Global Electroceuticals Market Size, Share, Trends & Growth Forecast Report By Product (Implantable Cardioverter Defibrillators, Cardiac Pacemakers, Spinal Cord Stimulators, Cochlear Implants, Deep Brain Stimulators, Transcutaneous Electrical Nerve Stimulators, Vagus Nerve Stimulators, Sacral Nerve Stimulators, Retinal Implants and Other Electrical Stimulators), Type of Device, Application, End User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Electroceuticals Market Size

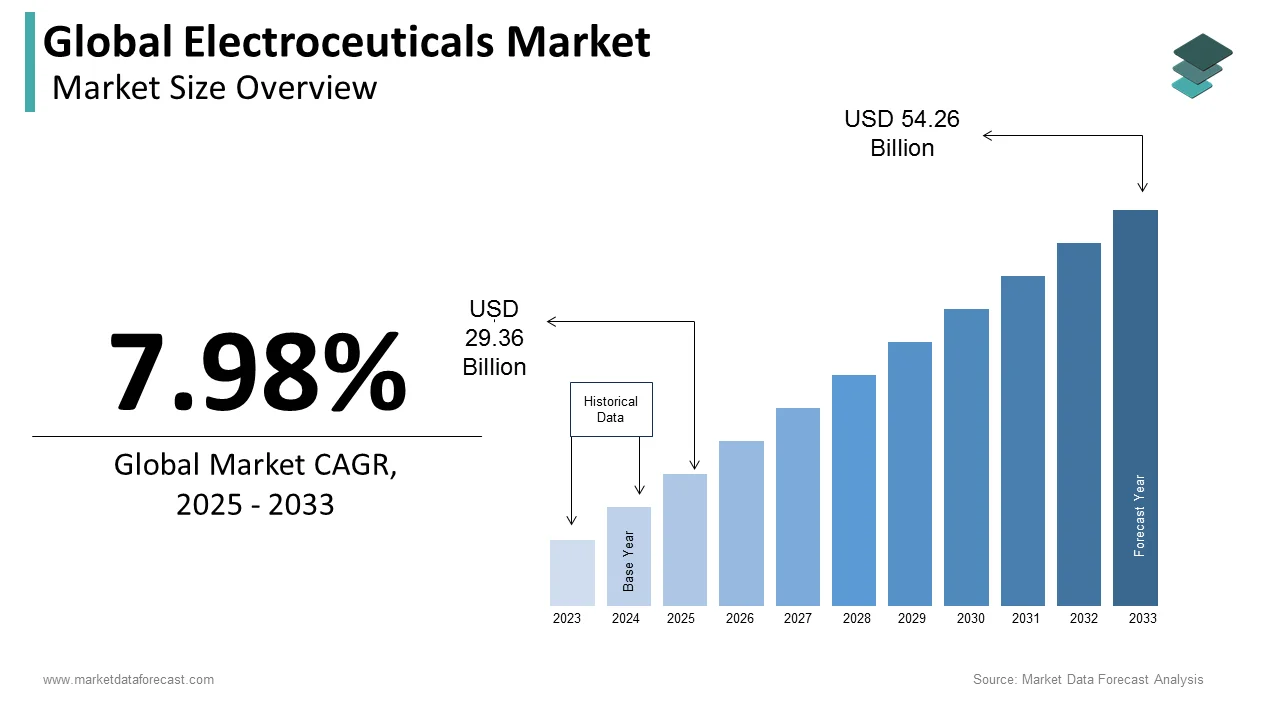

The size of the global electroceuticals market was worth USD 27.19 billion in 2025. The global market is anticipated to grow at a CAGR of 7.98% from 2025 to 2033 and be worth USD 54.26 billion by 2033 from USD 29.36 billion in 2025.

Electroceuticals is an instituted term for an old therapeutic methodology that comprehensively involves all the bioelectronic meds. It includes clinically related gadgets that use electrical driving forces to influence change, adjusting bodily functioning as a choice to medicate-based remediation. These gadgets essentially recount and change electrical signals passing along the body's nerves containing sporadic or various impulses associated with various illnesses. Electroceutical comprises neural embeds, for instance, cochlear implants, retinal implants, or spinal cord for relief from discomfort, cardiovascular pacemakers, and implantable defibrillators. In past years, this field has extended to include deep brain stimulation and the electrical stimulation of the vagus nerve.

