Global Digital Diabetes Management Market Size, Share, Trends & Growth Forecast Report By Type, Product & Service, End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033.

Global Digital Diabetes Management Market Size

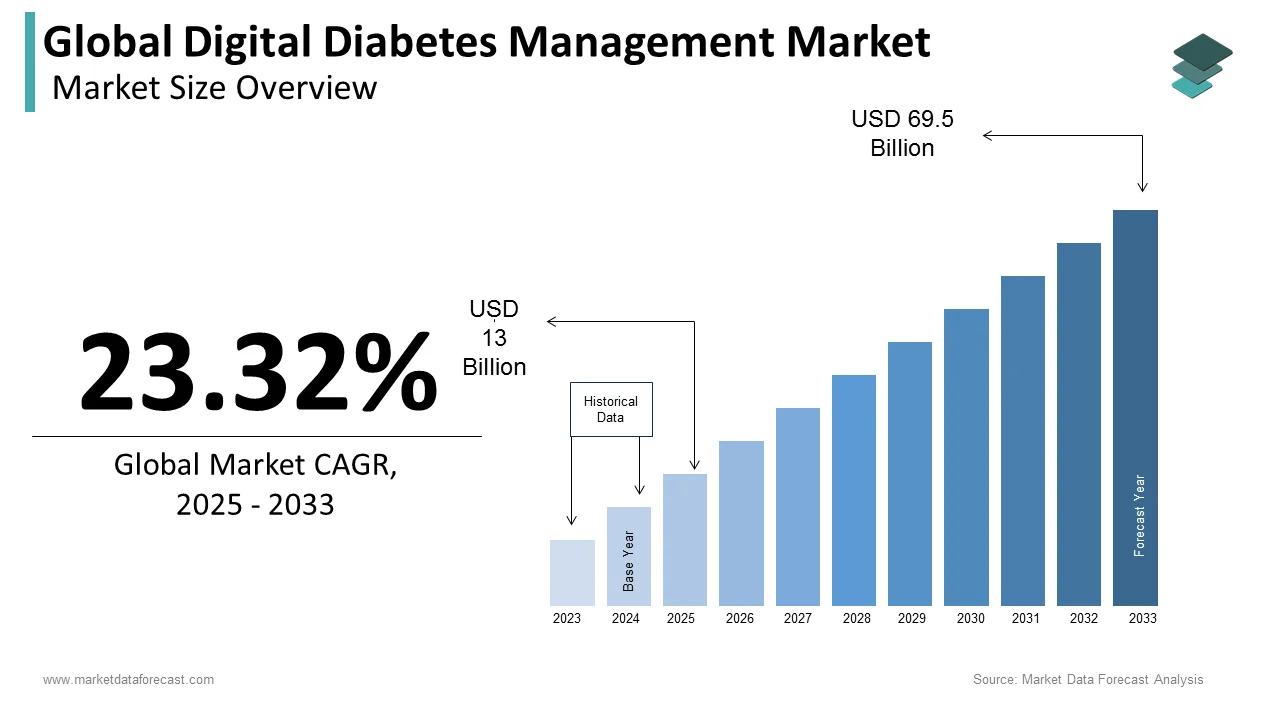

The size of the global digital diabetes management market was valued at USD 10.5 billion in 2024. The global market is anticipated to grow at a CAGR of 23.32% from 2025 to 2033 and be worth USD 69.5 billion by 2033 from USD 13 billion in 2025.

MARKET DRIVERS

Growing Prevalence of Diabetes Worldwide

The number of people suffering from diabetes worldwide is growing significantly with each year passing. As per the statistics published by the IDF (International Diabetes Federation), there were 463 million patients diagnosed with diabetes, which is estimated to increase by 700 million by 2045. The diabetes prevalence rose by 157% between 2000 and 2019. WHO says an estimated 1.5 million deaths worldwide in 2019 have a connection with diabetes. Patients suffering from diabetes are required to take ongoing management and monitoring, which is a complex task for the patients. People have been using solutions such as digital diabetes management, which offers real-time feedback, personalized recommendations, and remote monitoring. Digital technologies such as digital diabetes management help diabetic patients manage their blood glucose levels better, track their physical activity and diet, and manage their medications. Digital diabetes management solutions further help diabetic patients reduce their healthcare costs and achieve improved healthcare outcomes. The demand for innovative healthcare solutions such as digital diabetes management grows with the increasing diabetic patient population worldwide. The popularity of digital diabetes management solutions has increased notably in recent years, and this trend is expected to be fueled in the coming years and contribute to market growth.

