Global Diabetes Devices Market Size, Share, Trends & Growth Forecast Report – Segmented By Product Type (Glucose Monitoring Devices, Insulin Delivery Systems & Control Solutions) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis From 2025 to 2033

Global Diabetes Devices Market Size

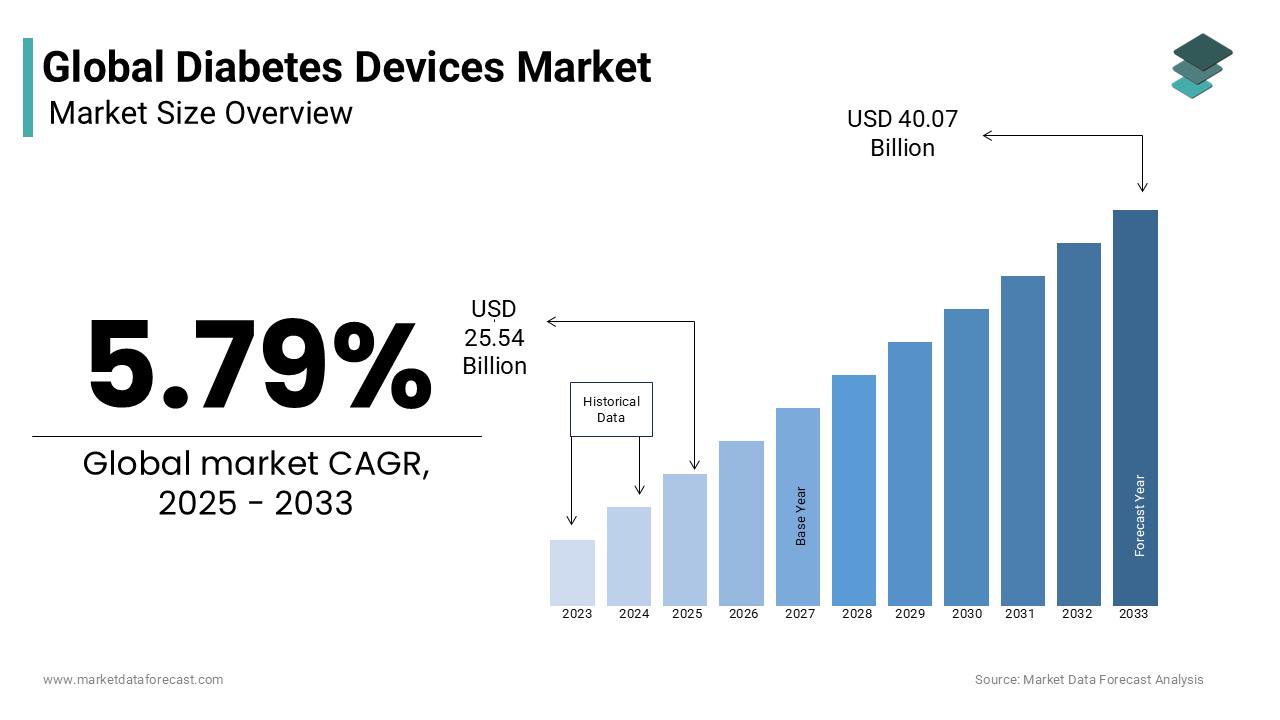

As per our report, the global diabetes devices market is estimated to be worth USD 40.07 billion by 2033 and USD 25.54 billion by 2025, growing at a CAGR of 5.79% during the forecast period. The diabetes devices market size was valued at USD 24.14 billion in 2024

Diabetes devices help know the sugar levels and take appropriate measures to manage blood sugar levels. These devices decrease the burden on the patient who has Diabetes and improve the quality of life. According to the International Diabetes Federation (IDF), in 2015, the number of diabetes patients was 414 million, which rose to 425 million in 2017. Also, the report stated that around 1.6 million people died due to Diabetes in 2016. As a result, government organizations are planning to give proper access to diabetes care devices in healthcare sectors, especially in rural areas, to minimize the risk of Diabetes.

MARKET DRIVERS

The growing prevalence of diabetes worldwide and the increasing need for safety measures drive the global diabetes devices market growth.

The rapid increase in the incidence of Diabetes due to urbanization and sedentary lifestyles is a crucial factor in the growth of the diabetes devices market. The World Health Organization (WHO) predicts that Diabetes is one of the leading causes of death. As the number of patients with Diabetes increased, the demand for diabetes treatment devices also did. In addition, the need for quick and effective diagnostic methods has also contributed to the growth of the diabetes devices market. Owing to the rapid technological advances in treating diabetes, the increase in the population of obesity, the increase in the consumption of Junk food, and the fast diagnosis and treatment of diabetes are further anticipated to promote the growth of the diabetes devices market growth.

