Global Electrolyte Mixes Market Size, Share, Trends, & Growth Forecast Report - Segmented By Product Type (Tablets & Capsules, Electrolyte Powders, RTD Beverages), Distribution Channel, and Region (North America, Europe, Latin America, Asia Pacific, And Middle East and Africa) – Industry Analysis 2025 to 2033

Global Electrolyte Mixes Market Size

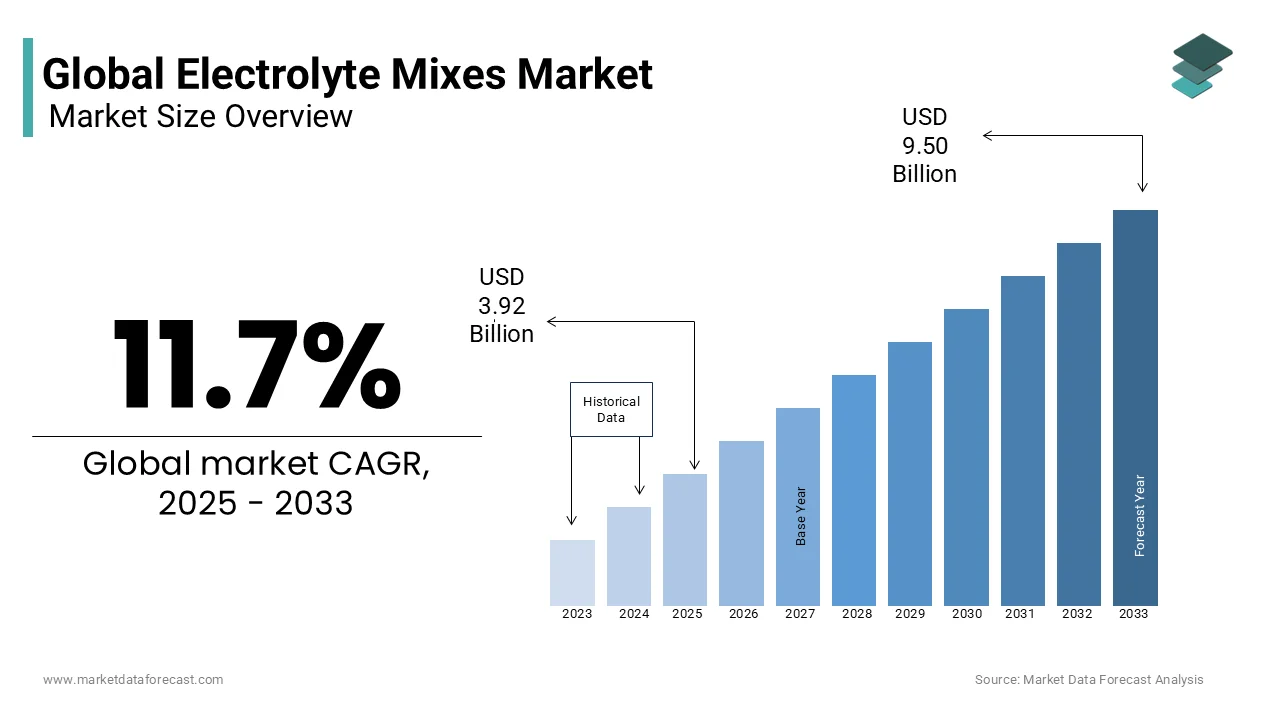

The global electrolyte mixes market size was valued at USD 3.51 billion in 2024, and the global market size is expected to reach USD 3.92 billion in 2025, to reach over USD 9.50 billion by 2033, recording a CAGR of 11.7% over the projection period 2025 to 2033.

As the number of consumers concerned about health and fitness increases globally, the demand for electrolyte mixes, especially in developed regions, has grown dramatically. Additionally, as more consumers continue to seek consulting services from dietitians, food experts, and fitness trainers, among others, levels of awareness of the benefits of electrolyte mixes have increased, which has led to steady growth in demand for these blends. Also, since electrolyte mixtures play an imperative role in enhancing the functions of the human body and regulating blood pressure, popularity levels around the world have risen in recent years. Players involved in today's electrolyte mixes market should focus on engaging in marketing campaigns, increasing awareness of their benefits, and pricing strategies to gain an advantage. Oral rehydration solutions have gained popularity around the world due to ease of use, availability of different flavors, and constant research effort, a factor that is supposed to drive the growth of the global electrolyte mixes market during the outlook period.

