Global End-User Computing Market Size, Share, Trends, & Growth Forecast Report By Solution (Virtual Desktop Infrastructure, Unified Communication, Device Management, Software Asset Management); Service (Consulting, Support and Maintenance, Training and Education, System Integration, Managed Services); Industry Vertical (IT and Telecom, Banking Financial services and Insurance, Education, Healthcare, Government, Retail, Media and Entertainment, Manufacturing, Others) & Region - Industry Forecast From 2025 to 2033

Global End-User Computing Market Size

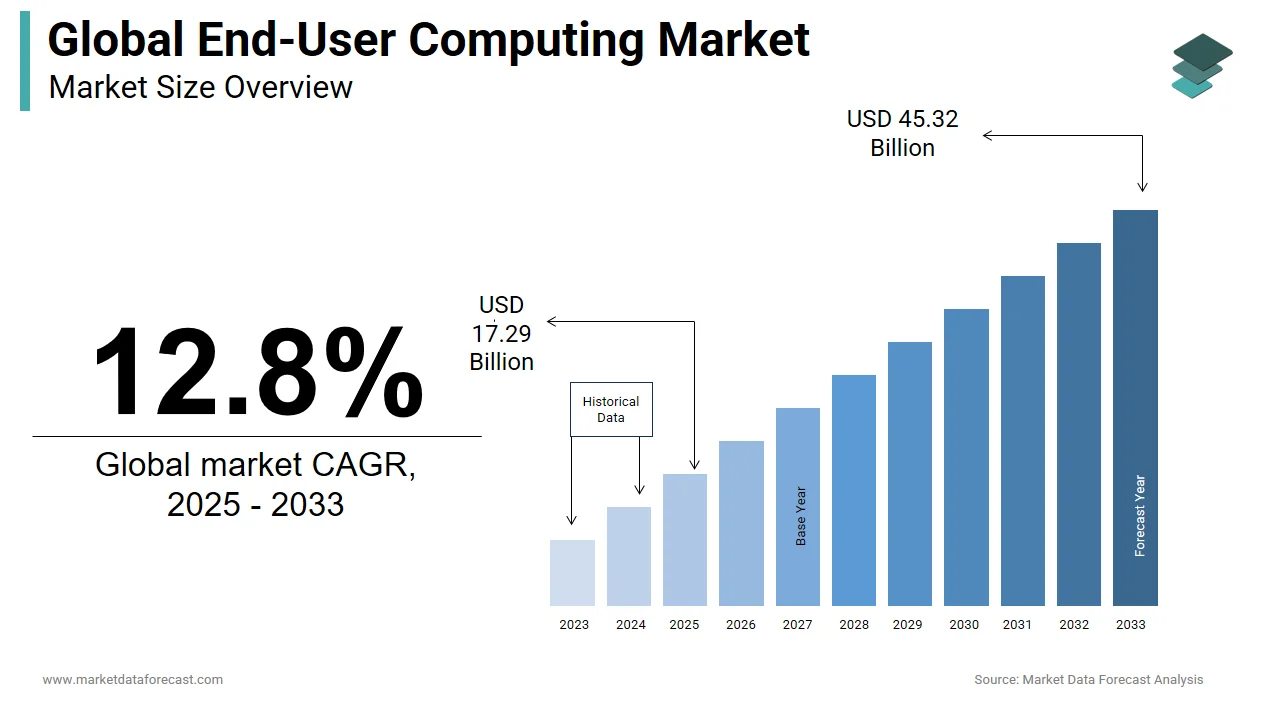

The global end-user computing market was worth USD 15.33 billion in 2024. The global market is predicted to reach USD 17.29 billion in 2025 and USD 45.32 billion in 2033, growing at a CAGR of 12.8% during the forecast period.

The fast-changing landscape of cloud, artificial intelligence (AI), and innovative solutions is rapidly driving the end-user computing market growth. The industry got a major push from Europe’s deal on the world’s first comprehensive artificial intelligence rules in December 2023. Moreover, the market is transitioning to digital-first business and hybrid working models. So, the number of collaborations and partnerships between technology providers and end-user companies has significantly surged in the North American and European markets. For instance, Intel reported the appointment of IBM as a partner for an Intel Foundry Accelerator Cloud Alliance to propel and speed up the deployment of sophisticated technologies in May 2024. However, one of the biggest challenges for industry players is cyberattacks.

MARKET DRIVERS

With the proliferation of hybrid work and the Bring Your Own Device (BYOD) trend, companies are increasingly integrating technologies and methods to exploit digital opportunities, which are driving the end-user computing market.

