Europe Diabetes Devices Market Research Report – Segmented By Product (Glucose Monitoring Devices, Insulin Delivery Systems, Control Solutions), By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From 2025 to 2033

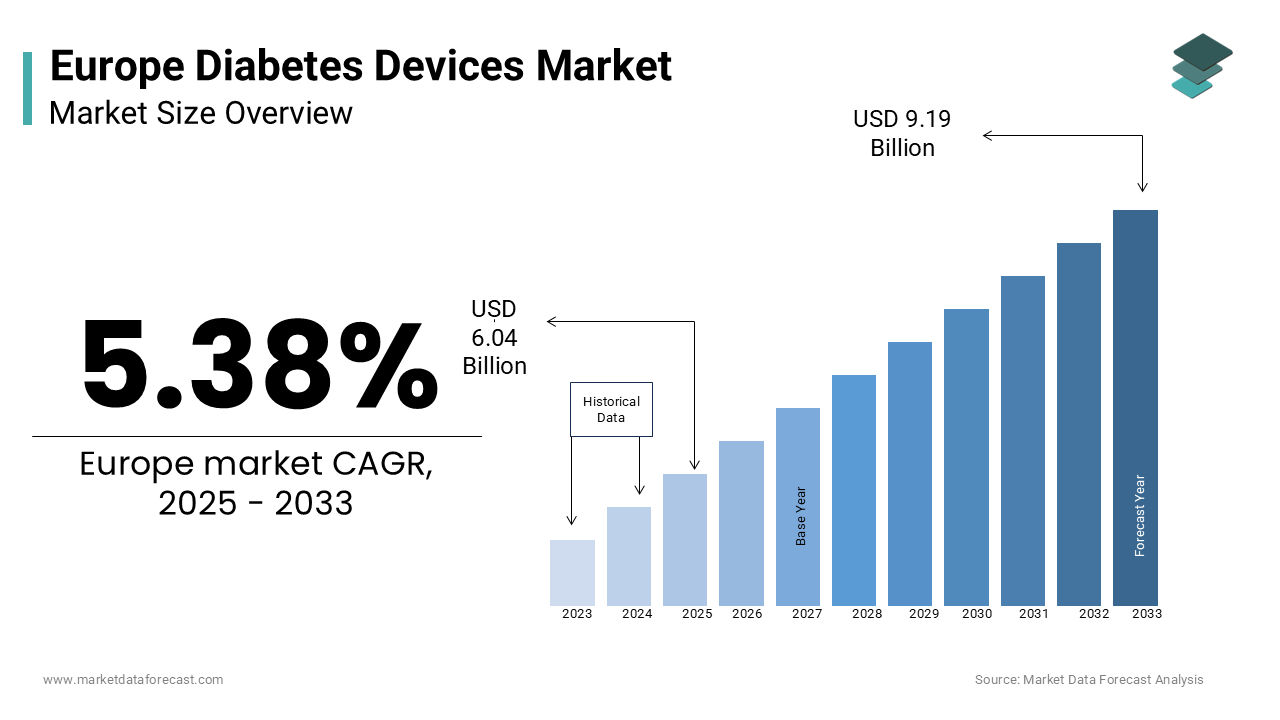

Europe Diabetes Devices Market Size

The europe diabetes devices market size was valued at USD 5.73 billion in 2024. The diabetes devices market size in europe was worth USD 6.04 billion in 2025 and is forecasted to reach USD 9.19 billion by 2033, at a CAGR of 5.38% during the forecast period from 2025 to 2033.

Diabetes care devices include a wide range of products such as blood glucose monitoring (BGM) systems and insulin delivery devices, which are essential for managing both Type 1 and Type 2 diabetes. According to the International Diabetes Federation, over 60 million individuals in Europe are living with diabetes, with projections indicating a 15% increase by 2045 due to aging populations and lifestyle-related risk factors. The European Commission underscores that diabetes accounts for approximately €150 billion in annual healthcare expenditures, highlighting the urgent need for advanced and accessible care solutions. For instance, Eurostat estimates that over 80% of diabetes-related complications, such as neuropathy and retinopathy, can be mitigated through consistent monitoring and timely insulin administration. Additionally, technological advancements, such as continuous glucose monitors (CGMs) and smart insulin pumps, have revolutionized diabetes management, enabling real-time data tracking and personalized treatment plans