Technological Advancements In Diabetes Monitoring

Technological advancements such as wearable medical devices, mobile health applications, and cloud-based platforms have brought several positive changes to digital diabetes management solutions and have made it easier for patients to monitor their blood glucose levels, track their physical activity, and manage their medications. The rising demand for personalized care for diabetic patients is another major factor propelling the digital diabetes management market growth. Diabetic patients need personalized care to manage their condition effectively, and digital diabetes management solutions analyze the patients' data and offer personalized recommendations for diet, exercise, and medication management.

The growing usage of telemedicine boosts market growth. Digital diabetes management solutions can be integrated into telemedicine platforms and thus provide remote monitoring and healthcare for diabetic patients. The growing number of initiatives by governments to promote the usage of digital healthcare solutions, such as digital diabetes management, drive market growth. For instance, the Centers for Medicare and Medicaid Services (CMS) in the U.S. has reimbursement policies for digital diabetes management solutions for patients.

The growing healthcare expenditure, increasing awareness among patients regarding the benefits of digital diabetes management solutions, rising emphasis on prevention, growing demand for AI-powered digital diabetes management solutions, and rising usage of data analytics fuel the growth rate of the market. Furthermore, the growing focus on patient engagement, rising demand for home healthcare for chronic diseases such as diabetes, and shift towards value-based care support the market growth.

MARKET RESTRAINTS

High costs & inadequate reimbursement policies for digital diabetes management solutions in some countries majorly hamper the market growth. Poor awareness among patients and healthcare providers regarding the potential benefits of these solutions is another major roadblock to the market’s growth rate. Regulatory hurdles, including requirements for clinical trials and approval by regulatory agencies, further impede market growth. Privacy and security concerns and interoperability issues are anticipated to have a negative impact on market growth in the coming years.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Products & Services, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Medtronic (Ireland), B. Braun (Germany), Dexcom (United States), Abbott Laboratories (United States) |

SEGMENTAL ANALYSIS

By Type Insights

The wearable devices segment had the leading share of the global market in 2024 and is predicted to occupy a dominating share of the global digital diabetes management market during the forecast period owing to the growing prevalence of diabetes and the rising demand for real-time monitoring of glucose levels. Factors such as the growing demand for the use of convenient devices and reliable devices and rapid adoption of technological advancements such as advanced technologies such as artificial intelligence (AI) to develop innovative and effective wearable devices primarily fuel segmental growth. The growing usage of self-administering insulin delivery devices for diabetes management and the increasing number of product launches by market participants boost the growth rate of the segment.

On the other hand, the handheld devices segment is anticipated to witness a healthy CAGR during the forecast period. The affordability and ease of use of handheld devices majorly drive the segmental growth. The growing adoption of smartphones and the availability of mobile apps for diabetes management is further contributing to the segmental growth.

By Product and Service Insights

The devices segment led the market in 2024 and is expected to register a promising CAGR during the forecast period. The rising prevalence of diabetes, increasing awareness of self-monitoring and technological advancements in digital diabetes management devices primarily propel the segmental growth. Under the sub-segments, the smart glucose meters segment is the most lucrative and is expected to register a healthy CAGR during the forecast period. The continuous glucose monitoring meters segment is expected to grow at a healthy CAGR during the forecast period due to their consistency with smart devices, which act as display devices, and favorable government policies in developed countries in promoting CGM systems. Furthermore, the smart insulin pens segment is predicted to have lucrative possibilities to explore to the next level due to factors such as the growing number of product launches related to the digital healthcare of AI.

The applications segment had a considerable share of the worldwide market in 2024 and is estimated to register a healthy CAGR during the forecast period. Under the sub-segments, diabetes & blood glucose tracking segment held a notable share of the worldwide market in 2024 and is predicted to register a healthy CAGR in the coming years owing to the growing concern towards healthcare among people and the increasing number of patients suffering from diabetes. The weight and diet management segment is expected to hold a considerable share of the global market during the forecast period owing to factors such as growing awareness about chronic diseases such as diabetes and other difficulties related to it.

