Europe Diagnostic Imaging Market Research Report – Segmented By Type ( MRI,fNIRS) Application ( Oncology,Neurology) & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis on Size, Share, Trends & Growth Forecast (2025 to 2033)

Europe Diagnostic Imaging Market Size

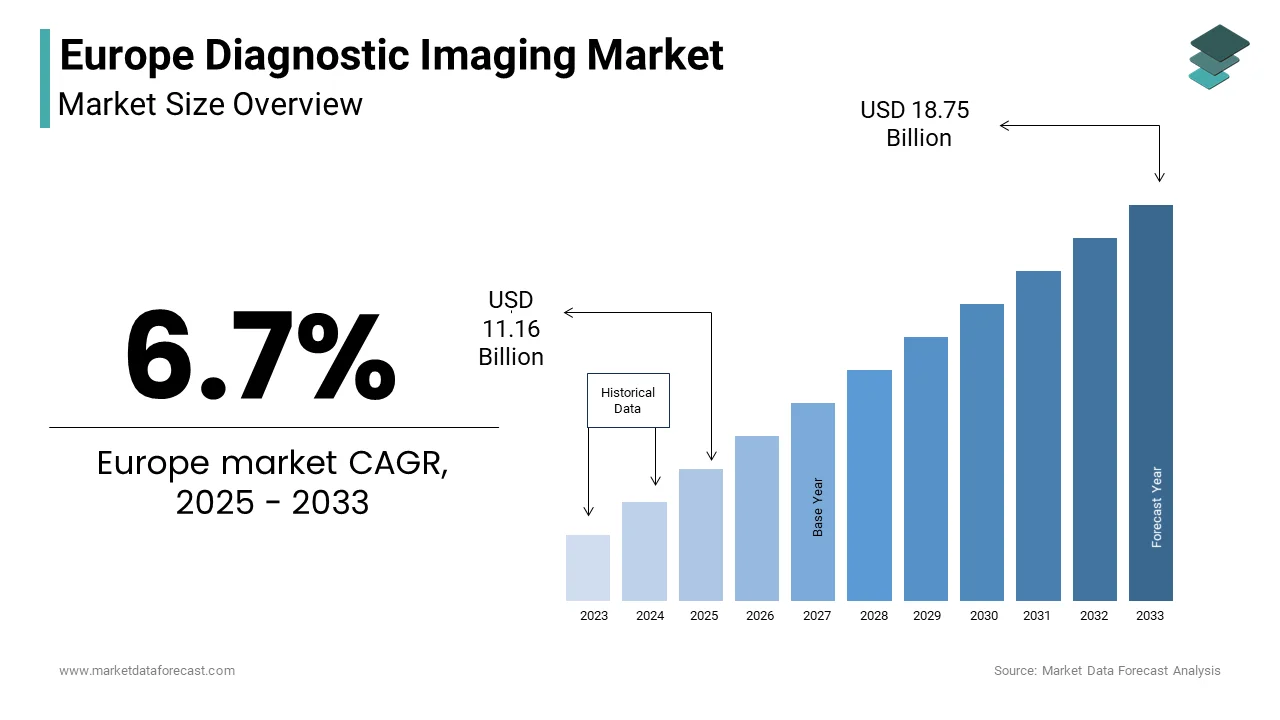

The Europe Diagnostic Imaging Market was valued at USD 10.46 billion in 2024. The Europe Diagnostic Imaging Market is expected to have 6.7% CAGR from 2024 to 2033 and be worth USD 18.75 billion by 2033 from USD 11.16 billion in 2025.

The Europe diagnostic imaging market covers a wide array of technologies including magnetic resonance imaging (MRI), computed tomography (CT), X-ray, ultrasound, and nuclear imaging systems. These modalities play a crucial role in early disease detection, treatment planning, and monitoring across hospitals, diagnostic centers, and ambulatory care settings. The region is recognized for its high healthcare standards, robust regulatory framework, and strong emphasis on technological innovation. This financial commitment supports widespread adoption of advanced imaging equipment and integration of digital health tools such as AI-driven diagnostics and cloud-based image storage solutions. In addition, the European Society of Radiology highlights that radiological diagnostics are integral to managing major disease categories such as oncology, cardiology, and neurology.

