Europe PC Market Size, Share, Trends & Growth Forecast Report By Type (Panel IPC, Rack Mount IPC, Box IPC, Embedded IPC, DIN Rail IPC), End User (Automotive, Semiconductor & Electronics, Chemical, Healthcare, Aerospace & Defense, Energy & Power, Others), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe PC Market Size

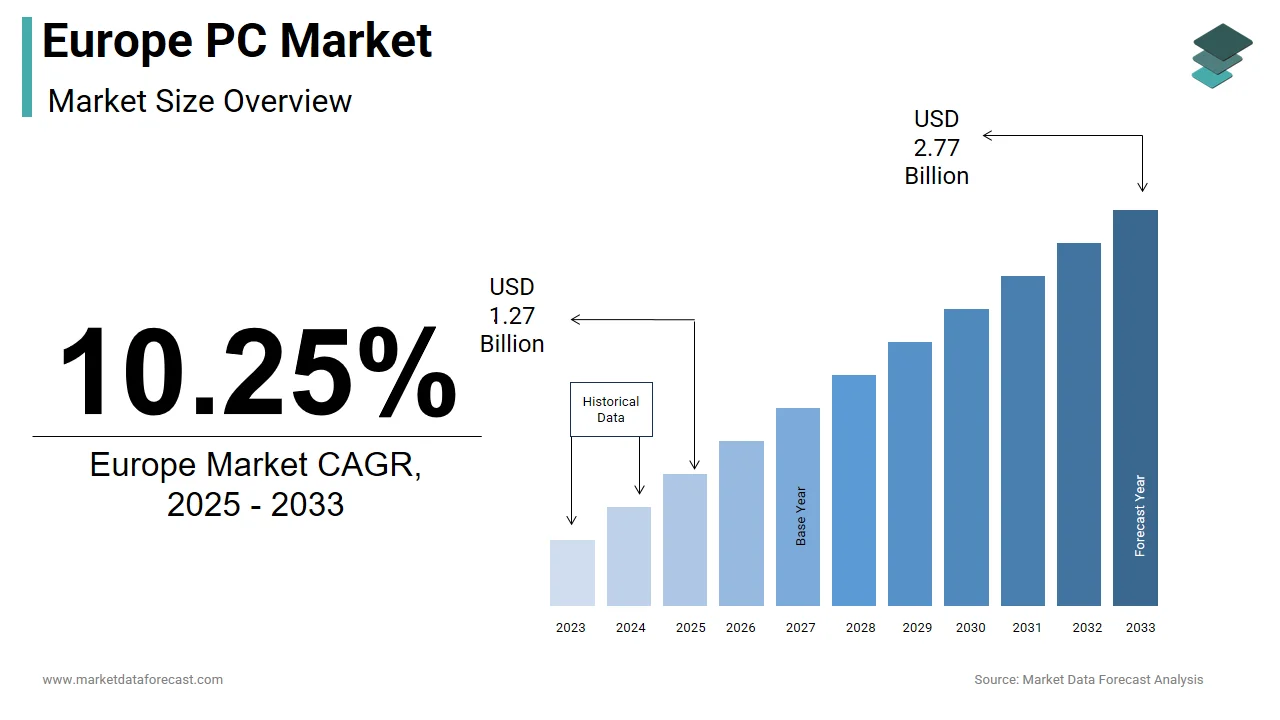

The size of the Europe PC market was valued at USD 1.15 billion in 2024. This market is expected to grow at a CAGR of 10.25% from 2025 to 2033 and be worth USD 2.77 billion by 2033 from USD 1.27 billion in 2025.

Europe has historically been a major contributor to global PC shipments, driven by strong IT infrastructure, high digital adoption in businesses and educational institutions, and sustained consumer demand for computing devices. As of 2023, Europe accounted for over one-fifth of the global PC market volume, with Germany, the UK, France, and Italy being the dominant contributors.

According to IDC, the European PC ecosystem has experienced a cyclical demand pattern post-pandemic, with a notable slowdown in 2022 due to inventory corrections but signs of stabilization in late 2023. The education sector remains a vital segment under government-backed digitization initiatives, with nations like Spain and Poland launching procurement programs to equip schools with laptops and Chromebooks. Additionally, the enterprise segment continues to drive consistent demand, particularly in sectors such as finance, healthcare, and professional services, where device modernization is crucial for cybersecurity and operational efficiency.

Environmental consciousness is also shaping the industry's direction, with the EU emphasizing circular economy principles and product longevity. The introduction of the Right to Repair legislation in several member states is influencing manufacturers’ design strategies. While the market faces macroeconomic challenges, evolving usage patterns and hybrid work models continue to create pockets of resilience and innovation across the European PC landscape.

