Europe Automated Breast Ultrasound Systems Market Size, Share, Trends & Growth Forecast Report By Product (Automated Breast Volume Scanner, Automated Breast Ultrasound (ABUS)), End Use (Hospital, Diagnostics Imaging Laboratories, Others), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe Automated Breast Ultrasound Systems Market Size

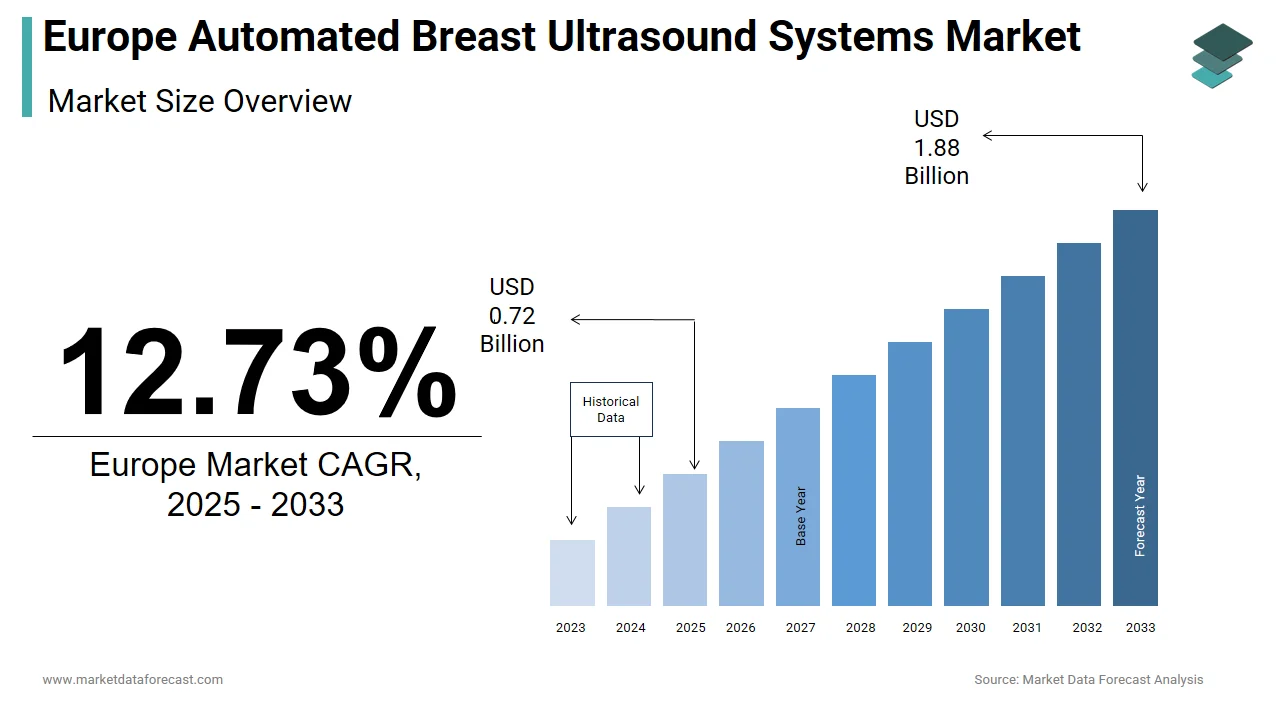

The size of the Europe automated breast ultrasound systems market was valued at USD 0.64 billion in 2024. This market is expected to grow at a CAGR of 12.73% from 2025 to 2033 and be worth USD 1.88 billion by 2033 from USD 0.72 billion in 2025.

Automated Breast Ultrasound (ABUS) systems are advanced imaging technologies designed to provide high-resolution, three-dimensional ultrasound images of the breast. These systems are increasingly being adopted as complementary tools to mammography, particularly in women with dense breast tissue where conventional imaging may be less effective. In Europe, the rising incidence of breast cancer and growing emphasis on early detection have positioned ABUS as a critical component of modern diagnostic workflows.

Additionally, several European countries have updated national guidelines to include ultrasound-based screening for women with dense breasts. As per the European Society of Radiology, more than 15 million women in Europe undergo supplemental screening annually due to high breast density. The integration of ABUS into these protocols is driven by its ability to detect lesions missed by mammography alone.

