Europe Dental Disposables Market Size, Share, Trends & Growth Forecast Report By Type (Disposable Dental Examination Kit, Disposable Saliva Evacuation Products, Sponges and Gauze Products, Disposable Air/Water Syringe Tips, Consumables, Disposable Impression Trays, Others) Application, End-User, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Dental Disposables Market Size

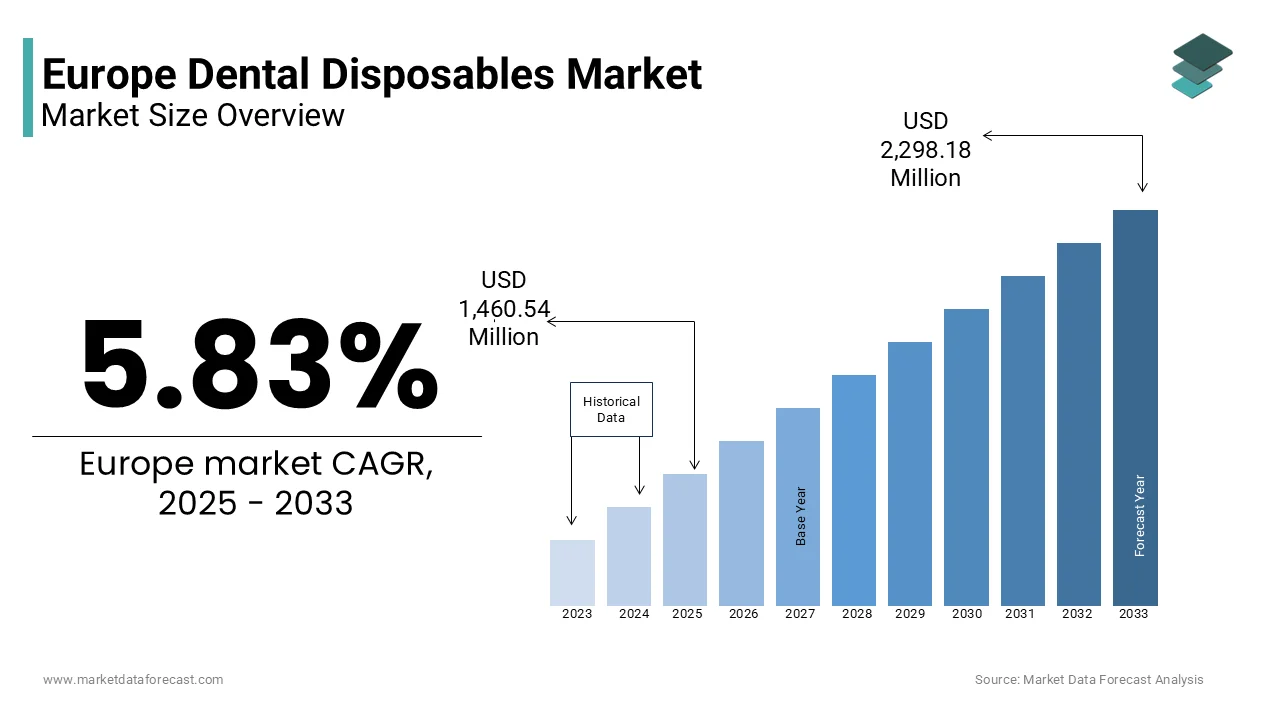

The Europe Dental Disposables market size was valued at USD 1,380.08 million in 2024. The European market size is estimated to be worth USD 2,298.18 million by 2033 from USD 1,460.54 million in 2025, growing at a CAGR of 5.83% from 2025 to 2033.

