Global Erythropoietin Drugs Market Size, Share, Trends & Growth Forecast Report By Product, Application, Drug Class and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Erythropoietin Drugs Market Size

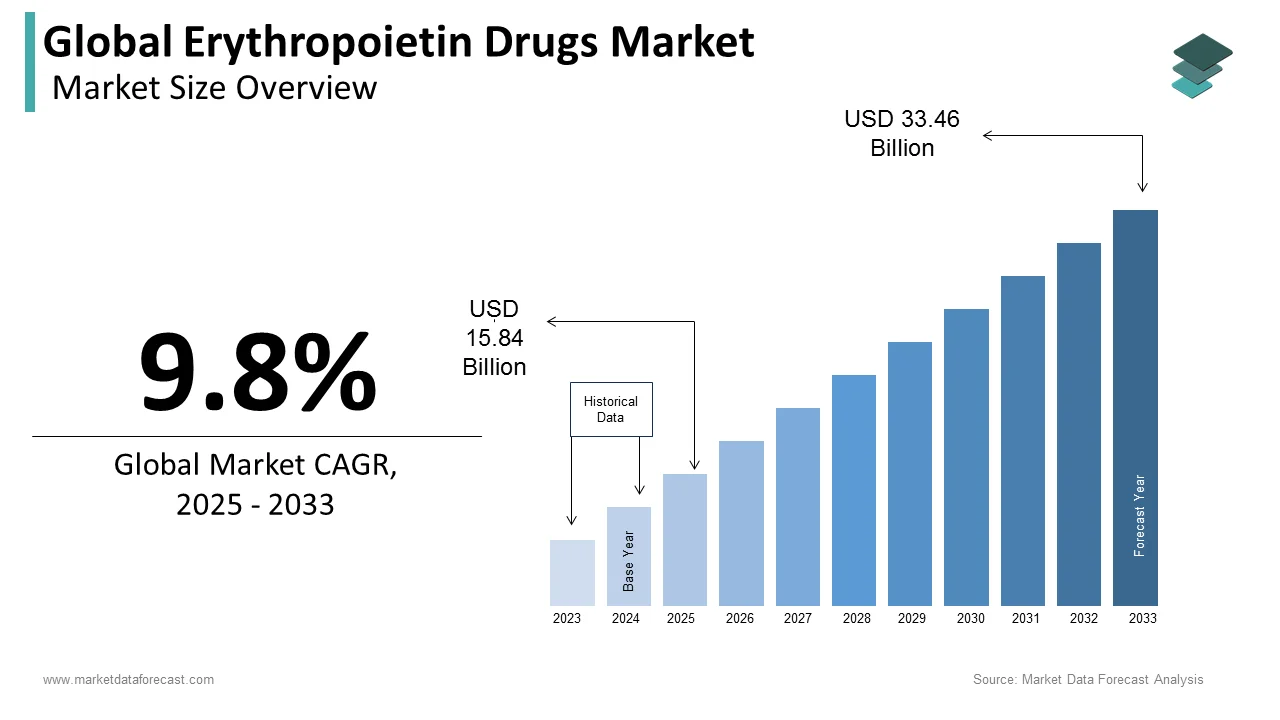

The global erythropoietin drugs market size was worth USD 14.43 billion in 2024. The global market is estimated to grow at a CAGR of 9.8% from 2025 to 2033 and be worth USD 33.46 billion by 2033 from USD 15.84 billion in 2025.

MARKET DRIVERS

The growing prevalence of anemia and rising demand levels for biosimilar and biologic drugs primarily boost the erythropoietin drugs market growth.

Chronic diseases, unhealthy diets, intestinal problems, and other infections majorly cause Anemia. This medical condition has become very common in the United States, and around 6% of the U.S. population is diagnosed with Anemia. At a global level, 1/3rd of the population is living with anemia-related conditions. Erythropoietin drugs are effectively used to treat Anemia, which is expected to drive market growth. Fast approval of erythropoietin drugs gives pharmaceutical & biotechnology firms opportunities to grow their drug production.