MARKET DRIVERS

Rising Prevalence of Diabetes Across Europe

The escalating prevalence of diabetes is driving the growth of the European diabetes devices market. According to the International Diabetes Federation, over 60 million people in Europe were diagnosed with diabetes in 2022, representing approximately 8.5% of the adult population. According to the European Commission, this figure is projected to rise by 15% by 2045 due to the growing aging population, sedentary lifestyles, and increasing obesity rates. For instance, Germany alone accounts for over 8 million diabetes patients, with Type 2 diabetes being the most prevalent form. Additionally, the economic burden of diabetes-related complications, estimated at €150 billion annually, underscores the necessity for effective management tools like BGM devices and insulin pumps. A study by the European Health Economics Association reveals that early intervention through advanced diabetes care devices reduces hospital readmissions and long-term healthcare costs by up to 30%. These statistics highlight the critical role of diabetes care devices in alleviating the public health burden posed by diabetes, driving market expansion across Europe.

Technological Advancements in Diabetes Management

Technological innovations in diabetes care devices are further fuelling the growth of the European market. According to the European Medical Device Technology Association, advancements in continuous glucose monitors (CGMs) and smart insulin pumps have transformed traditional diabetes management into a more precise and patient-friendly process. For example, CGMs achieve accuracy rates exceeding 95% in tracking blood glucose levels, enabling real-time adjustments to insulin dosing. The European Commission notes that investments in research and development have led to the introduction of AI-driven algorithms, which analyze glucose trends and provide personalized recommendations, improving patient outcomes by 25%. Additionally, wearable devices with wireless connectivity facilitate seamless data sharing between patients and healthcare providers, enhancing remote monitoring capabilities. A study by the European Cardiovascular Research Institute reveals that hospitals and clinics utilizing advanced diabetes care technologies report a 20% reduction in hypoglycemic events. These advancements not only enhance clinical efficacy but also foster greater acceptance among patients, solidifying technological progress as a key driver of market growth.

MARKET RESTRAINTS

High Costs and Limited Reimbursement Coverage

The prohibitive cost of diabetes care devices is one of the key restraints to the European diabetes devices market, limiting accessibility for a substantial portion of the population. According to the European Health Economics Association, the average cost of a continuous glucose monitor (CGM) ranges between €1,000 and €2,000 annually, while smart insulin pumps can exceed €5,000 upfront. This financial burden is exacerbated by limited reimbursement coverage in several European countries, particularly in Eastern Europe, where public healthcare budgets are constrained. The European Commission notes that less than 40% of patients requiring advanced diabetes care devices receive full reimbursement, forcing many to bear out-of-pocket expenses. For instance, a survey conducted by the European Patients’ Forum reveals that over 35% of eligible patients defer adopting these technologies due to cost concerns. Additionally, disparities in healthcare funding across member states create inequities in access, with rural and underserved regions disproportionately affected. These financial barriers not only hinder market penetration but also exacerbate existing inequalities in diabetes care, posing a formidable challenge to widespread adoption.

Patient Adherence and Behavioral Challenges

Low patient adherence to diabetes care regimens is another major restraint to the European diabetes devices market. According to the European Society of Endocrinology, over 50% of patients fail to consistently use prescribed devices, such as blood glucose monitors or insulin pumps, often due to discomfort, complexity, or perceived invasiveness. As per the European Commission, misconceptions about device usage, fueled by misinformation and cultural beliefs, deter patients from fully integrating these tools into their daily routines. For example, a survey conducted in Southern Europe reveals that 40% of respondents associate frequent glucose monitoring with inconvenience, despite evidence suggesting its role in preventing complications. Additionally, language barriers and insufficient educational campaigns in rural areas further exacerbate knowledge gaps, limiting patient engagement. The European Health Economics Association underscores that addressing these challenges requires sustained investment in awareness initiatives and community outreach programs, yet resource constraints and competing healthcare priorities often undermine their effectiveness. These barriers not only hinder patient uptake but also impede efforts to maximize the therapeutic potential of diabetes care devices.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

The untapped potential of emerging markets within Europe is a promising opportunity for the diabetes devices market in Europe. According to the European Investment Bank, countries in Eastern and Southeastern Europe, such as Poland, Romania, and Bulgaria, exhibit significant growth potential due to their large populations and increasing healthcare expenditure. For instance, Romania’s healthcare budget has grown by 12% annually over the past five years, driven by government initiatives to modernize infrastructure and adopt advanced medical technologies. The European Commission highlights that these regions currently account for less than 15% of total diabetes care device usage in Europe, leaving ample room for market penetration. Additionally, partnerships between multinational device manufacturers and local healthcare providers have facilitated the introduction of affordable solutions tailored to regional needs. A report by the European Health Innovation Network underscores that strategic investments in training programs for local healthcare professionals have accelerated adoption rates by 25% in pilot regions. These dynamics position emerging markets as a lucrative avenue for growth, enabling stakeholders to address unmet clinical needs while expanding their geographical footprint.