The Europe dental disposables market encompasses a wide range of single-use products designed to maintain hygiene, prevent cross-contamination, and ensure infection control in dental practices. These include items such as gloves, face masks, saliva ejectors, prophylaxis cups, disposable handpieces, bibs, barriers, and patient accessories. The use of these disposable products has become integral to modern dental care due to increasing awareness regarding oral health, rising prevalence of infectious diseases, and stringent regulatory guidelines governing sterilization practices. Additionally, the European Centre for Disease Prevention and Control (ECDC) emphasized the importance of personal protective equipment (PPE) in healthcare settings post-pandemic, reinforcing the shift away from reusable alternatives. Germany, France, and the UK lead in adoption rates due to robust healthcare infrastructure, high patient awareness, and strong reimbursement policies for dental procedures. Moreover, an aging population with increased dental care needs, coupled with a growing number of private dental practices, is further driving market expansion.

MARKET DRIVERS

Increasing Prevalence of Dental Diseases Across Europe

One of the primary drivers of the Europe dental disposables market is the rising incidence of oral diseases such as caries, periodontitis, and tooth loss, which have necessitated frequent dental interventions. This widespread prevalence has led to a surge in both preventive and restorative dental procedures, directly increasing the consumption of disposable products used during treatments. In countries like Italy and Spain, where public dental services have expanded in recent years, there has been a parallel rise in the use of disposable gloves, masks, and sterilization barriers to ensure compliance with health regulations. Moreover, national dental associations in France and Sweden have issued updated guidelines recommending the exclusive use of single-use instruments for certain procedures to reduce the risk of bacterial transmission.

Expansion of Private Dental Clinics and Rise in Aesthetic Dentistry

Another significant driver of the Europe dental disposables market is the rapid expansion of private dental clinics and the increasing popularity of aesthetic dentistry procedures. Over the past decade, there has been a notable shift from publicly funded dental services to privately operated clinics, especially in Central and Eastern Europe. According to the European Observatory on Health Systems and Policies, private dental facilities accounted for a major share of all dental consultations in Poland and Hungary in 2023, up from that in 2015. This growth has been fueled by rising disposable incomes, greater consumer focus on appearance, and the availability of flexible payment plans for cosmetic procedures such as veneers, teeth whitening, and implants. As private practices prioritize efficiency, sterility, and patient satisfaction, they increasingly rely on disposable tools and equipment to streamline operations and reduce turnaround times between appointments. Furthermore, aesthetic dentistry often involves multiple visits and complex procedures, leading to higher usage of single-use items such as impression trays, disposable mirrors, and barrier films.

MARKET RESTRAINTS

Regulatory Complexity and Stringent Compliance Requirements

A major restraint impacting the Europe dental disposables market is the complexity of regulatory frameworks and the stringent compliance requirements imposed by national and regional health authorities. The European Union enforces strict medical device regulations under the Medical Device Regulation (MDR), which governs the approval, labeling, and traceability of disposable dental products. According to the European Commission, compliance with MDR has resulted in extended certification timelines for manufacturers, with some companies reporting delays of up to two years before bringing new products to market. These regulations require extensive documentation, including clinical evaluations and post-market surveillance, which can be burdensome for small and medium-sized enterprises (SMEs) that lack the resources to navigate the approval process efficiently. Moreover, varying interpretations of the regulation across EU member states create inconsistencies in product registration and distribution. In response, some manufacturers have opted to limit their offerings or withdraw from certain markets altogether, reducing product diversity and limiting innovation.

Environmental Concerns and Rising Demand for Sustainable Alternatives

Environmental concerns surrounding the disposal of single-use dental products are increasingly influencing policy decisions and consumer preferences across Europe. According to the European Environment Agency, healthcare-related waste, including dental disposables, contributed significantly to total municipal waste in the EU in 2023, prompting calls for more sustainable alternatives. Countries such as Denmark and the Netherlands have introduced legislation encouraging the reduction of plastic-based disposable items, while others are promoting biodegradable or recyclable materials. Dental professionals and patients alike are becoming more conscious of their environmental footprint, with the European Dental Students’ Association reporting that nearly 40% of surveyed dentists expressed interest in adopting eco-friendly alternatives if cost parity could be achieved. Some clinics in Austria and Switzerland have already begun transitioning to reusable or compostable options for items like bibs, suction tips, and instrument covers. However, sustainable disposables often come at a premium, limiting widespread adoption. Also, biodegradable materials may not always meet the same sterility or performance standards required in clinical settings.