Additionally, the emergence of new technologies such as AI, blockchain, edge computing, and software-defined architecture is expected to accelerate the market growth rate in the coming years. The reason behind this is the increasing concentration of organizations in digital technologies.

Cloud-based management, desktops, infrastructure built on an advanced virtual GPU, and technologies like Nvidia Grid and a new Blast Extreme protocol help companies deliver a full-featured, exceptional user experience. For example, VMware announced its partnership with Microsoft to develop a new solution called VMware Workspace ONE (now acquired by KKR) for Microsoft Endpoint Manager to enable modern device management with Windows 10.

MARKET RESTRAINTS

The lack of security and model interdependence are some of the major obstacles to the end-user computing market growth. Presently, the attackers are concentrating on logging in instead of hacking it, which shows the ease and minimal effort in acquiring credentials against taking advantage of security gaps or running phishing attacks. Also, industry experts found that identification and authentication failures were the most frequent incidents that happened in 2023. According to a study, there was a 71 per cent surge in cyberattacks for compromised or stolen credentials. Thus, the absence of identity protections is decreasing the expansion of the market.

MARKET OPPORTUNITIES

The end-user computing market is believed to expand quickly in the future due to the integration of AI and automation, coupled with the transition towards a multi-cloud EUC environment. Also, the market is expected to grow further as companies progressively shift to consolidated cloud and Software-as-a-Service (SaaS) providers for computing requirements. Additionally, the field of customer offerings is likely to strengthen the demand for end-user computing solutions. For instance, in April 2024, Cloud Software Group announced an investment of 1.65 billion dollars in Microsoft tools to enhance the go-to-market of its Citrix virtual application and desktop platform. Furthermore, personalization, predictive analytics, and automation will see increased usage in the coming years.

MARKET CHALLENGES

The year-on-year rise in cyberattacks, Kerberoasting, and other incidents, particularly in manufacturing, finance, and insurance industries, challenges the expansion of the End-user computing market. Manufacturing gained the first spot, and Finance with insurance at second in the top attacked industries in 2023. Similarly, the portion of attacks throughout the energy, retail and wholesale, medical and pharma, transportation and arts, entertainment, and recreation industries surged every year.

Additionally, the growing intense competition among the established and emerging players is making it difficult for other entries into the market and develop. For instance, strong competition from Citrix and KKR to tthe hree technology giants – Microsoft, Amazon, and Google.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.8% |

|

Segments Covered |

By Solution, Service, Industry Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

IGEL (Europe), Genpact (USA), Tech Mahindra (India), Mindtree (India), Nucleus Software (India), Patriot Technologies (USA), NetApp (USA), HCL Infosystems (India), Synapse360 (United Kingdom), Hitachi Systems Micro Clinic (India), IDS (United States), CSS Corp (India), SITA (Switzerland), Infosys (India), Data Integrity (Canada), Fujitsu (Japan), Focus Technology Solutions (UnitedStates), SMP-Corp (United States), Emerio (Singapore), Fortem Information Technology (UnitedKingdom), Serole Technologies (Australia), The Ergonomic Group (USA), Coreio (Canada), Emtec (USA) and Others. |

SEGMENTAL ANALYSIS

By Solution Insights

virtual desktop infrastructure (VDI) segment holds more than fifty percent of the end-user computing market share. The increased emphasis on data protection and compliance is influencing the demand for VDI. Moreover, technological developments in virtualization is pushing the segment’s market share. In addition, cybersecurity enterprises anticipate that the cost of cybercrime is believed to be valued at about 10.5 trillion dollars by 2025. For instance, in July 2024, it was reported that approximately 10 billion passwords of a large number of individuals, including their social media and email accounts, had been stolen and released on the world's platforms.

On the other hand, the device management segment is also gaining traction and is estimated to capture a notable market share in the coming years. The increasing security problems and culture of bringing your device (BYOD) are considerable factors fuelling the segment’s market size. The quickly rising number of mobile and portable gadgets has become an important element for all organizations. Moreover, North America is leading the segment, followed by Europe and Asia Pacific at third.

By Service Insights

The managed services segment accounted for the maximum share of the end-user computing market and is forecasted to grow at a higher CAGR during the estimation period. This can be attributed to the shift to cloud-hosted DaaS, the growing necessity of agility and scalability, improved security and management, and allows companies to focus on innovations. Further, developments in automation and AI have revolutionized managed services by empowering suppliers and providers for easy monitoring of systems and automating daily and periodic tasks. Moreover, extensive use of cloud-based services i.e., 94 per cent of all companies worldwide, is also contributing to the expansion of the segment’s market size.

