Europe Commercial Vehicle Market Size, Share, Trends & Growth Forecast Report By Vehicle Type (Light Commercial Vehicle, Heavy Vehicle Buses), Fuel Type and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Commercial Vehicle Market Size

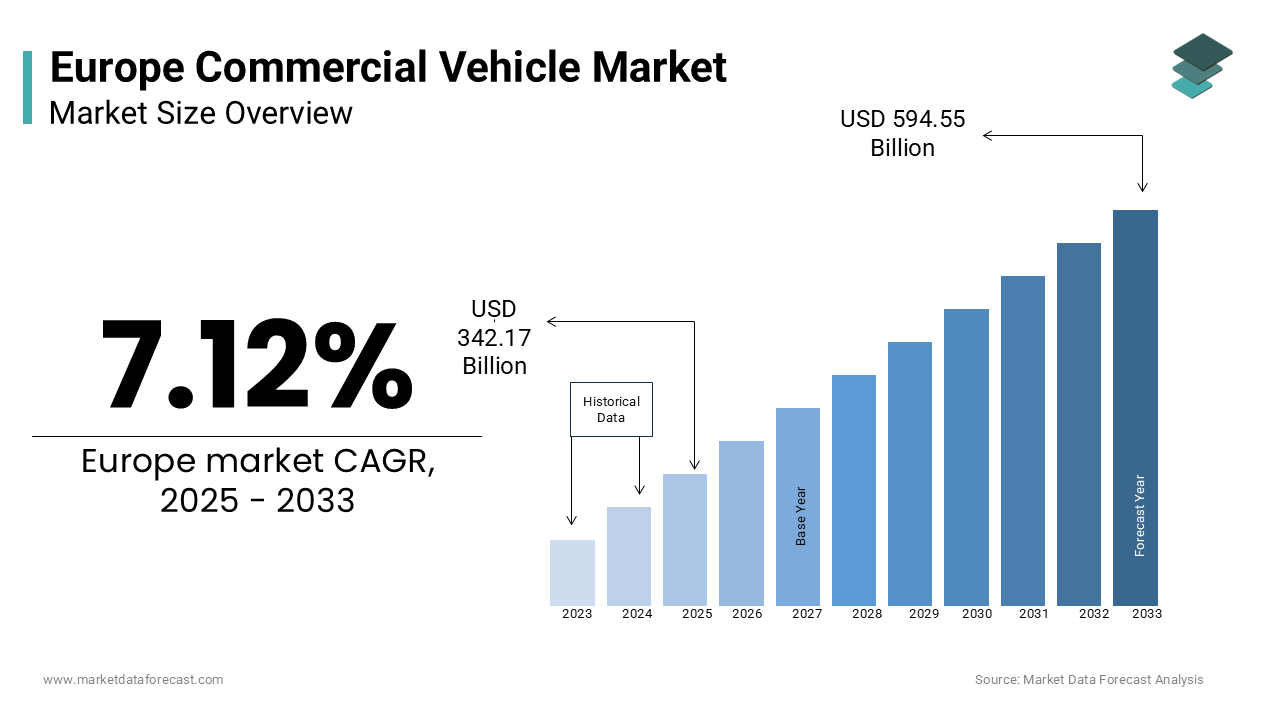

The europe commercial vehicle market was worth USD 320.16 billion in 2024. The European market is estimated to grow at a CAGR of 7.12% from 2025 to 2033 and be valued at USD 594.55 billion by the end of 2033 from USD 342.17 billion in 2025.

The European commercial vehicle market is a cornerstone of the region's logistics and transportation infrastructure which is deeply intertwined with economic activities across various sectors. As per the European Automobile Manufacturers' Association, the demand for commercial vehicles has seen steady growth over recent years, driven by e-commerce expansion, urbanization, and stringent emission regulations encouraging fleet modernization. In 2022 alone, the region witnessed sales exceeding two million units reflecting a resurgence post-pandemic disruptions. According to McKinsey & Company, electric commercial vehicles are gaining traction, accounting for nearly 10% of new registrations in key markets like Germany and France due to government incentives and corporate sustainability goals.

A significant portion of this demand stems from small and medium enterprises relying on light commercial vehicles for last-mile delivery solutions, particularly amid the booming online retail sector. However, Eastern Europe presents untapped potential with increasing investments in infrastructure development. Challenges persist including supply chain bottlenecks and semiconductor shortages which have tempered production capacities temporarily. Nevertheless, the overall outlook remains optimistic supported by evolving consumer preferences and green mobility initiatives shaping the future landscape.