MARKET DRIVERS

Rising Incidence of Breast Cancer Among Women Across Europe

One of the primary drivers of the Europe Automated Breast Ultrasound Systems market is the increasing prevalence of breast cancer, particularly among younger and middle-aged women. According to the European Institute of Oncology, breast cancer incidence rates in Europe rose by approximately 12% between 2018 and 2023 with over 500,000 new cases diagnosed annually. This surge in diagnoses has intensified the need for advanced diagnostic tools capable of detecting tumors at earlier stages in patients with dense breast tissue where mammography is less sensitive.

The World Health Organization’s Regional Office for Europe reported that more than 40% of women under the age of 50 have dense breast tissue by making them ideal candidates for supplementary imaging. ABUS provides a non-invasive, radiation-free alternative that enhances lesion visibility without compromising diagnostic accuracy. In response, leading radiological societies including the British Institute of Radiology and the German Cancer Society, have endorsed ABUS as part of multi-modality screening strategies.

Technological Advancements and Integration of Artificial Intelligence

Another significant driver fueling the growth of the Europe Automated Breast Ultrasound Systems market is the rapid advancement in imaging technology and the incorporation of artificial intelligence (AI) into diagnostic workflows. Modern ABUS systems now feature enhanced image resolution, faster scanning times, and AI-powered lesion detection algorithms that improve diagnostic consistency and reduce radiologist workload.

As per the European Society of Medical Oncology, AI-integrated ABUS platforms can reduce false-negative readings by up to 25% compared to manual ultrasound scans. This improvement in accuracy is crucial in busy clinical environments where radiologists face increasing demands. Additionally, the Fraunhofer Institute for Medical Image Computing reported in 2023 that AI-enhanced ABUS systems reduced average interpretation time by 18%, allowing for higher throughput in screening centers.

Several European hospitals, including Charité in Berlin and University Hospital Zurich, have begun implementing AI-driven ABUS solutions as part of their digital transformation strategies. These innovations align with broader EU health digitization goals, which encourage the adoption of smart diagnostic tools to enhance early disease detection and streamline care delivery. As a result, the integration of intelligent imaging technologies is playing a pivotal role in expanding the reach and effectiveness of automated breast ultrasound systems across the region.

MARKET RESTRAINTS

High Cost of Automated Breast Ultrasound Equipment

A major restraint impeding the widespread adoption of Automated Breast Ultrasound (ABUS) systems in Europe is the high initial cost associated with acquiring and maintaining this advanced imaging equipment. Unlike conventional handheld ultrasound devices, ABUS systems require specialized hardware, software, and trained personnel to operate effectively. This financial burden is particularly challenging for smaller clinics and regional healthcare facilities that operate under tight budget constraints. Despite the long-term benefits of early cancer detection, many institutions in Eastern and Southern Europe lack the funding required to invest in such high-cost modalities. Moreover, ongoing maintenance, software updates, and technician training further add to the total cost of ownership.

Limited Reimbursement Coverage and Regulatory Hurdles

Another key challenge limiting the expansion of the Europe Automated Breast Ultrasound Systems market is the inconsistent reimbursement landscape and complex regulatory approval processes across different countries. While some nations, including Germany and the Netherlands, have incorporated ABUS into their national screening guidelines with partial coverage, many others do not recognize it as a reimbursable procedure under public health schemes. Regulatory barriers also pose challenges, as ABUS manufacturers must navigate varying CE marking requirements and post-market surveillance obligations. The European Medicines Agency highlighted in a 2023 publication that over 40% of ABUS-related applications faced delays due to inconsistencies in clinical validation data, which is slowing down market entry and hindering innovation diffusion across the region.

MARKET OPPORTUNITIES

Expansion of Screening Programs for Dense Breast Tissue

A major opportunity shaping the future of the Europe Automated Breast Ultrasound Systems market is the increasing implementation of structured screening programs targeting women with dense breast tissue. Mammography, while widely used, has limitations in detecting malignancies in dense breast tissue, prompting healthcare authorities across Europe to explore supplementary imaging options. In response, several countries have initiated or expanded population-based screening protocols that include ultrasound as an adjunct modality. For example, France launched a nationwide initiative in 2023 to integrate ABUS into existing breast cancer screening pathways for high-density patients. These policy shifts are creating a conducive environment for ABUS adoption in both public and private healthcare settings.

