Global Electrolyte Drinks Market Size, Share, Trends & Growth Forecast Report Segmented By Type (Hypertonic, Hypotonic and Isotonic), Application (Sports and Medical Centres), Distribution Channel (Supermarkets/Hypermarkets, Pharmacies And Online Stores), And Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), Industry Analysis (2025 To 2033)

Global Electrolyte Drinks Market Size

The global electrolyte drinks market was anticipated to be worth USD 1.52 billion in 2024 and is expected to be worth 2.02 billion by 2033 from USD 1.57 billion in 2025, growing at a CAGR of 3.2% from 2025 to 2033.

Electrolytic drinks are gaining ground worldwide with the rise in physical activities of the Millennium and Generation Z demographics. The electrolyte is the scientific term for "salt." Electrolytic drinks contain salt and sugar, with electrolytes like sodium, potassium, and water. Electrolyte drinks generally help maintain energy and recover from exercise by rehydrating the body. Electrolyte drinks are specially created beverages that are supposed to develop ions when mixed with body fluids. The primary use of the drink is to compensate for the loss of electrolytes in athletes or people who exercise regularly. The number of electrolytes varies from person to person due to various parameters such as age, sex, fitness, duration of exercise, and environmental factors. Electrolytic drinks are of three types: isotonic, low, and high. Electrolyte drinks offer instant energy and physical stimulation.

MARKET DRIVERS

Growing Awareness about the Necessity of Hydration

The growing awareness and adoption of healthy beverages among consumers and the need for instant energy for people after physical activities boost the global market growth. The rising disposable incomes of the people and the growing adoption of physical activities and sports across the globe are enhancing the adoption of electrolyte drinks, leading to market expansion. Additionally, there is an increasing propensity for beverages and drinks that do not have unhealthy ingredients and may provide functional or health benefits to fuel the market. Manufacturers of electrolyte hydration drinks are aimed at athletes, hikers, and those who are actively involved in physical activities, and electrolyte drinks help to prevent dehydration and replenish multiple electrolytes such as sodium, potassium, calcium, magnesium, and phosphate, which are essential for muscle and nerve stimulation. The strategic market plans by the manufacturers, which involve developing and introducing innovative and different flavors of the product, are estimated to propel the market growth opportunities.

The rising popularity of fitness and wellness activities is fuelling the growth rate of the electrolyte drinks market globally. The growing awareness among consumers regarding physical fitness and the number of gyms and health clubs are contributing to the electrolyte drinks market expansion. Excessive physical exercise causes fluid loss through excessive sweating, requires the same restorations, and mineral loss varies from person to person. Manufacturers are introducing various flavors and variations to improve palatability. Manufacturers are concentrating on extending their product portfolios by launching innovative flavors with additional health advantages. They are targeted at different ages due to the popularity of electrolyte drinks among teens and adults. All these advancements by the manufacturers are accelerating the expansion of market size. The busy lifestyles of people are inducing them to opt for ready-to-go healthy beverages, and the prevalence of various lifestyle-related disorders due to the consumption of alcoholic and carbonated beverages is augmenting the adoption of healthy and instant energy drinks such as electrolyte beverages is expected to drive the market in the coming years. The growing mergers and acquisitions among the market players and government initiatives promoting the necessity of healthy beverages are estimated to accelerate the market growth opportunities over the forecast period.

MARKET RESTRAINTS

Side Effects Associated with the Increased Electrolyte Drink Consumption

Excessive consumption of electrolyte drinks, especially when not performing vigorous exercise, leads to an increase in the risk of being overweight and other health problems like diabetes and cardiovascular diseases, which act as a significant limitation to the market expansion. The need for awareness regarding the benefits of electrolyte drinks and the growing cases of adulterations in the products lead to the trust of consumer brands, hampering the global market growth. The presence of various alternatives to healthy beverages may hinder the market growth opportunities for the global electrolyte drinks market. The availability of non-branded low-price drinks, which consumers can prefer due to low cost and the competitive market, is restraining the market size growth.

MARKET OPPORTUNITIES

The growing climatic variations and sweltering climatic conditions are expected to increase dehydration cases among consumers, leading to the adoption of hydrating and electrolytic beverages, which provides market growth opportunities over the forecast period. Urbanization and product varieties such as innovative flavors, formulations, and functional benefits are estimated to propel the electrolyte drinks market worldwide. Market players use advanced strategic marketing initiatives and promote the products with sports celebrities, gaining consumer traction and accelerating global market revenue.