MARKET DRIVERS

E-commerce Growth and Last-Mile Delivery Demand

The exponential rise of e-commerce in Europe has emerged as a pivotal driver for the commercial vehicle market, particularly in the segment of light commercial vehicles (LCVs). As per the Eurostat, online retail sales in the European Union grew by over 12% annually between 2019 and 2022, with countries like the UK, Germany, and France leading the charge. This surge has intensified the need for efficient last-mile delivery solutions, prompting businesses to expand their fleets. A report by McKinsey & Company shows that LCVs account for nearly 70% of urban deliveries making them indispensable for logistics providers. Urbanization trends exacerbate this demand, with approximately 75% of Europeans residing in cities, according to the United Nations. The shift toward electric LCVs is also gaining momentum backed by government subsidies. For instance, Germany offers incentives of up to €10,000 for electric commercial vehicles, as stated by the Federal Ministry for Economic Affairs and Climate Action. These factors collectively underscore how e-commerce is reshaping fleet compositions and driving innovation in the commercial vehicle sector.

Stringent Emission Regulations and Fleet Modernization

Stringent emission regulations across Europe have become a transformative force in the commercial vehicle market, compelling fleet operators to adopt cleaner technologies. The European Green Deal which aims for carbon neutrality by 2050 has set ambitious targets for reducing greenhouse gas emissions from transportation. The International Council on Clean Transportation stresses that heavy-duty vehicles account for approximately 25% of road transport emissions in Europe, necessitating rapid adoption of alternative powertrains. In response, manufacturers are prioritizing electric and hydrogen-powered trucks, with BloombergNEF estimating that zero-emission trucks could constitute 30% of new truck sales by 2030. Financial incentives further bolster this transition; for example, the French government provides grants of up to €50,000 for replacing older diesel trucks with low-emission models. In addition, as per the European Environment Agency, over 40 major cities in Europe have introduced low-emission zones restricting access for high-polluting vehicles. This regulatory push has accelerated fleet modernization, with companies investing in newer compliant vehicles to avoid penalties. The convergence of environmental mandates and technological advancements is thus steering the market toward sustainable growth while reshaping operational strategies for logistics providers.

MARKET RESTRAINTS

Supply Chain Disruptions and Component Shortages

The European commercial vehicle market has been significantly hampered by persistent supply chain disruptions, particularly the global semiconductor shortage. According to the European Automobile Manufacturers' Association, production delays caused by chip shortages resulted in a 10% decline in commercial vehicle output during the first half of 2022 compared to pre-pandemic levels. Semiconductors are critical components for modern vehicles enabling advanced driver-assistance systems (ADAS), connectivity features, and fuel efficiency technologies. The shortage has forced manufacturers to prioritize high-margin passenger vehicles over commercial ones exacerbating fleet operators' challenges in procuring new vehicles. A report by Deloitte notes that nearly 60% of European logistics companies faced delays in fleet expansion plans due to these shortages. Apart from these, geopolitical tensions such as the Russia-Ukraine conflict have disrupted the supply of raw materials like palladium and neon, which are essential for semiconductor manufacturing. These disruptions not only inflate production costs but also extend lead times leaving businesses reliant on aging fleets and impacting operational efficiency. The ongoing volatility in global supply chains remains a critical restraint, undermining the market's ability to meet rising demand.

High Initial Costs of Electrification and Infrastructure Gaps

The transition to electric commercial vehicles (ECVs) in Europe is hindered by their high upfront costs and insufficient charging infrastructure. As indicated by the BloombergNEF, electric trucks and vans are approximately 50-70% more expensive than their diesel counterparts making them less accessible for small and medium enterprises that dominate the logistics sector. While government subsidies exist, they often do not fully offset the price gap, particularly for heavy-duty vehicles. In addition, as per the European Alternative Fuels Observatory, only 35,000 public charging points were available for commercial vehicles across Europe in 2022, far below the estimated 1 million needed by 2030 to support widespread adoption. This infrastructure deficit limits operational flexibility, especially for long-haul freight, where charging networks remain sparse. A study by PwC notes that 45% of fleet operators cite inadequate charging infrastructure as a main barrier to electrification. Besides these, the energy demands of ECVs strain the existing grid, with the International Energy Agency warning that Europe's power systems require €2 trillion in upgrades by 2040 to accommodate this shift. These financial and infrastructural challenges collectively impede the rapid scaling of electric commercial vehicles, slowing industry-wide decarbonization efforts.