MARKET OPPORTUNITIES

Integration of Smart and Technologically Advanced Disposable Products

A key opportunity emerging in the Europe dental disposables market is the integration of smart and technologically advanced disposable products that enhance infection control, treatment accuracy, and patient experience. Innovations such as antimicrobial-coated gloves, RFID-tagged instruments, and disposable intraoral cameras are gaining traction among forward-thinking dental practices seeking to improve efficiency and safety. These advancements help reduce human error, minimize waste, and ensure compliance with hygiene standards without compromising workflow efficiency. Moreover, companies specializing in digital dentistry are collaborating with disposable product manufacturers to develop integrated solutions that support chairside diagnostics and minimally invasive procedures. For instance, some disposable impression trays now feature embedded sensors that provide instant feedback on material placement, improving outcomes in prosthetic and orthodontic treatments. As digital transformation gains momentum in the dental sector, the convergence of disposable products with intelligent features is expected to drive a new wave of product development.

Growing Use of Tele-dentistry and Mobile Dental Services

The expansion of tele-dentistry and mobile dental services presents a compelling opportunity for the Europe dental disposables market, particularly in rural and underserved regions. As digital consultation models gain acceptance, especially in the wake of the pandemic, there is an increasing need for portable, pre-packaged disposable kits that enable hygienic and effective on-site treatments. These services rely heavily on disposable gloves, masks, sterilization wraps, and single-use diagnostic tools to maintain hygiene standards outside traditional clinic settings. Mobile dental units operating in Romania, Bulgaria, and parts of Scandinavia have reported a significant increase in disposable product usage, as they must adhere to strict sanitation protocols without access to centralized sterilization equipment. Also, dental startups offering home visit services in urban centers like London and Paris are contributing to the demand for compact, ready-to-use disposable packs tailored for field applications.

MARKET CHALLENGES

Supply Chain Disruptions and Raw Material Cost Volatility

One of the foremost challenges facing the Europe dental disposables market is the volatility in raw material prices and recurring supply chain disruptions that impact production timelines and pricing stability. The aftermath of the global pandemic, geopolitical tensions, and energy crises have collectively strained the availability of essential inputs such as polypropylene, latex, and synthetic polymers—key components in the manufacturing of gloves, masks, and other disposable dental products. According to the European Chemical Industry Council (CEFIC), raw material costs for polymer-based disposables increased in 2023 , primarily due to fluctuating oil prices and reduced production capacity in Asia. This inflationary pressure has forced manufacturers to either absorb additional costs or pass them on to end-users, making dental disposables less affordable for smaller clinics and independent practitioners. Furthermore, logistical bottlenecks, including shipping delays and customs restrictions, have disrupted the timely delivery of finished products to distributors and healthcare providers.

Price Sensitivity Among Smaller Dental Practices and Independent Clinics

Price sensitivity among smaller dental practices and independent clinics poses a significant challenge to the Europe dental disposables market, particularly in lower-income regions. While larger hospitals and corporate dental chains can afford consistent procurement of premium disposable products, independent practitioners often seek cost-effective alternatives, sometimes compromising on quality and sterility. This behavior is exacerbated by inconsistent enforcement of infection control guidelines in some countries, allowing substandard practices to persist. Moreover, price competition among manufacturers has led to a proliferation of low-cost generic brands, some of which may not meet the same performance and safety benchmarks as established products. To address this issue, industry stakeholders are advocating for government subsidies, bulk purchasing programs, and training initiatives aimed at educating practitioners on the long-term benefits of investing in high-quality disposable products. However, until affordability improves across the board, price sensitivity will continue to constrain market expansion in certain segments.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.83% |

|

Segments Covered |

By Type, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Detax GmbH & Co. KG, Keystone Industries GmbH, Kerr Dental (Envista), Dispotech Srl, Akzenta International SA, President Dental GmbH, VOCO GmbH, 3M Company, Hager & Werken GmbH & Co. KG, and tgDent (Technical & General Limited), and others. |

