Europe Home Improvement Market Size, Share, Trends & Growth Forecast Report By Home Section (Disaster Repairs, Bath Improvement & Additions, Kitchen Improvement & Additions, Disaster Repairs, Exterior Replacements, System Upgrades, Property Improvements, and Others), Type, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Home Improvement Market Size

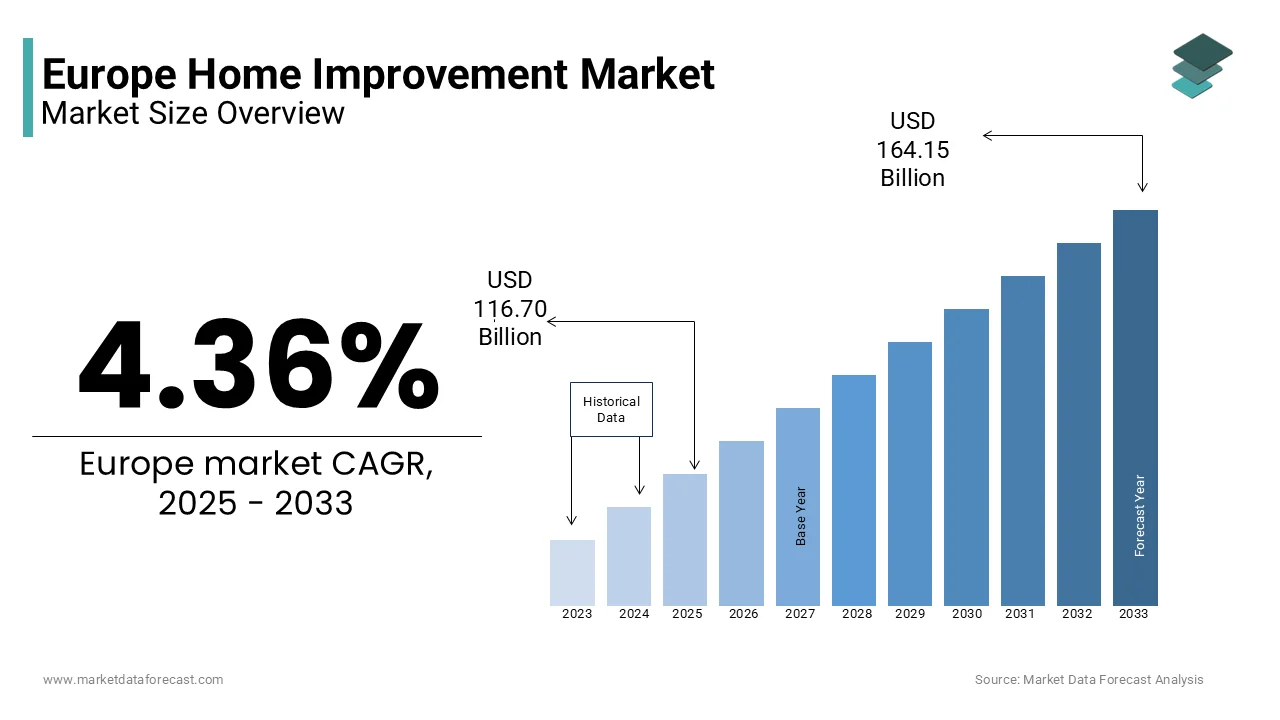

The Europe Home Improvement market size was valued at USD 111.82 billion in 2024. The European market is estimated to be worth USD 164.15 billion by 2033 from USD 116.70 billion in 2025, growing at a CAGR of 4.36% from 2025 to 2033.

The European home improvement market is driven with a robust consumer base and evolving housing trends. As per Eurostat, over 70% of households in the EU own their homes by creating a fertile ground for home improvement activities. The market is further bolstered by urbanization rates exceeding 75% in countries like Germany and France, where homeowners prioritize modernizing living spaces. Rising environmental awareness has also influenced demand, with energy-efficient renovations accounting for nearly 25% of all projects, as per the European Commission. Another notable trend is the increasing preference for smart home technologies, which saw a 15% year-on-year adoption rate in 2022. These factors collectively shape a dynamic market environment characterized by innovation and sustainability.