MARKET DRIVERS

The market for electrolyte mixes is driven by growing health awareness among consumers, especially athletes, as simply drinking water would not provide all the necessary minerals organization. However, electrolyte-infused sports drinks are intended for athletes and sportsmen and not for people with sedentary lifestyles, as these drinks contain calories from added sugar. The ever-changing behavior of consumers around the world is one of the key factors that continue to influence global trends in the food and beverage industry. One of the main trends that has emerged in the food and beverage industry is that of electrolyte blends. While innovations in the food and beverage industry have come at a steady pace over the past decade, today brands aim to increase the health quotient of their products to meet the growing concerned population of your health in the world. Electrolyte-mixed functional waters have gained enormous popularity around the world as the fitness market grows exponentially.

MARKET RESTRAINTS

Sensing the rising need for fitness products, several leading companies have entered the electrolyte mixes market in recent years. Additionally, increased consumer awareness of the benefits of consuming electrolyte blends has significantly driven the overall demand around the world. The increase in the number of health-oriented consumers globally, attractive marketing strategies and the growing focus on introducing electrolyte blends with innovative packaging are some of the other factors expected to drive market growth overall electrolyte mixes business over the conjecture period. The market demand for electrolyte mixes is rising due to the augmented use of these products and the growing need for energy drinks across the planet. The growing number of health-conscious consumers, as well as the high number of consumers participating in various outdoor sports and athletic activities, have led to a worldwide demand for electrolyte mixes.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

11.7% |

|

Segments Covered |

By Product Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Ultima Health Products, Inc, Cargill, BA Sports Nutrition LLC, The Coca-Cola Company, Vega (CA), LyteLine LLC, Prestige Brands Holdings, Inc, PepsiCo, Inc, Fonterra Co-operative Group Limited, Abbott Laboratories Incorporated. |