The market has also seen a shift toward portable and hybrid imaging platforms, particularly in rural and decentralized healthcare environments. A report by the European Investment Bank notes that investments in medical imaging infrastructure rose in Central and Eastern Europe between 2020 and 2023, signaling broader accessibility improvements.

MARKET DRIVERS

Rising Prevalence of Chronic Diseases

One of the primary drivers of the Europe diagnostic imaging market is the increasing incidence of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions, which necessitate early and accurate diagnosis through advanced imaging technologies. According to the European Cancer Organisation, cancer remains one of the leading causes of death in Europe, with over 2.7 million new cases diagnosed in 2023 alone. Early detection significantly improves treatment outcomes, prompting greater reliance on MRI, CT scans, and PET imaging for diagnostic accuracy. In countries like Italy and Spain, where heart disease prevalence remains high, hospitals have increased their utilization of non-invasive imaging techniques to reduce the burden on emergency services and improve patient triage efficiency. Moreover, the rise in neurodegenerative diseases such as Alzheimer's and Parkinson’s has further amplified demand for brain imaging modalities. Research from the European Brain Council indicates that neurological disorders affect more than 179 million people across the continent, underlining the growing need for MRI and functional imaging tools.

Integration of Artificial Intelligence in Imaging Technologies

Another significant driver fueling the growth of the Europe diagnostic imaging market is the rapid integration of artificial intelligence (AI) into imaging workflows, enhancing diagnostic accuracy, reducing interpretation time, and improving overall patient outcomes. AI algorithms are increasingly being deployed to assist radiologists in detecting abnormalities such as tumors, fractures, and vascular anomalies with greater speed and consistency. A study by EIT Health found that AI-enhanced imaging systems could reduce diagnostic errors contributing to more efficient healthcare delivery and resource optimization. In Germany, academic medical centers have pioneered the use of machine learning models to analyze lung nodules in CT scans, improving early lung cancer detection rates. Beyond diagnostics, AI is also enabling predictive analytics and personalized treatment planning. With regulatory bodies encouraging innovation while maintaining safety standards, the convergence of AI and medical imaging presents a transformative pathway for improving patient care and operational efficiency across Europe’s healthcare systems.

MARKET RESTRAINTS

High Cost of Advanced Imaging Equipment

A major restraint affecting the Europe diagnostic imaging market is the substantial capital investment required for acquiring and maintaining advanced imaging systems such as MRI, CT scanners, and hybrid PET-CT units. Public healthcare systems in countries like Greece and Portugal face particular challenges in upgrading outdated equipment due to budget constraints and prolonged procurement cycles. The German Institute for Quality and Efficiency in Health Care (IQWiG) notes that despite the clinical benefits of newer imaging technologies, many hospitals delay replacements due to limited funding availability and stringent reimbursement policies. Furthermore, the operational costs associated with these machines—including maintenance, software updates, and specialized personnel training—add to the financial burden.

Regulatory and Compliance Challenges Under the MDR Framework

Another critical constraint impacting the Europe diagnostic imaging market is the implementation of the Medical Device Regulation (MDR), which came into full effect in May 2021. While designed to enhance patient safety and device reliability, the regulation has introduced complex compliance challenges for manufacturers, particularly those developing AI-integrated and software-based imaging solutions. The requirement for extensive clinical evidence and post-market surveillance has significantly raised the bar for market entry, especially for smaller firms lacking dedicated regulatory teams. Notably, the limited capacity of Notified Bodies—third-party organizations responsible for assessing compliance—has exacerbated delays. These regulatory complexities have prompted some firms to reconsider their presence in the European market, posing a challenge to the industry’s competitive dynamism and timely access to new imaging technologies.