Integration with Telemedicine and Remote Diagnostic Platforms

An emerging opportunity for the Europe Automated Breast Ultrasound Systems market lies in the integration of ABUS technology with telemedicine and remote diagnostic platforms. The shift toward decentralized healthcare delivery, accelerated by the pandemic, has created a strong demand for digital imaging solutions that support remote consultations and centralized reading capabilities.

According to the European Commission’s Digital Health Strategy, over 60% of EU member states had implemented tele-radiology services by 2023 by enabling cross-border expert consultations and second opinions. ABUS systems, with their standardized image acquisition and compatibility with Picture Archiving and Communication Systems (PACS), are well-suited for integration into these networks. Additionally, cloud-based storage and AI-assisted triage tools allow radiologists to analyze studies from centralized hubs, improving efficiency and resource utilization.

MARKET CHALLENGES

Shortage of Trained Professionals and Technical Expertise

A major challenge facing the Europe Automated Breast Ultrasound Systems market is the shortage of trained professionals and technical expertise required to operate and interpret ABUS scans effectively. Unlike conventional mammography, which follows standardized protocols, ABUS requires specific knowledge of ultrasound physics, image acquisition techniques, and lesion differentiation, making training a critical barrier to adoption. Additionally, the scarcity of certified sonographers and technologists trained in ABUS operation hampers deployment in smaller healthcare centers. The European Society of Radiology emphasized that the average waiting time for ABUS certification courses in Germany and France exceeds six months, delaying workforce readiness.

Patient Awareness and Acceptance of Supplementary Imaging Modalities

Another critical challenge influencing the Europe Automated Breast Ultrasound Systems market is the relatively low level of patient awareness and acceptance of supplementary imaging modalities beyond mammography. Many women remain unfamiliar with the concept of dense breast tissue and the added value of ultrasound in early cancer detection. This lack of awareness leads to lower compliance with recommended follow-up exams and reduces the uptake of ABUS in both public and private screening settings. In countries such as Italy and Portugal, where breast cancer screening participation already lags behind Northern Europe, the reluctance to embrace new modalities further slows adoption. Public health campaigns aimed at educating women about dense breast tissue and the benefits of ABUS are still in early stages.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, End-use, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

GE HealthCare, Koninklijke Philips N.V., Siemens Healthcare Private Limited, CANON MEDICAL SYSTEMS CORPORATION, TELEMED Medical Systems srl, Hologic, Inc., SuperSonic Imagine, Lunit Inc., Delphinus Medical Technologies, Inc., and others. |

SEGMENTAL ANALYSIS

By Product Insights

The Automated Breast Ultrasound (ABUS) segment was the largest and held 58.2% of the Europe automated breast ultrasound systems market share in 2024. One key driver behind this segment’s dominance is the increasing integration of ABUS into national breast cancer screening programs across several European countries. According to the European Society of Radiology, over 15 million women annually undergo supplemental imaging, with a significant portion receiving ABUS due to its standardized scanning protocol and high reproducibility. Additionally, the system's compatibility with AI-assisted diagnostics and digital health platforms has further enhanced its utility. A 2023 report by the University Medical Center Utrecht found that AI-integrated ABUS reduced false-negative rates by up to 24%, making it a preferred choice for radiologists seeking precision in early detection.

The Automated Breast Volume Scanner (ABVS) segment is growing lucratively with a CAGR of 9.7% during the forecast period. This rapid growth is driven by technological advancements that enable full volumetric imaging of the breast with minimal operator dependency. ABVS captures comprehensive three-dimensional data in a single scan, allowing for more accurate lesion localization and multiplanar reconstruction. The European Institute for Biomedical Imaging Research noted in 2023 that ABVS improved lesion visibility by 30% compared to conventional methods by enhancing diagnostic confidence among radiologists.