Whereas the consulting segment is closely following the managed services owing to volatility in IT hiring and recruitment, cost reduction amid the struggling world economy, and a surge in the adoption of IT advisory services. This is due to swift progress in data analytics, cloud and edge computing, and AI. Close to 47 per cent go for outsourcing IT services to save cost.

By Industry Vertical Insights

The IT & telecommunications segment dominated the end-user computing market because of the increased pace of digital transformation. Moreover, as companies steadily support digital procedures, IT & telecom organisations play an essential part in providing advanced solutions that modernise operations, improve customer satisfaction, and upgrade service deliveries. This propels toward digitalization is enabling these companies to achieve breakthroughs in end-user computing solutions, offering state-of-the-art platforms & applications for smooth incorporation, data-driven insights, and agile responses to the rising demands of the industry.

Also, the banking segment witnessed substantial growth and is believed to advance further during the forecast period. The banks and financial institutions are focusing on evolving their finance operating models for sustainable growth, driving the segment’s market share. However, the changing regulatory, technological, and economic landscape has compelled the banking sector to adopt a more robust system. For instance, the European Central Bank (ECB) has been focusing on the necessity to shift to centralized data architecture from End-User Computing (EUC) solutions.

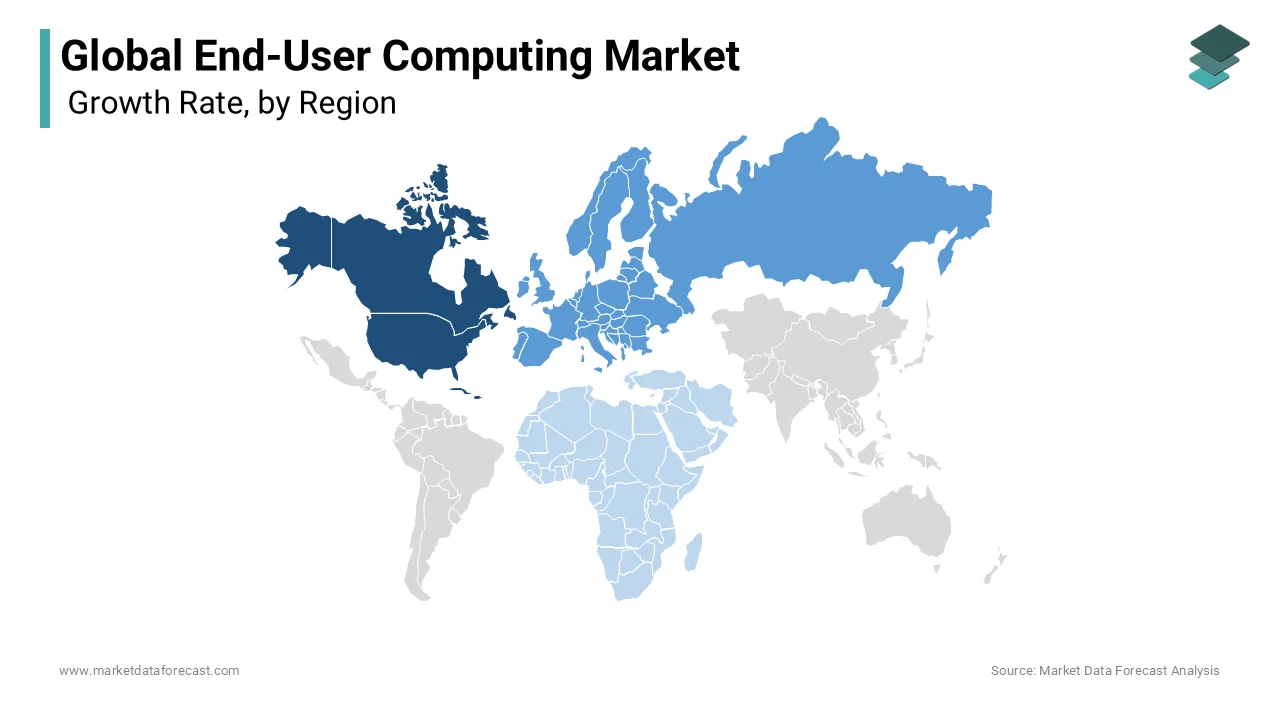

REGIONAL ANALYSIS

North America had a significant share and is expected to dominate the global end-user computing market over the calculated period. The proliferation of the mobile workforce, the advancement of network technologies, SaaS flexibility, and the presence of advanced mobile platforms are the main engines of growth in the region. Companies have seen a significant increase in productivity and workforce commitment when implementing EUC solutions in this region.

The end-user computing market in the Asia-Pacific is expected to grow significantly over the anticipated time. The region offers growth opportunities to key players in the EUC market, as companies in the region are eager to adopt solutions to meet the growing demand for dynamic labour, such as customer interaction, partners, clients, and employees, and develop custom applications with limited technical support and deliver tangible business benefits.