MARKET DRIVERS

Hybrid Work Models Driving Corporate Demand

One of the primary drivers fueling the Europe PC market is the widespread adoption of hybrid and remote work models, which have redefined workplace technology requirements. According to Eurofound, nearly 40% of professionals in Western Europe were working remotely at least once a week in 2023 by reinforcing the need for reliable corporate-grade PCs. Enterprises are investing in standardized notebook fleets that meet security, performance, and manageability benchmarks, leading to increased procurement from vendors such as Lenovo, HP, and Dell.

Moreover, as companies transition to long-term hybrid setups, they are replacing outdated desktops with lightweight, high-performance laptops capable of supporting video conferencing, cloud collaboration tools, and virtual private networks. In response, Microsoft and Intel have introduced platform-level optimizations tailored for remote productivity, encouraging enterprises to refresh their hardware. As per McKinsey & Company, approximately 60% of firms in Germany and France had initiated or completed endpoint modernization programs in 2023 to support flexible work arrangements.

Expansion of Digital Education Initiatives

Another key driver of the Europe PC market is the increasing integration of digital learning platforms in primary and secondary education. Governments across the continent have launched large-scale initiatives to bridge the digital divide and ensure students have access to computing resources. For instance, the European Commission’s Digital Education Action Plan emphasizes equipping classrooms with digital infrastructure, prompting public sector tenders for bulk laptop purchases. As per Eurostat, in 2023, over 90% of households in Northern Europe reported owning at least one computer, up from 78% in 2019.

Countries such as Spain, Poland, and Romania have implemented national programs to distribute subsidized or free laptops to students from low-income families. Similarly, in Poland, the "Digital School" initiative led to significant investments in Chromebook deployments across public schools. These efforts have created a steady demand stream for entry-level and mid-range PCs, especially among white-label and established OEMs participating in public procurement contracts.

MARKET RESTRAINTS

Economic Slowdown and Consumer Spending Constraints

A significant restraint affecting the Europe PC market is the broader economic slowdown, marked by inflationary pressures, rising interest rates, and reduced disposable incomes among consumers. This financial strain has discouraged households from making discretionary purchases, including new PCs for leisure or basic computing needs. Consumer confidence indices published by the European Commission showed a decline in household sentiment across multiple markets, with Germany and Italy experiencing some of the sharpest drops. In these regions, consumers have opted to extend the lifespan of existing devices rather than replace them, contributing to an aging installed base of PCs. Gartner noted that average PC replacement cycles in Europe increased from four to five years between 2020 and 2023, dampening near-term sales prospects. Additionally, retailers have reported declining footfall and online conversion rates for non-essential electronics, further indicating a cautious buying environment.

Declining Interest in Traditional Computing Among Younger Demographics

Another pressing challenge for the Europe PC market is the waning preference for traditional PCs among younger consumers who increasingly rely on smartphones, tablets, and cloud-based applications for daily tasks. According to a study conducted by Pew Research Center, more than 70% of teenagers in Western Europe use mobile-first platforms for schoolwork, social media, and entertainment, reducing the perceived necessity of owning a dedicated PC. This behavioral shift is particularly evident in urban centers where digital natives prioritize portability and instant connectivity over desktop performance. In academic settings, many institutions have adopted tablet-based learning environments, often integrated with Google Workspace or Microsoft Teams, diminishing the reliance on Windows or macOS-powered laptops.

MARKET OPPORTUNITIES

Growth in Healthcare Digitization and Telemedicine Infrastructure

An emerging opportunity within the Europe PC market is the rapid expansion of healthcare digitization initiatives and telemedicine infrastructure. Governments and private healthcare providers are increasingly investing in electronic health records, virtual consultations, and AI-assisted diagnostics, necessitating robust computing endpoints that support secure data processing and real-time communication. According to the European Health Data Space (EHDS) initiative, launched in 2023, all EU member states are mandated to enhance digital health interoperability, creating demand for certified medical PCs and ruggedized laptops used in clinical settings.

Hospitals and clinics across Germany, France, and the Netherlands are procuring specialized PCs equipped with antimicrobial casings, touchscreens, and compliance certifications such as HIPAA and ISO 13485. In addition, telehealth kiosks deployed in rural areas require durable, high-performance computing units capable of running diagnostic software and video conferencing platforms simultaneously.