MARKET CHALLENGES

Stringent regulatory laws regarding composition, health claims, and labeling restrict product launches and constitute a significant challenge for manufacturers. The availability of limited flavors in electrolyte drinks is expected to limit consumer preference and high costs associated with equipment, restricting access to small business organizations and impeding market growth during the forecast period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.2% |

|

Segments Covered |

By Type, Application, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

PepsiCo., AJE, Coco-Cola, Body Armor Superdrink, Pacific Health Labs, Otsuka Pharmaceutical and Fraser & Neave Limited (F&N), Suntory Beverage & Food Ltd., Ajinomoto Co. Inc. |

SEGMENTAL ANALYSIS

By Type Insights

The isotonic segment dominated the global electrolyte drinks market revenue with a significant share of 59% in the global market in 2024. The isotonic solutions have the same concentration of solutes as other solutions. The isotonic solutions provide more energy and electrolytes than hypotonic drinks, driving the segment growth. The isotonic solutions provide more carbohydrates than the other drinks as the isotonic drinks consist of more sweeteners and additives, which increase the carbohydrate concentration.

The hypotonic segment is estimated to grow prominently during the forecast period due to its quick recovery of hydration and low sugar content, as it has a lower concentration of solutes than other drinks. It provides fast rehydration as the drink rapidly absorbs across the gut lining and replenishes the lost fluids.

The hypertonic segment is expected to grow steadily during the forecast period as these are used as recovery drinks and consist of added protein. The solution has a higher concentration of salt and sugar than blood, which is a good supplement for carbohydrates.

By Application Insights

The sports segment held a significant revenue share in the global electrolyte drinks market in 2024. Sports drinks are specially formulated to hydrate during and after physical activity. Athletes and fitness people favor these as they help restore lost minerals and are enriched with electrolytes like sodium, potassium, salt, and water. These advantages of electrolytic drinks are driving the segment's growth. The greater adoption among the sports and gym people fuels the market growth opportunities.

The medical center's segment is estimated to grow significantly during the forecast period. Healthcare professionals widely prescribe these for conditions like diarrhea, dehydration, and vomiting. They are crucial in medical care as they accelerate the healing process after disease conditions. They consist of electrolytes that support medical conditions like electrolyte imbalances and dehydration, which is propelling the market growth in this segment.

By Distribution Channel Insights

The supermarkets/hypermarkets segment dominated the global electrolyte drinks market in 2024. This segment has a vast distribution network due to the availability of various electrolyte drinks from different manufacturers, which drives the segment's growth. Most people prefer supermarkets due to brand availability, different flavors, and traditional retail outlook, which fuels the segment revenue. This segment can access a large customer base, which can be exposed to various product accessibility.

The pharmacies segment is estimated to grow prominently during the forecast period as these are key distribution channels for medical electrolyte solutions. Prescribed products can be accessible through this channel, augmenting the market growth in this segment.

The online stores segment is expected to have the fastest growth during the forecast period due to the expansion of the e-commerce sector through a comprehensive adoption rate. Online shopping allows customers to explore various products, research their alternatives, and evaluate the product through reviews from other customers. All these advantages enhance the adoption of online stores more than traditional supermarkets and hypermarkets, which are estimated to increase in the coming years.