MARKET OPPORTUNITIES

Expansion of Tele-Radiology and Remote Diagnostics

A significant opportunity emerging in the Europe diagnostic imaging market is the expansion of tele-radiology and remote diagnostics, driven by advancements in digital connectivity, cloud computing, and AI-enabled interpretation tools. Countries such as Norway, Denmark, and the Netherlands have been at the forefront of integrating teleradiology into national healthcare frameworks, leveraging centralized reading centers to serve both urban and rural facilities. A report by EIT Health indicates that AI-assisted image analysis in remote settings improved diagnostic accuracy, reducing the workload on local radiologists and expediting patient care. Moreover, the adoption of Picture Archiving and Communication Systems (PACS) and Vendor Neutral Archives (VNA) has facilitated seamless data sharing across borders, enabling cross-border consultations and second-opinion services. The European Commission has actively supported these initiatives through funding programs aimed at strengthening digital health infrastructure.

Growth of Point-of-Care and Portable Imaging Devices

Another promising avenue for growth in the Europe diagnostic imaging market is the rising adoption of point-of-care (POC) and portable imaging devices, particularly in emergency medicine, ambulatory care, and home healthcare settings. Portable ultrasound devices have gained significant traction among general practitioners and paramedics due to their mobility, real-time imaging capabilities, and ease of use. Additionally, mobile X-ray and CT units have become essential in responding to public health emergencies, particularly in underserved and rural areas.

With rising preference for decentralized healthcare models and advancements in miniaturized imaging technology, the POC and portable imaging segment is poised for sustained expansion, offering manufacturers new opportunities beyond traditional institutional markets.

MARKET CHALLENGES

Shortage of Skilled Radiologists and Technicians

One of the most pressing challenges facing the Europe diagnostic imaging market is the persistent shortage of skilled radiologists and imaging technicians, which limits the effective utilization of advanced imaging equipment and delays diagnostic turnaround times. According to the European Society of Radiology, there is a significant disparity in radiologist-to-population ratios across the EU, with Eastern European countries experiencing the most acute workforce deficits.Data from the European Union of Medical Specialists (UEMS) indicates that several member states fall below the recommended threshold of one radiologist per 100,000 inhabitants. In Romania and Bulgaria, this ratio drops to less than half, severely constraining diagnostic capacity and increasing patient wait times. This shortage is further exacerbated by an aging workforce and insufficient training pipelines. To mitigate this issue, healthcare providers are investing in AI-assisted diagnostics and tele-radiology solutions; however, these technologies still require human oversight and expertise.

Data Management and Interoperability Issues

Another significant challenge confronting the Europe diagnostic imaging market is the complexity of managing large volumes of imaging data and ensuring interoperability across disparate hospital information systems. According to ENISA (European Union Agency for Cybersecurity), the digitization of radiology departments has led to exponential growth in medical image repositories, making efficient storage, retrieval, and sharing increasingly difficult. A report by the European Commission’s Directorate-General for Health and Food Safety found that inconsistencies in DICOM (Digital Imaging and Communications in Medicine) standards and electronic health record (EHR) integration hinder seamless data exchange between hospitals, clinics, and specialist centers. This fragmentation impedes timely diagnosis and complicates longitudinal patient care, particularly in cross-border healthcare scenarios. Moreover, cybersecurity risks associated with centralized image databases have heightened concerns over data breaches and unauthorized access. The European Medicines Agency (EMA) has issued guidelines urging healthcare institutions to adopt secure cloud-based PACS (Picture Archiving and Communication Systems) and implement encryption protocols to protect sensitive patient records.

