Europe Feed Palatability Enhancers Market Size, Share, Trends, Growth & Analysis Research Report Segmented By Type, Livestock And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Feed Palatability Enhancers Market Size

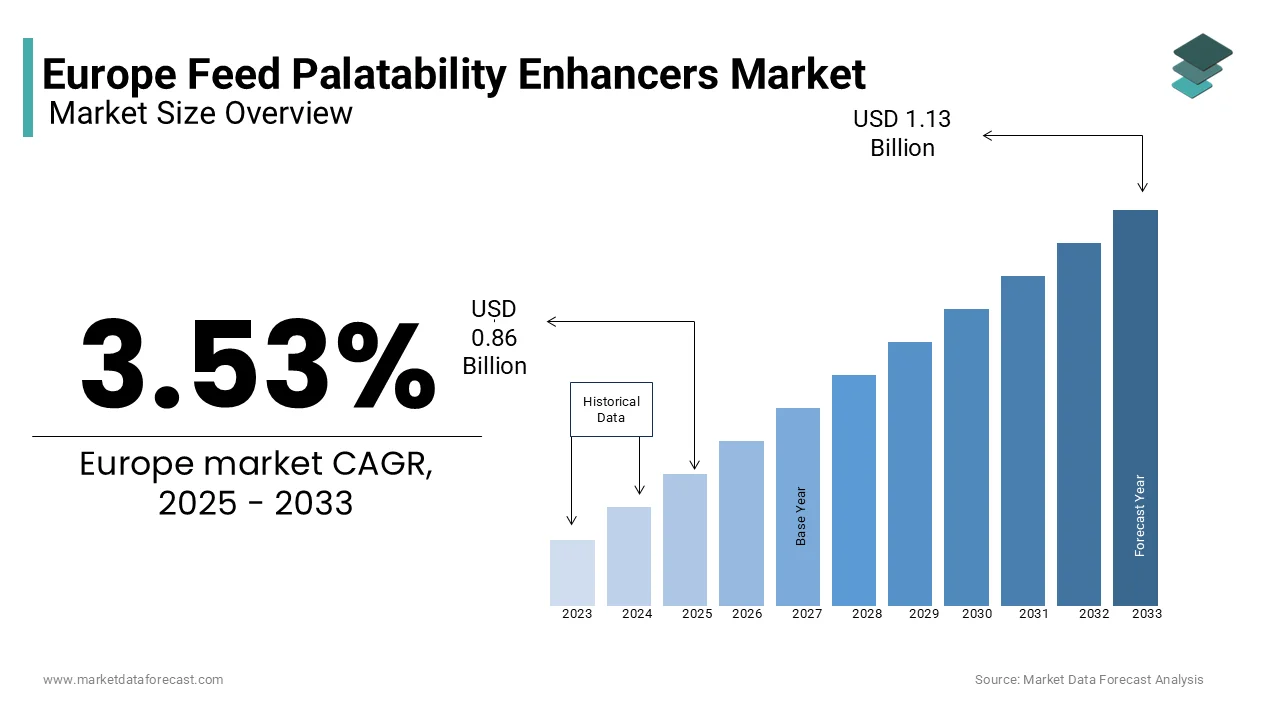

Europe's feed palatability enhancers market was valued at USD 0.83 billion in 2024 and is anticipated to reach USD 0.86 billion in 2025 from USD 1.13 billion by 2033, growing at a CAGR of 3.53% during the forecast period from 2025 to 2033.

Feed palatability enhancers are used to improve the taste and appeal of animal feed to enhance consumption rates among livestock. These enhancers include a variety of additives such as flavors, sweeteners, and aroma enhancers, which are designed to stimulate the appetite of animals, thereby promoting better feed intake and overall health. The market is driven by the increasing demand for high-quality animal products, including meat, dairy, and eggs, as consumers become more health-conscious and discerning about food quality. The advancements in feed formulation technologies and a growing awareness of the importance of palatability in animal nutrition are fuelling the demand for feed palatability enhances in Europe. As the livestock industry continues to evolve, the focus on optimizing feed efficiency and animal welfare will play a pivotal role in shaping the future of the feed palatability enhancers market in Europe.

MARKET DRIVERS

Increasing Demand for High-Quality Animal Products in Europe

The rising demand for high-quality animal products is one of the key factors propelling the growth of the Europe feed palatability enhancers market. As consumers become more health-conscious and seek premium meat, dairy, and egg products, livestock producers are compelled to enhance the quality of their offerings. According to a report by the European Commission, the demand for organic and high-quality animal products has increased by approximately 20% over the past five years. This trend is prompting farmers to invest in feed additives that improve the palatability of their products, ensuring that animals consume adequate amounts of feed to achieve optimal growth and health. Enhanced feed palatability not only improves feed intake but also contributes to better nutrient absorption, leading to healthier livestock and higher-quality products. As the market for premium animal products continues to expand, the demand for feed palatability enhancers is expected to grow significantly, positioning this segment for robust growth in the coming years.