SEGMENT ANALYSIS

By Type Insights

Disposable dental examination kits represented the largest segment in the Europe dental disposables market by accounting for a 28.6% of total market share in 2024. These kits typically include gloves, masks, bibs, mouth mirrors, explorers, and protective eyewear, making them essential for routine checkups, diagnostics, and preventive care. The dominance of this segment is primarily driven by the widespread adoption of infection control protocols across European dental clinics. Also, rising patient awareness regarding clinic sterility has led to higher demand for transparent and visibly clean environments, encouraging clinicians to use pre-packaged disposable kits. In countries like Germany and France, regulatory mandates require the use of disposable instruments for each patient visit, further reinforcing this trend.

Disposable impression trays are emerging as the fastest-growing segment in the Europe dental disposables market, projected to expand at a CAGR of 7.8%. This growth is fueled by increasing demand for restorative and orthodontic procedures, which require accurate dental impressions for crowns, bridges, implants, and aligners. Disposable trays eliminate the need for sterilization between uses, reducing cross-contamination risks and saving time in busy dental practices. Moreover, advancements in tray materials such as polystyrene and polypropylene have improved dimensional stability and compatibility with various impression materials, enhancing clinical outcomes. In Sweden and the Netherlands, dental professionals have increasingly adopted these trays due to their ease of use and compliance with environmental regulations compared to reusable alternatives.

By Application Insights

Cosmetic dentistry had the largest application segment in the Europe dental disposables market by capturing 34.4% of total revenue in 2024. This dominance is attributed to the rising consumer interest in aesthetic dental enhancements such as veneers, teeth whitening, bonding, and smile makeovers. These procedures often require multiple disposable items including applicators, barriers, gauzes, and isolation products, contributing to high consumption rates. The influence of social media and celebrity culture has played a pivotal role in shaping beauty standards, prompting individuals to invest in dental aesthetics. Furthermore, the proliferation of private dental clinics offering flexible payment plans and bundled services has made cosmetic dentistry more accessible.

Dental implants is the quickly expanding application segment in the Europe dental disposables market, rising at a CAGR of 8.2%. This growth is driven by an aging population, increasing edentulism rates, and rising acceptance of implant-supported prosthetics as a durable alternative to traditional dentures. Each implant procedure involves extensive use of disposable items such as surgical drapes, irrigation tips, micro-applicators, and barrier films to maintain a sterile field. The German Implant Study Group noted that average disposable product usage per implant surgery increased in 202 , reflecting enhanced infection control measures. Also, technological advancements such as guided surgery and immediate loading implants have streamlined workflows, increasing procedural volume and, consequently, disposable consumption.

By End-User Insights

Hospitals and clinics constitute the largest end-user segment in the Europe dental disposables market, holding a 62% of total market share in 2024. This dominance is largely due to the high frequency of patient visits, strict adherence to hygiene protocols, and the extensive range of dental procedures conducted in these settings. Public and private dental facilities alike rely heavily on disposables to minimize cross-contamination risks and comply with health regulations. Germany and France lead in disposable utilization within hospital settings, where infection control guidelines mandate the exclusive use of single-use instruments in certain procedures. Also, the expansion of private dental chains in Eastern Europe has contributed to increased procurement of standardized disposable products.

Dental laboratories are the booming end-user segment in the Europe dental disposables market, projected to expand at a CAGR of 6.9%. This progress is primarily driven by the increasing outsourcing of dental prosthetics, crowns, bridges, and implants to specialized labs, which require disposable tools and materials to maintain precision and cleanliness. This shift is attributed to rising demand for complex dental work and the preference for centralized, high-quality production. Disposable items such as impression trays, mixing pads, micro-brushes, and protective coatings are extensively used during the fabrication process. The Italian Dental Technicians Association reported that disposable material expenditure in dental labs increased in 2023 , particularly in regions adopting digital workflows and CAD/CAM technologies. Moreover, stricter hygiene standards enforced by national dental authorities have prompted labs to transition away from reusable tools to prevent contamination between cases.