REPORT COVERAGE

|

PORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.7 % |

|

Segments Covered |

By Type, Application and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland, Switzerland, Netherlands, Rest of Europe. |

|

Market Leaders Profiled |

C.H. Robinson Worldwide Inc. (US), IJ.B. Hunt Transport Services (US), Ceva Holdings LLC (France), FedEx Corp (US) |

SEGMENTAL ANALYSIS

By Type Insights

The Magnetic Resonance Imaging (MRI) holds the largest share of the Europe diagnostic imaging market by capturing approximately 68.5% of total value in 2023. This dominance is primarily attributed to its widespread adoption across hospitals and specialized imaging centers for high-resolution, non-invasive diagnostics. MRI technology is particularly essential in oncology, neurology, and musculoskeletal diagnostics, where soft tissue contrast plays a critical role in accurate diagnosis. The European Society of Radiology highlights that MRI usage has grown steadily due to its ability to detect early-stage cancers, brain abnormalities, and spinal injuries without exposing patients to ionizing radiation. Moreover, advancements in ultra-fast scanning, open MRI configurations, and AI-assisted interpretation tools have enhanced patient comfort and reduced examination times. With continued investment in healthcare infrastructure and rising demand for precision diagnostics, MRI remains the cornerstone of advanced imaging in Europe.

Functional near-infrared spectroscopy (fNIRS) is emerging as the fastest-growing segment in the Europe diagnostic imaging market, expanding at a CAGR of 14.2%. This rapid ascent is driven by increasing applications in neuroscience research, cognitive disorder diagnostics, and real-time monitoring of cerebral oxygenation levels in neonatal and intensive care settings. fNIRS offers a non-invasive alternative for studying brain function, particularly in developmental neuroscience and rehabilitation medicine. The modality’s portability and compatibility with mobile healthcare units make it especially valuable in decentralized and ambulatory settings. Additionally, academic institutions in Sweden and Switzerland are integrating fNIRS into brain-computer interface (BCI) research, supporting the development of assistive technologies for patients with paralysis or communication disorders.

By Application Insights

Oncology constituted the largest application segment in the Europe diagnostic imaging market by accounting for an estimated 49% of total demand in 2024. This leading position is directly linked to the rising incidence of cancer and the critical role of imaging in early detection, staging, treatment planning, and post-therapy monitoring. According to the European Society of Radiology, radiological imaging is involved in over 90% of cancer diagnoses, making it indispensable in modern oncology practice. Germany and the UK have been at the forefront of integrating advanced imaging into national cancer screening programs. Furthermore, the expansion of personalized medicine and targeted therapies has heightened the need for precise imaging biomarkers to assess treatment response.

Neurology is witnessing the highest growth rate in the Europe diagnostic imaging market, expanding at a CAGR of 11.6%. This acceleration reflects the rising burden of neurological disorders such as Alzheimer’s disease, Parkinson’s disease, stroke, and epilepsy, which require advanced imaging for early intervention and management. Early diagnosis through imaging modalities like MRI and functional imaging techniques has become crucial in managing these diseases effectively. Research conducted by the Karolinska Institute in Sweden found that diffusion-weighted MRI played a pivotal role in identifying acute ischemic strokes within the first hour of symptom onset, improving patient outcomes through timely thrombolysis. Additionally, growing investment in neuroimaging research and the integration of AI-driven image analysis tools have enhanced diagnostic precision.

COUNTRY LEVEL ANALYSIS

Germany had the largest share of the Europe diagnostic imaging market by contributing an estimated 22.7% of total regional demand in 2024. The country maintains its leading position due to a strong industrial base, world-class research institutions, and one of the most advanced healthcare infrastructures in Europe. These firms benefit from close collaboration with university hospitals and research institutes, ensuring rapid translation of scientific breakthroughs into clinical applications. Germany also leads in regulatory compliance, hosting key Notified Bodies responsible for CE marking under the Medical Device Regulation (MDR).

France is another strong player in the market and is bolstered by a well-developed healthcare ecosystem that combines public funding with dynamic private sector participation. The country benefits from a centralized healthcare system that ensures broad access to imaging services while fostering innovation through targeted investments. Companies such as Guerbet and General Electric Healthcare have established major R&D facilities in Lyon and Grenoble, focusing on next-generation contrast agents and multi-modal imaging systems. The French National Authority for Health (HAS) has played a pivotal role in streamlining device approvals and promoting cost-effective technologies. In addition, government-backed initiatives such as the France Relance recovery plan allocated substantial amount to strengthen domestic biotech and imaging equipment production.