In addition, the elderly population is very vulnerable to diabetes due to unhealthy eating and sedentary lifestyles. It has led to increased demand for diabetes care devices and accelerated market growth recently. As knowledge of diabetes management has increased, the market growth of diabetes management devices has accelerated. The widespread advances in health infrastructures and economic development have benefited the market.

Furthermore, some governments plan to provide optimal diabetes treatment at a low cost. Therefore, many companies also focus on minimizing the cost of diabetes management devices, which is estimated to favor the global diabetes device market growth. Furthermore, increased awareness of diabetes monitoring devices and untapped market opportunities in developing countries are expected to provide numerous opportunities for diabetes device market growth in this vicinity.

MARKET RESTRAINTS

Less awareness regarding the usage and benefits of these devices in underdeveloped countries is majorly hindering the global diabetes device market growth.

In addition, the long process of registration and reimbursement problems also pose a threat to the market. Further, the diabetes devices market is restricted by the high costs of diagnosis and treatment. Moreover, reimbursement issues and patent expiry are also an issue. The diabetes devices offer a solution for diabetes patients to manage glucose in the blood.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Roche Diagnostics, Johnson & Johnson, LifeScan, Inc. and Animas Inc., Becton- Dickinson, Novo Nordisk, Bayer AG, Abbott Laboratories, Ypsomed AG, Medtronic ple, insult Inc., Terumo Corporation, Tandem Diabetes Care, Inc. and Dexcom, Inc. (U.S.). |

SEGMENTAL ANALYSIS

By Type Insights

The insulin delivery systems segment held the major share of the global diabetes devices market in 2024. Under this segment, the insulin pens segment had the largest share due to the increasing use of these pens suffering from a high level of blood sugar. These insulin pens come preloaded with insulin of the patient's required amount to be prescribed by the doctor. These are very easy to use on their own. Many manufacturers are focusing on different designs of insulin pens with different colors coded according to the patient's level of sugar levels. These pens are portable and have been designed with advanced applications to help remind the last injected insulin and the time to take the insulin shot.

Most sales of diabetes devices worldwide happen to disposable pens, insulin pumps, and blood glucose test strips. These devices represent a substantial share of the global diabetes devices market. In the European market for diabetes medications, 21.03% of the income is contributed from the blood glucose strain insulin pump, projected to grow at 5.06% CAGR from 2025 to 2033. The use of insulin pumps has increased in Europe over the years. However, the low frequency of insulin pumps in Europe is due to the lack of diabetic patients.

The glucose monitoring devices segment is anticipated to grow at a healthy CAGR. Increasing the prevalence of effective diabetes management procedures in hospitals and clinics, growing awareness of monitoring glucose levels regularly and shifting trends towards self-medication, and a rise in the demand for point-of-care testing devices are favoring the growth of the glucose monitoring devices segment. Initiatives by the government by increasing campaign programs, especially in rural areas, promote the segment’s growth to an extent.

Under this segment, the hemoglobin AIC testing kits sub-segment is anticipated to grow at a promising CAGR. It measures the amount of glucose bound to the heme found in red blood cells. Healthcare professionals use this test to help diagnose conditions like Diabetes, prediabetes, and gestational Diabetes that cause excessive blood sugar levels. In addition, A1C, also available as home test kits, allows people with type 1 or 2 diabetes to check their hemoglobin.