REGIONAL ANALYSIS

The United Kingdom is benefiting from a well-established healthcare system, high patient awareness, and stringent infection control policies. According to the Care Quality Commission (CQC), all dental practices in England must adhere to mandatory hygiene and sterilization standards , driving consistent demand for disposable products. Private dental clinics have also expanded rapidly, particularly in urban centers like London and Manchester, further boosting disposable usage. Also, the British Dental Association emphasized the importance of single-use instruments in preventing disease transmission, reinforcing industry-wide adoption. With increasing focus on oral health and regulatory enforcement, the UK remains a key contributor to regional market dynamics.

France has high adoption of disposables in public and private dental facilities which is driven by strong government-backed infection control initiatives and a well-developed network of both public and private dental providers. This widespread adoption is supported by favorable reimbursement policies for dental procedures, ensuring affordability and accessibility for patients. Moreover, the country has seen a surge in aesthetic dentistry and implantology, both of which rely heavily on disposable components.

Spain has a rising demand for preventive and restorative procedures with growth fueled by rising demand for preventive and restorative dental treatments. In addition, Spain has been proactive in integrating digital dentistry into clinical practice, which requires complementary disposable accessories for scanning and modeling. With increasing insurance coverage and consumer spending on oral health, Spain continues to strengthen its presence in the regional market.

Germany was the largest individual country share at 18% , underpinned by its advanced healthcare infrastructure, rigorous hygiene regulations, and a rapidly aging population. Moreover, Germany leads in research and development of dental disposables, with companies collaborating on biodegradable alternatives and smart packaging innovations. As the region’s largest economy with strong purchasing power, Germany remains the dominant force in the European dental disposables market.

Italy is characterized by a growing private dental sector and increasing emphasis on oral hygiene. Additionally, the country has witnessed a surge in implant and orthodontic treatments, both of which rely on high-volume disposable usage. Government initiatives promoting preventive dental care have also boosted market expansion. The Ministry of Health launched a nationwide campaign in 2023 encouraging regular check-ups and disposable-based procedures to reduce cross-infection risks. With rising consumer spending and policy support, Italy continues to play a crucial role in shaping the regional market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Detax GmbH & Co. KG, Keystone Industries GmbH, Kerr Dental (Envista), Dispotech Srl, Akzenta International SA, President Dental GmbH, VOCO GmbH, 3M Company, Hager & Werken GmbH & Co. KG, and tgDent (Technical & General Limited) are playing a dominant role in the Europe dental disposables market.

The Europe dental disposables market is characterized by intense competition driven by technological advancements, regulatory demands, and shifting consumer preferences toward hygiene-centric care. Major multinational corporations coexist with well-established regional manufacturers, creating a dynamic landscape where product quality, sterility assurance, and pricing strategies play decisive roles. Market leaders maintain dominance through continuous innovation, broad product portfolios, and robust supply chain infrastructures. At the same time, emerging players are leveraging cost-effective production models and sustainable alternatives to capture market share, particularly in Eastern Europe. Regulatory scrutiny remains a defining factor, influencing product approval timelines and manufacturing compliance. Additionally, growing patient awareness and demand for safe clinical environments have prompted dental practitioners to prioritize high-performance disposable products. As a result, competition extends beyond product features to include brand positioning, customer service excellence, and environmental responsibility, shaping a rapidly evolving and highly responsive marketplace.

TOP PLAYERS IN THIS MARKET

3M Oral Care

3M Oral Care is a leading global player with a strong presence in the Europe dental disposables market. The company offers a wide range of disposable products including impression materials, prophylaxis pastes, isolation kits, and micro-applicators. Known for its innovation and reliability, 3M supports both general and specialized dental practices with high-quality disposable solutions that enhance clinical efficiency and sterility.