The United Kingdom is maintaining a strong presence despite regulatory shifts following Brexit. The country remains a major center for medical imaging innovation, particularly in AI-powered diagnostics, digital pathology, and tele-radiology. The National Health Service (NHS) has actively promoted the use of cloud-based PACS (Picture Archiving and Communication Systems) and vendor-neutral archives to enhance data accessibility and streamline radiology workflows. Post-Brexit adjustments have introduced new regulatory pathways under the Medicines and Healthcare products Regulatory Agency (MHRA), which launched the Innovative Licensing and Access Pathway (ILAP) to fast-track novel imaging device approvals.

Italy commands a notable share of the Europe diagnostic imaging market, driven by demographic pressures and ongoing efforts to modernize healthcare infrastructure. Public healthcare expenditure in Italy remained stable in 2023. However, disparities between northern and southern regions have led to uneven distribution of imaging resources and varying levels of access to advanced diagnostics. The Italian Medicines Agency (AIFA) has been working to streamline device reimbursement processes, particularly for high-cost specialties such as oncology and neurology. Despite budgetary constraints, Italy’s commitment to digital health initiatives and the expansion of teleradiology services is expected to drive long-term growth, positioning the country as a resilient yet evolving participant in the European imaging market.

Switzerland is distinguished by its high-income economy, world-class research institutions, and proximity to major European markets. The country serves as a strategic headquarters for multinational imaging firms, including Roche Diagnostics and GE Healthcare, which leverage Swiss expertise in precision medicine and biomedical engineering. This financial commitment supports the widespread adoption of premium imaging technologies, particularly in oncology, neurology, and cardiac imaging. The Swiss Agency for Therapeutic Products (Swissmedic) maintains rigorous yet efficient regulatory standards, facilitating faster approval times for innovative imaging devices compared to some EU counterparts. Additionally, the country’s strong intellectual property protections encourage R&D investments, with Zurich and Basel emerging as innovation clusters for molecular imaging and AI-driven diagnostics.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

A few promising companies in the Europe Diagnostic Imaging Market profiled in this report are GE Healthcare, Siemens Healthcare, Toshiba Medical Systems Corporation, Hitachi Medical Corporation, Hologic Inc., Fujifilm Corporation & Shimadzu Corporation.

The competition in the Europe diagnostic imaging market is intense and multifaceted, shaped by a mix of global industry leaders, emerging MedTech innovators, and domestic manufacturers vying for dominance across a highly regulated and fragmented landscape. Established players such as Siemens Healthineers, GE Healthcare, and Philips leverage their brand strength, technological expertise, and deep regulatory knowledge to maintain a stronghold in core segments like MRI, CT, and AI-assisted diagnostics.

However, they face growing pressure from agile startups introducing portable imaging devices, AI-powered interpretation tools, and decentralized diagnostic platforms tailored to evolving patient expectations. The implementation of the Medical Device Regulation (MDR) has intensified the competitive environment, particularly for smaller firms struggling with compliance costs and extended certification timelines.

In this dynamic environment, differentiation is increasingly driven by innovation speed, digital integration, and adaptability to shifting reimbursement frameworks. As healthcare systems prioritize cost-effectiveness and patient outcomes, the battle for market share hinges not only on product performance but also on strategic positioning within evolving digital and regulatory ecosystems.

Top Players in the Market

Siemens Healthineers

Siemens Healthineers is a leading force in the Europe diagnostic imaging market, offering a comprehensive portfolio of MRI, CT, ultrasound, and molecular imaging systems. The company plays a pivotal role in advancing digital health solutions, including AI-driven imaging analytics and integrated hospital management tools. With its headquarters in Germany, Siemens influences both regional and global markets by setting benchmarks in innovation, regulatory compliance, and clinical efficiency. Its focus on value-based healthcare and partnerships with public health institutions positions it as a strategic player shaping the future of European and global diagnostics.