The growing investments by governmental organizations for R&D to develop new and improved erythropoietin drugs further propel the market growth. Finally, the patent expiration of these novels & hard drugs is another major factor in helping the erythropoietin drug market grow.

MARKET RESTRAINTS

High costs associated with erythropoietin drugs may hamper the erythropoietin drugs market growth.

In addition, the lack of proper knowledge of the usage of the medicines is hampering the growth rate of the erythropoietin drug market. Furthermore, using erythropoietin drugs might lead to several complications or side effects like high blood pressure, vomiting, allergic reaction, headache, nausea, risk of a blood clot, diarrhea, flu-like symptoms, muscle, joint, or bone pain, stroke, and rash. Epoetin alpha is the first erythropoietin drug approved by the USFDA that was available for treating Anemia. Erythropoietin is a cytokine that plays a potential neuroprotective & cardioprotective lead role against ischemia. However, there are a few limitations noticed with the use of Epoetin alfa, whose overdose would lead to the development of signs and symptoms associated with the rapid increase in hemoglobin concentration, leading to cardiovascular events and related disorders, which are leading to a declined growth of erythropoietin drugs market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Analysed |

By Product, Application, Drug Class, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Analysed |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Key Market Players |

Intas Pharmaceuticals Ltd., Biocon Ltd., L.G. Life Sciences Ltd., F. Hoffmann-La Roche Inc., Amgen, Dr. Reddy's Laboratories, Sun Pharmaceutical Industries Ltd, Johnson & Johnson, Celltrion, Inc., and Teva Pharmaceutical Industries |

SEGMENTAL ANALYSIS

By Product Insights

The epoetin-alfa segment holds the largest share of the global erythropoietin drugs market during the forecast period. The segmental growth is primarily due to the wide range of acquisitions among healthcare professionals. In addition, it is the first organic or natural product that the US FDA accepted for the treatment of Anemia. Belonging to a class of medications called erythropoiesis-stimulating agents, Epoetin alfa products work by producing more red blood cells through stimulation of bone marrow, the soft tissue inside bones, which is the site of production of blood. Epoetin-beta is a recombinant of epoetin-alfa. This segment has substantial growth in the product segment credited to improved efficiency and a long half-life compared with epoetin-life. To treat Anemia in adults with chronic kidney disease (CKD) on or off dialysis and children with CKD on dialysis, methoxy polyethylene glycol-epoetin beta injection is used.

On the other hand, the darbepoetin–alfa segment is expected to observe significant growth during the forecast period due to its economic value, improved efficiency, and ongoing research to invent new therapies. Usually, Anemia also occurs in people who received chemotherapy for cancer, which can be treated with Darbepoetin alfa, a form of erythropoietin, helping the bone marrow produce more red blood cells is also used for kidney patients, on dialysis or not.

By Application Insights

The cancer segment is expected to lead the market and is likely to be the fastest-growing segment. The cancer segment is increasing due to the increasing number of cancer occurrences globally, and this cancer chemotherapy produces medication that decreases the patient's red blood cells count. As a result, the cancer segment is likely to grow with a high CAGR of 13.97%. In addition, recombinant human erythropoietin (rhEpo) has been used for many years to treat chemotherapy and cancer-associated Anemia since it's resulted in a better quality of life for patients and has helped save blood transfusions.

The hematology segment will likely have fixed growth during the forecast period. The factors responsible for the growth rate are growing research and development activities to develop economic and inconsistent solutions for treating conditions like hypoxia and Anemia of prematurity.

The role of EPO in making red blood cells is understood by hematology. The hemoglobin level increases due to having more red blood cells. Red blood cells contain hemoglobin, a protein that helps blood carry oxygen throughout the body, which results in Anemia in case of insufficient hemoglobin in the blood.