Surge in AI-Powered Creative and Productivity Tools

The proliferation of AI-powered creative and productivity tools is opening new avenues for PC demand across professional and prosumer segments in Europe. As artificial intelligence becomes embedded in content creation, graphic design, video editing, and architectural modeling applications, users are seeking higher-performance machines with dedicated GPUs, multi-core CPUs, and optimized thermal designs. Adobe, Autodesk, and Blender have launched AI-integrated versions of their software suites, which require enhanced local processing capabilities even as cloud-based alternatives emerge. This has prompted professionals to invest in high-end PCs that can handle complex rendering, machine learning inference, and real-time video compositing without latency. Additionally, major tech firms such as NVIDIA and Intel have partnered with European retailers to promote Creator Ready PCs as essential tools for digital artists and entrepreneurs.

MARKET CHALLENGES

Supply Chain Disruptions and Component Shortages

One of the most persistent challenges confronting the Europe PC market is the ongoing volatility in global supply chains and semiconductor shortages. Despite some normalization since the peak of pandemic-related disruptions, geopolitical tensions, energy price fluctuations, and logistical bottlenecks continue to affect component availability and lead times. According to the European Semiconductor Industry Association, the region's reliance on Asian manufacturing hubs for memory chips, display panels, and microcontrollers leaves it vulnerable to export restrictions and trade imbalances. Furthermore, labor shortages at European logistics centers and port congestion have extended delivery schedules, which is disrupting pre-order campaigns and back-to-school promotions. Companies such as ASUS and Lenovo acknowledged in internal briefings that component scarcity pushed some product launches into Q4 2023 instead of aligning with traditional seasonal release windows. This unpredictability has forced manufacturers to increase safety stock levels and raise prices to offset inventory risks, thereby deterring cost-sensitive buyers.

Regulatory Pressures and E-Waste Management Mandates

Regulatory pressures, particularly around e-waste management and device recyclability, are increasingly shaping the operating environment for PC manufacturers in Europe. The European Union has intensified its focus on sustainable electronics through directives such as the Circular Economy Action Plan and the Right to Repair legislation, compelling Original Equipment Manufacturers (OEMs) to redesign products for easier disassembly and longer usability. This regulatory shift has resulted in additional compliance costs for manufacturers, who must now incorporate modular components, reduce hazardous substances, and provide spares for at least seven years after product discontinuation. Companies like Dell and HP have adapted by introducing repairable chassis designs and using recycled plastics in notebook construction, but these changes often come at the expense of slim form factors and cost-efficiency. Moreover, shifting toward eco-friendly materials and processes increases manufacturing complexity, which is potentially

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Advantech, Emerson Electric, Mitsubishi Electric, Siemens, Omron, Panasonic, Schneider Electric, Rockwell Automation, Beckhoff Automation, and Nexcom International. |

SEGMENTAL ANALYSIS

By Type Insights

The Panel IPC segment held 32.1% of the Europe PC market share in 2024. The growing integration of Industry 4.0 technologies in European manufacturing hubs is propelling the growth of the segment. As per the German Engineering Federation (VDMA), over 65% of industrial automation projects in Germany in 2023 included Panel IPC-based HMIs for seamless machine interaction. Additionally, these devices offer space-saving designs with touchscreen capabilities, making them ideal for embedded control panels. The European Commission's push for smart factories under its Digital Europe Program has further accelerated demand.

The Embedded IPC segment is projected to grow with a CAGR of 11.4% during the forecast period. This rapid expansion is driven by increasing deployment in edge computing, autonomous systems, and AI-driven industrial applications. As per a report by IDC, 60% of European manufacturers prioritized edge computing investments in 2023 to enhance operational efficiency and reduce latency. Embedded IPCs provide the necessary computational power while maintaining ruggedness for harsh industrial environments. Furthermore, the European Union’s Horizon Europe initiative has funded multiple R&D projects focused on embedded AI systems, boosting innovation in this segment. IHS Markit noted that demand for modular, scalable Embedded IPCs surged in the automotive and semiconductor sectors, where precision and speed are critical to production outcomes.

By End User Insights

The automotive industry segment was the largest by capturing 28.5% of the Europe PC market share in 2024, with the sector’s reliance on high-performance industrial PCs for design, testing, production line automation, and quality control. According to the European Automobile Manufacturers’ Association (ACEA), over 16 million vehicles were produced in Europe in 2023, which is necessitating advanced digital infrastructure for manufacturing operations. BMW and Volkswagen have both expanded their use of industrial PCs in smart factories to support real-time data analytics and robotic assembly lines. Moreover, the EU’s Green Deal and Battery Passport initiative have mandated digital traceability of components, reinforcing the need for connected PC systems in production workflows by ensuring compliance and supply chain transparency.