Integration of Artificial Intelligence and Data Analytics

The integration of artificial intelligence (AI) and data analytics into diabetes care workflows provides a significant opportunity to enhance patient outcomes and operational efficiency. According to the European Medical Device Technology Association, AI-powered algorithms can analyze glucose data to predict trends and recommend personalized insulin dosing strategies, reducing hypoglycemic events by up to 30%. For example, machine learning models developed by the European Cardiovascular Research Institute have demonstrated a 90% accuracy rate in identifying optimal insulin adjustments, surpassing traditional manual methods. The European Commission notes that the adoption of AI-driven tools not only improves precision but also enables proactive interventions, aligning with the broader trend toward value-based healthcare. Additionally, cloud-based platforms facilitate real-time data sharing and remote monitoring, ensuring timely interventions and enhancing post-market surveillance. A study by the European Health Economics Association reveals that hospitals leveraging AI technologies report a 20% improvement in patient satisfaction scores. These innovations not only elevate the standard of care but also create new revenue streams for market players, positioning AI as a catalyst for sustainable growth.

MARKET CHALLENGES

Regulatory Hurdles and Compliance Requirements

Stringent regulatory frameworks governing the approval and commercialization of diabetes care devices is a significant challenge to the European market. According to the European Medicines Agency, compliance with the Medical Device Regulation (MDR) imposes rigorous testing protocols and documentation requirements, delaying market entry for innovative products. For instance, the transition to MDR has resulted in a 25% increase in approval timelines, with smaller manufacturers particularly affected by the heightened scrutiny. The European Commission highlights that non-compliance with these regulations can lead to product recalls, legal liabilities, and reputational damage, deterring investment in research and development. Additionally, the fragmented nature of regulatory policies across member states creates inconsistencies in approval processes, complicating cross-border distribution. A study by the European Medical Device Technology Association reveals that over 30% of new diabetes care devices fail to meet initial regulatory benchmarks, necessitating costly revisions. These regulatory hurdles not only impede innovation but also exacerbate supply chain bottlenecks, posing a formidable challenge to market expansion.

Shortage of Skilled Healthcare Professionals

The shortage of skilled healthcare professionals trained in diabetes management is impeding the growth of the European diabetes devices market. According to the European Society of Endocrinology, there are fewer than 10,000 certified diabetes educators practicing across Europe, with significant regional disparities in their distribution. The European Commission highlights that this shortage is particularly acute in Southern and Eastern Europe, where the ratio of educators to patients is as low as 1:50,000. Furthermore, the complexity of using advanced devices, such as continuous glucose monitors and smart insulin pumps, requires extensive training and experience, which limits the number of qualified practitioners capable of guiding patients effectively. A study by the European Cardiovascular Research Institute reveals that over 40% of hospitals face delays in generating actionable insights from device data due to a lack of trained personnel. Additionally, the rapid pace of technological advancements necessitates continuous education and upskilling, further straining already limited resources. These workforce challenges not only restrict the availability of diabetes care services but also undermine efforts to meet the growing demand for advanced management tools, posing a significant barrier to market expansion.

SEGMENTAL ANALYSIS

By Product Insights

The blood glucose monitoring (BGM) devices segment captured 60.9% of the European market share in 2024. The dominating position of BGM devices segment in the European market is attributed to their widespread adoption in both Type 1 and Type 2 diabetes management, offering a cost-effective and reliable solution for daily glucose tracking. According to the European Society of Endocrinology, BGM devices achieve accuracy rates exceeding 90%, making them indispensable in clinical settings. As per the European Commission, advancements in sensor technology and wireless connectivity have enhanced the usability of BGM devices, enabling seamless data transmission to healthcare providers. Additionally, their versatility allows for application across diverse patient demographics, further reinforcing their dominance. A study by the European Cardiovascular Research Institute reveals that over 80% of diabetes patients in Western Europe utilize BGM devices, reflecting their integral role in modern diabetes care. These factors collectively underscore the segment's importance, emphasizing its contribution to improving patient outcomes and healthcare efficiency.