MARKET OPPORTUNITIES

Expansion of Green Financing and Subsidies for Sustainable Fleets

The European commercial vehicle market is poised to benefit significantly from the proliferation of green financing mechanisms and government subsidies aimed at promoting sustainable fleets. According to the European Investment Bank, over €20 billion in green bonds were issued in 2022 to support low-carbon transportation projects, including electric and hydrogen-powered commercial vehicles. These financial instruments are complemented by national incentives such as France’s €50,000 grant for replacing diesel trucks with zero-emission alternatives, as outlined by the French Ministry of Ecological Transition. Moreover, a report by Roland Berger states that companies adopting electric commercial vehicles can reduce total cost of ownership by up to 20% over five years due to lower maintenance and fuel costs, further enhancing their appeal. The European Union’s Recovery and Resilience Facility has allocated €672 billion to member states, with a significant portion earmarked for clean mobility initiatives. This influx of funding creates an enabling environment for fleet operators to transition to greener technologies. As per the International Transport Forum, nearly 40% of logistics companies in Europe are actively exploring partnerships with financial institutions to leverage these opportunities. With regulatory frameworks aligning with financial incentives, the market stands to gain substantial momentum in scaling eco-friendly solutions.

Emergence of Autonomous and Connected Vehicle Technologies

The integration of autonomous and connected vehicle technologies presents a transformative opportunity for the European commercial vehicle market. The European Commission estimates that connected vehicle technologies could prevent 80% of road accidents caused by human error enhancing safety standards across the sector. Pilot programs are already underway; for instance, Scania and Einride have successfully tested autonomous electric trucks on public roads in Sweden. A study by Arthur D. Little notes that 60% of European logistics firms view automation as a strategic priority to address driver shortages, which currently stand at 400,000 unfilled positions across the continent. By embracing these innovations, the market can achieve higher operational efficiencies while addressing critical labor challenges.

MARKET CHALLENGES

Rising Energy Costs and Their Impact on Operational Expenses

The European commercial vehicle market is grappling with the challenge of escalating energy costs, which have significantly increased operational expenses for fleet operators. According to Eurostat, energy prices in Europe surged notably in 2022 due to geopolitical tensions and supply chain disruptions, particularly following the Russia-Ukraine conflict. This has disproportionately affected the logistics sector, where fuel accounts for approximately 30% of total operating costs, as per a study by PwC. For diesel-powered vehicles which still dominate the market, this spike has eroded profit margins, especially for small and medium enterprises reliant on road freight. Even electric vehicles (EVs) often viewed as a cost-saving alternative, face challenges as electricity prices rose by 12% across Europe in 2022, according to the International Energy Agency. The lack of widespread renewable energy integration exacerbates the issue, with only 22% of Europe’s energy mix currently sourced from renewables, as stated by the European Environment Agency. These rising costs are forcing fleet operators to delay investments in newer, more efficient vehicles, creating a vicious cycle of reliance on aging, less sustainable fleets. Without immediate measures to stabilize energy prices or enhance renewable energy adoption, the industry risks long-term inefficiencies and financial strain.

Fragmented Regulatory Landscape Across Member States

A fragmented regulatory landscape across European Union member states poses another significant challenge to the commercial vehicle market. While the EU has set overarching emission reduction targets under the European Green Deal, individual countries implement varying standards, subsidies, and compliance requirements, complicating cross-border operations. As suggested by the European Automobile Manufacturers' Association, discrepancies in low-emission zone regulations have resulted in over 40 different urban access rules across major cities, creating logistical hurdles for fleet operators. For instance, while Germany offers substantial incentives for electric commercial vehicles neighboring Poland lacks similar frameworks leading to uneven adoption rates. A report by KPMG notes that 55% of logistics companies cite regulatory inconsistencies as a barrier to scaling operations efficiently. Apart from these, the transition to digital systems like e-tolling and electronic logging devices varies widely, with some countries lagging behind in implementation. This regulatory fragmentation not only increases compliance costs but also stifles innovation, hindering the market's ability to achieve cohesive growth.

SEGMENTAL ANALYSIS

By Vehicle Type

The light Commercial Vehicles segment dominated the European commercial vehicle market by commanding a 65.6% share in 2024. This dominance is mainly driven by their critical role in last-mile delivery and urban logistics, particularly amid the e-commerce boom. LCVs, with payloads under 3.5 tonnes, are perfectly suited for navigating narrow city streets and delivering goods efficiently. Urbanization further amplifies demand; the United Nations estimates that over 75% of Europeans live in urban areas, creating a sustained need for compact, versatile vehicles. Additionally, government incentives for electrification have bolstered LCV adoption, with BloombergNEF reporting that electric LCVs accounted for 12% of new registrations in 2022. Germany’s €10,000 subsidy for electric LCVs has accelerated this trend making them an attractive option for small businesses. Furthermore, advancements in telematics and connectivity are enhancing operational efficiency, driving fleet operators to upgrade their vehicles. These factors collectively cement LCVs as the backbone of the European commercial vehicle market.