By End-User Insights

The individual/home healthcare segment had the largest share of the global market in 2024 and is expected to dominate the global digital diabetes management market during the forecast period. The rising trend of self-monitoring and self-management of diabetes and the growing adoption of wearable devices and diabetes management apps majorly accelerate segmental growth. The convenience of managing diabetes at home, reduced healthcare costs, and the ability to access personalized diabetes management solutions further contribute to the segmental growth.

The hospitals and specialty diabetes clinics segment accounted for the second-largest share of the worldwide market in 2024 and is predicted to witness a healthy CAGR during the forecast period. The rising need for diabetes management solutions, the availability of advanced diabetes management technologies, and the rising need for accurate and real-time glucose monitoring in hospital settings favor segmental growth.

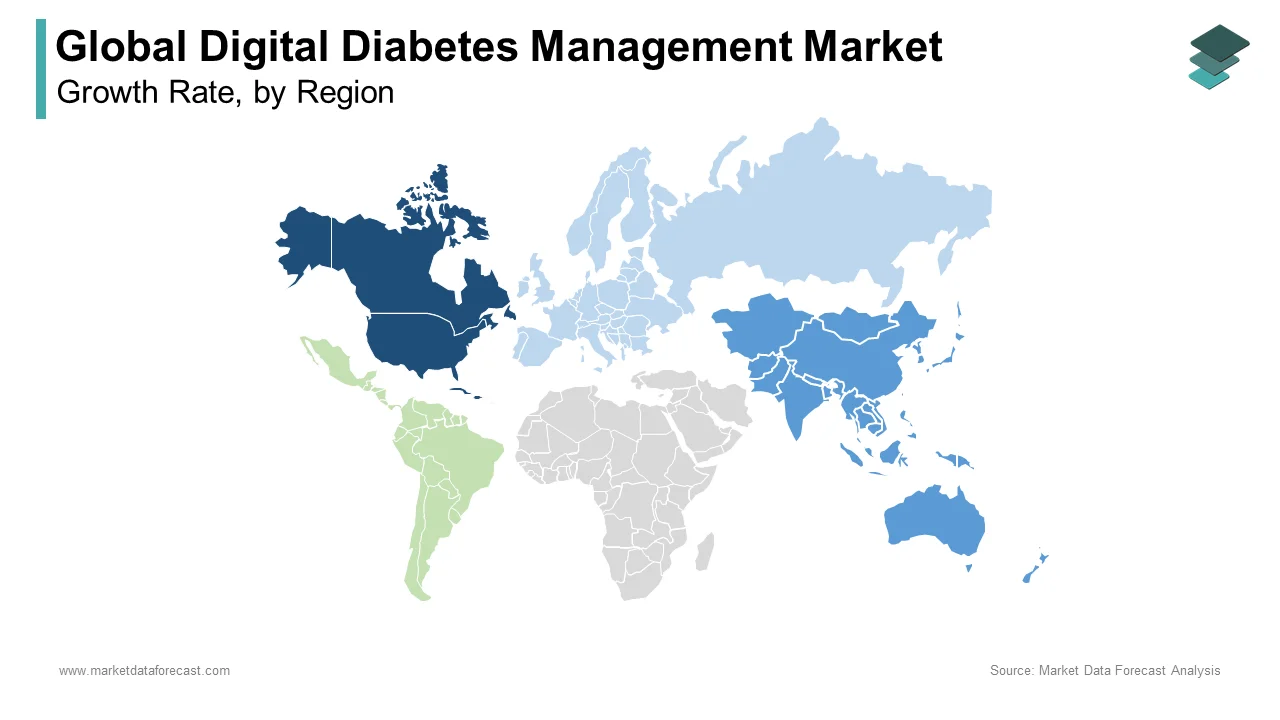

REGIONAL ANALYSIS

North America was the most dominating regional market in the global market in 2024. The domination of the North American region is anticipated to continue throughout the forecast period. The growing diabetic population across the North American region, the presence of well-established healthcare infrastructure with advanced technologies, the presence of international market participants and favorable reimbursement policies for diabetes management solutions majorly propel the North American market growth. The growing adoption of wearable devices and diabetes management apps and the rising trend of self-monitoring and self-management of diabetes further boost the growth rate of the North American market. The U.S. held the major share of the North American market in 2024 and is expected to grow promisingly during the forecast period owing to the rising prevalence of diabetes, favorable reimbursement policies and a well-established healthcare infrastructure. The Canadian market is projected to register healthy growth during the forecast period as the diabetic population in Canada is growing at a significant pace.