REGIONAL ANALYSIS

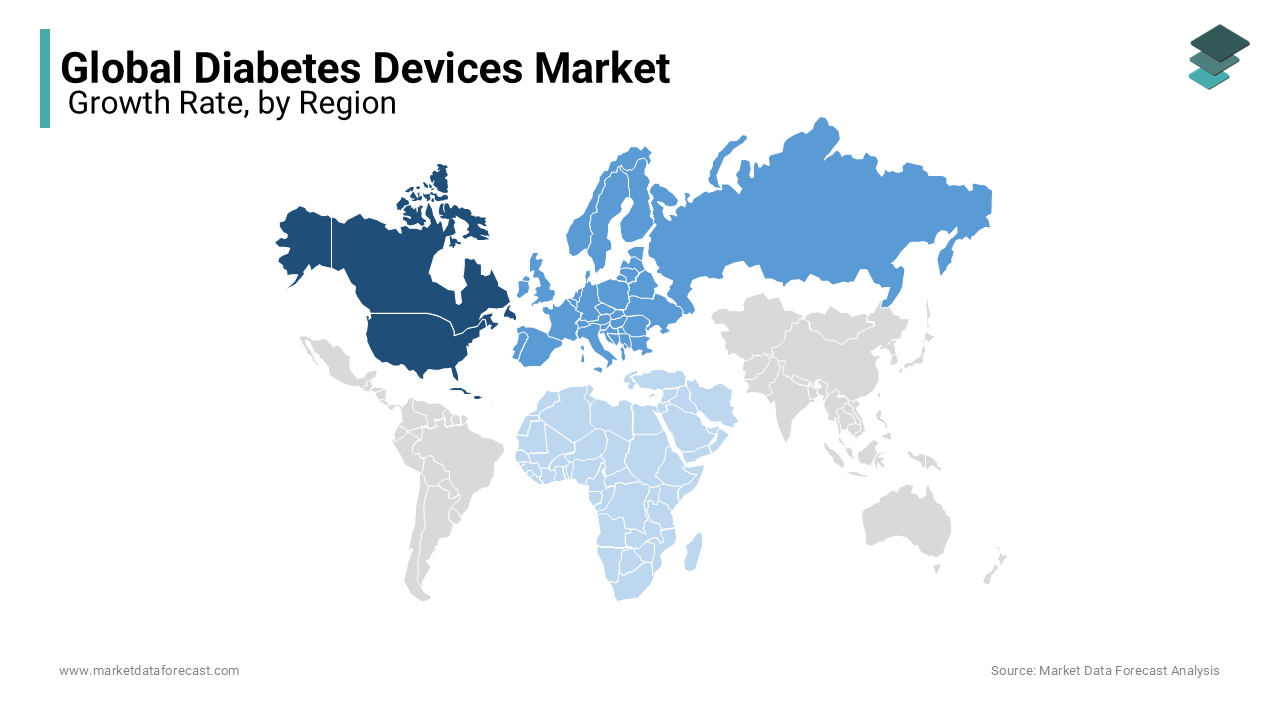

North America held the largest share of global diabetes care products. However, over the past few years, with the exponential increase in the cost related to Diabetes, cost-efficient pen needle development will significantly impact the market for diabetes care devices in North America in the years ahead. In the U.S., most people have type 1 diabetes. The U.S. Food and Drug Administration has approved the first implantable continuous glucose monitoring (CGM) device for diabetes prevention and continuous glucose level monitoring. The device is named Eversense continuous glucose monitoring system and can be used for ages above 18. Real-time continuous glucose monitors are the most recent innovation for diabetes care by the Ontario government's Assistive Devices Program. Diabetes affects nearly 1.5 million Ontarians. Diabetes Canada is increasing the production of real-time continuous glucose monitoring devices for diabetes patients.

Europe is driven by a sudden rise in the number of people affected with Diabetes and high investments in R&D. Also, with increasing awareness among the patients, there is quite a hike in demand for diabetes care devices. In Germany, this diabetes device usage is more due to most children and adolescents with type 1 diabetes. These people use continuous glucose monitoring devices. Therefore, researchers are increasing their focus on providing diabetes devices such as monitoring devices, insulin, and medication-related devices, which drives the market forward. They manufacture different types of devices, and government approval has increased for these devices to prevent or cure Diabetes in suffering people.

APAC region has many opportunities. Europe and Asia-Pacific follow North America's way. China (1.3 billion) and India (1.2 billion), the most populous countries in this region, contribute to the demand for diabetes care devices. According to the International Diabetes Federation, China had the most significant diof abetic patients, with around 96.2 million, and India had about 66.8 million diabetic patients. As of 2019, approximately 45% of the global diabetic population is from China and India. Many global diabetes care device companies are interested in investing in these countries. In India, 80 million people have Diabetes, and twenty percent suffer from prediabetes. Several awareness programs have been conducted to empower the Indian people to take control of their Diabetes. To maintain blood glucose levels, everyone should have accurate blood glucose management tools with the latest technology and be easy to use, which drives the market in this region. India has the second-largest diabetes population in the world, and this will be increased in the coming years. India has a high prevalence of prediabetes and undiagnosed Diabetes. In India, people are adopting digital health systems for the wellness and treatment of chronic diseases like Diabetes. The digital device can collect and store information on the person's glucose level for further evaluation. Most healthcare providers suggest using home-based kits to check glucose levels for continuous monitoring of glucose to avoid sudden problems like a heart attack or death.

Latin America has been estimated at USD 2.24 billion in 2024. It is projected to reach USD 3.08 billion by 2029, at a CAGR of 6.47% during the forecast period from 2024 to 2029. In Latin American countries, governmental policies and programs have been conducted for the diagnosis and treatment of Diabetes. There are successful approaches to the management of Diabetes in this region. Latin America has successfully used trained peer volunteers, mobile health tools, and community health workers to help diabetes patients.