Focus on Animal Health and Welfare

The growing focus on animal health and welfare is boosting the expansion of the Europe feed palatability enhancers market. As consumers increasingly prioritize ethical and sustainable farming practices, livestock producers are under pressure to ensure the well-being of their animals. According to the World Animal Protection organization, approximately 70% of consumers in Europe consider animal welfare when making purchasing decisions related to meat and dairy products. This heightened awareness is driving farmers to adopt practices that promote animal health, including the use of palatability enhancers in feed formulations. By improving feed intake and encouraging animals to consume their rations, these enhancers play a crucial role in maintaining optimal health and reducing the incidence of diseases. Furthermore, the European Union's regulations on animal welfare are prompting producers to invest in high-quality feed solutions that support the overall well-being of livestock. As the emphasis on animal health and welfare continues to grow, the demand for feed palatability enhancers is expected to rise, driving market expansion.

MARKET RESTRAINTS

Regulatory Challenges and Compliance Issues

Regulatory challenges and compliance issues are hampering the growth of the Europe feed palatability enhancers market. The feed industry is subject to stringent regulations regarding the use of additives, which can complicate the formulation and approval processes for new products. The European Food Safety Authority (EFSA) imposes rigorous safety assessments and evaluations for feed additives, which can lead to lengthy approval timelines and increased costs for manufacturers. According to industry estimates, approximately 30% of feed additive applications face delays due to regulatory hurdles, impacting the ability of companies to bring innovative products to market. Additionally, the evolving regulatory landscape, including potential changes in safety standards and labeling requirements, adds further complexity for manufacturers. As companies navigate these regulatory challenges, the potential for increased operational costs and delays in product launches may hinder growth in the feed palatability enhancers market.

Market Competition and Price Sensitivity

Intense market competition and price sensitivity are inhibiting the growth of the Europe feed palatability enhancers market. The presence of numerous players in the market has led to increased competition, resulting in downward pressure on prices. According to market analyses, the average selling price of feed palatability enhancers has declined by approximately 10% over the past three years due to competitive pricing strategies. This price competition can make it difficult for manufacturers to maintain profitability while investing in research and development to innovate and improve their product offerings. Additionally, the growing trend towards cost-effective feed solutions among livestock producers further exacerbates this challenge, as many are seeking to minimize expenses without compromising on quality. As companies strive to differentiate themselves in a crowded market, they must balance the need for competitive pricing with the imperative to deliver high-quality, effective products. This challenge requires strategic planning and investment in marketing and product development to ensure long-term sustainability in the feed palatability enhancers market.

MARKET OPPORTUNITIES

Growth of the Organic Livestock Sector

The growth of the organic livestock sector is a major opportunity for the Europe feed palatability enhancers market. As consumer demand for organic and sustainably produced animal products continues to rise, livestock producers are increasingly seeking high-quality feed solutions that align with organic farming practices. According to the European Commission, the organic livestock market in Europe has grown by over 25% in the past five years, reflecting a shift in consumer preferences towards organic products. This trend is driving the demand for feed palatability enhancers that are compliant with organic standards, such as natural flavors and sweeteners derived from plant sources. As organic farming practices gain traction, the feed palatability enhancers market is well-positioned to capitalize on this growth, providing innovative solutions that enhance feed intake and support the health of organic livestock. The emphasis on sustainability and quality in the organic sector will continue to drive demand for palatability enhancers, creating lucrative opportunities for manufacturers in this evolving market.

Technological Advancements in Feed Formulation

Technological advancements in feed formulation are another promising opportunity for the Europe feed palatability enhancers market. Innovations in feed processing technologies, such as extrusion and pelleting, are enabling manufacturers to create more palatable and digestible feed products. These advancements not only enhance the palatability of feed but also improve nutrient absorption and overall animal health. Additionally, the integration of data analytics and precision nutrition in feed formulation is allowing producers to tailor feed solutions to the specific needs of different livestock species, further enhancing feed efficiency and palatability. As the industry continues to embrace technological innovations, the feed palatability enhancers market is poised for significant growth, providing opportunities for manufacturers to develop cutting-edge products that meet the evolving demands of livestock producers.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions have emerged as a significant challenge for the Europe feed palatability enhancers market, particularly in the wake of the COVID-19 pandemic. The pandemic has exposed vulnerabilities in global supply chains, leading to delays in the delivery of raw materials and increased costs. According to a survey conducted by the European Feed Manufacturers' Federation, approximately 65% of feed manufacturers reported experiencing supply chain issues in 2021, with many citing difficulties in sourcing key ingredients for palatability enhancers. These disruptions can hinder production schedules, increase operational costs, and ultimately impact the overall growth of the feed palatability enhancers market. Furthermore, geopolitical tensions and trade restrictions can exacerbate supply chain challenges, leading to further uncertainty in the availability of essential materials. As the industry grapples with these supply chain issues, stakeholders must develop strategies to mitigate risks and ensure a stable supply of materials to support ongoing and future projects.