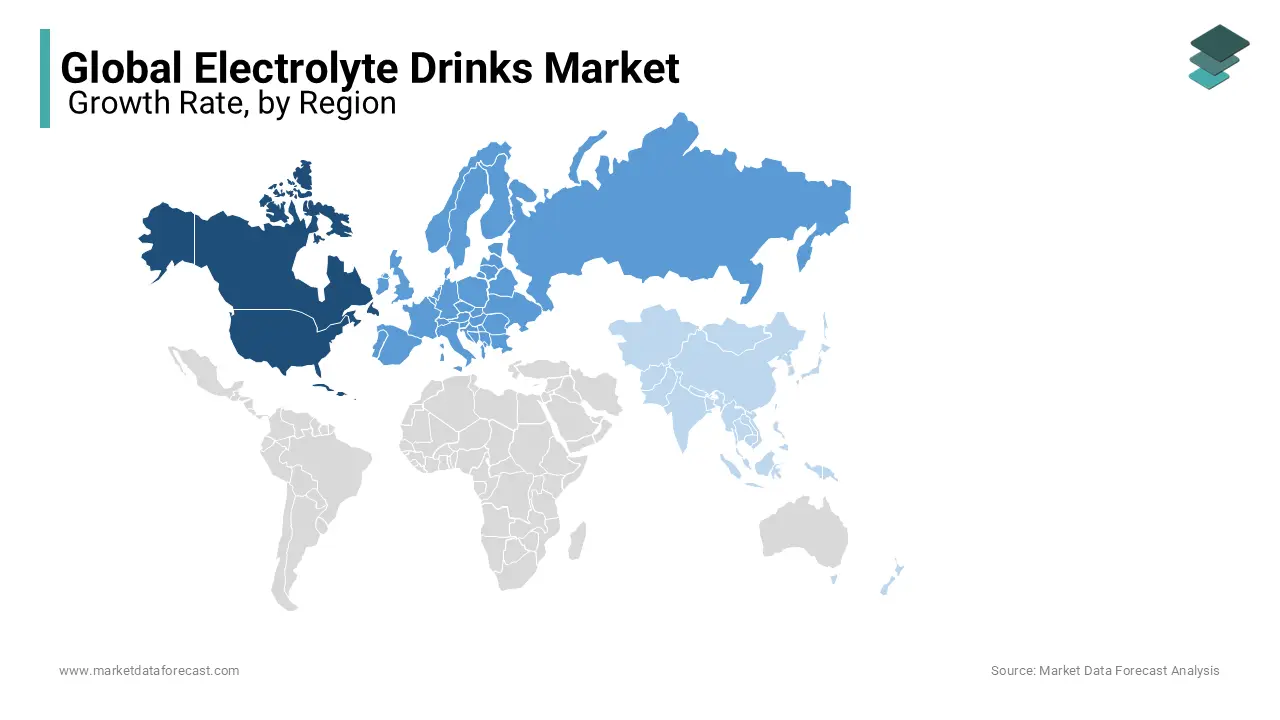

REGIONAL ANALYSIS

North America is the largest market, representing over 40% of the global electrolyte drinks market share. Market dominion is due to the rising preference among consumers for healthy beverages over regular sweet drinks. Furthermore, as participation in trekking and other similar activities increases, the consumer base that participates in physical activity is increasing, demanding electrolyte drinks to avoid dehydration, boosting the market share growth in the region. The trend of urbanization, preferring ready-to-go drinks, and significant beverage companies in the United States and Canada fuel the regional market growth. The growing sports activities in the region due to the increasing population in physical activities propel the market growth.

The European region is expected to grow significantly during the forecast period due to the increased acceptance of various innovative products without preservatives and low-sugar content beverages. Moreover, the market will be further strengthened by government support regulations. For example, the UK government has introduced additional taxes on sugary drinks, causing manufacturers to relocate and restructure their portfolios to accommodate the sugar-free or low-sugar drinks market. These initiatives will accelerate the market growth opportunities.

The Asia Pacific region is expected to record the fastest growth rate during the projection period. This growth is recognized by increasing health and wellness awareness and a large regional customer base. Countries like India and China contribute significantly to the market's growth as the number of professional people increases. The presence of emerging markets in the sports sector, where Australia is the major country, having almost 35% of the sports nutrition market, escalates the market growth opportunities during the forecast period.

KEY MARKET PARTICIPANTS

Companies playing a vital role in the global electrolyte drinks market include PepsiCo. AJE, Coco-Cola, Body Armor Superdrink, Pacific Health Labs, Otsuka Pharmaceutical and Fraser & Neave Limited (F&N), Suntory Beverage & Food Ltd., Ajinomoto Co. Inc.

RECENT HAPPENINGS IN THE MARKET

- Gatorade launched Gatorade Zero as a new product on the market. This product reduces sugar content to shake consumers of Electrolyte Drinks thoroughly.

- PowerAde presents a new product that includes coconut water. According to a recent study, coconut water can be as valuable to consumers as drinks with electrolytes. PowerAde then attempted to use this information to create a new product.

- American sports-themed food and beverage maker Gatorade announced the launch of BOLT24. Bolt24 is free from artificial flavors and sweeteners, and to help athletes stay hydrated 24 hours a day, the company's new drink is a low-calorie electrolyte drink.

- Coca-Cola, which owns Powerade, also invested in BodyArmor, an electrolyte Drink Company that started with Kobe Bryant's support.

MARKET SEGMENTATION

This research report on the global electrolyte drinks market has been segmented and sub-segmented based on type, distribution channel, application, & region.

By Type

- Hypertonic

- Hypotonic

- Isotonic

By Distribution Channel

- Supermarkets/Hypermarkets

- Pharmacies

- Online Stores

By Application

- Sports

- Medical Centers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is driving the growth of the electrolyte drinks market?

The worldwide electrolyte drinks market grew at a rate of 3.2% over the last five years.

2. Are there any challenges facing the electrolyte drinks market?

Challenges in the market may include competition from alternative beverages, concerns about added sugars and artificial ingredients, regulatory scrutiny, and the need for continuous innovation to meet changing consumer preferences.

3. What are the trends shaping the future of the electrolyte drinks market?

Emerging market trends include the development of natural and organic electrolyte drinks, the use of functional ingredients like antioxidants and vitamins, personalized nutrition solutions, and sustainable packaging practices.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com