The MEA accounted for a moderate share of the worldwide market in 2024 and is predicted to grow at a steady CAGR during the forecast period. Middle East & Africa is driven by the rising awareness about disease care and the increasing incidence of chronic diseases. The Middle East and North Africa currently witness 35.4 million people affected with Diabetes, reaching 72.1 million by 2040. The rest of the African region witnesses 14.2 million people affected with Diabetes, which is said to reach 34.2 million by 2040. People with Diabetes in this region are prone to the risk of premature mortality. Due to this, the government in the Middle East Africa region approves the devices used to check blood glucose and prevent death. In Saudi Arabia, nearly 30 million people have Diabetes.

KEY MARKET PLAYERS

The most promising companies dominating the global diabetes devices market profiled in this report are Roche Diagnostics, Johnson & Johnson, LifeScan, Inc. and Animas Inc., Becton-Dickinson, Novo Nordisk, Bayer AG, Abbott Laboratories, Ypsomed AG, Medtronic ple, insult Inc., Terumo Corporation, Tandem Diabetes Care, Inc. and Dexcom, Inc. (U.S.).

RECENT MARKET HAPPENINGS

- In 2022, Abbott, CamDiab, and Ypsomed partnered with one another to develop an integrated automated insulin delivery (AID) system to help reduce the burden of diabetes management for people with Diabetes.

- In 2022, Insulet Corporation announced that it had received a C.E. marking under the European Medical Device Regulation for its Omnipod 5 Automated Insulin Delivery System, which is used for individuals aged two years and above.

- In 2022, Labcorp launched a First-of-its-kind At-home collection device for diabetes testing. This is the new way of testing Diabetes at home using a small blood sample.

- In 2021, Nova Biomedical had an agreement with the Benelux. As a result, Nova will directly sell the BioProfile FLEX2 cell culture analyzers and introduce the company's critical care and point-of-care whole blood analyzers.

- In 2020, Abbott's FreeStyle Libre 14-day system was approved by the U.S. Food and Drug Administration (FDA) for continuous glucose monitoring (CGM) technology that can be used in the hospital setting during the COVID-19 pandemic. In addition, Abbott has partnered with the American Diabetes Association (ADA), Insulin for Life USA, and Diabetes Disaster Response Coalition to donate 25,000 FreeStyle Libre 14-day sensors.

- In 2020, DKSH Business Unit Healthcare partnered with LifeScan to provide blood glucose monitoring products and solutions for the treatment of Diabetes.

- In 2019, MySugr App & Accu-Chek Instant were introduced by Roche Diabetes Care India, which is helpful for people to know the sugar level in their bodies. People with Diabetes can easily control their blood sugar levels with the help of the mySugr App and Accu-Chek Instant when used together. Nearly 1 million individuals have downloaded the mySugr app and responded positively to the App usage. Indians use the new 'mySugr app' and Accu-Chek Instant across India to help diabetes patients with diabetes management.

- In 2018, Medtronic plc acquired Nutrino Health Ltd. (Israel). This acquisition made the company grow eventually and accelerated the company's leading position in the diabetes care devices market.

- In 2018, Roche Diagnostics partnered with Wellthy Therapeutics Private Limited (India). As a result, it extensively offered a digital-based diabetes coaching solution using artificial intelligence for the Accu-chek active system users.

- In 2017, the MiniMed 670G Insulin Pump System was launched by Medtronic.

- In March 2018, the Food and Drug Administration (FDA) approved Guardian (T.M.) Connect, launched by Medtronic PLC for diabetes patients aged 17-75, as a continuous glucose monitoring system.

MARKET SEGMENTATION

This research report on the global diabetes devices market has been segmented and sub-segmented based on the type and region.

By Type

- Glucose Monitoring Devices

- Self-Blood Glucose Monitoring Devices

- Glucose Meters

- Test Strips

- Lancets

- Hemoglobin A1C Testing Kits

- Continuous Glucose Monitoring Devices

- Self-Blood Glucose Monitoring Devices

- Insulin Delivery Systems

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Jet Injectors

- Control Solutions

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which segment by type dominated the diabetes devices market in 2024?

The global market size for diabetes devices was worth USD 24.14 billion in 2024 and is forecasted to reach USD 37.87 billion by 2032.

Who are the major players in the global diabetes devices market?

Based on type, the glucose monitoring devices segment accounted for a dominating share of the global diabetes devices market in 2024.

Which geographical region is growing the fastest in the global diabetes devices market?

Roche Diagnostics, Johnson & Johnson, LifeScan, Inc. and Animas Inc., Becton-Dickinson, Novo Nordisk, Bayer AG, Abbott Laboratories, Ypsomed AG, Medtronic plc, Insulet Inc., Terumo Corporation, Tandem Diabetes Care, Inc. and Dexcom, Inc. (U.S.) are a few of the notable players in the global diabetes devices market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com