Global Self-Driving Cars Market Size, Share, Trends & Growth Forecast Report, Segmented By Application (Taxi, Civil, Public Transport, Heavy Duty Trucks, Ride Shares, Ride Hail), Component (Hardware, Software and Services), Automation Level (Level 3, Level 4, Level 5), And Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa), Industrial Analysis From (2025 to 2033)

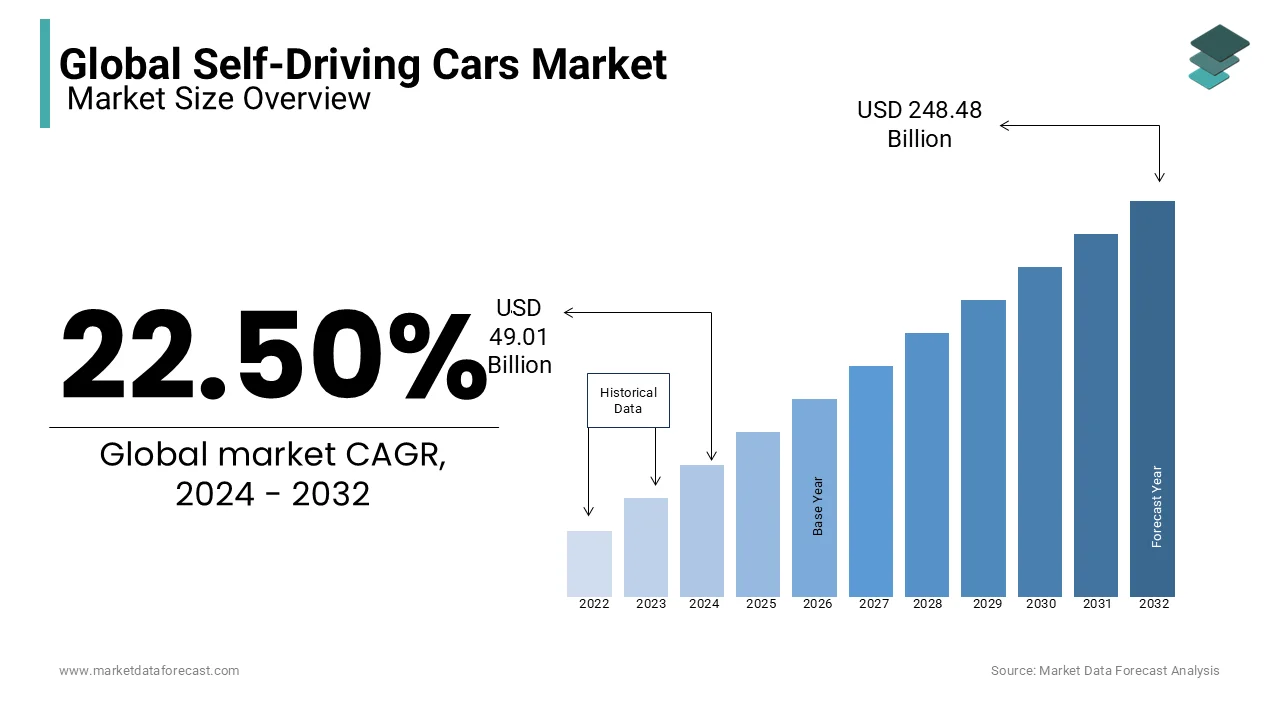

Global Self-Driving Cars Market Size

The global self-driving cars market was valued at USD 49.01 billion in 2024 and is anticipated to reach USD 60.04 billion in 2025 from USD 304.45 billion by 2033, growing at a CAGR of 22.50% during the forecast period from 2025 to 2033.

CURRENT SCENARIO OF THE SELF-DRIVING CARS MARKET

The autonomous cars, also known as self-driving cars, use artificial intelligence (AI) software, light detection & scope (LiDAR), and RADAR sensing technology, which is used to track the 60-meter range of the vehicle and to create an accurate 3D map of the current environment. The car is intended to travel between destinations without a human operator. We incorporate sensors and software to monitor, navigate and operate the vehicle. The autonomous vehicle uses LiDAR sensors and RADAR sensors for its service. Most self-driving systems create and maintain an internal map of their environment based on a wide variety of sensors, such as radar.

MARKET DRIVERS

With the development of new technology, there has been a significant decrease in the cost of equipment., Leading automotive companies and new companies are focused on perfecting their technologies and investing heavily in R&D. Developing smart cities and increasing demand for connected vehicles using the Internet of Things (IoT), helping to solve the issue of traffic congestion and affecting the development of the market.