REGIONAL ANALYSIS

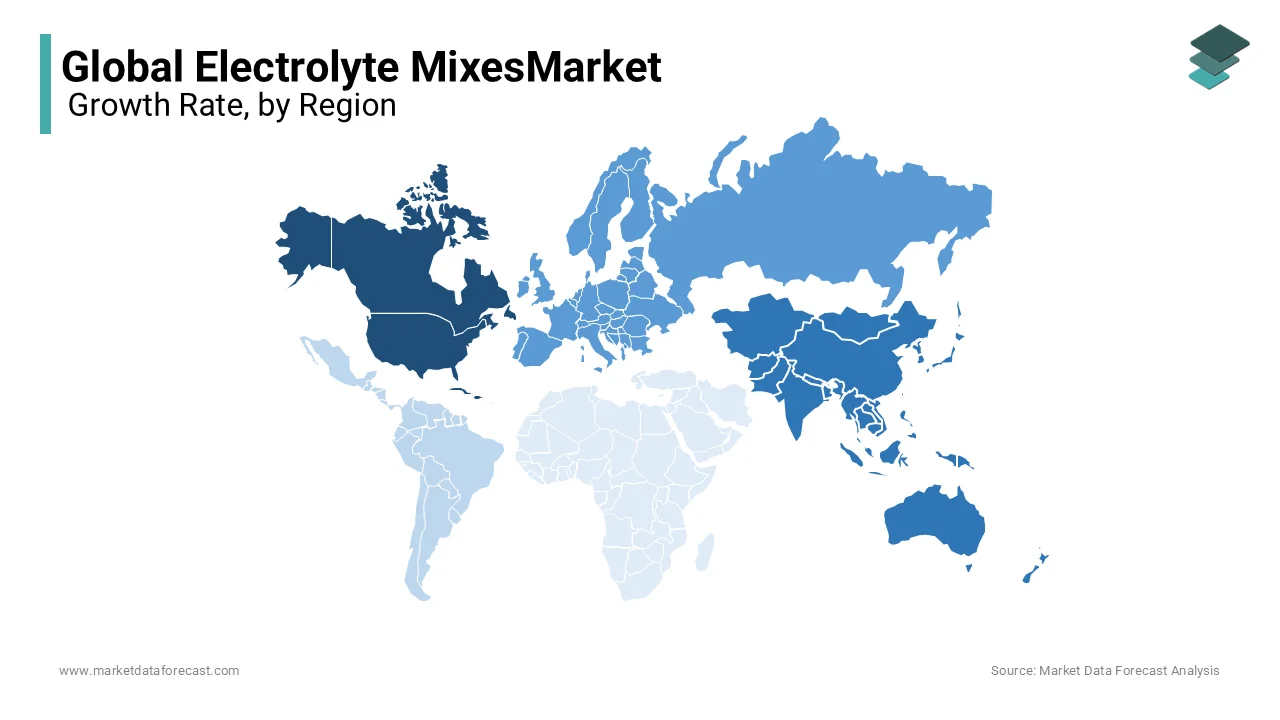

In North America, the adoption of healthy lifestyles with an emphasis on sports and fitness and high disposable incomes is driving business growth. Additionally, the increasing consumption of RTD beverages and health beverages is supporting the market boom.

In Asia-Pacific, the consumption of electrolyte mixes is increasing especially in developing countries such as China and India. The market has growth potential in the hot and humid Asian subcontinent. Additionally, the increase in per capita disposable income in the region is expected to drive market growth during the outlook period. The introduction of innovative isotonic drinks with varied flavors such as lemon and strawberry is driving industry growth in Europe. Furthermore, the growing health-conscious population in the region is expected to fuel the demand for electrolyte blends in Europe. The rest of the world market is estimated to grow at a significant rate due to effective product positioning, increased per capita disposable income, and ease of consumption in the form of electrolyte powders concentrates, and tablets.

KEY MARKET PLAYERS

Electrolyte Mixes Market Key Players are Ultima Health Products, Inc, Cargill, BA Sports Nutrition LLC, The Coca-Cola Company, Vega (CA), LyteLine LLC, Prestige Brands Holdings, Inc, PepsiCo, Inc, Fonterra Co-operative Group Limited, Abbott Laboratories Incorporated.

RECENT HAPPENINGS IN THE MARKET

-

Unilever announced that it has entered into an agreement to acquire Liquid I.V., a manufacturer of electrolyte drink mixes, for an undisclosed amount. Liquidate I.V. was founded in 2012 by businessman Brandon Cohen, who prior to founding the company worked in sales for the Arizona Diamondbacks. The brand touts its proprietary cell transport technology, which is said to improve water hydration two to three times.

-

Jagdale Industries has sold its brand ORS-L, an electrolyte-fortified ready-to-drink product to Johnson & Johnson Pte. Limited. Although the financial terms of the transaction are unknown, it has been obtained from sources that the sale was valued at Rs 750 million. MAPE's advisory group was the only banker to sign this transaction. The patented ORS-L brand developed by Jagdale has gained momentum in the marketplace as a non-invasive and easy-to-consume fluid replacement process at home, reducing hospitalizations.

- Johnson & Johnson (J&J), one of the world's leading companies in health products, acquired the ORSL brand of ready-to-drink electrolytes from Jagdale Healthcare, according to a press release. Jagdale Health Care is one of many Bangalore-based Jagdale Industries dedicated to food, health, plantations and related businesses.

- BASF Corporation, the largest subsidiary of German chemical manufacturer BASF, has agreed to sell its electrolyte business in Europe and the United States to Shenzhen Capchem Technology Co., Ltd. (Capchem) for $ 1.2 million. Under the terms of the agreement, Capchem will take over the electrolyte business of the New Jersey-based company, including associated technologies, the Selectilyte brand and other assets, as well as all customers.

MARKET SEGMENTATION

This research report on the global electrolyte mixes market has been segmented and sub-segmented based on product type, distribution channel & region.

By Product Type

- RTD Drinks

- Electrolyte Powders

- Tablets

- Capsules

- Among Others.

By Distribution Channel

- Store-Based

- Non-Store-Based

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- The Middle East and Africa.

Frequently Asked Questions

1. What is the expected compound annual growth rate (CAGR) of the electrolyte mixes market?

The electrolyte mixes market is forecasted to grow at a CAGR of 11.7% from 2025 to 2033.

2. What factors are driving the growth of the electrolyte mixes market?

Key drivers include rising health awareness, increased focus on hydration and wellness, and the growing popularity of sports and fitness activities.

3. Which regions are expected to see the highest growth in the electrolyte mixes market?

Asia Pacific is projected to experience the fastest growth, driven by increasing health consciousness and expanding consumer bases in countries such as India and China.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com