MARKET DRIVERS

Rising Demand for Energy-Efficient Renovations

The energy efficiency has emerged as a pivotal driver for the European home improvement market. According to the International Energy Agency (IEA), residential buildings account for nearly 40% of the EU’s total energy consumption is prompting governments to incentivize eco-friendly upgrades. For instance, the German government allocated €10 billion in subsidies for energy-efficient renovations in 2022 is leading to a 20% surge in such projects. Households are increasingly adopting solutions like thermal insulation and solar panel installations, with investments in these areas reaching €25 billion across Europe in 2023. Additionally, the European Green Deal mandates that all new buildings must be carbon-neutral by 2030, further propelling demand. This regulatory push, coupled with rising energy costs, has made energy-efficient renovations a top priority for homeowners is driving substantial market growth.

Aging Housing Stock and Renovation Needs

Europe’s aging housing infrastructure is another significant driver of the home improvement market. According to Eurostat, over 40% of residential buildings in the EU were constructed before 1970 is necessitating extensive repairs and modernizations. In countries like Italy and Spain, this percentage exceeds 50% is creating a pressing need for upgrades. The European Mortgage Federation reports that renovation spending in these regions grew by 12% annually between 2019 and 2022. Moreover, initiatives like the Renovation Wave Strategy aim to renovate 35 million buildings by 2030 by providing a clear roadmap for market expansion. Homeowners are investing heavily in structural improvements, with kitchen and bathroom renovations accounting for nearly 30% of total spending. This convergence of aging infrastructure and policy-driven incentives fuels sustained demand.

MARKET RESTRAINTS

Economic Uncertainty and Inflationary Pressures

The Economic instability and inflation have emerged as significant restraints for the European home improvement market. According to the European Central Bank, inflation rates in the Eurozone averaged 8.4% in 2022 by causing a sharp increase in raw material costs. Steel and aluminum prices surged by 25% and 18%, is impacting the affordability of construction materials. This cost escalation has deterred many homeowners from initiating large-scale projects, with discretionary spending on home improvements declining by 10% in 2023, as per Deloitte. Furthermore, rising interest rates have limited access to affordable financing by making loans for renovations less accessible.

Skilled Labor Shortages

The scarcity of skilled labor presents another critical challenge for the market. According to Eurofound, the construction sector faces a workforce deficit of approximately 1.2 million workers across Europe. This shortage is particularly acute in countries like the UK and Germany, where Brexit and demographic shifts have exacerbated the issue. The lack of qualified professionals has led to project delays and increased labor costs, which rose by an average of 15% in 2022. Additionally, younger generations are less inclined to pursue careers in manual trades that is also hinder the growth of the market. This labor bottleneck not only hampers timely project completion but also drives up overall expenses by discouraging homeowners from undertaking complex renovations.

MARKET OPPORTUNITIES

Smart Home Integration

The integration of smart home technologies represents a transformative opportunity for the European home improvement market. The increasing consumer demand for convenience and security is ascribed to boost the growth of the market. Devices like smart thermostats, lighting systems, and voice-controlled appliances are gaining traction, with over 30% of households in countries like Sweden and Denmark already adopting such solutions. The European Commission estimates that smart home installations could reduce household energy consumption by up to 20%, aligning with broader sustainability goals. Furthermore, partnerships between tech companies and home improvement retailers are simplifying access to these innovations by creating lucrative avenues for market players.

Urbanization and Compact Living Solutions

Urbanization trends offer another promising opportunity in densely populated cities. According to the United Nations, urban areas in Europe are expected to house 80% of the population by 2030 by driving demand for space optimization solutions. Products like modular furniture, wall-mounted storage systems, and multi-functional designs are witnessing a 25% annual growth rate, as per PwC. Cities like Paris and Berlin are seeing a surge in compact living renovations, with investments in such projects reaching €15 billion in 2023. Additionally, the rise of co-living spaces and micro-apartments is fueling demand for innovative design solutions is presenting a unique niche for market players to capitalize on.