Consumer Awareness and Education

Consumer awareness and education is another major challenge for the Europe feed palatability enhancers market. As consumers become more informed about animal nutrition and welfare, there is an increasing demand for transparency regarding the ingredients used in animal feed. According to a survey by the European Consumer Organisation, approximately 70% of consumers express concern about the additives used in animal feed and their potential impact on animal health and product quality. This heightened scrutiny can lead to skepticism regarding the use of palatability enhancers, particularly synthetic additives. As a result, manufacturers must invest in consumer education and transparency initiatives to build trust and demonstrate the safety and efficacy of their products. Additionally, the growing trend towards natural and organic products may further challenge the acceptance of certain palatability enhancers, necessitating a shift towards more natural formulations. As the market navigates these challenges, companies must prioritize consumer education and transparency to ensure the continued growth and acceptance of feed palatability enhancers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.53% |

|

Segments Covered |

By Type, Livestock and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

Associated British Foods PLC, Diana Group, E. I. Dupont. Eli Lilly and Company, Ferrer, Kemin Europa, Kent Feeds Inc., Kerry Group PLC, Ensign-Bickford Industries Inc., and Tanke International Group. |

SEGMENTAL ANALYSIS

By Type Insights

The flavors segment captured 51.7% of the Europe feed palatability enhancers market share in 2024. Flavors are essential in enhancing the taste and aroma of animal feed, making it more appealing to livestock and encouraging higher feed intake. The demand for flavors is driven by the increasing focus on improving animal performance and health, as well as the growing awareness of the importance of palatability in feed formulations. As livestock producers continue to prioritize feed efficiency and animal welfare, the flavors segment is expected to maintain its leading position in the feed palatability enhancers market, supporting the overall growth of the industry.

The aroma enhancers segment is projected to grow at a healthy CAGR in the Europe feed palatability enhancers market over the forecast period. Aroma enhancers play a crucial role in stimulating the appetite of livestock by providing appealing scents that attract animals to their feed. The increasing demand for high-quality animal products and the focus on optimizing feed intake are driving the growth of this segment. The aroma enhancers segment is expected to capture a larger share of the market as livestock producers recognize the benefits of incorporating these additives into their feed formulations. As the industry continues to innovate and develop effective aroma-enhancing solutions, this segment is well-positioned for significant growth in the coming years.

By Livestock Insights

The poultry segment occupied the leading share of 45.5% of the European market in 2024. The poultry industry is a significant consumer of feed palatability enhancers, as improving feed intake is crucial for optimizing growth rates and overall health in birds. The increasing demand for poultry products, driven by rising consumer preferences for chicken and eggs, is propelling the growth of this segment. According to the European Commission, poultry meat production in the EU is projected to reach approximately 13 million tons by 2025, reflecting a steady increase in consumption. The use of palatability enhancers, such as flavors and aroma enhancers, is essential in ensuring that poultry consume adequate amounts of feed, which directly impacts their growth performance and feed conversion efficiency. Additionally, the focus on animal welfare and health in poultry farming is driving producers to invest in high-quality feed solutions that enhance palatability. As the poultry sector continues to expand, the demand for feed palatability enhancers is expected to grow significantly, reinforcing its position as the largest segment in the market.

The aquaculture segment is anticipated to exhibit a CAGR of 7.17% over the forecast period in the European market. The aquaculture industry is experiencing rapid growth due to the increasing global demand for seafood and the need for sustainable fish farming practices. According to the Food and Agriculture Organization (FAO), global aquaculture production is expected to reach 100 million tons by 2025, with Europe playing a significant role in this expansion. The use of palatability enhancers in aquaculture feed is critical for improving feed intake and growth rates in fish and other aquatic species. As aquaculture producers seek to optimize feed efficiency and enhance the health of their stock, the demand for effective palatability enhancers is on the rise. The importance of this segment lies in its potential to support sustainable aquaculture practices while meeting the growing consumer demand for high-quality seafood. As the industry continues to innovate and develop specialized feed solutions, the aquaculture segment is well-positioned for substantial growth in the coming years.

COUNTRY ANALYSIS

Germany captured the major share of the Europe feed palatability enhancers market in 2024. The robust livestock sector in Germany, particularly in poultry and swine production, significantly contributes to this dominance. According to the German Federal Ministry of Food and Agriculture, the country produced over 6 million tons of poultry meat in 2021, underscoring the critical role of feed palatability enhancers in optimizing feed intake and animal health. Additionally, Germany's commitment to sustainability and animal welfare is driving the adoption of high-quality feed solutions that enhance palatability. The increasing focus on improving livestock productivity and health is prompting producers to invest in innovative feed additives, further solidifying Germany's position as a market leader. As the demand for high-quality animal products continues to grow, the feed palatability enhancers market in Germany is expected to maintain its strong growth trajectory.