Europe's end-user computing market holds a considerable industry share. Germany, the United Kingdom, France, Italy, and Spain are the prominent nations in the regional market. Also, the surge in the adoption rate of cloud-based EUC solutions like Desktop as a Service (DaaS) is taking the regional industry forward, as companies want remote and hybrid work models. Apart from this, the continent also witnessed the largest percentage of cases (32 per cent) among other regions. Malware was the most observed action on target, capturing 44 per cent of cases.

Latin America is a relatively smaller industry and presents potential opportunities for the end-user computing market players. This can be linked to the gradual rise in the application of cloud-based solutions and the heightening incidence of cyberattacks. However, several studies have highlighted the worrying trend of increased risk. Likewise, malware and particularly ransomware again came on top with 31 per cent of all cases across incidents. Also, for malicious objectives, both the use of tools and server access accounted for 23 per cent of incidents.

Middle East and Africa are expected to propel at a moderate rate during the forecast period for the end-user computing market. Saudi Arabia and the United Arab Emirates are believed to generate the highest demand for EUC. 40 per cent of all online attack incidents in the region happened in Saudi Arabia, UAE at 30 per cent, and Mauritius at 12 per cent.

KEY MARKET PARTICIPANTS

The major companies operating in the global end-user computing market include IGEL (Europe), Genpact (USA), Tech Mahindra (India), Mindtree (India), Nucleus Software (India), Patriot Technologies (USA), NetApp (USA), HCL Infosystems (India), Synapse360 (United Kingdom), Hitachi Systems Micro Clinic (India), IDS (United States), CSS Corp (India), SITA (Switzerland), Infosys (India), Data Integrity (Canada), Fujitsu (Japan), Focus Technology Solutions (United States), SMP-Corp (United States), Emerio (Singapore), Fortem Information Technology (United Kingdom), Serole Technologies (Australia), The Ergonomic Group (USA), Coreio (Canada), Emtec (USA).

RECENT MARKET HAPPENINGS

- In June 2024, NVIDIA and Hewlett-Packard Enterprise announced the formation of “NVIDIA AI Computing by HPE”. It is a bundle of jointly developed AI solutions and Co-go-to-market integrations that help companies boost the acceptance of generative AI. Moreover, among the major offerings in the portfolio is HPE Private Cloud AI.

- In February 2024, KKR reported it had completed the signing of a definitive agreement with Broadcom Inc. to take over its End-User Computing Division (EUC Division) for around 4 billion dollars. After this, the EUC will be a standalone company with better availability to growth capital and a committed strategic emphasis on enabling consumers and partners globally with unique digital workplace products and services.

MARKET SEGMENTATION

This research report on the global end-user computing market is segmented and sub-segmented based on the solution, service, industry vertical, and region.

By Solution

- Virtual Office Infrastructure

- Unified Communication

- Device Management

- Software Asset Management and more

By Service

- Consulting

- Support and Maintenance

- Training and Education

- Systems Integration

- Managed Services

By Industry Vertical

- IT and Telecommunications

- Banking

- Financial and Insurance Services (BFSI)

- Education

- Healthcare

- Government

- Retail

- Media and Entertainment

- Manufacturing

- Others

By Region

- North America

- The United States

- Canada

- Rest of North America

- Europe

- The United Kingdom

- Spain

- Germany

- Italy

- France

- Rest of Europe

- The Asia Pacific

- India

- Japan

- China

- Australia

- Singapore

- Malaysia

- South Korea

- New Zealand

- Southeast Asia

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of LATAM

- The Middle East and Africa

- Saudi Arabia

- UAE

- Lebanon

- Jordan

- Cyprus

Frequently Asked Questions

What key technological trends are shaping the Global End-User Computing Market?

The market is witnessing a surge in demand for Virtual Desktop Infrastructure (VDI), Cloud-based solutions, and advancements in edge computing technologies.

How is the Global End-User Computing Market responding to the rise in remote work trends?

The market is adapting by offering solutions focused on enhancing remote collaboration, security, and productivity, with a notable emphasis on Unified Endpoint Management (UEM) tools.

What is the anticipated impact of 5G technology on the End-User Computing Market?

The implementation of 5G is expected to significantly improve connectivity and enable faster data transfer, enhancing the performance of end-user computing devices and applications.

What role does Artificial Intelligence (AI) play in the evolution of End-User Computing?

AI is increasingly integrated into end-user computing solutions for predictive analysis, automation of routine tasks, and providing personalized user experiences, contributing to overall efficiency and user satisfaction.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com