By End Use Insights

The hospitals segment was the largest by occupying a dominant share of the Europe automated breast ultrasound systems market in 2024. Public and private hospitals are the primary sites for breast cancer screening programs, which often include automated ultrasound as a supplementary modality. According to Eurostat, in 2023, over 80% of breast imaging procedures in Europe were conducted within hospital settings, where multidisciplinary teams ensure seamless coordination between radiology, oncology, and surgery departments. Furthermore, hospitals are better equipped to handle capital-intensive equipment such as ABUS and ABVS systems, supported by trained personnel and integrated PACS infrastructure.

The diagnostic Imaging Laboratories segment is likely to experience a CAGR of 10.3% from 2025 to 2033. The growth of the segment is outsourcing trends, increased access to advanced imaging services, and a shift toward outpatient diagnostic centers. These laboratories offer cost-effective, high-efficiency environments for conducting breast imaging studies without requiring hospital admission. In addition, many private imaging centers are investing in ABUS technology to differentiate themselves in competitive markets.

COUNTRY LEVEL ANALYSIS

Germany led the Europe automated breast ultrasound systems market by holding 24.3% of the share in 2024. As Europe’s largest economy and a hub for medical innovation, Germany benefits from a well-developed healthcare infrastructure, strong research funding, and proactive government policies supporting early cancer detection. According to the Robert Koch Institute, over 70,000 new breast cancer cases were diagnosed in Germany in 2023, which is prompting national health authorities to enhance screening capabilities. Additionally, Germany has been at the forefront of adopting AI-enhanced imaging technologies. The Fraunhofer Institute for Medical Image Computing reported that AI-assisted ABUS systems reduced radiologist workload by nearly 20% by improving efficiency in high-volume diagnostic centers.

France was positioned second with 19.2% of the Europe automated breast ultrasound systems market share in 2024. The French National Cancer Institute launched a nationwide campaign in 2023 to incorporate automated ultrasound into supplemental screening for women with dense breasts. Moreover, France has seen a surge in academic research focused on improving ultrasound-based diagnostics.

The United Kingdom automated breast ultrasound systems market is esteemed to grow lucratively in the coming years. NHS Digital reported in 2023 that nearly 2.5 million women underwent breast screening, with an increasing number benefiting from ultrasound supplementation. Additionally, the UK government has allocated funds under the “Cancer Recovery Plan” to upgrade imaging infrastructure, including automated ultrasound equipment.

Italy's automated breast ultrasound systems market is growing steadily with a dual healthcare model that combines public provision with a growing private clinic network by facilitating broader access to advanced imaging technologies. According to Istituto Superiore di Sanità, over 55,000 new breast cancer cases were recorded in Italy in 2023, which is prompting both public and private institutions to invest in early detection tools. The Italian Society of Medical Radiology reported that private imaging centers in Milan and Rome accounted for 40% of all ABUS installations by leveraging them as differentiators in competitive urban markets.

Spain's automated breast ultrasound systems market is likely to grow with huge growth opportunities in the coming years. According to Spain’s National Institute of Statistics, in 2023, over 30,000 Spanish women were diagnosed with breast cancer, with the need for enhanced screening strategies. Additionally, Spain has expanded digital health integration, enabling remote image interpretation and cloud-based storage.

KEY MARKET PLAYERS

Companies playing a prominent role in the European automated breast ultrasound systems market profiled in this report are GE HealthCare., Koninklijke Philips N.V., Siemens Healthcare Private Limited, CANON MEDICAL SYSTEMS CORPORATION, TELEMED Medical Systems srl, Hologic, Inc., SuperSonic Imagine, Lunit Inc., Delphinus Medical Technologies, Inc., and others.

TOP LEADING PLAYERS IN THE MARKET

GE Healthcare

GE Healthcare is a global leader in medical imaging technologies and holds a strong position in the Europe automated breast ultrasound systems market. The company offers advanced ABUS solutions integrated with AI-driven analytics, enhancing diagnostic accuracy and workflow efficiency. Its commitment to innovation and strategic partnerships with leading European hospitals has reinforced its presence in both public and private healthcare sectors.