Dentsply Sirona

Dentsply Sirona is a dominant force in the European dental disposables sector, offering comprehensive product lines tailored to restorative, endodontic, and preventive dentistry. Its portfolio includes disposable handpieces, syringes, applicators, and barrier films designed to meet evolving hygiene standards. The company’s integration of digital dentistry with disposable components has strengthened its position across both public and private dental settings.

Henry Schein Dental

Henry Schein Dental plays a pivotal role in supplying dental disposables across Europe through its extensive distribution network. While not a manufacturer itself, the company serves as a critical link between producers and practitioners, offering an expansive catalog of disposable gloves, masks, bibs, and sterilization products. Its commitment to infection control education and supply chain reliability makes it a trusted partner for dental professionals throughout the region.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

One major strategy employed by key players in the Europe dental disposables market is product diversification and innovation , focusing on developing advanced disposable solutions that align with evolving clinical needs. Companies are introducing biocompatible, eco-friendly, and ergonomically designed disposables to cater to diverse dental specialties while ensuring compliance with hygiene standards.

Another crucial approach is expanding distribution networks and forging strategic partnerships with regional distributors, dental clinics, and procurement agencies. By strengthening logistics and local presence, manufacturers ensure consistent supply and accessibility across both Western and Eastern Europe, particularly in high-growth markets.

Lastly, companies are investing heavily in educational initiatives and training programs for dental professionals , emphasizing the importance of infection control and proper disposal techniques. These efforts not only reinforce brand credibility but also drive long-term adoption of premium disposable products across various dental applications.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, 3M Oral Care launched a new line of antimicrobial-coated disposable gloves specifically designed for enhanced infection control in high-risk dental procedures, aiming to strengthen its foothold in the hygiene-sensitive segment of the European market.

- In May 2024, Dentsply Sirona expanded its European operations by opening a dedicated dental disposables innovation center in Vienna, focusing on developing next-generation single-use instruments tailored for digital dentistry workflows and minimally invasive treatments.

- In October 2023, Henry Schein Dental entered into a strategic partnership with a leading European medical logistics provider to optimize last-mile delivery of disposable dental products, enhancing accessibility for independent practitioners and rural clinics across multiple countries.

- In March 2024, Bego Germany introduced a fully biodegradable line of disposable impression trays made from plant-based polymers, targeting environmentally conscious dental practices and aligning with the EU’s sustainability-driven healthcare policies.

- In August 2023, Colgate-Palmolive Healthcare partnered with several European dental associations to launch an educational campaign promoting the use of single-use products in preventing cross-contamination, reinforcing brand trust and encouraging wider adoption of disposables in both public and private dental facilities.

MARKET SEGMENTATION

This research report on the Europe Dental Disposables market is segmented and sub-segmented into the following categories.

By Type

- Disposable Dental Examination Kit

- Disposable Saliva Evacuation Products

- Sponges and Gauze Products

- Disposable Air/Water Syringe Tips

- Consumables

- Tray

- Paper Toothbrushes

- Mouthwash

- Hand Sanitizers

- Washing Soap

- X-ray Films

- Disposable Impression Trays

- Disposable Micro-applicators

- Dental Mouth Opener

- Silicone Structures

- Restorative/Protective Materials

- Medications

- Sedative Products

- Paper Clips

- Band Adaptors

- Blocking Structures

- Others

- Dental Bibs

- Others

By Application

- Cosmetic Dentistry

- Teeth Straightening

- Dental Implants

- Others

- Composite Filling

- Gum Reshaping

- Others

By End-User

- Hospitals and Clinics

- Dental Laboratories

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected market size of the Europe Dental Disposables market by 2033?

The Europe Dental Disposables market is expected to reach approximately USD 2,298.18 million by 2033.

2. What factors are driving the growth of the Europe Dental Disposables market?

While not specified in the data, typical drivers include increasing demand for dental procedures, rising awareness of oral hygiene, and advancements in disposable dental product manufacturing.

3. What are the current trends shaping the Europe Dental Disposables market?

Key trends include rising demand for eco-friendly products, integration of digital dentistry tools, and growth in dental tourism across Eastern Europe.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com