The insulin delivery devices segment is anticipated to register the fastest CAGR of 12.5% over the forecast period owing to their superior convenience and precision compared to traditional insulin administration methods. The European Society of Endocrinology reports that insulin pumps achieve glycemic control rates exceeding 85%, making them a preferred option for patients requiring intensive insulin therapy. Additionally, advancements in smart insulin pumps, such as those integrated with AI-driven algorithms, have expanded their applicability and improved outcomes. The European Commission underscores that the adoption of insulin delivery devices is particularly pronounced in tertiary care centers, where multidisciplinary teams collaborate to optimize patient care. According to a study by the European Cardiovascular Research Institute, hospitals utilizing advanced insulin delivery systems report a 30% reduction in hypoglycemic events, reflecting their growing popularity. These dynamics position insulin delivery devices as a pivotal growth driver, emphasizing their expanding therapeutic utility and technological advancements.

REGIONAL ANALYSIS

Germany accounted for 27.7% of the European diabetes devices market in 2024 and emerged as the leading player in the European market. The dominating position of Germany in the European market is attributed to the country's advanced healthcare infrastructure and robust adoption of cutting-edge medical technologies. According to the German Diabetes Society, over 8 million individuals in Germany live with diabetes, driving demand for advanced care solutions such as continuous glucose monitors and insulin pumps. The European Commission highlights that Germany’s aging population, with over 21% aged 65 or older, amplifies the need for effective diabetes management tools, further solidifying its market position. Additionally, the country’s strong emphasis on research and development has fostered innovations in AI-driven glucose monitoring systems, further enhancing market leadership. The European Medical Device Technology Association notes that investments in telemedicine platforms and remote monitoring solutions have positioned Germany as a hub for technological advancements.

France occupied a prominent share of the European market in 2024 and is anticipated to continue to play a key role in the European diabetes devices market throughout the forecast period. The prominence of France in the European market is driven by the country’s proactive approach to healthcare innovation and its universal healthcare system, which ensures equitable access to advanced diabetes care solutions. The French Diabetes Society reports that France performs over 30% of all diabetes-related clinical trials in Europe, supported by government initiatives to modernize healthcare infrastructure. Additionally, France’s expertise in AI-driven analytics and cloud-based platforms has positioned it as a leader in developing next-generation diabetes care devices. The European Commission underscores that collaborations between public and private entities have accelerated innovation, driving the French market growth.

The UK is estimated to exhibit prominent growth in the European diabetes devices market during the forecast period due to the increasing number of initiatives of the UK government in diabetes management. According to the British Diabetic Association, the UK performs over 25% of all diabetes-related R&D activities in Europe, supported by nationwide awareness campaigns and specialized research centers. The UK Department of Health underscores that the rising prevalence of Type 2 diabetes, coupled with advancements in AI and data analytics, has amplified demand for advanced diabetes care devices. Additionally, the country’s focus on sustainability and ethical sourcing aligns with global trends, enhancing its market reputation.

Italy is likely to command a considerable share of the European diabetes devices market over the forecast period. The Italian Diabetes Society reports that Italy performs over 20% of all diabetes-related clinical trials in Europe, supported by advancements in AI-driven analytics and wearable technologies. Additionally, Italy’s expertise in personalized medicine has expanded the scope of diabetes care applications, enhancing their therapeutic utility. The European Commission highlights that collaborations between academic institutions and industry players have accelerated innovation, driving the Italian diabetes devices market growth.

Spain is projected to progress at a steady CAGR in the European market over the forecast period. The high adoption rates of advanced diabetes care technologies is one of the factors driving the Spanish market growth. The Spanish Diabetes Society emphasizes that Spain performs over 15% of all diabetes-related R&D activities in Europe, supported by investments in automation and AI-driven platforms. Additionally, the country’s focus on regenerative medicine and biotechnological advancements has expanded the therapeutic applications of diabetes care devices. The European Commission highlights that Spain’s strategic initiatives to enhance procedural safety and accessibility have strengthened its market position.

KEY MARKET PLAYERS

Major companies dominating most of the European Diabetes Devices Market are Roche Diagnostics, Johnson & Johnson, Abbott Laboratories, Novo Nordisk, Ascensia, Tandem, and Terumo.

MARKET SEGMENTATION

This research report on the Europe Diabetes Devices Market has been segmented and sub-segmented into the following categories.

By Product

- Glucose Monitoring Devices

- Self-Blood Glucose Monitoring Devices

- Glucose Meters

- Test strips

- Lancets

- Hemoglobin A1C Testing Kits

- Continuous Glucose Monitoring Devices

- Self-Blood Glucose Monitoring Devices

- Insulin Delivery Systems

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Jet Injectors

- Control Solutions

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com