for pollution hotspots in towns and cities.

- (ADL) Alexander Dennis Limited and BYD Europe jointly introduced that Glasgow Airport has switched its long-stay parking lot shuttle to 0-emission electric mobility with the launch of three BYD ADL Enviro200EV battery buses.

- The conclusion from the tie-up between Alstom and NTL is that Aptis may be a new 100%-electric mobility solution that gives all the benefits of the tram during a bus. Designed to ensure a clean and efficient transport system for cities, Aptis offers a replacement experience to its passengers with its low floor and 20% more glass surface.

MARKET SEGMENTATION

This research report on the global electric commercial vehicle market has been segmented and sub-segmented based on the propulsion, electric vehicle, range, component, and region.

By Propulsion Type

- BEV

- HEV

- PHEV

- FCEV

By Vehicle Type

- Bus

- Truck

- Van

- Pick-up Trucks

By Range

- 0-150 Miles

- 151-250 Miles

- 251-500 Miles

- 500 Miles & Above

By Component

- Electric Motor

- EV Battery

- Hydrogen Fuel Cell

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current global market size of the electric commercial vehicle market?

The global electric commercial vehicle market is valued at USD 201.89 billion in 2025.

Which regions dominate the global electric commercial vehicle market in terms of market share?

Asia-Pacific is the leading region, holding a significant share of the global electric commercial vehicle market.

How has the adoption of electric commercial vehicles progressed in North America over the past year?

North America has experienced rapid adoption, with a current market share of 25.10%, driven by increasing awareness of environmental sustainability and government incentives.

What factors contribute to the growth of the electric commercial vehicle market?

There is increasing interest in zero-emission vehicles within the logistics sector. Improvements in battery pack techniques and electric powertrains are a number of the main growth driving factors for the expansion of the global electric commercial vehicle industry.

who are the key market players involved in the electric commercial vehicle market?

AB Volvo, Alexander Dennis Ltd., Alstom–NTL, Anhui Ankai Automobile Co. Ltd., Ashok Leyland Ltd., Bluebus SAS, Bozankaya A.S., BYD Co. Ltd., Caetanobus - Fabrico De Autocarros E Carrocarias S.A., Chariot Motors, Dongfeng Motor Corp., etc... are the market key players involved in the electric commercial vehicle market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com