By Drug Class Insights

The bio-similar segment is expected to grow significantly over the forecast period. This segment will likely grow at a CAGR of 13.58% from 2019 to 2024. Increasing funds for research and development in the bio-similar, strong product pipeline, and rising partnerships among the hospitals and manufacturers are factors fuelling the market growth. Biosimilars for recombinant human erythropoietin (rEPO) are versions of epoetin-based medications created after the first patents expired. However, slight structural variations from the reference product could be caused by variations in the production process.

The Biologics segment is also expected to hold a significant market share with biosimilars. For example, EPO, a very effective and complex biological product, a glycosylated protein produced by genetic engineering, treats Anemia by stimulating the production of red blood cells.

REGIONAL ANALYSIS

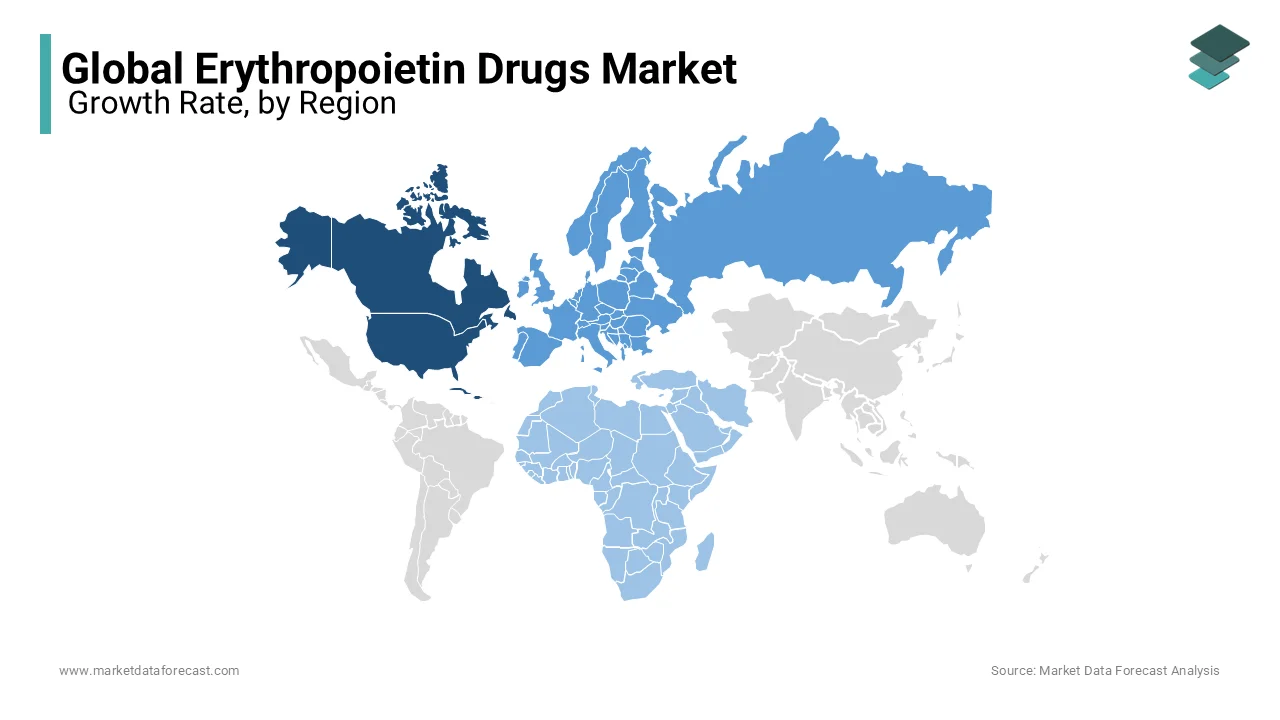

Geographically, the North American erythropoietin drugs market had the major share of the global market in 2024 and is predicted to register a healthy CAGR during the forecast period. The availability of a robust healthcare system with advanced medical facilities and high healthcare expenditure in North America drive the North American market growth. The strong infrastructure supports the adoption and availability of erythropoietin drugs in North America and contributes to regional market growth. The growing patient population of CKD in the North American region boosts the demand for erythropoietin drugs in this region and supports the North American market growth. The U.S. led the market in North America, followed by Canada in 2024.