MARKET CHALLENGES

Regulatory Hurdles and Compliance Costs

Navigating stringent regulations poses a significant challenge for the European home improvement market. According to the European Construction Industry Federation, compliance with building codes and safety standards adds approximately 10-15% to project costs. For instance, the EU’s General Data Protection Regulation (GDPR) impacts smart home installations, requiring additional investments in data security measures. Furthermore, varying regulations across member states complicate cross-border operations, as per Ernst & Young. In 2022, non-compliance penalties amounted to €2 billion, deterring smaller firms from entering the market. These regulatory complexities not only inflate operational costs but also delay project timelines is hindering market growth.

Environmental Concerns and Material Sourcing

Sustainability mandates have introduced challenges in sourcing eco-friendly materials. According to the World Green Building Council, the demand for sustainable building materials has outpaced supply, leading to shortages and price volatility. For example, the cost of certified timber increased by 30% in 2022, as per the Forest Stewardship Council. Additionally, stricter environmental regulations require manufacturers to adopt cleaner production methods, raising operational costs by 20%, according to Boston Consulting Group. These constraints force companies to balance profitability with sustainability by complicating decision-making processes and slowing market expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.36% |

|

Segments Covered |

By Home Section, Type, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

, and others. |

SEGMENTAL ANALYSIS

By Home Section Insights

The kitchen improvement and additions segment dominated the European home improvement market by accounting for 28.4% of the total share in 2023, as per Allied Market Research.2024. This segment's prominence stems from growth is due to the kitchen's role as a central living space, with modernization efforts focusing on functionality and aesthetics. The integration of smart appliances, such as connected ovens and refrigerators, has fueled demand, with smart kitchen devices growing at a CAGR of 18% since 2020.. Additionally, the rise of open-plan layouts has spurred investments in premium finishes, with quartz countertops and custom cabinetry seeing a 22% annual growth rate. Government incentives for energy-efficient upgrades further drive this segment, as kitchens consume 15% of household energy, according to the European Environment Agency.

The system upgrades segment is likely to register a CAGR of 14.4% from 2025 to 2033. This growth is fueled by the increasing adoption of renewable energy systems, such as solar panels and heat pumps, which accounted for €30 billion in investments in 2022. The European Green Deal’s mandate for carbon neutrality by 2050 has accelerated this trend, with homeowners prioritizing long-term savings. Smart HVAC systems are also gaining traction, reducing energy consumption by 25%, as per the International Renewable Energy Agency. Additionally, the proliferation of IoT-enabled devices allows seamless system integration, by enhancing user convenience and driving rapid adoption.

By Type Insights

The DIFM segment led the European home improvement market by capturing prominent share in 2024. This dominance is attributed to the growing complexity of projects, which require professional expertise. For instance, smart home installations and energy-efficient retrofits often involve intricate wiring and system integrations is driving demand for skilled contractors. Additionally, time-constrained urban professionals prefer outsourcing renovations, with 70% of London-based homeowners opting for DIFM services, according to Oliver Wyman. Government subsidies for energy-efficient upgrades further bolster this segment, as professional execution ensures compliance with stringent regulations by enhancing consumer confidence.

The DIY segment is likely to grow with a CAGR of 12.4% from 2025 to 2033. This surge is driven by the accessibility of online tutorials and affordable tools, empowering homeowners to undertake minor projects independently. Platforms like YouTube and Pinterest have democratized knowledge, with DIY content views increasing by 40% annually, according to Nielsen. Moreover, the post-pandemic shift towards remote work has encouraged individuals to invest in home aesthetics, with paint and decor sales rising by 25% in 2022. Budget-conscious millennials, who constitute 35% of the DIY demographic, are particularly drawn to cost-effective solutions is propelling this segment’s growth.

REGIONAL ANALYSIS

Germany stands as the largest contributor to the European home improvement market by holding a 22.4% of share in 2024. The country’s robust economy and high homeownership rates create a fertile environment for renovations. Government incentives, such as the €10 billion subsidy for energy-efficient upgrades, have spurred a 15% annual growth in such projects. Additionally, Germany’s aging housing stock, with over 50% of buildings constructed before 1970, necessitates extensive modernizations, driving sustained demand.