MARKET DRIVERS

The growth of the global electroceuticals market is majorly driven by the rise in the geriatric population and the regulatory approval of the latest advanced electromechanics. In addition, the rising investments and funds for developing new therapies and electro-pharmaceuticals, the increase in the prevalence of neurological disorders, and the increasing prevalence of hearing loss. According to the Pan American Health Organization (PAHO), 33 people of 100,000 population died from neurological conditions in the United States in 2019. The rise in the worldwide geriatric population, increasing cost pressures from drug-based medicines, the developing interest of major pharmaceutical players in the electrical items segment, and the growing prevalence of neurological problems and chronic infections around the world are a portion of the likely factors to drive the growth of the global electrical products market. Key market participants such as GlaxoSmithKline plc have made serious investments in the electrical products segment. In addition, various organizations, such as the National Institutes of Health (NIH) in the U.S., have significantly impacted the electrical products field. For example, the rising extent of neurological problems, epilepsy, Parkinson's disease, and more chronic diseases is predicted to grow the market for electroencephalographic/bioelectric drugs.

Additionally, factors accountable for driving the market are the growing geriatric population, increasing financial expenditure on R&D to develop novel and innovative therapies and devices, the rise in prevalence of neural diseases among the aging population like Alzheimer’s and Parkinson’s disease, and regulatory approvals or new and advanced electroceuticals.

Technological innovations in wearable devices, support from the regulatory bodies for electroceuticals, growing adoption of personalized medicine, rapid adoption of minimally invasive treatments and rise in funding for electroceutical startups are favouring the growth rate of the global market. An increase in the adoption of wireless and remote monitoring, rising research efforts on neurodegenerative disease and growth in the market for bioelectronic medicine are promoting the global market growth.

MARKET RESTRAINTS

However, factors such as the expensive nature of products and low awareness among individuals hinder the growth of the global electroceuticals market. Furthermore, the high installation cost and lack of qualified professionals limit the market growth to some extent. In addition, a lack of awareness in undeveloped countries is slowly restraining the growth rate of the electroceuticals market.

Impact of COVID-19 on the Global Electroceuticals Market

COVID-19 infections are spreading worldwide, and apprehensions are also growing over the shortage of essential life-saving devices and other essential medical supplies to prevent the rise of this pandemic and provide optimal care for those infected. Additionally, until drug treatment is developed, ventilators are a vital treatment preference for COVID-19 patients, who may require intensive care. Furthermore, there is an urgent need to rapidly accelerate the manufacturing process of a wide range of test kits (antibody tests, self-administered, etc.). These attributes are to double the market growth in the coming years.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2025 to 2033 |

|

Base Year |

2025 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.98% |

|

Segments Covered |

By Product, Type of Device, Application, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Medtronic plc, St. Jude Medical, Inc., Boston Scientific Corporation, Cochlear Limited, Sonova Holding AG, LivaNova PLC, Biotronik, Nevro Corporation, Second Sight Medical Products, Inc., and ElectroCore LLC., and Others. |

SEGMENTAL ANALYSIS

By Product Insights

Based on the product, the implantable cardioverter defibrillators segment accounted for 22.8% of the global market share in 2025 and is expected to hold the largest share of the global electroceuticals market during the forecast period. An increasing number of cardiovascular problems associated with lifestyle changes enhance this segment's growth rate. In addition, the rising utilization of these devices in hospitals for emergency healthcare is significantly influencing the growth rate of this segment. As a result, the cardiac pacemaker segment to have significant growth opportunities in the coming years. The development of smaller and more efficient ICDs with extended battery life is promising revolution in the ICD segment.

On the other hand, the cardiac pacemakers segment captured 19.7% of the worldwide market share in 2025 and is predicted to grow at a noteworthy CAGR during the forecast period. The growing population suffering from lifestyle-related heart conditions and the trend towards remote monitoring are propelling the growth of the cardiac pacemakers market.

By Type of Devices Insights

Based on device type, the implantable devices segment held for a 64.9% of the worldwide market share in 2025 and is predicted to register healthy growth during the forecast period due to the prevalence of neurological diseases. The growing usage of implantable devices in neurostimulation, cardiac devices, and sustained release of medications is driving the segmental growth.

In contrast, non-implantable devices are expected to grow at a higher CAGR during the forecast period. As a result, the non-invasive electroceuticals devices segment leads with the prominent share of the market, increasing prominence for minimally non-invasive procedures. The patient preference, ease of use, and applications in various therapeutic areas of non-implantable devices are primarily boosting the growth of the segment in the global market.