The semiconductor and electronics segment is likely to grow with a CAGR of 12.2% during the forecast period, with the surging demand for high-precision computing systems in chip fabrication, PCB testing, and electronic design automation (EDA). According to the European Semiconductor Industry Association (ESIA), Europe’s semiconductor industry saw a 9.4% increase in capital expenditure in 2023, which is spurred by government incentives under the EU Chips Act.

This growth is largely fueled by the localization of semiconductor manufacturing and R&D activities, particularly in Germany and France. Companies like Infineon and STMicroelectronics have ramped up investment in cleanroom facilities equipped with Industrial PCs for wafer inspection, lithography control, and yield management. In addition, the rise of nanoscale fabrication processes requires ultra-stable computing platforms with low-latency response times, which further strengthens the role of specialized Industrial PCs in this high-tech ecosystem.

COUNTRY-LEVEL ANALYSIS

Germany was the top performer in the Europe PC market by capturing 24.3% of the share in 2024. Germany maintains a robust demand for both consumer and industrial PCs, which is driven by its advanced manufacturing base, strong automotive sector, and digitalization policies. A key driver of Germany’s dominant position is its focus on Industry 4.0, which integrates smart manufacturing technologies requiring high-performance computing infrastructure. The German Federal Ministry for Economic Affairs and Climate Action reported that over EUR 5 billion was allocated to digital transformation initiatives in 2023, supporting the deployment of industrial PCs in SMEs and large-scale production units. Additionally, the country’s automotive and machinery exports depend heavily on embedded and panel IPCs for automation and diagnostics.

The United Kingdom was positioned second in the Europe PC market by holding 15.3% of the share in 2024. The UK remains a significant contributor to the region’s PC demand, which is driven by sustained corporate IT investments and government-led education digitization programs. One of the primary factors sustaining the UK’s market position is the continued modernization of enterprise IT infrastructure, particularly in finance, healthcare, and legal services. Additionally, the Department for Education’s National EdTech Strategy has facilitated the procurement of laptops and hybrid devices for schools and universities.

The French PC market is expected to have significant growth opportunities in the coming years. The French market benefits from a well-diversified demand base, spanning enterprise, education, healthcare, and public administration sectors. A major driver of France’s market strength is the government’s digital sovereignty strategy, which emphasizes local data security and technology independence. Additionally, the education sector has seen consistent investment through the “École Numérique” program, which supports device distribution for students and teachers. In the private sector, financial institutions and engineering firms are upgrading legacy systems to comply with new cybersecurity mandates.

Italy's PC market growth is likely to grow with a resilient PC demand profile, supported by ongoing digital transformation in small and medium enterprises (SMEs), educational institutions, and public administration. Under this initiative, several public agencies have launched tenders for bulk PC procurements aimed at improving administrative efficiency and citizen service delivery.

Spain's PC market is anticipated to grow steadily with strong public sector investments, educational reforms, and increasing enterprise adoption of cloud-integrated computing solutions. One of the main drivers of Spain’s market performance is the Ministry of Education’s “Digital School Plan,” which aims to equip public schools with modern computing infrastructure. In 2023 alone, the government procured over 700,000 laptops and tablets to bridge the digital gap among students from different socioeconomic backgrounds. Additionally, the healthcare sector has embraced digital transformation, with hospitals deploying industrial PCs for telemedicine, patient records management, and medical imaging systems. The banking and retail industries have also initiated large-scale PC replacements to enhance cybersecurity and customer experience.

KEY MARKET PLAYERS

Companies playing a prominent role in the European PC market profiled in this report are Advantech, Emerson Electric, Mitsubishi Electric, Siemens, Omron, Panasonic, Schneider Electric, Rockwell Automation, Beckhoff Automation, and Nexcom International.

TOP LEADING PLAYERS IN THE MARKET

Lenovo held a dominant position in the Europe PC market by offering a broad portfolio that spans consumer laptops, enterprise workstations, and industrial PCs. The company has built a strong presence across both public and private sectors, particularly in government education programs and corporate IT deployments. Lenovo's emphasis on innovation, design efficiency, and localized customer support has reinforced its brand loyalty across diverse user segments. In addition to hardware, the company invests heavily in software integration and device lifecycle management solutions tailored for European businesses.

HP is a major contributor to the Europe PC ecosystem, known for its reliable commercial-grade laptops, desktops, and workstation solutions. The company plays a critical role in supporting digital transformation initiatives in healthcare, finance, and education through secure and scalable computing platforms. HP’s focus on sustainability, including energy-efficient designs and recyclable packaging, aligns well with European regulatory expectations. Its partnerships with educational institutions and cloud service providers have further expanded its reach, which is making it a preferred choice among enterprise buyers and institutional users.