The European erythropoietin drugs market occupied the second-largest share of the global erythropoietin drugs market in 2024 and is predicted to grow at a promising CAGR during the forecast period. The growing aging population and increasing prevalence of chronic diseases such as renal diseases and cancer drive the demand for erythropoietin drugs in Europe and propel regional market growth. The stringent regulatory frameworks and reimbursement policies that support the use of erythropoietin drugs further accelerate the growth rate of the European market.

The erythropoietin drugs market in Asia-Pacific is set to grow at the fastest CAGR during the forecast period. The population suffering from chronic diseases is on the rise in the Asia-Pacific region. The growing usage of erythropoietic drugs to manage anemia associated with chronic diseases majorly drives the growth of the APAC market. The growing number of investments from the governments of APAC countries to develop the healthcare infrastructure to provide improved healthcare access and affordability favors the growth of the APAC market.

The Latin American erythropoietin drugs market is expected to grow steadily during the forecast period. Easy accessibility of resources, skilled labor, and a growing number of occurrences are majorly market growth in Latin America. Brazil represents a significant market share due to growing support from public and private organizations to develop innovative products.

The Middle East & Africa Erythropoietin drugs market is predicted to have sluggish growth during the forecast period. However, creating awareness by government authorities in rural areas fuels the market's growth rate in this region.

KEY MARKET PLAYERS

Some of the promising companies leading the global erythropoietin drugs market profiled in the report are Intas Pharmaceuticals Ltd., Biocon Ltd., L.G. Life Sciences Ltd., F. Hoffmann-La Roche Inc., Amgen, Dr. Reddy's Laboratories, Sun Pharmaceutical Industries Ltd, Johnson & Johnson, Celltrion, Inc., and Teva Pharmaceutical Industries.

RECENT HAPPENINGS IN THE MARKET

- In November 2022, the first ever lab-grown red blood, cultured from donor stem cells for the comparison of lifespans of lab-grown cells with normal red blood cells, was transfused into human recipients by volunteers in National Health Service, U.K., potentially paving the way for innovative treatments for people with rare blood types or blood disorders such as sickle cell disease.

- In October 2022, scientists at St. Jude Children's Research Hospital demonstrated the responsibility of protein adaptation to low oxygen conditions called hypoxia, which increases fetal hemoglobin in adults, whose discovery could lead to solving severe blood disorders like sickle cell disease and beta-thalassemia that affect millions of people globally.

- In June 2022, characteristic behaviors of erythropoietin (Epo)-producing cells, a hormone produced by the kidney that stimulates the production of red blood cells, were revealed by a research team from Kyoto University, providing additional insight into the mechanism of a common complication of chronic kidney disease, renal Anemia, as a result of insufficient renal production of EPO.

- In March 2022, Zydus Lifesciences received its New Drug Application (NDA) approval for Oxemia, India's first oral treatment for Anemia associated with chronic kidney disease, from the Drug Controller General of India (DCGI).

MARKET SEGMENTATION

This research report on the global erythropoietin drugs market has been segmented and sub-segmented based on product, application, drug class, and region.

By Product

- Epoetin-alfa

- epoetin-beta

- darbepoetin-alfa

By Application

- Cancer

- Hematology

- Renal Diseases

- Neurology

By Drug Class

- Biologics

- Biosimilars

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which region has the highest market share in the erythropoietin drugs market ?

The erythropoietin drugs market in North America is expected to show the most significant revenue during the forecast period.

At What CAGR, The erythropoietin drugs market is expected to grow from 2025 to 2033?

The erythropoietin drugs market is expected to grow at a CAGR of 9.80% from 2025 to 2033.

Does this report include the impact of COVID-19 on the erythropoietin drugs market ?

Yes, we have studied and included the COVID-19 impact on the global erythropoietin drugs market in this report.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]