France home improvement market growth is substantially to achieve a CGAR of 12.1% in the next coming years. The growth is driven by urbanization and lifestyle shifts. According to INSEE, over 60% of French households reside in urban areas, fueling demand for compact living solutions. The government’s MaPrimeRénov’ program, which allocated €2 billion in 2022, has encouraged energy-efficient renovations, with participation rates increasing by 30%.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

ADEO, Kingfisher, HORNBACH Baumarkt, Travis Perkins, BAUHAUS, Die Fachhandler, Bauvista, Intergamma, EUROBAUSTOFF, Les Mousquetaires, K-GROUP, The Sherwin-Williams Company, and Toolstation are playing dominating role in the Europe home improvement market.

The European home improvement market is characterized by intense competition, with established players vying for market share through innovation and customer engagement. According to Bain & Company, the top five players collectively control 45% of the market, leveraging economies of scale to maintain dominance. Smaller firms differentiate themselves through niche offerings, such as bespoke design services. Price wars are prevalent, with discounts ranging from 10-20% during peak seasons. The rise of e-commerce has intensified rivalry, as online platforms enable direct-to-consumer sales, bypassing traditional retail channels. Additionally, partnerships with tech companies are reshaping competitive dynamics, as seen in Adeo Group’s collaboration with IoT providers to integrate smart home solutions.

TOP PLAYERS IN THIS MARKET

Kingfisher plc

Kingfisher, owner of B&Q and Castorama, is a dominant player in the European home improvement market. The company’s focus on sustainability aligns with consumer trends, as evidenced by its commitment to sourcing 100% responsibly sourced timber by 2025. Its strategic investments in e-commerce platforms have enhanced customer accessibility is amplifying its dominance in the marketplace.

Adeo Group

Adeo Group, operating Leroy Merlin, emphasizes innovation and customer-centric solutions. The company’s digital transformation initiatives, including augmented reality tools for virtual renovations, have set industry benchmarks. Adeo’s expansion into Eastern Europe has diversified its revenue streams by strengthening its global footprint.

Bauhaus AG

Bauhaus AG specializes in premium home improvement products, catering to affluent consumers. Its emphasis on quality and craftsmanship has earned a loyal customer base. Strategic partnerships with local artisans ensure tailored solutions by enhancing brand equity across Europe.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Digital Transformation

Leading players are investing in digital platforms to enhance customer experience. For instance, Kingfisher’s adoption of AI-driven recommendation engines has streamlined product discovery by boosting online sales by 25% in 2022, as per McKinsey.

Sustainability Initiatives

Companies are prioritizing eco-friendly practices to align with regulatory mandates. Adeo Group’s commitment to achieving net-zero emissions by 2030 has positioned it as a sustainability leader by attracting environmentally conscious consumers.

Strategic Acquisitions

Acquisitions are a key strategy for market expansion. Bauhaus AG’s acquisition of regional distributors in Scandinavia has strengthened its supply chain by enabling faster delivery and enhanced market penetration.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Kingfisher acquired a Berlin-based startup specializing in AR tools, enhancing its digital capabilities.

- In June 2023, Adeo Group launched a recycling initiative, aiming to reduce waste by 30% across its operations.

- In August 2023, Bauhaus AG expanded its distribution network in Eastern Europe, opening 15 new outlets.

- In October 2023, Leroy Merlin partnered with a renewable energy provider to offer solar panel installations.

- In December 2023, B&Q introduced a subscription-based service for tool rentals, targeting DIY enthusiasts.

MARKET SEGMENTATION

This research report on the Europe home improvement market is segmented and sub-segmented into the following categories.

By Home Section

- Disaster Repairs

- Bath Improvement & Additions

- Kitchen Improvement & Additions

- Disaster Repairs

- Exterior Replacements

- System Upgrades

- Property Improvements

- Others

By Type

- Do It For Me (DIFM)

- Do It Yourself (DIY)

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected size of the Europe Home Improvement market by 2033?

The Europe Home Improvement market is expected to reach USD 164.15 billion by 2033.

2. What factors are driving the growth of the Europe Home Improvement market?

Growth is driven by increasing interest in DIY projects, advancements in smart home technology, and rising residential real estate development.

3. What challenges does the Europe Home Improvement market face?

Challenges include competition from professional services (Do-It-For-Me or DIFM), varying consumer preferences across regions, and environmental sustainability concerns.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com