The Asia Pacific market captured the second largest share of the global market in 2024and is estimated to grow at the highest CAGR during the forecast period owing to the growing patient population, the emergence of the latest technologies in the medical sector and rising support from the governments of APAC countries. Factors such as rapidly developing healthcare infrastructure, increasing healthcare spending, rising adoption of digital healthcare technologies, favorable government initiatives and policies for diabetes management, rising demand for personalized diabetes management solutions and the presence of emerging players offering innovative digital diabetes management solutions accelerate the digital diabetes management market growth in the Asia-Pacific region. China occupied the leading share of the APAC market in 2024 and is estimated to grow at a healthy CAGR during the forecast period.

Europe is forecasted to account for a substantial share of the global market during the forecast period due to the rising prevalence of diabetes, increasing aging population and favorable government initiatives and policies for diabetes management. The presence of a well-established healthcare infrastructure and advanced technologies, growing demand for personalized diabetes management solutions, rising awareness about diabetes self-management and the benefits of digital solutions and availability of advanced data management software and platforms further contribute to the European market growth. Germany captured a major share of the European market in 2024.

Latin America accounted for a considerable share of the worldwide market in 2024 and is expected to register a healthy CAGR during the forecast period owing to the rising prevalence of diabetes in the Latin American region, increasing awareness about diabetes self-management and the benefits of digital solutions, rising Increasing healthcare spending and increasing number of initiatives by the governments of Latin American countries to develop the healthcare infrastructure. Brazil led the market in Latin America in 2024.

The Middle East and Africa are deemed to have substantial growth opportunities in the coming years.

KEY MARKET PARTICIPANTS

Leading companies operating in the global digital diabetes management market are Medtronic (Ireland), B. Braun (Germany), Dexcom (United States), Abbott Laboratories (United States), Roche Diagnostics (Switzerland), Insulet Corporation (United States), Tandem Diabetes Care (United States), Ascensia Diabetes Care (Switzerland), LifeScan (United States), Tidepool (United States), AgaMatrix (United States), Glooko Inc. (United States), and DarioHealth (Israel).

RECENT HAPPENINGS IN THE MARKET

- In June 2020, Abbott Laboratories received FDA clearance for its new continuous glucose meter, Freestyle Libre2. This new device is another challenge for CGM in the growing market. The new device is used in children above 4 years and adults, too, and is applied on the back of the upper arm. This new version adds an advantage for users in setting the alarm for people whose glucose levels are too high or low.

- In February 2020, Dexcom collaborated with DreaMed to couple Dexcom continuous glucose monitors. The DreaMed Advisor is a digital solution that generates insulin delivery by investigating continuous glucose monitoring, self-monitoring blood glucose, and insulin delivery devices.

- In April 2020, Roche Diagnostics announced free access to the mySugr Pro app to assist millions of people who have diabetes in maintaining their personalized daily diabetes during the COVID-19 crisis.

MARKET SEGMENTATION

This research report on the global digital diabetes management market has been segmented and sub-segmented based on type, products & services, end-user, and region.

By Type

- Wearable Devices

- Handheld Devices

By Product and Service

- Devices

- Smart Glucose Meters

- Continuous Glucose Monitoring Systems

- Smart Insulin Pens

- Smart Insulin Pumps/Closed-Loop Systems and Smart Insulin Patches

- Applications

- Digital Diabetes Management Apps

- Diabetes and Blood Glucose Tracking Apps

- Weight and Diet Management Apps

- Data Management Software and Platforms

- Services

By End-User

- Individual/Home Healthcare

- Hospitals and Specialty Diabetes Clinics

- Academic and Research Institutes

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How much is the global digital diabetes management market going to be worth by 2032?

As per our research report, the global digital diabetes management market size is projected to be USD 69.5 billion by 2033.

Which region is growing the fastest in the global digital diabetes management market?

Geographically, the North American digital diabetes management market accounted for the largest share of the global market in 2024.

At What CAGR, the global digital diabetes management market is expected to grow from 2025 to 2033?

The global digital diabetes management market is estimated to grow at a CAGR of 23.32% from 2025 to 2033.

Which are the significant players operating in the digital diabetes management market?

Insulet Corporation (United States), Tandem Diabetes Care (United States), Ascensia Diabetes Care (Switzerland), LifeScan (United States), Tidepool (United States), AgaMatrix (United States), Glooko Inc. (United States) are some of the significant players operating in digital diabetes management market,

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com