Dell maintains a strong foothold in the Europe PC market by delivering high-performance computing solutions tailored for business professionals, engineers, and data scientists. The company excels in providing end-to-end IT infrastructure packages that include not only PCs but also integrated software and services. Dell’s direct-to-customer model allows for customized configurations and efficient after-sales support, which is particularly valued in the enterprise segment. Its commitment to cybersecurity and hybrid cloud compatibility has made its devices a staple in large corporations and government agencies across the region.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One of the most prominent strategies employed by key players in the Europe PC market is product differentiation through specialized form factors and performance enhancements. Companies are focusing on developing ultra-portable notebooks, convertible 2-in-1 devices, and ruggedized industrial PCs that cater to niche professional and sector-specific requirements. This approach allows vendors to capture demand beyond generic consumer segments and into verticals such as healthcare, engineering, and logistics.

Another strategic priority is strengthening sustainability credentials in line with EU regulations and consumer expectations. Leading manufacturers are integrating recycled materials, improving energy efficiency, and enhancing repairability features in their products. These efforts not only comply with environmental directives but also serve as competitive differentiators in procurement decisions made by public institutions and large enterprises.

Expanding partnerships with software developers, cloud service providers, and channel resellers has become essential for securing long-term contracts and distribution networks. PC vendors are reinforcing customer retention and positioning themselves as comprehensive technology partners rather than just hardware suppliers by embedding value-added services and optimizing hardware-software ecosystems.

COMPETITION OVERVIEW

The competition in the Europe PC market is highly dynamic, shaped by the coexistence of global OEMs, regional specialists, and emerging white-label brands vying for dominance across multiple user segments. Established players like Lenovo, HP, and Dell maintain strong brand equity and extensive distribution networks by allowing them to dominate enterprise and institutional procurement cycles. However, the market is witnessing growing influence from niche manufacturers that offer cost-effective alternatives tailored for specific applications such as industrial automation, medical diagnostics, and edge computing.

A key battleground lies in product innovation and customization, where vendors are increasingly focusing on modular designs, enhanced security features, and sustainable manufacturing practices to differentiate themselves. Additionally, the shift toward hybrid work and digital learning environments has intensified competition in the notebook and Chromebook segments, prompting companies to optimize performance-to-price ratios while ensuring compliance with local data protection standards.

RECENT MARKET DEVELOPMENTS

- In February 2024, Lenovo launched a new line of AI-optimized workstations tailored for creative professionals and engineering firms across Germany and France. These devices were designed to seamlessly run generative AI applications, marking a strategic move to capture demand in knowledge-intensive industries.

- In May 2024, HP introduced a modular PC platform under its Elite series, featuring enhanced repairability and upgradability in line with the EU’s Right to Repair regulations. This initiative was aimed at strengthening HP’s position in public sector tenders and environmentally conscious business segments.

- In July 2024, Dell partnered with a leading European cloud provider to develop integrated hybrid cloud workstations for enterprise clients. This collaboration allowed Dell to offer pre-configured systems optimized for remote collaboration, data analytics, and virtualization tools used in financial and research institutions.

- In September 2024, ASUS expanded its industrial PC division by opening a dedicated R&D center in Poland focused on developing embedded and panel IPCs for smart manufacturing applications. This investment was intended to strengthen ASUS’s footprint in Eastern Europe’s growing automation sector.

- In November 2024, Acer entered into a joint venture with a German educational technology firm to deploy budget-friendly Chromebooks in schools across Italy and Spain. This initiative aligned with national digitization goals and positioned Acer as a key player in the education-oriented PC market.

MARKET SEGMENTATION

This Europe PC market research report is segmented and sub-segmented into the following categories.

By Type

- Panel IPC

- Rack Mount IPC

- Box IPC

- Embedded IPC

- DIN Rail IPC

By End User

- Automotive

- Semiconductor & Electronics

- Chemical

- Healthcare

- Aerospace & Defense

- Energy & Power

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What drives the growth of the Europe PC market?

The Europe PC market is driven by widespread adoption of hybrid and remote work, digital learning initiatives in education, strong enterprise IT investments, and government-backed programs to bridge the digital divide

2. What challenges does the Europe PC market face?

The Europe PC market faces challenges from economic slowdowns, inflation, rising interest rates, supply chain disruptions, longer device replacement cycles, and competition from tablets and mobile devices among younger users

3. What opportunities exist in the Europe PC market?

Opportunities in the Europe PC market include healthcare digitization, telemedicine, AI-powered creative tools, regulatory pushes for sustainability, and rising demand for industrial PCs in manufacturing and automotive sectors

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com