By Application Insights

Based on the application, the arrhythmia segment dominated the market, accounting for a significant market share in 2025 and is expected to witness a prominent CAGR during the forecast period owing to an increasing number of cardiac arrest problems and growing adoption of the latest medical devices and launching innovative products in favor of the end-users. As a result, chronic back pain and Parkinson’s disease segments are expected to have the market's largest share soon.

By End-Users Insights

Based on end-users, the hospital segment is expected to account for the market's most significant share in 2025 and the domination of the segment is estimated to continue throughout the forecast period. A considerable portion of this sector can be attributed to the expanding weight of diseases such as cardiac arrhythmias, Parkinson’s, Alzheimer’s, retinitis pigmentosa, epilepsy, and depression; and rising awareness about electroceuticals. Moreover, the individual user segment is projected to grow at the highest CAGR in the forecast period.

REGIONAL ANALYSIS

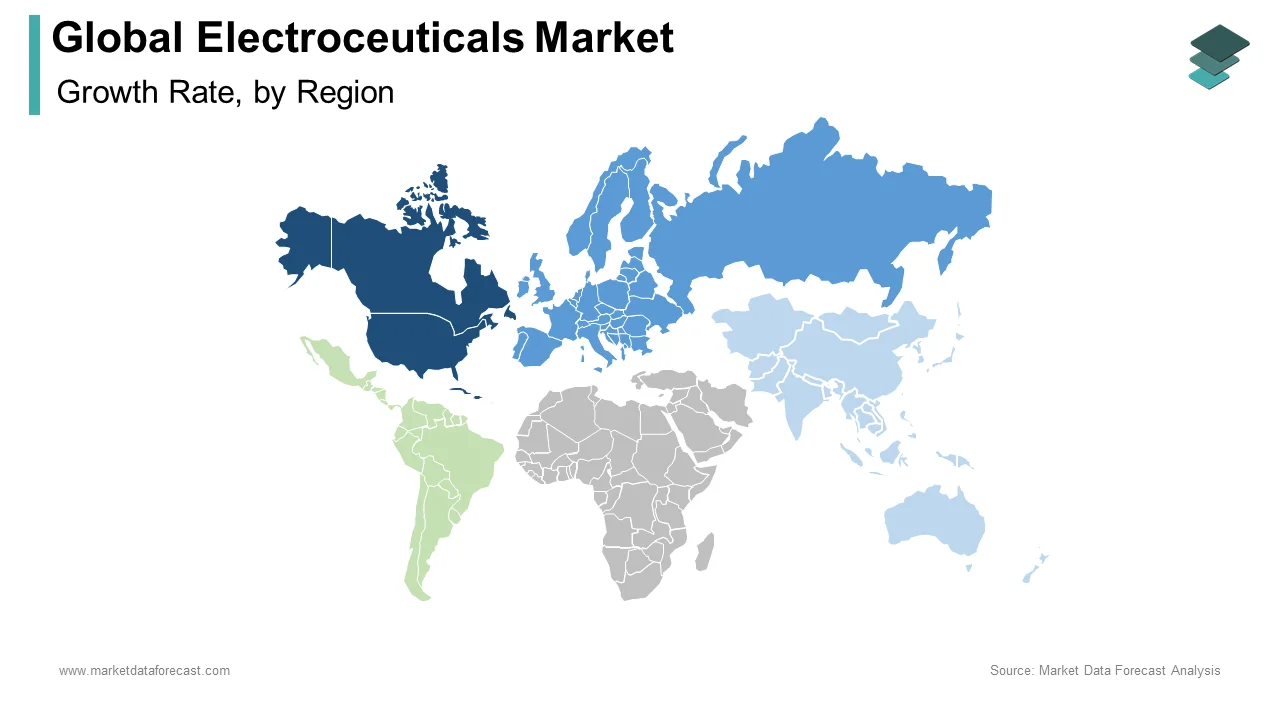

Geographically, the electroceuticals market in North America had 41.5% of the global market share in 2025 and the lead of the North American region in the global market is estimated to continue throughout the forecast period owing to a developed healthcare system and the presence of several market leaders. Furthermore, North America dominates the bioelectric medicines market with the most significant income share due to medical device manufacturers such as Medtronic, Boston Scientific Corporation, and BIOTRONIK. Additionally, the significantly developed healthcare and availability of highly edge products in this region propel the electroceuticals market growth in North America. The U.S. is expected to account for the major share of the North American market during the forecast period. Collaboration between U.S. research institutions and pharmaceutical companies for developing neurostimulation therapies is majorly driving the U.S. market growth.