Siemens Healthineers

Siemens Healthineers plays a pivotal role in shaping the European automated breast ultrasound landscape through its high-resolution imaging platforms and digital integration capabilities. The company focuses on developing comprehensive diagnostic ecosystems that support early breast cancer detection. Its emphasis on clinical research collaborations and training programs for radiologists further strengthens its market foothold.

Hologic Inc.

Hologic is a key player known for its specialized women’s health imaging solutions, including automated breast ultrasound systems tailored for dense breast screening. In Europe, the company actively supports national screening initiatives and works closely with regulatory bodies to expand access to advanced diagnostics. Its patient-centric approach and continuous product enhancements make it a trusted name in the region’s evolving breast imaging space.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One of the major strategies employed by key players in the Europe automated breast ultrasound systems market is product innovation and technological differentiation, where companies continuously develop enhanced imaging features, AI-assisted interpretation tools, and streamlined workflows to meet evolving clinical demands.

Another critical approach is strategic partnerships with academic institutions, healthcare providers, and government agencies, aimed at influencing policy decisions, improving adoption in national screening programs, and conducting clinical validation studies to reinforce product efficacy.

COMPETITION OVERVIEW

The competition in the Europe automated breast ultrasound systems market is characterized by a dynamic mix of established medical imaging giants and emerging innovators striving to capture market share through differentiated offerings. As demand for precision diagnostics grows, particularly in breast cancer screening, manufacturers are intensifying efforts to integrate artificial intelligence, improve image resolution, and streamline clinical workflows. While large multinational firms leverage their brand recognition, extensive distribution networks, and deep R&D resources, smaller companies focus on niche innovations such as portable systems or cloud-based diagnostic platforms to gain traction.

The market is also shaped by varying levels of reimbursement, regional regulatory landscapes, and differences in national screening policies, which influence purchasing behavior across countries. Companies must navigate these complexities while investing in physician education, clinical trials, and direct-to-consumer awareness campaigns. Additionally, the push toward tele-radiology and remote diagnostics is driving collaboration between technology developers and healthcare providers, further reshaping competitive dynamics.

RECENT MARKET DEVELOPMENTS

- In February 2024, GE Healthcare launched an AI-integrated ABUS platform across Germany and France, designed to enhance lesion detection and reduce radiologist workload, marking a significant step toward smarter, more efficient breast imaging workflows.

- In May 2024, Siemens Healthineers partnered with a leading European oncology network to deploy its next-generation automated breast ultrasound system in multiple cancer care centers, which is aiming to standardize imaging protocols and improve early diagnosis rates.

- In July 2024, Hologic Inc. initiated a multi-center clinical study in the UK to validate the effectiveness of its latest ABUS system in detecting cancers missed by mammography, which is reinforcing its scientific credibility and supporting broader adoption in public health settings.

- In September 2024, Philips Healthcare expanded its ABUS service division in Italy and Spain, offering comprehensive installation, maintenance, and training packages to ensure seamless integration into hospital radiology departments.

- In November 2024, Canon Medical Systems introduced a compact, portable ABUS device specifically designed for outpatient clinics and mobile screening units by targeting underserved regions in Eastern Europe and enhancing accessibility to advanced breast imaging technologies.

MARKET SEGMENTATION

This Europe automated breast ultrasound systems market research report is segmented and sub-segmented into the following categories.

By Product

- Automated Breast Volume Scanner

- Automated Breast Ultrasound (ABUS)

By End Use

- Hospital

- Diagnostics Imaging Laboratories

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What factors are driving the Europe automated breast ultrasound systems market?

The Europe automated breast ultrasound systems market is driven by rising breast cancer incidence, increased screening for women with dense breast tissue, and technological advances like AI integration that improve detection and workflow efficiency

2. What challenges does the Europe automated breast ultrasound systems market face?

The Europe automated breast ultrasound systems market faces high initial equipment and maintenance costs, inconsistent reimbursement policies, complex regulatory approvals, and a shortage of trained ABUS professionals

3. What opportunities exist in the Europe automated breast ultrasound systems market?

Opportunities in the Europe automated breast ultrasound systems market include expanding structured screening programs for dense breast tissue, integrating ABUS with telemedicine, and leveraging cloud-based and AI-powered diagnostics

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com