MARKET RESTRAINTS

The government regulations in many companies pose a significant constraint on the self-driving cars market. The safety concerns and the misconception that people end up without jobs are not letting the governments lift these regulations. Highly competitive market with constant innovations, where the range of companies includes from small start-ups to Huge MCNs, it could be a bit hard to compete for a good market share in such a market. The massive potential for aggressive expansion of the self-driving market left an enormous void in the market, so this can be considered an opportunity as well.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

22.50% |

|

Segments Covered |

By Application, Component, Automation Level, and region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Uber Technologies Inc., Daimler AG, Toyota Motor Corp, Tesla Inc., Google Inc., Nissan Motor Co. Ltd, Volvo Cars, Volkswagen AG, General Motors Company (GM), BMW, and Others. |

SEGMENTAL ANALYSIS

By Application Insights

Of these, the Taxi segment is expected to dominate the market during the forecast period. The sheer demand for taxis, which was caused as a result of urbanization and an increase in disposable income is driving demand for this segment. Apart from this, heavy-duty trucks are expected to show some significant growth, because of the extreme and inhabitable conditions that these trucks are used in, it would be less burden on the drivers of these trucks if self-driving cars take over the market.

By Component Insights

Of these, the software segment is expected to witness rapid growth in the coming years due to the increasing digitization around the world.

By Automation Level

Of these, Level-3 cars are expected to dominate the market during the forecast period purely because of the lower amount of risk associated with the market. But the market is slowly moving towards Level-4 and Level-5.

Level-3: - Driver is still needed, but it is not necessary to navigate or track the environment if specific criteria are met. Nevertheless, the driver must remain ready to resume control of the vehicle once the conditions requiring the ADS have ceased to be met.

Level-4: - The vehicle can perform all driving functions and does not require the driver to remain ready to take charge of navigation. Nonetheless, under certain circumstances, such as off-road driving or other types of unusual or hazardous situations, the reliability of ADS navigation can decline. The driver may well be able to regulate the vehicle.

Level-5: - The ADS system is advanced enough to enable the vehicle to perform all driving functions, no matter the conditions. The driver may be able to control the car.

REGIONAL ANALYSIS

Geographically, North America and Europe represented more than half of the global semi-autonomous car market in 2018 and are expected to continue to grow their market share during the forecast period, due to the growing release of semi-autonomous car models and the rising growth of self-driving vehicle systems by automotive industry players.

KEY MARKET PLAYERS

Some of the key players in the global self self-driving cars market include Uber Technologies Inc., Daimler AG, Toyota Motor Corp, Tesla Inc., Google Inc., Nissan Motor Co. Ltd, Volvo Cars, Volkswagen AG, General Motors Company (GM), and BMW.

SELF-DRIVING CARS MARKET RESEARCH REPORT KEY HIGHLIGHTS

- Evaluation of the current stage of the market and future implications of the market based on the detailed observation of recent key developments.

- Address the matter by better understanding the market size estimates through CAGR analysis to forecast the future market.

- Comprehensive segmentation of the market, a detailed evaluation of the market by further sub-segments.

- Address Market Drivers and restraints and provide insights for gaining market share.

- Porter’s Five Forces are used to analyze the factors responsible for the shaping of the industry as it is a result of a competitive environment.

RECENT HAPPENINGS IN THIS MARKET

- In 2018, tesla, as an update to Autopilot's essential features, the company's stated intention is to offer full self-driving (FSD) capabilities in the future, realizing the legal, regulatory, and technological barriers that must be addressed in order to achieve this target. Elon, the CEO of Tesla, on many occasions, stated the solidity of their product but waiting for government regulatory approvals to pave off.

MARKET SEGMENTATION

This research report on the global self-driving cars market is segmented and sub-segmented into the following categories.

By Application

- Taxi

- Civil

- Public Transport

- Heavy Duty Trucks

- Ride Shares

- Ride Hail

By Component

- Hardware

- Software

- Services

By Automation Level

- Level 3

- Level 4

- Level 5

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East Africa

Frequently Asked Questions

What are the different levels of automation in self-driving cars, and how do they impact market adoption?

The SAE (Society of Automotive Engineers) defines six levels (0-5) of automation, ranging from no automation (Level 0) to full autonomy (Level 5). Market growth depends on advancements in Level 4 (high automation) and Level 5 technologies.

Which factors are driving the growth of autonomous vehicle technology worldwide?

AI and machine learning advancements, government regulations supporting AV testing, increased R&D investments, and demand for safer, more efficient mobility solutions are key drivers.

What are the major challenges and risks associated with self-driving cars?

Safety concerns, cybersecurity threats, high development costs, regulatory hurdles, and public trust in autonomous technology remain significant challenges for widespread adoption.

Which industries and applications are benefiting the most from autonomous vehicles?

Ride-hailing, logistics, public transportation, and industrial automation (e.g., mining and agriculture) are key sectors adopting self-driving technology for efficiency and cost savings.

Who are the leading companies shaping the global self-driving car market?

Major players include Tesla, Waymo (Alphabet), Cruise (GM), Baidu, NVIDIA, Mobileye (Intel), and Aptiv, investing heavily in AI, sensor technology, and regulatory compliance.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com