The electroceuticals market in Europe accounted for more than 28.1% of the global market in 2025. Developing interest in creative clinical gadgets for the treatment and the presence of substantial bioelectric medication producers, mainly in Germany, Switzerland, the U.K., and France, combined with highly developed healthcare infrastructure, are required to stay significant driving factors for the market.

The electroceuticals market in the Asia Pacific is expected to grow the fastest CAGR during the forecast period owing its increasing disposable income, government initiatives to develop healthcare infrastructure, and growing awareness. In addition, factors such as the growing senior population in Asian countries, such as China and India, are significant drivers of market growth. However, the predominance of chronic infections, including cardiac arrhythmias, Alzheimer's disease, Parkinson's disease, and epilepsy, is likely to drive the adoption of electroceuticals.

The electroceuticals market in Latin America is expected to grow steadily during the forecast period.

The electroceuticals market in the Middle East & Africa is growing due to the rising prevalence of chronic diseases such as diabetes, cardiovascular diseases, and other heart-related diseases, and neurological diseases such as epilepsy and many other disorders related to neurological disorders are increasing the growth in the market.

KEY MARKET PARTICIPANTS

Companies playing a leading role in the global electroceuticals market profiled in this report are Medtronic plc, St. Jude Medical, Inc., Boston Scientific Corporation, Cochlear Limited, Sonova Holding AG, LivaNova PLC, Biotronik, Nevro Corporation, Second Sight Medical Products, Inc., and ElectroCore LLC.

RECENT MARKET DEVELOPMENTS

- Medtronic plc (Ireland) gained US FDA clearance in March 2021 for their Intellis Platform with Differential Target Multiplexed (DTM) programming to treat chronic persistent back and leg pain.

- Boston Scientific Corporation (US) got US FDA clearance for their Vercise Genus Deep Brain Stimulation System in January 2021.

- Medtronic plc (Ireland) purchased Stimgenics, LLC (US) in January 2020, a pioneer of DTM, a new spinal cord stimulation treatment.

- According to ElectroCore, about 325,000 people in the United States suffer from cluster headaches each year. To get into this underserved market, the company developed gammaCore, a noninvasive VNS therapy for managing severe headaches in adults, which the FDA approved in 2018.

- ReShape Lifesciences Inc. reported in April 2019 that the business had successfully implanted its first patient in the ENDURE II study to support the CE Marking of the ReShape Vest to treat obesity and metabolic disorders with clinical data showing an 85 percent excess weight loss at one year.

- In 2018, the InterStim Smart Programmer was utilized with the InterStim System to provide sacral neuromodulation therapy. Medtronic was a pioneer in sacral neuromodulation, and this product improvement was intended to assist the firm increase its market position.

MARKET SEGMENTATION

This research report on the global electroceuticals market has been segmented and sub-segmented based on the product, type of devices, application, end-users, and region.

By Product

- Implantable Cardioverter Defibrillators

- Cardiac Pacemakers

- Spinal Cord Stimulators

- Cochlear Implants

- Deep Brain Stimulators

- Transcutaneous Electrical Nerve Stimulators

- Vagus Nerve Stimulators

- Sacral Nerve Stimulators

- Retinal Implants

- Other Electrical Stimulators

By Type of Devices

- Implantable

- Non-Invasive

By Application

- Arrhythmia

- Chronic Back Pain

- Failed Back Syndrome

- Ischemia

- Sensorineural Hearing Loss

- Parkinson’s Disease

- Tremor

- Alzheimer's disease

- Depression

- Migraine

- Epilepsy

- Other Applications

By End-Users

- Hospitals

- Research Institutes

- Individual Users

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much was the global electroceuticals market worth in 2024?

The global electroceuticals market size was worth USD 27.19 billion in 2024.

What is the growth rate of the global electroceuticals market?

The global electroceuticals market is anticipated to grow at a CAGR of 7.8% from 2025 to 2033.

Which region had the largest share in the global electroceuticals market in 2024?

North America captured the leading share of the electroceuticals market in 2024.

What are the companies playing a leading role in the electroceuticals market?

Medtronic plc, St. Jude Medical, Inc., Boston Scientific Corporation, Cochlear Limited, Sonova Holding AG, LivaNova PLC, Biotronik, Nevro Corporation, Second Sight Medical Products, Inc., and ElectroCore LLC. are some of the notable players in the electroceuticals market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]