France was the second-largest market for feed palatability enhancers in Europe in 2024. The French livestock sector is characterized by significant investments in animal nutrition, particularly in the poultry and cattle industries. According to the French Ministry of Agriculture, the country produced around 1.5 million tons of poultry meat in 2021, reflecting a strong demand for effective feed solutions. The emphasis on improving animal welfare and health is driving French producers to adopt palatability enhancers that promote better feed intake and overall livestock performance. Furthermore, France's focus on sustainability and organic farming practices is influencing the development of natural feed additives, aligning with consumer preferences for high-quality animal products. As the French market continues to evolve, the demand for feed palatability enhancers is expected to grow, reinforcing France's position as a key player in the European market.

Italy is predicted to account for a prominent share of the European feed palatability enhancers market over the forecast period. The Italian livestock sector is diverse, with significant production in poultry, swine, and dairy. According to the Italian National Institute of Statistics, the country produced over 1.3 million tons of poultry meat in 2021, highlighting the importance of effective feed solutions in optimizing livestock performance. The increasing focus on animal health and welfare in Italy is driving the demand for palatability enhancers that improve feed intake and overall animal well-being. Additionally, Italy's strategic location within Europe facilitates trade and distribution, further enhancing its position in the feed palatability enhancers market. As the country continues to invest in modernization and innovation in animal nutrition, the demand for feed palatability enhancers is expected to rise, contributing to the overall growth of the market.

The United Kingdom is also a key player in the Europe feed palatability enhancers market and is predicted to account for a considerable share of the European market over the forecast period. The UK livestock sector is characterized by a diverse range of applications, including poultry, cattle, and swine production. According to the UK Department for Environment, Food & Rural Affairs, the country produced around 1.8 million tons of poultry meat in 2021, reflecting a strong demand for high-quality feed solutions. The emphasis on improving animal welfare and health is driving UK producers to invest in palatability enhancers that promote better feed intake and overall livestock performance. Furthermore, the UK's commitment to sustainability and regulatory compliance is influencing the development of eco-friendly feed additives, aligning with broader market trends. As the UK navigates post-Brexit challenges, the feed palatability enhancers market is expected to adapt and evolve, presenting opportunities for growth.

Spain is projected to grow at a healthy CAGR in the European feed palatability enhancers market over the forecast period. The Spanish livestock sector is experiencing significant growth, driven by a resurgence in poultry and swine production. According to the Spanish Ministry of Agriculture, the country produced over 1.4 million tons of poultry meat in 2021, highlighting the importance of effective feed solutions in optimizing livestock performance. The increasing focus on sustainable farming practices and the demand for high-quality animal products are propelling the growth of feed palatability enhancers in Spain. Additionally, Spain's growing e-commerce sector is driving the need for innovative feed solutions that enhance animal health and productivity. As the country continues to develop its industrial capabilities and invest in sustainable practices, the demand for feed palatability enhancers is anticipated to rise, reinforcing its position in the European market.

KEY MARKET PLAYERS

Associated British Foods PLC, Diana Group, E. I. Dupont. Eli Lilly and Company, Ferrer, Kemin Europa, Kent Feeds Inc., Kerry Group PLC, Ensign-Bickford Industries Inc., and Tanke International Group. are the market players tht are dominating the Europe feed palatability enhancers market.

MARKET SEGMENTATION

This research report on the European feed palatability enhancers market is segmented and sub-segmented into the following categories.

By Type

- Flavors

- Sweeteners

- Aroma Enhancers

By Livestock

- Swine

- Poultry

- Cattle

- Pets

- Aquaculture

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

Why are feed palatability enhancers important in animal nutrition?

They improve feed taste and aroma, ensuring better consumption, digestion, and overall livestock growth, leading to higher productivity in meat and dairy industries.

What key trends are shaping the European feed palatability enhancers market?

The rise in high-quality animal feed demand, increased focus on pet nutrition, growing livestock farming, and regulatory shifts toward natural additives.

Which animal segments benefit the most from feed palatability enhancers?

Primarily used in swine, poultry, ruminants, and pet food, with a growing emphasis on enhancing feed intake efficiency and animal health.

How are European regulations influencing the feed palatability industry?

Strict EU regulations on artificial additives are pushing manufacturers toward natural flavoring agents, leading to innovation in plant-based and organic enhancers.

Who are the leading companies in the European feed palatability enhancers market?

Key players include DuPont, Kerry Group, Symrise, Kemin Industries, and Nutriad, focusing on R&D for sustainable and effective feed solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]