The electric heavy vehicles segment emerging as the fastest-growing segment in the European commercial vehicle market, with a projected CAGR of 28.2% between 2025 and 2033. This sudden rise is fueled by stringent emission regulations and the urgent need to decarbonize freight transport. The European Green Deal mandates a 55% reduction in greenhouse gas emissions from heavy-duty vehicles by 2030 pushing manufacturers and fleet operators to adopt zero-emission alternatives. A report by the International Council on Clean Transportation notes that heavy-duty vehicles contribute approximately 25% of road transport emissions in Europe making them a focal point for regulatory action. Financial incentives are also accelerating adoption; for instance, France offers grants of up to €50,000 for replacing diesel trucks with electric models, as stated by the French Ministry of Ecological Transition. Moreover, advancements in battery technology are addressing range anxiety, with next-generation batteries offering ranges exceeding 500 kilometers, as per McKinsey & Company. Pilot programs like Scania’s electric truck trials in Sweden demonstrate feasibility for long-haul operations. The convergence of regulatory pressure, technological innovation, and financial support positions electric heavy vehicles as the fastest-growing segment, reshaping the future of freight logistics in Europe.

By Fuel Type

The Internal Combustion Engine (I.C. Engine) vehicles segment held the highest share of the European commercial vehicle market in 2024. This is caused by their established infrastructure, widespread availability, and lower upfront costs compared to electric alternatives. Diesel-powered vehicles, a subset of I.C. Engine vehicles, remain particularly popular in heavy-duty applications due to their superior torque and range capabilities, with BloombergNEF estimating that diesel trucks still account for over 90% of long-haul freight operations. In addition, the existing refueling network which includes over 100,000 diesel stations across Europe ensures operational continuity for fleet operators, as noted by the European Alternative Fuels Observatory. Another factor driving this segment's dominance is the relatively slower adoption of electric vehicles in rural and less-developed regions, where charging infrastructure remains sparse. A study by PwC notes that 60% of logistics companies in Eastern Europe still rely heavily on diesel-powered fleets due to limited access to renewable energy sources. While regulatory pressures are mounting, the entrenched nature of I.C. Engine vehicles, coupled with their proven reliability, continues to make them the preferred choice for many businesses across Europe.

Electric vehicles (EVs) segment is advancing at a fast pace in the European commercial vehicle market, with a calculated CAGR of 35% during the forecast period. This rapid expansion is driven by stringent emission regulations and ambitious decarbonization goals set by the European Union. The European Green Deal mandates a 90% reduction in transport-related emissions by 2050 incentivizing fleet operators to transition to zero-emission vehicles. Financial support further accelerates this shift; for instance, Germany offers subsidies of up to €40,000 for electric commercial vehicles, as outlined by the Federal Ministry for Economic Affairs and Climate Action. Technological advancements are also playing a pivotal role, with improvements in battery efficiency reducing costs by 89% over the past decade, as stated by BloombergNEF. Moreover, the rise of urban low-emission zones has created a strong demand for electric light commercial vehicles (LCVs). Pilot projects like DHL’s fully electric delivery fleet in Berlin demonstrate the feasibility of large-scale EV adoption. These factors involve regulatory mandates, financial incentives, and technological breakthroughs are propelling electric vehicles to the forefront of the commercial vehicle market making them the fastest-growing segment in Europe.

REGIONAL ANALYSIS

Germany continued to be the biggest commercial vehicle market in Europe by accounting for an 28.3% of the total market in 2024. Its position in the market is due to robust automotive manufacturing hubs and high demand for logistics solutions supported by its central location in Europe. In 2022, Germany registered over 700,000 new commercial vehicles driven by e-commerce growth and urbanization trends. The German government’s €3 billion investment in electric mobility infrastructure further strengthen its place, as stated by the Federal Ministry for Economic Affairs and Climate Action. With over 40% of European truck production originating from Germany, its role remains pivotal in shaping industry standards.

France is the fastest-growing market for commercial vehicles in Europe, with a projected CAGR of 12.1% between 2025 and 2033. This progress is fueled by aggressive emission reduction targets under the French Mobility Orientation Law, which mandates a 50% reduction in transport emissions by 2030. The government offers substantial incentives such as €50,000 grants for replacing diesel trucks with electric models, as outlined by the French Ministry of Ecological Transition. Urban low-emission zones in cities like Paris are accelerating EV adoption. France’s focus on decarbonization and innovation underscores its rapid expansion, making it a key driver of sustainable mobility in Europe.