GE Healthcare

GE Healthcare maintains a strong presence in the Europe diagnostic imaging market through its diverse offerings in MRI, CT, X-ray, and nuclear medicine technologies. The company supports European healthcare systems by supplying cutting-edge imaging platforms that enhance diagnostic accuracy and streamline radiology workflows. GE’s emphasis on AI integration and cloud-based image storage aligns with evolving digital health strategies across the region. By collaborating with academic institutions and leveraging its R&D capabilities, GE Healthcare continues to drive advancements in precision diagnostics and personalized treatment planning across Europe.

Philips Healthcare

Philips Healthcare is a key participant in the Europe diagnostic imaging landscape, known for its innovative MRI and CT scanners, AI-enhanced radiology software, and integrated diagnostics solutions. The company actively promotes digital transformation in healthcare through cloud-based PACS systems and teleradiology networks, improving access to high-quality imaging services. Philips’ commitment to sustainability and patient-centric design has reinforced its relevance in the region. By aligning product development with EU health policies, Philips remains a trusted partner in European healthcare delivery and innovation.

Top strategies used by the key market participants

One of the primary strategies employed by leading players in the Europe diagnostic imaging market is accelerating digital transformation through AI and machine learning integration . Companies are embedding smart technology into imaging workflows to enable real-time data analysis, predictive diagnostics, and automated reporting, enhancing clinical outcomes and operational efficiency.

Another critical approach is expanding localized R&D centers and production facilities within the EU . This strategy allows firms to better align with stringent MDR compliance requirements while reducing dependency on global supply chains, improving time-to-market, and fostering closer collaboration with European regulators and healthcare providers.

Lastly, major players are increasingly focusing on strategic partnerships and acquisitions to expand their portfolio breadth and enter new therapeutic areas . These collaborations often involve digital health startups, academic institutions, and telehealth platforms, enabling traditional imaging firms to integrate cutting-edge innovations and maintain competitive differentiation in an evolving landscape.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Siemens Healthineers launched a new AI-powered radiology platform at the European Congress of Radiology in Vienna. This innovation enables faster image analysis and early disease detection, reinforcing the company’s leadership in diagnostic imaging across European hospitals.

- In March 2024, Canon Medical Systems partnered with a Dutch AI startup to integrate deep learning algorithms into its CT and MRI scanners, enhancing tumor segmentation and reducing false-positive readings. This collaboration aligns with broader efforts to improve diagnostic accuracy and operational efficiency in European radiology departments.

- In June 2024, GE Healthcare opened a state-of-the-art R&D center in Lyon, France, focused on developing next-generation MRI sequences and AI-enabled image reconstruction software tailored for European healthcare providers and regulatory requirements.

- In September 2024, Philips launched an updated version of its integrated diagnostics suite, featuring cloud-based PACS integration and AI triage tools for stroke detection. This update was specifically designed to meet the needs of NHS hospitals in the UK and Ireland.

- In November 2024, Fujifilm Sonosite introduced a new point-of-care ultrasound system optimized for emergency departments across Scandinavia and Central Europe, addressing the growing demand for portable imaging in trauma and critical care settings.

MARKET SEGMENTATION

This research report on the europe diagnostic imaging market has been segmented and sub-segmented into the following categories.

By Type

- MRI

- fNIRS

By Application

- Oncology

- Neurology

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe.

Frequently Asked Questions

What are the key drivers of the diagnostic imaging market in Europe?

The market size is influenced by factors like technological advancements, increasing prevalence of chronic diseases, and rising demand for early diagnosis.

Which imaging modalities are most commonly used in Europe?

Common modalities include X-ray, MRI, CT scan, ultrasound, and nuclear imaging (PET & SPECT).

What are the key trends shaping the Europe Diagnostic Imaging Market?

Trends include AI integration in imaging, portable and point-of-care imaging solutions, and increased adoption of cloud-based imaging software.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com