The UK, Italy, and Spain are poised for steady growth, driven by urbanization and e-commerce expansion. The UK registered 350,000 commercial vehicles in 2022 supported by post-Brexit trade adjustments, as per the UK Department for Transport. Italy’s market is expected to grow at a 6% CAGR, buoyed by government subsidies for EVs and a strong manufacturing base, according to ANFIA (Italian Association of Automotive Manufacturers). Spain, with its strategic Mediterranean location, is investing €14 billion in green logistics, as stated by the Spanish Ministry of Transport, boosting demand for eco-friendly fleets. Collectively, these regions will play critical roles in Europe’s transition to sustainable transportation.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Volkswagen AG, Daimler AG, Volvo Group, IVECO, Scania AB, Renault Group, Ford Otosan, Stellantis N.V., and DAF Trucks. are some of the key market players in the europe commercial vehicle market.

The European commercial vehicle market is highly competitive, characterized by intense rivalry among global giants and regional players. Daimler AG, Volkswagen Group, and Volvo Group dominate, leveraging their technological prowess and extensive distribution networks. However, emerging players like Renault Trucks and Iveco are gaining traction by focusing on niche markets such as urban delivery EVs. According to BloombergNEF, competition is further intensified by regulatory pressures, pushing companies to innovate in areas like electrification and automation. Strategic collaborations with tech firms and startups are common, enabling incumbents to stay ahead. Market consolidation is evident, with mergers and acquisitions driving growth. This dynamic landscape ensures continuous advancements, benefiting consumers through improved efficiency and sustainability.

Top Players in the Europe Commercial Vehicle Market

The European commercial vehicle market is dominated by three key players: Daimler AG, Volkswagen Group, and Volvo Group. Daimler AG, through its Mercedes-Benz Trucks and Freightliner brands, commands a significant share of the heavy-duty segment. Its focus on hydrogen fuel cell technology has positioned it as a leader in sustainable mobility. Volkswagen Group, via its MAN and Scania subsidiaries excelling in light and medium-duty vehicles. The company’s €1 billion investment in EV production underscores its commitment to electrification. Volvo Group is renowned for its advanced safety and automation technologies.

Top Strategies Used by Key Market Participants

Key players in the European commercial vehicle market employ strategies such as product innovation, strategic partnerships, and sustainability initiatives. For instance, Daimler AG has heavily invested in hydrogen-powered trucks, aligning with EU decarbonization goals. Volkswagen Group has formed alliances with battery manufacturers like Northvolt to secure supply chains for electric vehicles. Volvo Group focuses on autonomous driving technologies, partnering with NVIDIA to develop AI-driven solutions. McKinsey & Company highlights that mergers and acquisitions are also prevalent, enabling firms to expand their technological capabilities. Additionally, green financing and subsidies are leveraged to promote electric fleet adoption. These strategies collectively enhance competitiveness while addressing regulatory and environmental challenges.

RECENT MARKET DEVELOPMENTS

- In April 2023, Daimler AG launched the eActros LongHaul, an electric truck with a range of 500 kilometers, strengthening its position in the zero-emission freight sector.

- In June 2023, Volkswagen Group partnered with Siemens to develop smart charging infrastructure across Europe, enhancing EV adoption for commercial fleets.

- In September 2023, Volvo Group acquired OdinSpan, a software firm specializing in autonomous vehicle systems, boosting its capabilities in self-driving truck technology.

- In November 2023, Renault Trucks unveiled its new T-Series EV lineup, targeting urban logistics providers and expanding its presence in the light commercial vehicle segment.

- In January 2024, Iveco signed a €500 million deal with Nikola Corporation to co-develop hydrogen fuel cell trucks, marking a significant step toward sustainable heavy-duty transport solutions.

MARKET SEGMENTATION

This research report on the europe commercial vehicle market is segmented and sub-segmented based on categories.

By Vehicle Type

- Light Commercial Vehicle

- Heavy Vehicle

- Buses

By Fuel Type

- I.C. Engine

- Electric Vehicle (EV)

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What factors are driving the growth of the commercial vehicle market in Europe?

Growth is driven by rising e-commerce, increased infrastructure investments, and demand for fleet modernization. Government incentives for low-emission vehicles also contribute.

What are the challenges in the European commercial vehicle market?

Challenges include high EV costs, lack of infrastructure, and ongoing supply chain issues. Stricter emissions regulations also increase manufacturing complexity and costs.

What are the major trends shaping the market?

Key trends include the shift towards electric vehicles, digital fleet management, and autonomous technologies. There's also increasing demand for sustainable and efficient transport solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]